Intro: AmeriSave Reviews – What You Should Know Before Using AmeriSave Mortgage

When it comes to loan services, online lending has grown — and with increasing speed.

AmeriSave Home Mortgage has grown to be one of the largest online mortgage lenders in the United States. Despite mixed AmeriSave reviews, many people enjoy the convenience and ease of the application process.

You may have run across them in a few AmeriFirst home mortgage reviews, as their names are quite similar. Also, this lender can offer low rates since they are an online refinancing company, reducing overhead expenses.

Provided here is an in-depth analysis of AmeriSave mortgage reviews so you can make an informed decision on which mortgage option may be best for your family. We also include positive reviews and AmeriSave complaints from other sites.

Image Source: AmeriSave Home Mortgage

AmeriSave Reviews: The History behind AmeriSave

Headquartered in Atlanta, Georgia, AmeriSave Mortgage Corporation is a leading online mortgage lender founded in 2002.

They do have a few loan origination centers across the country as well. According to an Investopedia.com AmeriSave review, this private company has approved over 250,000 loans. In fact, AmeriSave’s tagline is, “Direct Lender. Billions Funded,” which shows a certain level of confidence — and success.

AmeriSave is licensed in all 50 states and offers a variety of mortgage products. Applying is free as all paperwork can be processed online or via fax. During our AmeriSave reviews research, we learned that you can find out in just a few minutes if you’ve been approved for a mortgage loan.

See Also: Spot Loan Reviews – Get the Facts Before Using (Pros, Complaints, & Review)

Types of Loans Approved with AmeriSave

Based on the AmeriSave reviews, AmeriSave offers a variety of loan products so that consumers have a selection of the best possible rates for their particular circumstances. From low-rate to fixed-rate options, you’ll find that if you meet the requirements for FHA, VA, USDA, Jumbo, and government loans, this lender can work with you.

AmeriSave claims that over 70% of their customers return for additional mortgage services. In a CreditKarma.com AmeriSave mortgage review, one customer even stated that they received a bonus for being a returning customer.

The lender does offer refinancing options such as adjustable-rate, interest-only loans and fixed-rate options. A refinancer stated per their AmeriSave review that it was the “Best Re-fi experience I’ve ever had.”

You can find other refinancing AmeriSave reviews on their reviews page. Borrowers should also look into the On Time Closing Promise where AmeriSave promises to issue a $1,000 on-time closing guarantee.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Who AmeriSave Can Work With

Another finding in this AmeriSave review shows that the variety of loan options means that AmeriSave can work with consumers in multiple types of situations. Your options are not limited, so whether it’s low income, low credit score, veteran status, active duty, or even purchasing within a rural area, there should be a suitable program for you.

Many consumers praised the ease of working with AmeriSave during their AmeriSave mortgage reviews. Of course, as with all mortgage approval processes, income and the appraised value of the home are also major factors in the lender’s decision-making process.

Image Source: BigStock

AmeriSave Mortgage Review – Website

We discovered during this AmeriSave mortgage review that the AmeriSave website is clean-cut and offers a variety of menu options. You can request information via live chat or call the posted 800-number for assistance. It’s also worth noting that you can connect with a licensed Loan Originator online with their live chat tool. The availability of someone to connect with is helpful to borrowers and real estate agents, per the findings in the AmeriSave reviews on their website.

Some online mortgage companies only offer example rates; AmeriSave appears to update their rates for each product daily, which is a good sign. The website is great for those seeking more information regarding various mortgage products or those who are ready to get an approval today.

Don’t Miss: What Is a Reverse Mortgage? – What You Need to Know (Pros & Cons, Disadvantages & Basics)

Helpful Educational Guidance on AmeriSave’s Site

AmeriSave takes the time to educate their potential customers. Conducting the AmeriSave reviews, we see that there are news feeds, articles, graphs, and calculators to help borrowers discover the best loan options for them. Some of the calculators include:

- What is the maximum home price I can afford?

- How much home can I afford at a monthly payment of $X?

- How much can I save in taxes?

- Am I better off renting?

- Should I refinance?

- Should I consolidate my debts?

- Which loan term is better?

- How advantageous are extra payments?

