Intro – Ardent Credit Union Reviews & Ranking

AdvisoryHQ recently published its list and review of the top credit unions in Pennsylvania, a list that included Ardent Credit Union.

Below we have highlighted some of the many reasons Ardent Credit Union was selected as one of the best credit unions in Pennsylvania.

Click here for a detailed review of AdvisoryHQ’s selection methodology: AdvisoryHQ’s Methodology for Selecting Top Banks and Credit Unions.

Ardent Credit Union Review

Ardent Credit Union considers themselves to be one of the best credit unions in Philadelphia, and with good reason. Since first opening their doors in 1977 to serve the employees of GlaxoSmithKline, they have built up a reputation of showing up, helping out, and getting things done.

Image Source: Ardent Credit Union

Recently rebranded as Ardent Credit Union from Sb1 Federal Credit Union, Ardent has accumulated more than $600 million in member assets. This credit union in Pennsylvania is a true community-chartered credit union serving residents in Philadelphia, Montgomery, Delaware, Bucks, and Chester counties.

Key Factors Leading Us to Rank This Firm as One of This Year’s Top Credit Union Firms

Upon completing our detailed review, Ardent Credit Union was included in AdvisoryHQ’s ranking of this year’s best credit unions based on the following factors.

Ardent Credit Union Review: Share Draft Checking Account

With their Share Draft Checking account, Ardent Credit Union gives members everything they want in a checking account and nothing they don’t – and it is completely free. On top of being completely free, this amazing checking account also pays dividends at a higher rate than most big name banks, and there is no minimum balance requirement to begin earning dividends.

Features of this credit union in Pennsylvania’s amazing checking account are:

- No minimum balance requirement

- No monthly service charge

- No per-check charge

- Pays dividends at a competitive rate

- Free Visa Rewards Check Card

- First 150 checks free

- Overdraft protection available

Ardent Credit Union Review: Flex CDs

Ardent Credit Union offers their high-yield Flex CD to help members power-up their savings. For those members who want more growth on their investment, this 18-month or 30-month CD can deliver it for them.

This extremely flexible CD allows members to access up to 50% of the funds invested in the CD penalty-free throughout the term. This Pennsylvania credit union’s Flex CD is designed to help its members reach their savings goals.

- $500 minimum deposit, $1,000 maximum deposit

- Withdraw up to 50% without penalty

- Add funds anytime throughout the term

- Receive maximum savings over the term

This credit union in Philadelphia’s Flex CD comes with high-yield rates that blow many big-name banks’ rates out of the water.

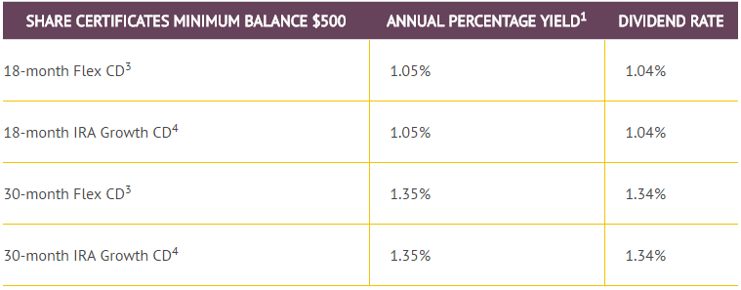

Rates on a Flex CD are:

Image Source: Ardent Credit Union

These CDs are also available as an IRA Growth CD with the same terms and same rates.

Ardent Credit Union Review: Auto Loan Rates

One of the main advantages of choosing a credit union over a bank is the lower loan rates, and Ardent Credit Union doesn’t disappoint in this respect. The credit union in PA’s auto loan rates are very hard to beat and can give members more wiggle room in their purchasing budget.

Current auto loan rates at this top notch credit union in Philadelphia start as low as 0.99% for a new auto with a 36-month term and 1.99% for a used auto aged 2009 and newer with a 48-month term.

Rates remain extremely competitive with longer terms. A new auto loan with a 72-month term can be had at a rate of 1.74% and a used auto aged 2009 and newer with a 72-month term can be had for a rate of 2.24%.

In addition to the above Ardent Credit Union review, you can click on any of the links below to browse exclusive reviews of AdvisoryHQ’s top rated banking firms & credit unions:

Top Rated Banks

Top Banking Firms

Review of Top Mortgage Firms

Bank Reviews

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.