2017 RANKING & REVIEWS

TOP RANKING CREDIT UNIONS IN FLORIDA

Intro: Finding the Top Credit Unions in Florida, U.S.

With 560 credit unions in the state, according to the National Credit Union Administration (NCUA), rising to the top of the list of the best Florida credit unions requires a level of dedication and commitment throughout the organization.

Competing head-to-head with banks and other money servicers, Florida credit unions at the top of our list tended to provide a strong product set, access to online banking and mobile bill pay, as well as branches and banking services by phone.

The best credit unions in Florida are able to leverage what is unique about a credit union but also give the consumer a similar quality experience to working with a traditional bank—and do so while offering member benefits and highly competitive loan rates.

Award Emblem: Top 15 Best Credit Unions in Florida

In our review of the top 15 best credit unions in Florida, financial institutions are disbursed throughout the state, covering dense metropolitan areas including Tampa, Orlando, and Miami as well as smaller markets in Northeast Florida, North Central Florida, and the Florida Pan Handle.

Our list of the top credit unions in FL includes the largest providers in the state as well as some smaller credit unions that excelled in terms of quality-of-service to their members and the community.

AdvisoryHQ’s List of the Top 15 Best Credit Unions in Florida

List is sorted alphabetically (click any of the credit union names below to go directly to the detailed review section for that credit union in Florida):

- Achieva Credit Union

- CFE Federal Credit Union

- Community First Credit Union

- Dade County Federal Credit Union

- Eglin Federal Credit Union

- FAIRWINDS Credit Union

- Grow Financial Federal Credit Union

- GTE Financial

- MIDFLORIDA Community Credit Union

- Pen Air Federal Credit Union

- Publix Employees Federal Credit Union

- Space Coast Credit Union

- Suncoast Credit Union

- Tyndall Federal Credit Union

- VyStar Credit Union

Click here for 2016’s ranking of the Top 15 Best Credit Unions in Florida

Top 15 Best Credit Unions in Florida | Brief Comparison & Ranking

Best Credit Unions in Florida | Highlighted Features |

| Achieva Credit Union | Comprehensive mobile, online, and branch banking features |

| CFE Federal Credit Union | Checking & savings accounts to encourage banking at a young age |

| Community First Credit Union | Exclusive member offerings for life insurance & dental insurance |

| Dade County Federal Credit Union | Wide range of financial consulting services |

| Eglin Federal Credit Union | Competitive rates on loan products |

| FAIRWINDS Credit Union | Partnerships with Universal Studios & the University of Central Florida |

| Grow Financial Federal Credit Union | Competitive APR rates for checking & savings accounts |

| GTE Financial | “Student Powered” locations are 100% staffed by local college students |

| MIDFLORIDA Community Credit Union | Wide array of checking account options |

| Pen Air Federal Credit Union | Advanced asset management & retirement planning services |

| PUBLIX Employees Federal Credit Union | Mobile banking & deposit options |

| Space Coast Credit Union | Multiple options for loan financing and lines of credit |

| Suncoast Credit Union | Strong community presence |

| Tyndall Federal Credit Union | Focus on enabling members to efficiently build their savings |

| VyStar Credit Union | BALANCE counselors provide financial coaching & education |

Table: Top 15 Best Florida Credit Unions | Above list is sorted alphabetically

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best Credit Unions in Florida

Below, please find the detailed review of each institution on our list of top credit unions in Florida.

We have highlighted some of the factors that allowed these best credit unions in Florida to score so highly in our selection ranking.

See Also: Best Credit Unions in Pennsylvania | Ranking | Review of the Best Pennsylvania Credit Unions

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Achieva Credit Union Review

Achieva Credit Union is one of a number of Suncoast CUs to make the list of top Florida credit unions. Chartered in 1937, Achieva Credit Union has 24 branch locations in Hillsborough County, Lee County, Manatee County, Pasco County, Pinellas County, and Sarasota County.

This top 15 best credit union in Florida has more than 140,000 members and is headquartered in Dunedin, Florida. The CU operates as a Federally-Insured State Credit Union (FISCU).

