Intro: Spot Loan Reviews – Get All the Facts Before Using Spotloan.com! (Pros, Complaints, & Review)

In the absence of other viable options, many consumers turn to what is often described as “non-traditional” lenders and financial providers like installment payday loan businesses and check-cashing stores.

For millions of Americans, installment payday loans and related services actually are the norm—as opposed to banks, credit unions, and mortgage companies.

According to a 2012 report by the Pew Charitable Trust, more than twelve million Americans use installment payday loans every year.

In 2013, the second half of their Payday Lending in America series reported that more than 3 in 4 borrowers relied solely on lenders to provide accurate information about their lending products.

Pew also found that the average borrower winds up indebted for up to 5 months, borrowing an average of $375, but paying $520 in finance charges. That translates to an annual percentage rate (APR) of more than 400%.

In this Spot Loan review, we will look at a company that claims to offer an alternative to the payday loan.

By offering consumers installment loans with longer terms than the two weeks used with payday loans, Spot Loans provides consumers with a hybrid product — one that has the payout features of a payday loan and the payback features of a traditional bank installment loan.

As a result, these installment payday loans are often seen as a better alternative to the traditionally fast-paced payback cycle of a payday loan.

Spot Loan Review

Our Spot Loan review includes a comparison of small-dollar loan options available in the marketplace, as well as an assessment of Spot Loan complaints. This will help provide a brief look at how loans from companies like Spot Loan may compare to this lender of small-dollar loans.

We will also review product features and pricing for both payday loans and installment loans like Spot Loan.

Where Do Borrowers Go to Access Small-Dollar Loans?

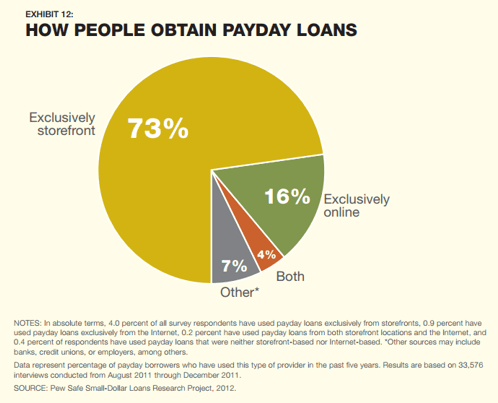

According to the report by the Pew Charitable Trust, the majority of consumers (73%) still access payday loans exclusively from storefronts.

While comparatively small, 20% of consumers either access payday loans exclusively online or use both online and brick-and-mortar storefronts.

Based on this data, there are almost 2.5 million consumers accessing payday loans through the online channel.

It’s no wonder that installment payday loans are suddenly popping up on every street corner. There is a significant consumer demand–and perhaps a legitimate need–for alternative methods of lending, like small-dollar loans and companies like Spot Loan.

Spot Loan Review – How People Obtain Payday Loans

See Also: Mortgage Loan Officer Job Description and Review (Compensation, License, and Requirements)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

What Is Spot Loan?

Offering its installment loan products in all states except Arkansas, Minnesota, New York, North Dakota, Pennsylvania, West Virginia, and Washington D.C., Spot Loan provides an alternative to online and in-person payday loans.

By delivering small-dollar loans with an easy online application process, our Spot Loan review found that companies like Spot Loan are able to compete directly with payday loans, offering more flexible terms and often a more fluid sign-up process.

Our Spot Loan review reveals that the lending company is a subsidiary of BlueChip Financial. BlueChip Financial is fully-owned by the Turtle Mountain Band of the Chippewa Tribe of North Dakota.

The tribe started BlueChip and Spot Loan in 2012 with the support of ZestFinance, a firm founded by former Google CIO Douglas Merrill and Shawn Budde, a former senior credit executive at Capital One.

Spotloan.com Reviews

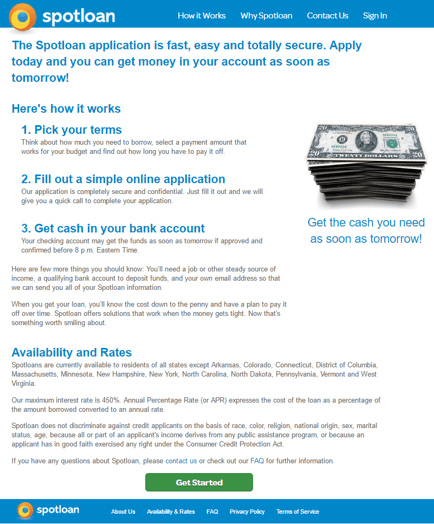

Spot Loan delivers all loans through its website, Spotloan.com. Our Spotloan.com review indicates that the website itself is fast and easy to use.

