2017 RANKING & REVIEWS

TOP RANKING CREDIT UNIONS IN PENNSYLVANIA

Finding the Top Credit Unions in PA

Credit unions are often known for their focus on providing a superior level of customer service to their customers. The majority of credit unions also show a deep commitment to providing support and financial education to the communities they serve. These reasons, coupled with their often better rates and lower fees, have many residents turning their backs on banks in favor of credit unions in Pennsylvania instead.

While there are many good options among the large number of credit unions Pennsylvania has to offer, there is a select group of credit unions in Pennsylvania that shine above the rest. The Pennsylvania credit unions on our list of the best credit unions in PA offer their members superior customer service along with a vast array of top-notch financial products and services.

Award Emblem: Top 15 Best Credit Unions in Pennsylvania

Through our comprehensive reviews of these outstanding credit unions, you will have the opportunity to learn more about what ranks them among the best that Pennsylvania has to offer. The credit unions on this list span the entire state and include credit unions in Philadelphia, Erie, Harrisburg, and Reading.

It is our sincere hope that the information within this article will help you narrow your search for a credit union in Pennsylvania down to the one that is truly the best credit union in Pennsylvania for you.

AdvisoryHQ’s List of the Top 15 Best Credit Unions in Pennsylvania

List is sorted alphabetically (click any of the names below to go directly to the detailed review section for that credit union)

- American Heritage Federal Credit Union

- Ardent Credit Union

- Citadel Federal Credit Union

- Clearview Federal Credit Union

- Diamond Credit Union

- Erie Federal Credit Union

- Franklin Mint Federal Credit Union

- Freedom Credit Union

- Members 1st Federal Credit Union

- Pennsylvania State Employees Credit Union

- People First Federal Credit Union

- Philadelphia Federal Credit Union

- Police and Fire Federal Credit Union

- TruMark Financial Credit Union

- Utilities Employees Credit Union

Click here for 2016’s Top 15 Best Credit Unions in Pennsylvania

Top Credit Unions in Pennsylvania | Brief Comparison

Credit Union in Pennsylvania | Highlighted Features |

| American Heritage Federal Credit Union | Totally Free Checking Plus |

| Ardent Credit Union | Flex CDs |

| Citadel Federal Credit Union | Citadel Cash Rewards MasterCard |

| Clearview Federal Credit Union | Commercial real estate loans |

| Diamond Credit Union | Membership Share account |

| Erie Federal Credit Union | Dividend Plus Checking |

| Franklin Mint Federal Credit Union | Estate planning |

| Freedom Credit Union | Student Visa card |

| Members 1st Federal Credit Union | Merchant services |

| Pennsylvania State Employees Credit Union (PSECU) | SBA loans |

| People First Federal Credit Union | People Perks |

| Philadelphia Federal Credit Union | Student Financial Services |

| Police and Fire Federal Credit Union | Premium Yield and Money Market Accounts |

| TruMark Financial Credit Union | Certificates of Deposit |

| Utilities Employees Credit Union | Home Equity Visa |

Table: Top 15 Best Credit Unions in Pennsylvania | Above list is sorted alphabetically

Free Wealth & Finance Software - Get Yours Now ►

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review—Top-Ranking Credit Unions in Pennsylvania

Below, please find the detailed review of each firm on our list of the best credit unions in Pennsylvania. We have highlighted some of the factors that allowed these Pennsylvania credit unions to score so high in our selection ranking.

See Also: Best Credit Unions in America | Ranking & Reviews | Best U.S. Credit Unions

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

People First Federal Credit Union Review

People First Federal Credit Union has been proudly serving the people of the Lehigh Valley for more than 65 years. With their more than 65,000 members and over $530 million in assets, this Pennsylvania credit union has the distinction of serving more members than any other credit union in the Lehigh Valley.

This top credit union in Pennsylvania has eight full-service branch locations strategically located throughout the Lehigh Valley to better serve their members. They also offer 24/7 banking through their online and automated banking services.

People First Federal Credit Union is one of the best credit union in Pennsylvania that operates with a mission to provide the highest quality of financial services in a friendly, convenient, and personalized atmosphere. They also make it their mission to operate in a financially sound and competitive manner to ensure long-term financial stability while safeguarding members’ assets.

