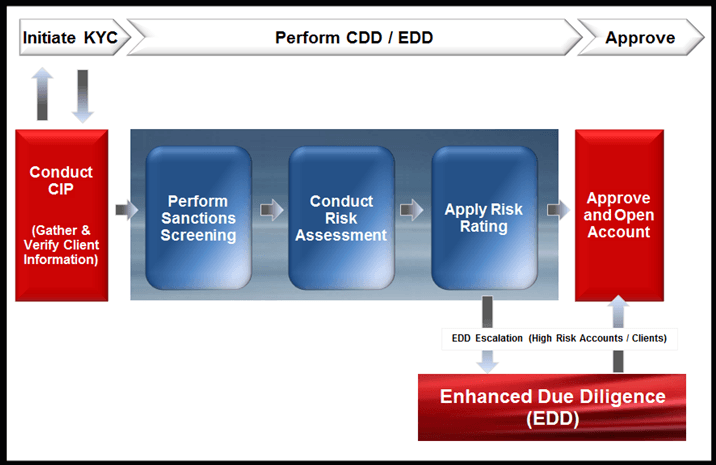

CDD (Customer Due Diligence) is the second step in the AML KYC Onboarding lifecycle. The first phase is the CIP (Customer Identification Program), which involves collecting and verifying customer information and documentation, and screening new customers against OFAC sanctions lists. CDD is broader than CIP, and is the foundation of a strong AML compliance program

What Is Customer Due Diligence (CDD)?

Customer due diligence is the process used by banks and other financial firms to assess a client’s money laundering risk.

CDD can be described as the following: Based on what I know about this new customer (customer type, products, etc.), how much of a risk (low, medium or high) is there that this customer will end up engaging in money laundering?

In order words, what is the probability that this new customer will attempt to launder money using this new account?

Objectives of CDD

A key objective of CDD is to obtain enough information from new customers at the time of the account opening that’ll allow a bank to gain a sound understanding of the customer’s normal and anticipated activity throughout the live of the relationship.

CDD enables the firm to evaluate the risk presented by each customer during the onboarding phase and throughout the life of the relationship. It also provides the financial firm with a baseline for evaluating customer transactions.

Before Conducting Customer Due Diligence

The following are critical AML procedures that financial firms need to complete before risk rating a customer:

- CIP Process – Gather Customer Info (Stage 1)

- CIP Process – Verifying Customer Identity (Stage 2)

- Developing a Well-Defined Customer Identification Program (CIP)

- KYC vs. CIP vs. CDD | Know Your Customer – Rules and Guidelines

Generating the Customer’s Risk Rating

To determine the AML risk rating for a new customer, financial firms normally assess the below factors:

- Customer’s name

- Customer’s address/location (country of operations, country of registration)

- Actual or anticipated account activities

- Account type (e.g., cash, trading, savings, and investing)

- Type of business in which the customer is engaged in (export, manufacturing, tobacco/alcohol, design, etc.)

- Type of entity (foreign bank, nonbank financial institution, domestic/foreign corporation, trust, individual, corporation, LLC, partnership, etc.)

- The source of wealth or source of assets

- Purpose of the account

- Involvement of any politically exposed persons (PEP), their immediate family members or close associates

When conducting due diligence, firms normally use a Risk Assessment Matrix (also referred to as a Risk Rating Template) to determine the overall risk rating of the client.

If an account is determined to be of higher risk, the financial firm may require additional information from the customer to perform enhanced due diligence. Such additional information may include the identity of the account’s beneficial owners.

The USA PATRIOT Act also requires enhanced due diligence on foreign private banking and foreign correspondent accounts.

Risk Rating Methodologies

Each of the assessed factors (above) will be given its own low, medium or high-risk rating.

For example, a customer’s location might be rated high if the customer is domiciled in a high-risk country (e.g., Colombia) or rated low if the customer is located in a low-risk country (e.g., the US or the UK).

In addition, customers involved in cash-intensive businesses (e.g., convenience stores or gambling centers) might be rated high as they possess a higher probability of a money laundering risk. Drug cartels have been known to attempt to launder money via gambling centers.

The overall customer risk rating is a cumulative average of all of the individual ratings.

Click here for further information on conducting AML CDD Risk Assessments and developing risk rating methodologies.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.