The loan application process is straight-forward. If a potential borrower qualifies and has the right personal information to provide on the web application, they can literally walk away from their computer minutes later with a loan headed directly to their bank account.

Our Spot Loan review found that these small-dollar loans range anywhere between $300-$800.

Spot Loan Reviews

Spot Loan provides clear information about its application and payback process and has detailed FAQs on their website. The company explicitly states that the maximum possible annual percentage rate is 490%.

However, a borrower will need to complete the application before they will know what their actual annual interest rate will be. This is because interest rates for small-dollar loans and installment payday loans depend largely upon state-specific regulation (discussed in greater detail below).

A survey of Spotloan.com reviews showed generally mixed grades. As an industry, alternative small-dollar loans are typically perceived as excessive in terms of interest rates.

In addition, the industry has been accused of providing loans to consumers who do not have adequate capacity to pay back the debts.

Many Spot Loan reviews–and reviews of companies who offer installment loans like Spot Loan–express frustration over not being properly prepared to pay back their small-dollar loans, particularly when coupled with high-interest rates.

Don’t Miss: LoanDepot Reviews | Details: Pros, Cons, Complaints & Mortgage Review

Spot Loan Complaints

In its own Spotloan.com review, the Better Business Bureau (BBB) rated the lender a “B.” The majority of Spotloan.com complaints to the BBB were related to billing and collections or to advertising.

Our Spot Loan review found that only 34 Spotloan.com complaints out of 106 filed with the BBB were resolved to the customer’s satisfaction.

While Spotloan.com complaints are often similar to those at online and brick-and-mortar payday lenders, Spot Loan explains on their website the differences between their loans and the payday loan products:

Spot Loan Review – Spot Loan Complaints

Surprisingly enough, aside from the BBB, Spotloan.com complaints and Spot Loan reviews are somewhat hard to come by.

It seems as though the BBB is the best option for consumers to post Spotloan.com complaints or Spot Loan reviews– but as a company, Spot Loan does not provide a forum for customers to publicly list Spotloan.com complaints or praise.

When considering Spotloan.com complaints, your decision will ultimately come down to whether you view the BBB as an authority in Spot Loan reviews, as there aren’t many other online avenues providing Spotloan.com reviews from actual customers.

Comparison: Spot Loan, Traditional Payday Lenders, and Loans Like Spot Loan

Ultimately, lenders are going to be judged based on their pricing of loans. Our Spot Loan review suggests that there are some price benefits to the installment loans they offer when compared to payday products.

Overall, though, the installment loans at Spot Loan and companies like Spot Loan are still extremely high.

Differences: Payday Loans Versus Spot Loan’s Installment Loan

What is the real difference between Spot Loan and payday loans? Here is the short answer based on our Spot Loans review:

- Spot Loan offer loans of up to $800. In many states, payday lenders can only offer loans of up to $500-$600.

- Spot Loan is an installment loan—you have regular payments that are predictable and are spread out over a period of time. Payday loans typically expire every two weeks and need to be paid off or a new loan needs to be opened at expiration.

- You can pay the loan off early without penalty. No need for this with a payday loan because they expire every two weeks.

- Online features provide convenience and efficiency for loan applications and payments.

- Our SpotLoan reviews show that the lender is able to deliver service via the web to a much broader consumer base than traditional payday lenders.

Related: What Is a Reverse Mortgage? – What You Need to Know (Pros & Cons, Disadvantages & Basics)

Similarities: Payday Loans Versus Spot Loan’s Installment Loans

Although Spotloan.com advertises their loans as “better than payday loans,” there are some similarities between Spotloan loans and traditional payday loans.

Our Spot Loan review has identified the following similar characteristics:

The Interest Rate

While Spot Loan says that you will save “up to 50%” compared to a payday loan, its literature is a little less specific about where those savings come from. We will delve into this a bit further below in our Spot Loans review.

