Intro: The Best Home Equity Calculators & Equity Line of Credit Calculator Websites

If you’re considering tapping into your home’s equity, you will likely be making use of the various home equity calculators that can be found online.

Home Equity Calculator

Accessing an equity loan is a big decision. We’ve compiled a list of the best home equity calculator websites for you to consider.

Plus, once you’ve taken out a home equity loan, it’s important to consider how you will repay it, so we’ve reviewed home equity loan payment calculators as well. But, before we review the best home equity calculators, let’s start from the beginning.

See Also: Best Mortgage Companies (Overview of the Top Mortgage Lenders)

What Is a Home Equity Loan?

To best understand the results of various home equity line of credit calculators and home equity loan payment calculators, it is helpful to also understand exactly what a home equity loan is. A home equity loan is essentially an additional mortgage on your home.

The second mortage is attached to your home, meaning you are borrowing against your home’s equity.

However, for both home equity loans and home equity lines of credit, the repayment period is generally shorter than for original mortgages.

According to bankrate.com, a “A home equity loan or line of credit allows you to borrow money, using your home’s equity as collateral.” When you take out the loan, your home is the property that you pledge as collateral, or the guarantee that you will repay the debt.

This means that if you fail to make regular payments, you can lose your home, because the bank will reclaim the property to recoup its losses. Be sure to use a home equity loan payment calculator to determing what your payments will be and whether you can afford them before taking on the loan.

Home equity lines of credit also allow you to just pay interest, rather than making payments against the loan itself. This might sound intriguing, especially if you are strappred for cash, but it becomes a dangerous cycle. By not chipping away at the principal amount, you extend the life of the loan, also extending how long you are in debt.

Despite the risk if you miss payments, home equity loans can be beneficial when they are handled responsibly. For example, people often use these types of loans to pay off other debt with high interest rates or to pay for home repairs.

When you take out the loan it is generally paid out in one lump sum. The length of the loan and the amount of your payments are set in advance. When you have paid the loan off in full, you can no longer borrow against the equity of your home. Instead, you would be required to open another home equity loan if you wish to do so.

Don’t Miss: Guild Mortgage Reviews – What You Need to Know

What Is a Home Equity Line of Credit?

A home equity line of credit is similar to a home equity loan in that it is also an additional mortgage on your home and your home’s equity guarantees the loan. However, it is handled differently.

Unlike fixed home equity loans, home equity lines of credit are revolving with variable interest rates, making them similar to credit cards. According to Investopedia:

“Borrowers are pre-approved for a certain spending limit and can withdraw money when they need it via a credit card or special checks. Monthly payments vary based on the amount of money borrowed and the current interest rate.”

The good news? You are only required to pay interest on the amount of money you take out, not the full amount that is available to you.

Once again, you are at risk of losing your home if you miss a payment, so the decision to take out a home equity line of credit should not be taken lightly. To ensure you can afford payments, consider using an equity line of credit payment calculator before taking on new debt.

If you are considering opening a home equity loan or a home equity line of credit, keep in mind that both must be fully repaid if you sell the home on which the loan is borrowed.

Do-It-Yourself Home Equity Calculator

There are many online equity loan calculators and equity line of credit calculator websites available, which we will review shortly. However, you can actually do a few simple calculations yourself to determine how much your equity is before you start shopping around for a home equity loan or line of credit.

Bankrate.com provides useful examples of how to calculate your equity so you can make the most of specific online home equity calculators, such as home equity loan rates calculators, when the time comes. To paraphrase bankrate.com’s example, let’s imagine you purchased a house for $200,000 with a down payment of $20,000. This means that you borrowed $180,000. To calculate equity, use the following equation:

$200,000 (home’s purchase price) – $180,000 (mortgage balance) = $20,000 (equity)

The day you buy the house, your equity is equal to your down payment. However, equity changes over time. For example, in five years, the value of your home may increase, say, to $300,000. By then, you will have made regular monthly payments, reducing your mortgage balance to $167,000. So, to determine your home’s equity, use the following equation:

$300,000 (appraised value of your home) – $167,000 (mortgage balance) = $133,000 (equity).