In 2015, Achieva Credit Union acquired Calusa Bank. With four branches and $165 million in assets, the deal helped to grow the CU’s branch system by 20% and total assets to $1.3 billion.

According to BayNews9, the acquisition was only the seventh credit union acquisition of a bank, and the first time that a CU had acquired a bank entity in the state of Florida.

Image Source: Top Credit Unions in Florida

Key Factors That Enabled This Firm to Rank as One of the Top Credit Unions in Florida

Below are key factors that enabled Achieva Credit Union to be rated as one of this year’s top credit unions in Florida.

Ways to Bank

Achieva’s product and service set is very well-tailored to Suncoast households and to the members of this top 15 best credit union in Florida.

Through the CU’s Ways to Bank service, for example, Achieva has packaged mobile, web, and in-branch capabilities in a way that is intuitive and efficient for members to use.

Ways to Bank ensures that members are able to do their financial transactions via the branch or the web, in the way that is most convenient for them.

Here is some information on the Ways to Bank services from Achieva CU’s website:

Mobile Banking

Achieva’s Mobile Banking service is free and secure and allows you to manage your accounts from anywhere, at any time. Mobile Banking can be accessed from all carriers and most device types, making it a good choice no matter where life takes you.

Whether you’re at home or out and about, you can use Mobile Banking to take charge of your everyday banking, right from the palm of your hand. Mobile Banking features include:

- Account balance inquiries

- Up-to-date rates information

- Funds transfer

- Mobile Online Bill Pay

- Mobile check deposit

- Can be accessed by all carriers and most mobile devices

Online Banking

Manage your banking all in one place with Online Banking from Achieva. With Online Banking, you can access your accounts and manage all of your finances 24 hours a day, seven days a week.

Achieva’s Online Banking offers helpful tools and options that allow you to view your account in real-time and access your money on your own schedule. Online Banking features include:

- Budget and savings tools

- Enhanced help features

- Password reset self-services

- A single login for all your accounts

- Customizable widgets and themes

- Transfers in just a few clicks

- Advanced transaction search & sort options

Bank in a Branch

If you prefer a more personal touch, Achieva’s branch staff are available to assist members with a wide array of financial services.

Achieva offers a full suite of financial solutions throughout their 24-branch network. Branch products and services at this top 15 best credit union in Florida include:

- Pre-paid Visa gift cards

- Official checks

- Automatic coin counters

- Notary Public Service

- Medallion Stamp Service

- Wire transfers

Speak with a Member Service Advisor or Online Chat

Achieva knows it’s not always easy to find time to visit a branch; sometimes a phone call just works better with your schedule.

Achieva CU’s knowledgeable staff can help you with any service you may need. If you need answers right away, you can use Achieva’s live chat service to get answers in real-time.

The same knowledgeable staff found in the branches will answer your questions on live chat during regular business hours of 8:30 AM EST – 5:30 PM EST, Monday through Friday.

Business Banking Solutions

Finally, Achieva is one of our top 15 Florida credit unions with a robust set of business banking products and services.

The credit union offers members with small- and mid-sized businesses personalized service providing lending, cash flow solutions, and individualized support for the business owner.

Achieva can assist with borrowing and other financial needs including:

- Financing of commercial and owner-occupied properties

- New construction, expansion, or remodeling

- Investment property in the multifamily and retail sectors

- Lines of credit for improved cash management

- Equipment & vehicle financing

- Small Business Administration (SBA) loans

Don’t Miss: Best Credit Unions in NYC | Ranking | Best NYC Credit Unions

CFE Federal Credit Union Review

CFE Credit Union, established in 1937 as the Central Florida Educators Credit Union, is a federally-chartered credit union serving the Greater Orlando area.

This member of our list of top credit unions in FL is community-focused and offers membership to anyone who lives, works, worships, volunteers, or attends school in Orange, Osceola, Seminole, or Lake Counties, Florida, as well as qualified businesses.

The credit union has 22 branches in Greater Orlando and is headquartered in Lake Mary, Florida.

With total assets of more than $1.5 billion and approximately 140,000 members, this best credit union in Florida is also one of the largest Florida credit unions.