Borrower Capacity

Loans are provided regardless of borrower capacity. As with a payday loan, the borrower is expected to have a regular paycheck.

Without additional credit reviews, though, many loan recipients may not have the true financial ability to fulfill their loan obligation and will inevitably have difficulties paying off their Spot Loans. This undoubtedly contributes to the number of negative Spot Loan reviews and Spotloan.com complaints.

In summary, our Spot Loans reviews suggest that while the loan offer is a comparatively expensive option for borrowers, the product is legitimate.

The process for application and payback is customer-friendly, and there are potential cost and convenience benefits to the installment products as compared to traditional payday loans.

Spot Loan Review: Interest Rate Comparison

When comparing Spot Loan and other small-dollar installment loans like Spot Loan, we see that there is typically a slight difference in interest rates, which comes out in favor of the installment loans.

However, interest rates for the installment loans tended to still be very high — close to the state limits for payday loans (payday loan limits also dictate the maximum interest rates for this class of installment loan in most states).

Does Your State Support Payday Loans?

Pew Charitable Trusts provides an excellent visual overview of which states are lenient towards payday loans, and which are not.

Although it does not demonstrate interest rate caps for individual states, it does give a good point of reference for those who are unsure as to whether their state allows payday lending.

Spot Loan interest rates vary by state but do not seem to stray too far from the law-mandated maximums and competitors’ pricing.

Our Spot Loan review also indicates that the lender competes against both online-only companies and brick-and-mortar payday loan companies like Advance America and Ace Cash Express.

State-By-State Interest Rates

While there is some potential price benefit to choosing an installment product over a payday loan, the interest rates on both are still very high. To get an idea of how loan interest rates will vary from one state to the next, take a look at the chart below.

The National Conference of State Legislatures provides a full listing of maximum loan amounts by state, while the average interest rates for payday loans by state is provided by the Center for Responsible Lending.

Brief Sampling of States that Allow Payday Lending | Maximum Loan Amount | State Maximum APR |

| Alabama | $500 | 456% |

| California | $300 | 460% |

| Florida | $500 | 304% |

| Illinois | $1,000 | 404% |

| Missouri | $500 | 521% |

| Ohio | $500 | 677% |

| South Carolina | $550 | 391% |

Table: National Conference of State Legislatures and Center for Responsible Lending

There are times where state-specific guidelines become the most important factor when deciding whether to get an installment loan or a payday loan.

For example, Spot Loan’s top annual percentage rate on its installment loans is 490%. Although this is much higher than Florida’s state maximum of 304%, it is much lower than Ohio’s, coming in at 677%.

At the traditional payday lender, Advance America, installment loans are also offered in selected markets.

In Illinois, Cash Advance payday loans and installment loans are priced identically (both at 404% APR); whereas the same products sold in South Carolina have a massive difference in percentage points (391% APR for the payday loan compared to 348% for the installment loan).

Popular Article: FHA Loan Requirements – What You Need to Know – FHA Mortgage & Home Loan Requirements

Free Wealth & Finance Software - Get Yours Now ►

Conclusion – Spot Loan Reviews

The addition of installment loans as an option for those looking to borrow against their salaries is a small step in the right direction.

Our Spot Loan review shows that their installment payday loans and loans from companies like Spot Loan provide consumers with a loan that is sometimes less expensive than the traditional payday loan.

As an additional benefit, these installment payday loans often come with friendlier repayment terms, making a loan even more accessible by comparison.

Ultimately, Spot Loan provides a service that consumers want and has a reputation for operating in a legally-reputable manner. For those with little option but to accept extremely high-interest rates, installment payday loans from Spot Loan are a viable choice.

We recommend you look at all of your options before taking on any debt, particularly when dealing with payday loans or installment payday loans.

Research the applicable lending limits for your state, and always seek reputable lenders that offer the best pricing and payment options for you.

Image Sources:

- https://www.bigstockphoto.com/image-86877935/stock-photo-mature-couple-signing-contract-in-lawyer-s-office

- https://www.pewtrusts.org/~/media/legacy/uploadedfiles/pcs_assets/2012/pewpaydaylendingreportpdf.pdf

- https://www.ncsl.org/research/financial-services-and-commerce/payday-lending-state-statutes.aspx

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.