Now that you understand the basic principles behind calculating equity, you will better understand the various home equity calculators available online. As you can see, it is also important to know your home’s value in order to get an accurate estimate from an equity loan calculator or an equity line of credit calculator. If you are not sure, consider having your home appraised by a professional.

Related: What Is a Jumbo Loan? A Complete Guide

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

The Best Equity Loan Calculators

If you are considering or have decided to take out an additional mortgage, you will likely want to determine what your payments will be. Since they are fixed rate loans, a home equity calculator will compute the amount you pay on a regular basis.

Fortunately for consumers, there are numerous equity loan calculators freely available online. In fact, the financial institution that provides your loan might very well provide this service, so it is a good place to start in your search for a reputable home equity loan payment calculator.

For example, Citibank’s Home Equity Rate Selector allows you to to choose between a fixed rate home equity loan and a home equity line of credit, and then input your mortgage balance, your home’s value, your desired loan amount, and the state in which your property is located for a personalized calculation of rates and loan payments.

Conveniently, like many other major banks, Citi also allows you to start your application online. However, due to the risks associated with borrowing against your home, be sure to use a home equity payment calculator and speak with a professional before committing to such a loan online.

Similarly, Fifth Third Bank offers low-rate home equity loans. Benefits of borrowing against your home’s equity with Fifth Third Bank include:

- The ability to use your home to consolidate bills, afford home renovations, or pay for large purchases

- The flexibility to borrow only the amount of money that you need, along with a set repayment schedule. Fixed, predictable payments provide for peace of mind

- A 0.25% discount when you use your personal checking account with Fifth Third Bank to deduct your home equity loan payment using its Auto BillPayer function

- An additional 0.25% discount when your payment is deducted from a Preferred or Enhanced checking account with Fifth Third

- Monthly service charge is waived when your Fifth Third home equity loan is deducted from the bank’s Essential Checking Account.

While there are certainly savings to be had with Fifth Third Bank, it is important to make sure you borrow with an instiution that is a good fit for you. You can do so by using Fifth Third’s home equity loan rates calculator to enter your loan amount, interest rate, and months needed to pay off the loan.

In addition to the equity loan calculators that can be found on the websites of financial instituions, other web based resources also house more general home equity loan payment calculators. At ratehub.ca, for example, you can get an idea of how much equity you have available by entering:

- The current value of your home

- The remaining balance of your mortgage

However, generic home equity loan rates calculators are simply a starting point in your research. You will need to visit your financial institution to determine exactly how much your rate and payments will be.

Popular Article: Top Bad Credit Mortgage Lenders for Bad Credit Borrowers

The Best Home Equity Line of Credit Calculators

As with home equity loan payment calculators, mainstream financial institutions generally provide home equity line of credit calculators as well. In fact, depending on the institiution, you are more likely to find equity line of credit payment calculators on the websites of large banks because they do not generally offer traditional home equity loans.

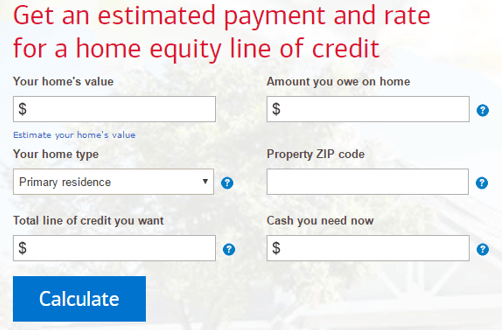

For example, the Bank of America houses an equity line of credit payment calculator. You can quickly get an estimated payment and rate by inputting the following information:

- The value of your home

- The amount you owe on your home

- The type of home (primary residence, second home, or vacation home)

- The ZIP code for your property

- The total amount of credit you are seeking

- The amount of cash you need right away

Home Equity Line of Credit Calculator

Hit “Calculate” and the equity line of credit calculator will give you an estimated payment. Bear in mind, as previously mentioned, that Bank of America only offers home equity lines of credit. It stopped providing home equity loans as of July, 2015.

