Guide to Loan Amortization: 7 Tips for Finding the Top Amortization Calculators & Schedules

Your mortgage is the loan you’ll be with the longest, with most people opting to extend their conventional mortgage loans to a lengthy thirty years.

Unfortunately, that also means that you’re likely to be paying an excessive amount of interest over the course of the next three decades.

What if you wanted to know exactly what it would take to pay off your loan? Loan amortization, the ability to pay off a loan over a period of time, can offer you some insight into exactly how much you’ll be shelling out in unproductive interest dollars.

Image Source: Amortization Calculator

With all of the interest in saving a few dollars here and there, many consumers would likely benefit from using an amortization calculator or amortization schedule in order to see exactly when their loan will be paid off and what the cumulative effect will be on their finances.

However, not many people know how to calculate loan amortization or even where to find a comprehensive amortization schedule.

AdvisoryHQ is here to take some of the mystery out of loan amortization and to put consumers in a position of power as they come to understand their finances.

Join us as we explore a few tips and tricks to help you find a loan amortization calculator that will break down the repayment process for you.

See Also: How to Calculate Income Tax – Complete Guide to Income Tax Calculations

Know When You Can Benefit from an Amortization Calculator

Before you can understand which amortization chart or mortgage amortization table will help you to understand your finances better, it’s important to comprehend exactly what amortization is and why it matters.

An amortized loan is paid through regular, scheduled payments which encompass both the interest from your lender as well as repaying a portion of the principal. It can technically apply to any type of loan: mortgage loans, auto loans, debt consolidation, and personal loans. However, in most instances, individuals are usually looking for an amortization calculator for their mortgages.

This is the standard type of loan for a conventional mortgage product. You should be aware that an amortization schedule will hold no value if you have an adjustable-rate mortgage, an interest-only loan (popular among some construction loans) or any sort of balloon payments involved in the repayment.

Keep an eye out in your loan documentation for terms like “negative loan amortization,” which also means that the amortization schedule will not accurately assess your payments.

Understand How the Amortization Formula Works

It can be tempting to use the first amortization calculator you stumble across on the Internet, but you should know how the amortization formula works first. Without knowing the math behind it, you’ll be left with a jumbled mess of numbers and dollar signs that carry little to no meaning to you. The only numbers that will really stand out to you are those at the bottom – the final price that you’re paying over the lifetime of your loan.

Each month, you send in a payment to your lender. Your loan amortization allocates a percentage of this payment to your principal and the rest covers the cost of your interest. That doesn’t come as a surprise to most people.

As your loan progresses, the payments that cover your loan amortization gradually increase the amount allocated for your principal while decreasing that for your interest. Why does this happen?

Each month, your interest is tallied according to the balance remaining on your overall loan. Even by chipping away at your principal with just a few hundred dollars each month, it can cause a slight shift in your loan balance and lower your accrued interest.

Since your payments each month are set in stone, that means that the amortization accounts for slightly more money being added to the principal each month.

The amortization formula accounts for all of these scenarios. When you take a look at an amortization schedule or amortization chart, you will notice that the money allocated to each section changes slightly from month to month.

Keep in mind that this is how the amortization formula functions. If the amortization calculator you’re using doesn’t demonstrate this, it’s time to find a new one.

Don’t Miss: The Best Home Equity Calculators & Equity Line of Credit Calculator Websites

Making an Amortization Chart

Want to be sure that the loan amortization calculator you’re using is generating accurate information in the mortgage amortization table? Consider doing the math on a few lines of the amortization table yourself just to be certain that the mathematics behind it check out. If you’re a math whiz, this might seem like a no-brainer.

However, for the rest of us, let’s take a closer look at how you can calculate the first few lines on an amortization table.

You should already know exactly what your monthly repayment amount is if you’re working with an existing loan. Let’s pretend that your annual interest rate will follow a monthly schedule, so you will need to change that annual rate into a monthly rate. To do so, you take your annual interest rate and divide it by twelve.