Top Credit Unions in Pennsylvania

Key Factors That Enabled This Credit Union to Rank as a Top Credit Union in Pennsylvania

Below are key factors that enabled People First Federal Credit Union to be rated as one of this year’s best credit unions in Pennsylvania.

Share Draft/Checking Account

People First Federal Credit Union’s Share Draft Checking account is perfect for everyone with many great features and no fees to go with them.

The benefits of this all-in-one checking account speak for themselves. Benefits of a Share Draft Checking account at this top Pennsylvania credit union are:

- No minimum balance requirement

- No monthly service charge

- No per check charge

- Free Visa debit card

- Free overdraft protection from savings

- Courtesy Pay coverage available

- First order of checks free

- Free online and automated phone account access

Auto Loans

This top credit union in Pennsylvania offers both new and used auto loans to help members get into the car of their dreams. This Pennsylvania credit union offers generous 100% financing for qualified borrowers and an easy pre-approval process to help members shop for their new car with confidence.

They also have an indirect auto lending program with several area car dealerships so that members can get financing through People First FCU at the dealership. This streamlines the car purchasing process for the member.

Full benefits of an auto loan from this credit union in Pennsylvania are:

- Flexible term options

- 100% financing for qualified borrowers

- Financing available directly through participating preferred auto dealers

- Easy online application process

- Low interest rates

- Automatic payment options

- Refinance a current loan into a lower rate

- Credit Life, Disability, and GAP insurance available

People Perks

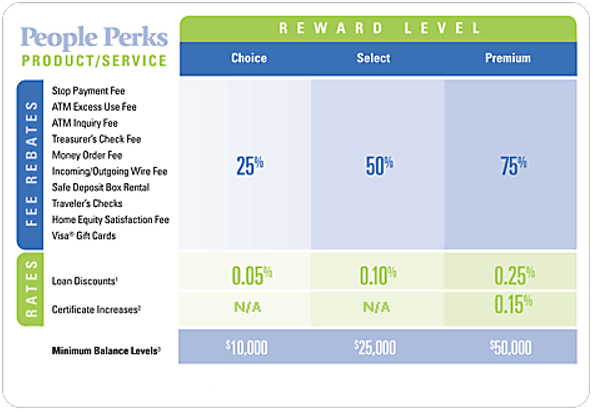

People First Federal Credit Union values their relationship with each of their members. For this reason, they offer the People Perks program to reward members for their relationship with this Pennsylvania credit union.

With this program, members receive rebates on many of the services they currently use plus a reduction on qualifying loan interest rates and an increase in qualifying share certificate rates. The amount of the rebates received are based on the member’s relationship level with the credit union in Pennsylvania.

All it takes to get started with People Perks is opening a share draft or money market account with direct deposit or payroll deduction. All of the loan, deposit, and certificate balances in a member’s household are added together to determine their qualifying reward level.

Source: People First Federal Credit Union

Reward levels are shown on the member’s monthly statement, taking the guesswork out of keeping track. Rebates are credited to members’ primary share account at the end of each month.

Don’t Miss: Best Credit Unions in Los Angeles | Ranking | List of LA Credit Unions

Philadelphia Federal Credit Union Review

Philadelphia Federal Credit Union was formed in 1951 to serve the financial needs of Philadelphia municipal employees. Today, they are one of the top six credit unions in Philadelphia with more than 112,000 members and over $900 million in assets.

Throughout the years, Philadelphia Federal Credit Union has focused on helping ordinary Philadelphians achieve their financial goals, from opening businesses to educating their kids. Today, they proudly continue with that mission, serving more than 400 organizations throughout Pennsylvania, New Jersey, and Delaware. It is their ambition to become the leading Pennsylvania credit union in the Delaware Valley, and they are well on their way to achieving their goal.

Source: Philadelpia Federal Credit Union

Key Factors That Enabled This Credit Union to Rank as a Top Credit Union in Pennsylvania

Below are key factors that enabled Philadelphia Federal Credit Union to be rated as one of this year’s best credit unions in Pennsylvania.