If you are unsure about the various loan products, we found during this AmeriSave review that each is broken down in simple terms, whether for fixed-rate home mortgage loans, VA loans, or cash out home mortgage loans. There is a mortgage education section detailing the refinance process available. But be sure to check out their knowledge base, which contains AmeriSave’s Frequently Asked Questions and a glossary explaining all mortgage financing terms. This is all helpful information when conducting AmeriSave reviews on your own.

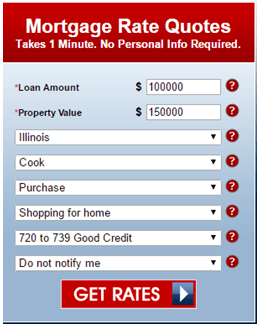

AmeriSave’s Quick Mortgage Rate Quote Tool

If you’re simply curious, AmeriSave has a mortgage rate quoting tool. We found it easily on their page when doing research for AmeriSave reviews. Using this tool requires no personal information from you.

Image Source: AmeriSave

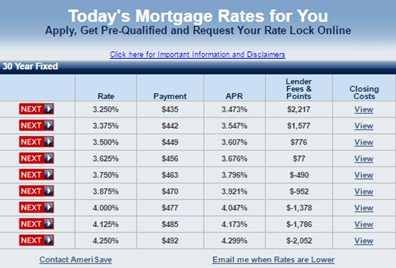

Today’s Mortgage Rates for You lists each product, such as 30-Year Fixed, 10-Year Fixed, ARM, 15 Year-Fixed – FHA, and 30 Year Fixed – USDA. Below in this AmeriSave mortgage review, you’ll see how easy the next steps are.

Image Source: AmeriSave

You can select “Next” to start your application or “View” to view all closing costs, including:

- Lender fees

- Closing attorney/agent

- Appraiser

- Title insurance

- Credit reporting

- Estimated prepaid and escrow items

- Government taxes and fees

- Monthly mortgage payment

This closing cost information helps AmeriSave reviewers to not only make the best selection but position themselves to apply at the right time. Not many AmeriSave reviews noted using this, but you definitely should.

Related: FHA Loan Requirements – What You Need to Know – FHA Mortgage & Home Loan Requirements

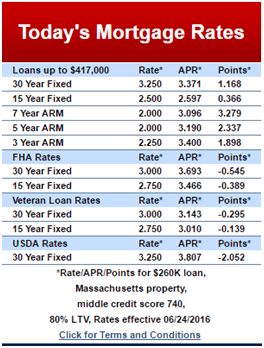

Interest Rates of an AmeriSave Loan

The interest rates of an AmeriSave Loan can vary and depend upon several factors. A handy chart we found on their website during our AmeriSave review provides current, real-time mortgage rates.

Image Source: AmeriSave

For starters, the rates displayed are based on the current mortgage rate for a particular state. Credit scores, the total loan amount, loan-to-value, down payment, and documented income all play a factor on what your APR would be. Some AmeriSave reviews on the Better Business Bureau (BBB), however, indicated the information provided on AmeriSave’s site was not accurate and up to date.

For those interested in taking on an Adjustable Rate Mortgage (ARM), the fixed rate period can vary from 5, 7, 10, or the full loan period of 30 years. Once an ARM expires, the interest rate will adjust based upon the new APR. If this confuses you, be sure to check out AmeriSave’s Frequently Asked Questions.

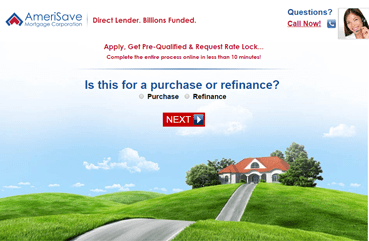

Steps to Apply for an AmeriSave Loan

During our AmeriSave review, the application process was also tested. According to the website, you can apply, get pre-qualified, and lock in a rate within 10 minutes. There are nine steps to the application process. In one customer’s AmeriSave mortgage review, they described the process as “streamlined.”

Image Source: AmeriSave

1. Loan Application Information. Here is the basic information, such as whether this is to purchase or refinance. For the purpose of this AmeriSave review article, we selected the option to purchase. Select the state the home will be in and your basic contact information. You’ll also create a password to access your mortgage application later.

2. Credit Review. Here, they request your Social Security number, authorizing AmeriSave Mortgage Corporation to pull your credit report. Please note, this will be a hard credit pull. If you are not ready for this, as stated earlier in this AmeriSave review, you’ll want to use their mortgage rate quoting tool for an estimate.