The first line of your amortization schedule will be easy to calculate. Take the number you receive in the last section for your monthly interest rate and multiply it by the principal you borrowed on your loan. You should get a number that is lower than what your monthly payment is. This number represents how much you are paying in interest during the first month. The remainder of your payment will be applied to the principal.

Calculate the next line based off the new loan balance (your principal minus whatever sum you applied toward it in the previous month). Perform this same amortization formula for the first few lines to make sure that the math on the amortization table is accurate.

If you’re really determined, you could create an entire amortization schedule on your own this way. However, there are so many options for a reliable amortization calculator at your disposal, it seems like an unnecessary step to repeat 360 times over.

Gather Your Information

As with all things, it’s important to be prepared. Gathering the necessary documents can save you a significant amount of time as you prepare to learn more about your loan amortization.

Before you begin with an amortization calculator, make sure to round up all of the pertinent information about your loan. You will need your starting principal, original starting date of your loan, the annual interest rate, and any information regarding the extra payments you may be making on your mortgage or loan.

Keeping all of that information easily at your fingertips allows you to compare the models from several different amortization calculators quickly and efficiently. Most of the options available will take only a few minutes to put all of your information into the corresponding blanks. Equally quickly, they can send back a full amortization schedule from your very first payment all the way up to the final payment 360 months later.

Related: Selling A Home? Here’s the Full Guide on How to Sell Your Own Home

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

How Do You Need the Data?

When it comes to finding a loan amortization calculator, you have a ton of options. A quick Google search will come up with thousands of choices which can make it incredibly overwhelming to determine which one is the best fit for you and how you would like to see your loan amortization broken down.

First things first, you need to decide what sort of format you would like your information to be displayed in. Do you prefer your amortization to be demonstrated through a neatly organized amortization table or chart? If you are a more visual person, you may prefer to see it in the form of a graph.

Know what format works best for you so that you can quickly and accurately assess your loan amortization and know where your financial standing is at all times. An amortization calculator can convey all kinds of information that you would find useful.

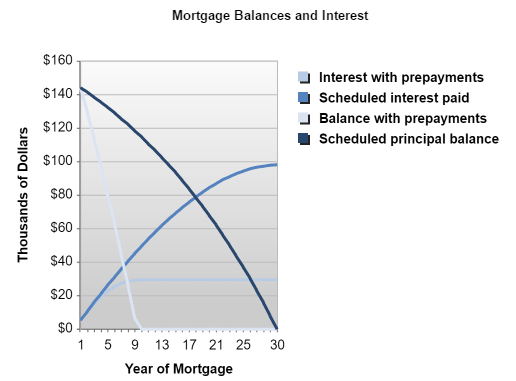

For a quick glance at how your interest rates and principal function according to the amortization formula, you can use this calculator from Bankrate which features a handy line graph designed to show how your principal balance decreases more dramatically during your loan amortization and how your interest payments tally quickly at the beginning and then taper off towards the end of the loan.

Image Source: Bankrate.com

If you prefer to view the amortization table, you can opt to see the full report on this same loan amortization calculator and see how the payments shift through all 360 payments (or whatever loan term you enter in for the initial loan amortization calculations).

Popular Article: What Is a Reverse Mortgage? – What You Need to Know (Pros & Cons, Disadvantages & Basics)

Extra Payment Option

Not all loan amortization will account for the fact that you might wish to make additional payments each month.

If you are interested in loan amortization for the simple fact that you would like to decrease the amount of money you shell out over the lifetime of your mortgage, you may also want to consider adding additional payments into your amortization calculator for inclusion in the amortization schedule.

It is said that more than 83 percent of the total funds that you pay on your monthly balance are used to cover the cost of your interest during the first year of your amortization. While that number does decrease to just three percent annually by the final year, it is still a hefty chunk of money that you are essentially losing.

In light of that, some individuals may opt to make additional payments, especially early into their mortgage. By decreasing your principal balance more rapidly, your interest will decrease faster and more funds from the monthly payment will be allocated to your balance as well. As a result, your loan amortization could occur significantly sooner.