Financial Education Events and Classes

Philadelphia Federal Credit Union is a credit union in Philadelphia that doesn’t just talk about providing financial education to its members—they actually walk the walk. Members of this Pennsylvania credit union have the opportunity to attend many free financial education events and classes hosted by Philadelphia FCU throughout the year.

As most free events are held at easily accessible public places such as local libraries, this credit union in Pennsylvania makes it easy for members to empower themselves to make sound financial decisions through financial education.

Source: Philadelphia Federal Credit Union

Events and classes cover everything from buying a home to understanding how credit works and safeguarding your identity—and attendance is completely free.

Specialty Accounts

Everyone has different financial needs and goals, and Philadelphia Federal Credit Union is a credit union in Pennsylvania that recognizes that. Because they know everyone has different priorities when it comes to saving, this top credit union in Philadelphia provides a variety of specialty savings accounts so that members can choose the one that best suits their specific financial needs.

All of the specialty accounts at Philadelphia FCU come with no fees attached. Available accounts are:

- Health Savings Account: can be used tax-free to pay for qualifying medical expenses, no minimum balance requirement

- Custodial/Pautma Accounts: perfect for building up savings for a child, $5 minimum balance requirement

- Estate Account: can be opened by a legal executor or administrator of an estate to settle the financial matters of a deceased person, $5 minimum balance

- Trust Account: designed to act on behalf of the well-being of another, such as a child or senior citizen

- Iolta Account: interest from this account is pooled to provide civil legal aid and support improvements to the justice system, $5 minimum balance

Student Financial Services

If you are looking for credit unions in Philadelphia who realize the importance of a good education and want to help its members achieve their educational goals, then Philadelphia Federal Credit Union may just be the right Pennsylvania credit union for you.

Philadelphia FCU offers its members competitive loans and financial assistance to help them make their college dreams a reality.

Source: Philadelphia Federal Credit Union

Student financial services available at this top credit union in Pennsylvania are:

- Student loan: Philadelphia FCU offers the Smart Option Student Loan by Sallie Mae, which offers three repayment options and competitive interest rates

- PFCU scholarship program: annual scholarship that awards $1,000 to four high school seniors who are members at Philadelphia FCU

- CCP scholarship program: awards $400 per fall semester to a member enrolled at Northeast Regional Center

- Tuition rewards program: college savings plan designed to earn guaranteed scholarships for family members at participating private colleges and universities across the nation

Related: Best Credit Unions in Houston, TX | Ranking | Comprehensive List of the Best Houston Credit Unions

Police and Fire Federal Credit Union Review

Police and Fire Federal Credit Union has been serving members in and around the Philadelphia area with low-cost financial solutions since its inception in 1938. Police and Fire FCU considers itself to be among the best credit unions in Philadelphia, serving more than 240,000 members and holding more than $4 billion in assets.

This top Pennsylvania credit union operates with a primary mission to be their members’ primary financial services provider, focusing on loans and deposits. They strive to earn their members’ trust through providing quality financial products at low cost, delivered with superior service, value, and convenience.

Key Factors That Enabled This Credit Union to Rank as a Top Credit Union in Pennsylvania

Below are key factors that enabled Police and Fire Federal Credit Union to be rated as one of this year’s best credit unions in Pennsylvania.

Free Checking

Police and Fire FCU offers a free, interest-bearing checking account to all members that features no minimum balance and no monthly fees.

This free and convenient checking account also features free online and mobile banking, free mobile app with mobile deposit, and free bill pay. It also features free overdraft protection from savings or a line of credit.

As if those aren’t enough great features, this credit union in Pennsylvania’s free checking account is also interest bearing. All members of this top credit union in Philadelphia receive the same incredible interest rate of 1.00% APY on the first $3,000 held in the account.

This interest rate is almost unheard of on a checking account and blows all of the big name banks’ rates out of the water.

Interest on all funds past the first $3,000 is earned at a rate of 0.10% APY.

Signature Loans

A Signature loan from Police and Fire FCU is a practical and economic way to finance major purchases, home improvements, or consolidate high-interest debt. Signature loans from this Pennsylvania credit union feature competitive fixed rates and fixed terms.

Members can also receive a 0.5% discount on this credit union in Pennsylvania’s already low rates when they sign up for automatic payments.