They also note that it will take approximately 45 days to close the transaction after they have received the completed application. Afterward, you’ll be taken to the Consent to Electronic Disclosures, which you will have to accept to continue.

3. Tell Us About The Property You Want to Purchase. Here, you’ll tell AmeriSave the basic information such as the purchase prices of the home, how much of a down payment you have, the address, if it’s under contract, and the option to include the home insurance and property taxes in the monthly payment. We found during this AmeriSave mortgage review that the more information you have ready, the smoother your application process will be.

4. Tell Us About Your Income and Expenses. Please note that you will need to provide documentation to verify all income sources you claim. This section breaks down various income and expense categories such as primary employment income, other taxable income, retirement, pension or Social Security income, and interest or dividend income, plus expenses. It seems like a lot, but as we completed this for this AmeriSave review, we noticed it still didn’t take too long to complete.

5. Tell Us More About You. This section is more basic information such as your mailing address, date of birth, dependent information, bankruptcy/foreclosure status, and most recent employer information.

6. Tell Us About Your Real Estate. This section is a short page indicating which county the property is located in, if you own other properties, and your current real estate agent’s contact information. In an AmeriSave review on CreditKarma.com, an applicant seemed to have problems qualifying as they needed a renter for their rental property. Be sure to update this accurately and be prepared to discuss with your loan originator as to not hold up your process.

7. Please Answer The Following Questions. These are declarations about delinquency and other defaults. It also verifies citizenship status. You’ll review their disclosures before moving onto the final steps.

8. Credit Review. Finished! This entire application process can be completed in 10 minutes should you know some of your basic financial information offhand.

Once the application is complete, you’ll be able to upload your documents right to the website. Don’t feel nervous if you haven’t done this before. One AmeriSave review describes the loan originator as being “patient and kind,” showing them how to upload the documents.

You can log back into your account to see the documents, where they are also under review by the lender. After going through the application process for this AmeriSave review, we were able to get back in immediately. The underwriting process begins following the examination of provided documents.

If you are actively looking for a property, upon approval, they’ll send you a Pre-Approval Certificate so you can look for homes in your pre-approved price range. AmeriSave will handle the closing in an attorney’s office or your home. Some real estate agents describe their experience with this pre-approval process in their AmeriSave reviews.

Popular Article: Guaranteed Rate Reviews – What You Need to Know! (Mortgage, Complaints & Review)

Free Wealth & Finance Software - Get Yours Now ►

AmeriSave Complaints and Reviews

When selecting a mortgage provider, it’s important to do your due diligence. There is a mixture of AmeriSave complaints, but you’ll find many customers are satisfied with their services. A key thing to look out for is if a mortgage servicer will honor their advertised rates.

According to Bankrate.com AmeriSave reviews, AmeriSave customers have a 99% satisfaction rate when it comes to honoring rates provided on their website. Bankrate.com ranks AmeriSave 4.9 out of 5 for professionalism, knowledge, and level of service.

In LendingTree’s AmeriSave review, they ranked AmeriSave as one of their top 10 in customer satisfaction. CreditKarma.com customers rank AmeriSave as having 4 out of 5 stars for their ease of application process, customer service, and loan holder ratings.

The AmeriSave Mortgage reviews and complaints found on ConsumerAffairs rates them as having 5 stars, and 86% of the reviews were positive.

The Better Business Bureau (BBB) states that AmeriSave is not BBB-accredited. However, they are rated with an A- as of June 2016. There have been 112 Amerisave complaints closed with the BBB in the last three years, of which 44 were closed in the past 12 months alone.

The highest AmeriSave complaints fell within the Problems with Product/Service and Advertising/Sales Issues categories. We looked at AmeriFirst home mortgage reviews in comparison to AmeriSave’s on the BBB. AmeriFirst is BBB-accredited and have an A+ rating. This is something to take into account.

The Bottom Line: AmeriSave Reviews

Despite their excellent A- rating with the BBB, having so many negative AmeriSave reviews on sites such as Yelp and Zillow may deter borrowers. However, their educational services, ability to contact a loan originator, and being Fannie Mae-approved shows that this Consumer Affairs Trusted lender gives consumers options and hope for being approved for a home loan. Also, do not get AmeriSave confused with AmeriFirst home mortgage reviews, as these are two separate companies.

Hopefully, this AmeriSave review can help you make an informed decision for your next mortgage or refinancing process.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.