The amortization calculator from Bankrate in the last section does give the option for an additional payment, but it only allows you to choose how much you would like to pay each month. Some families may find this option convenient, as they would prefer to simply add an extra few hundred dollars to their bill each month.

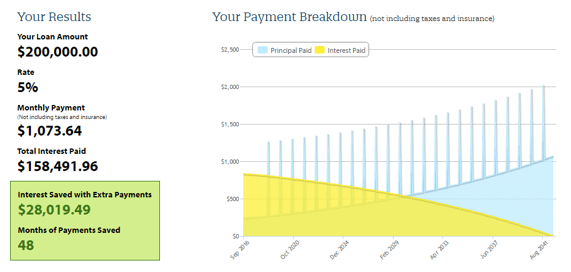

Others prefer to pay a lump sum annually or just one or two times. It doesn’t matter how you make additional payments because, in the end, it reduces the period for loan amortization no matter what. However, to view the most accurate information on an amortization schedule, consider using the amortization calculator from Quicken Loans. It gives you a choice between a monthly, yearly or one-time additional payment.

Image Source: Quickenloans.com

Unfortunately, the Quicken Loans calculator will not provide you with a full amortization table. It does, however, provide you with a color graph detailing how much you will have saved both in money and time before your loan is paid in full.

Read More: Vanderbilt Mortgage Reviews – What You Want to Know About VMF.com (Complaints & Mortgage Reviews)

Basic Starting Point

If you’re feeling overwhelmed by all of the different options available for your amortization calculator, you’re not alone. It’s hard not to be overwhelmed by the sheer volume of data that a mortgage amortization table provides. Adding in the possibility of additional payments that can alter your amortization schedule can make it even more confusing to understand exactly how your loan amortization functions.

If you want to begin to take a closer look at the amortization of your loan without all of the bells and whistles, you need to find a good basic amortization calculator. Fortunately, there are many of them to meet your needs, no matter what your preference is for how the data is displayed.

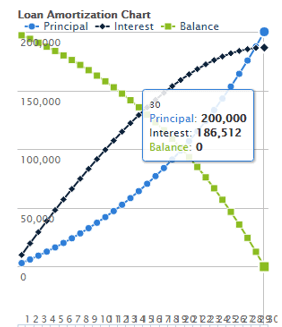

For a basic option that won’t leave you wanting for detail, consider using Credit Karma’s loan amortization calculator. It features a full amortization schedule broken down by month for the duration of your loan, as well as several graphs to demonstrate the ratio of your principal and interest over the lifetime of your loan.

Image Source: Creditkarma.com

Alternatively, Bankrate has a separate amortization schedule and calculator that gives you a detailed breakdown as to how you can expect your payments to work for the duration of your loan.

If you’re curious about how your payments will look for a loan that you don’t yet have the details for, it also has a great feature that allows you to have Bankrate pull today’s mortgage interest rates and substitute them with the rest of the information you provide.

Conclusion: Finding the Right Loan Amortization Calculator and Amortization Schedule

Understanding the inner workings of how your lender calculates the payments you make for your loan amortization is important. It can greatly affect how and when you may choose to make additional payments as well as help you understand exactly how the interest of your loan functions. The amortization formula may leave you overwhelmed with data, but it isn’t complicated to figure out.

Using the amortization formula, you can calculate your own loan amortization and format it into an amortization table that rivals those that the professionals make. It’s equally understandable if you prefer to let the mathematicians do the work and utilize the time-saving resources of an amortization calculator.

Find one that formats the data in the form you find easiest to read. Whether it is an amortization table or graph, there are plenty of options available to make the data easily accessible at a quick glance.

Understanding your loan amortization is a good step toward good financial health and understanding how your loan truly works. Especially if you are interested in paying off your mortgage early, a mortgage amortization table can tell you what you need to do to reach your goals.

AdvisoryHQ (AHQ) Disclaimer: Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info. Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.