Other benefits of Police and Fire FCU’s Signature loans are:

- Low monthly payments

- Terms up to 5 years on loans of $1,000 of greater

- Loan amounts up to $30,000

- No collateral required

Premium Yield and Money Market Accounts

Police and Fire FCU’s Premium Yield account and Money Market Plus account provide a great way for members to invest their money for growth while still retaining convenient access to their funds.

These money making investment options from this credit union in Pennsylvania are federally insured through the NCUA, making them a safe investment alternative.

Features of these high-yield accounts are:

- No minimum balance on Money Market Plus

- No service charges

- No minimum balance fees

- Free deposits and withdrawals

- Easy access to funds online, by phone, or in person

- Free transfer of funds from another financial institution

- Convenient deposit options

Members who currently have funds invested in a money market account or mutual fund at another financial institution could increase their earnings at Police and Fire FCU as their rates tend to be higher than most banks.

Popular Article: Best Credit Unions in California | Ranking | Top Rated California Credit Unions

TruMark Financial Credit Union Review

Founded in 1939 by a handful of employees of the Bell Telephone Company of Pennsylvania, TruMark Financial Credit Union has grown to be a leader among Pennsylvania credit unions. TruMark Financial is a full-service credit union that provides an array of low-cost financial solutions to members including savings, transactions, and credit services.

This top credit union in Philadelphia operates more than twenty locations throughout the Southeastern Pennsylvania counties of Bucks, Chester, Delaware, Montgomery, and Philadelphia counties.

Several of their locations are open seven days a week for member convenience. With more than 117,500 members and in excess of $1.9 billion in assets, this credit union in Pennsylvania is poised to continue serving its members for many generations to come.

Key Factors That Enabled This Credit Union to Rank as a Top Credit Union in Pennsylvania

Below are key factors that enabled TruMark Financial Credit Union to be rated as one of this year’s best credit unions in Pennsylvania.

Online and Mobile Banking Services

TruMark Financial is a top credit union in Pennsylvania that makes it easy for customers to manage their finances from anywhere. The best Pennsylvania credit unions prioritize providing modern online solutions for their customers.

Through this online and mobile banking service from this Pennsylvania credit union, customers can:

- Set up automatic transfers

- Pay bills

- Set up direct deposits

- Access e-Statements

- Enjoy secure access to their accounts online

- Securely access accounts and carry out transactions from their mobile phone

- Make mobile deposits

- Receive alerts of account activity to their mobile phone

Business Checking Accounts

Businesses fuel our economy, which is why TruMark Financial is among the credit unions in Pennsylvania that support local businesses through their low-cost business financial products.

All of TruMark Financial’s business checking accounts feature online bill payer, eStatements, online banking, direct deposit, bank by phone, and debit card for free. Businesses that wish to take advantage of one of these Pennsylvania credit union’s low-cost business checking accounts have three great options to choose from.

Business Checking account options available from TruMark Financial are:

- Business Basic Checking: maintain a low $500 average daily balance to avoid maintenance fee, first 100 transactions free

- Business Plus Checking: maintain a $2,500 average daily balance to avoid maintenance fee, first 250 transactions free

- Business Premium Checking: maintain a $10,000 average daily balance to avoid maintenance fee, first 500 transactions free

Certificates of Deposit

A Certificate of Deposit (CD) at TruMark Financial offers a safe way for members to invest their money with a guaranteed high-yield rate of return.

Features and benefits of a TruMark Financial CD are:

- Flexible terms available between 5 and 60 months

- Low minimum deposit of $500 to open

- Maximize interest earnings and return on savings

- Accumulate money for education, retirement, or vacations

- May be used as collateral for a loan with TruMark Financial

- Five-day grace period to make changes after maturity

For those members who wish to utilize CDs for larger deposit amounts, Jumbo CDs are available with a minimum deposit of $75,000 and terms ranging from 6 to 60 months.

Read More: Best Credit Unions in Florida (Ranking & Review)

Utilities Employees Credit Union Review

Utilities Employees Credit Union has been providing quality financial products to America’s utility and energy employees and their families since 1934. This credit union in Pennsylvania is a full-service virtual credit union with a goal to help workers improve their financial well-being, accumulate wealth, and conveniently manage their finances.