Likewise, Chase provides an online resource center with several home equity calculators. For starters, the Home Value Estimator will help you determine how much your home is worth.

Then, you can use the Home Equity Line of Credit Calculator to determine the amount of money you might be able to borrow against the value of your home. Finally, Chase’s Debt Consolidation Calculator can estimate your savings should you choose to consolidate your debts into one home equity line of credit.

A Top Ten Review of Wells Fargo identified the institution as “one of the best banks for home equity financing.” While it only offers home equity lines of credit, not traditional home equity loans, it offers an annual rate cap as well as lower rates than most other lenders.

Moreover, unlike most home equity lines of credit, Wells Fargo offers a fixed rate feature, which lets you predetermine your interest rate for terms of 1 to 20 years. It is a beneficial feature for those looking for the flexibility associated with a line or credit but also the predictability that comes with traditional, fixed rate loan payments. Wells Fargo’s website provides plenty of online resources to prepare you for applying, including a home equity line of credit payment calculator.

A generic and useful equity line of credit calculator can be found at bankrate.com.

Not only can it help you find out how much you may qualify for in terms of a credit line, it also provides detailed definitions to help you use the home equity calculator correctly. As is the case with generic equity loan calculators, you will need to visit a financial instiution to find out the exact amount you qualify to borrow.

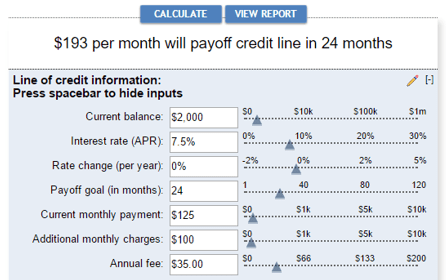

For those who already hold a home equity line of credit and are looking to find out how long it will take to pay it off, bankrate.com provides another useful resource. Its Line of Credit Payoff calculator will help you meet your repayment goals using your line of credit information, including:

- Current balance

- Interest rate

- Rate change (per year)

- Payoff goal (in months)

- Current monthly payment

- Additional monthly charges

- Annual fee

Home Equity Loan Payment Calculator

This unique home equity payment calculator can help you decrease the time it will take to repay your credit line; you will also receive a detailed report complete with visuals to make it easier to visualize the end date on your payments.

Therefore, when it comes to paying off your loan, bankrate.com offers one of the best home equity line of credit payment calculators online.

Read More: Apply For FHA Loan – How To Apply

Conclusion

This review of the best home equity calculators and equity line of credit calculator websites has provided an overview of what home equity is, as well as a look at the similarities and differences between a home equity loan and a home equity line of credit.

While they are both additional mortgages that borrow against your home’s equity, such loans typically provide fixed rates and set payments compared to the flexibility, but possible volatility, associated with the line of credit option.

You can use equity loan calculators and home equity line of credit calculators to see the differences and determine which option is right for you.

Remember, the decision to borrow against the equity of your home can be risky. Making use of the various home equity calculators mentioned in this article is a good starting point in deciding if you can afford certain rates and payments, and whether you are better suited to a fixed rate loan or a line of credit.

Additionally, it is always wise to speak with a professional to understand the specifics of your individual loan or line of credit, and determine if you are willing to take on the associated risks. If you already hold a home equity loan or line of credit, bankrate.com’s equity line of credit payment calculator is a great tool for determing when you will pay off the balance.

One thing is certain: home equity calculators are a useful resource for helping you make sound financial decisions.

Image sources:

- https://pixabay.com/photos/office-notes-notepad-entrepreneur-620817/

- https://www.bankofamerica.com/home-equity/home-equity-calculator/

- https://www.bankrate.com/calculators/home-equity/line-of-credit-calculator-tool.aspx

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.