This top Pennsylvania credit union currently serves close to 44,000 members and holds an impressive $1.1 billion in assets.

Key Factors That Enabled This Credit Union to Rank as a Top Credit Union in Pennsylvania

Below are key factors that enabled Utilities Employees Credit Union to be rated as one of this year’s best credit unions in Pennsylvania.

Flexible Checking Account Options

Utilities Employees Credit Union offers a variety of checking account options, providing something to suit the needs of all of their members. Whether a member is looking for an account for just the necessities or for a second chance after some financial troubles, this credit union in Pennsylvania can help.

Checking account options available at this top credit union in PA are:

- Interest-Bearing Checking: interest-bearing checking account with tiered interest rates up to 1.00% APY, no minimum balance to earn interest

- Youth Checking: free, interest-bearing checking account for youths with rates up to 0.40%, no monthly fees, and no minimum balance requirements

- No Minimum Balance Checking: basic free checking, perfect for those who want to eliminate account fees and maintain a lower balance

- Second Chance Checking: help rebuild a solid checking history, upgrade after six months in good standing, free REACH credit counseling

Mortgages

At Utilities Employees Credit Union, they recognize that one size doesn’t fit all when it comes to mortgage products. That is why they offer a variety of flexible mortgage options to help members find the product that is the perfect fit for their individual situation and budget.

Some of the mortgage types available at this Pennsylvania credit union are:

- Fixed-rate mortgages

- Adjustable-rate mortgages

- First-time homebuyer program

- Refinance options

First-time homebuyers only have to provide 3% down when obtaining a mortgage from this top credit union in Pennsylvania. They also have the opportunity to save up to $750 on their closing costs. Additionally, this Pennsylvania credit union offers flexible payment options including biweekly, semimonthly, and monthly payments.

Utilities Employees Credit Union also offers many online mortgage calculators and tools to aid members in making educated financial decisions when it comes to choosing a mortgage.

Credit Card Options

Utilities Employees Credit Union offers several credit card options for members to choose from. With such flexible terms and low rates, there is sure to be a credit card for everyone from this credit union in Pennsylvania.

Credit card options are:

- Home Equity Visa Card: a great way to put the equity in your home to work for you, no annual, balance, or transfer fees, and gives access to up to 100% of the value of the home

- Rewards Visa Power Card: earn reward points for every dollar spent, no annual, balance, or transfer fees, and rates as low as 8.99%

- Share-Secured Visa Card: the flexibility of a credit card without the qualifications normally required, credit limit secured by funds in member’s Share Savings account

Related: Top Credit Unions in Austin | Ranking | Review of the Best Austin Credit Unions

To browse exclusive reviews of all top-rated credit unions in Pennsylvania, please click on any of the links below.

- American Heritage Federal Credit Union

- Ardent Credit Union

- Citadel Federal Credit Union

- Clearview Federal Credit Union

- Diamond Credit Union

- Erie Federal Credit Union

- Franklin Mint Federal Credit Union

- Freedom Credit Union

- Members 1st Federal Credit Union

- Pennsylvania State Employees Credit Union

- People First Federal Credit Union

- Philadelphia Federal Credit Union

- Police and Fire Federal Credit Union

- TruMark Financial Credit Union

- Utilities Employees Credit Union

Free Wealth & Finance Software - Get Yours Now ►

Conclusion—Top 15 Best Credit Unions in Pennsylvania

As we wrap up our review of the best credit unions in Pennsylvania, it is important to keep in mind that there are many factors that go into choosing the best credit union in Pennsylvania for you.

When deciding which credit union in Pennsylvania is the right choice for you, take the time to thoroughly research important factors such as if you meet the membership eligibility requirements, whether they offer the services and products you need, if they are conveniently located to you, and their level of community involvement.

The Pennsylvania credit unions contained on this list represent the best credit unions Pennsylvania has to offer, but they are not one size fits all. Take the time to review what each of them have to offer before settling on the one you believe is right for you.

Whether you are looking for credit unions in Philadelphia or for credit unions in other parts of the state, our list of the best credit unions in PA will provide you with a good starting point in the search for the right credit union for you.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.