CFE Federal Credit Union also owns the naming rights for the arena at the University of Central Florida (UCF), which hosts UCF men’s and women’s basketball games, concerts, UCF and high school commencement ceremonies, and other events. CFE houses a branch in the arena as well as two branches on the UCF campus.

Key Factors That Enabled This Firm to Rank as One of the Top Credit Unions in Florida

Below are key factors that enabled CFE Federal Credit Union to be rated as one of this year’s top credit unions in Florida.

Banking Products and Services

Consistent with others from the list of credit unions in Florida that exceled in our rankings, CFE Federal Credit Union offers a full complement of financial products and services to assist consumers and small businesses.

Deposit accounts include share (checking) and savings accounts as well as money market and holiday-club accounts. CFE also offers a wide variety of business management and loan products.

CFE provides consumer loan products, investments, and insurance as well as an easy-to-use online and mobile platform.

CFE Student Center

The CFE Student Center provides banking services and learning options for children of all ages.

By providing accounts, incentives, and education in an age-appropriate format, CFE’s program is an example of Florida credit unions making the extra effort to attract young people and their parents by delivering responsive financial product and services.

Below are the age program brackets found in the CFE Federal Credit Union Student Center:

Explorers (Ages 0 – 11)

With just a five dollar deposit, your child will not only be on the road to financial smarts (your favorite part), they will also receive a special gift (their favorite part).

Explorers will also earn a prize for each deposit, earn dividends when their account balance reaches over $50, and can earn Fun Bucks, on top of other great banking features.Children love to explore the world around them.

Adventurers (Ages 12 – 14)

Pre-teens still receive a prize with each deposit, but since they are quickly moving toward more responsibility in the world, they may also purchase a Student Reloadable Visa® Card.

This card is prepaid by parents, so your child can get a taste of freedom and responsibility without going over the limit.

Innovators (Ages 15 – 17)

As teenagers move toward part-time jobs and greater need for independence, Innovators account holders receive a free Visa® Debit Card (they are also still eligible for the Student Reloadable Visa® Card).

Mobile banking is a perk they will enjoy…and they might even be glad to hear that they are still eligible for a free gift upon opening their account.

Horizons (Ages 18 – 22)

This account offers young adults all the banking options they could possibly need as they head toward college or the working world: 24-hour online and mobile banking options, unlimited CFE ATM access, free Visa® Debit Card, free first order of 120 custom checks, and many more perks.

CFE also offers loan options for those important firsts, whether it’s a car or tuition payment.

Related: Top Credit Unions in Chicago | Ranking | Review of the Best Chicago Credit Unions

Eglin Federal Credit Union Review

Eglin Federal Credit Union, also referred to as EFCU, was chartered in 1954 and serves military and civilian personnel on Eglin Air Force Base, Hurlburt Field, and Duke Field in the Florida Panhandle.

Membership also includes other Select Employee Groups at organizations in Okaloosa, Santa Rosa, and Walton counties.

Based on assets, Eglin is one of the largest Florida credit unions, with over $1.7 billion in assets and 114,000 members. EFCU has nine branch locations in Florida Pan Handle locations including Destin, Hollywood and Crestview.

Below is a snapshot of Eglin’s recent financials as of February 2017:

| Assets | $1,771,577,831 |

| Member Shares | $1,562,458,959 |

| Member Loans | $692,529,301 |

| Net Worth | $199,591,918 |

| Number of Members | 115,491 |

Key Factors That Enabled This Firm to Rank as One of the Top Credit Unions in Florida

Below are key factors that enabled Eglin Federal Credit Union to be rated as one of this year’s top credit unions in Florida.

Deposit and Loan Products

Eglin FCU has a set of deposit and loan products that is well-tailored to the needs of the military as well as the local community. This credit union offers traditional checking, savings, and money market products as well as financial counseling and investment services.

Eglin is also one of our top 15 best Florida credit unions with competitive consumer and small-business loan rates. Below is a sample of recently-quoted rates:

Consumer Loan Products | Loan Rates (As of April 2017) |

| Autos | As low as 1.99% APR |

| Boats & RVs | As low as 4.75% APR |

| MasterCard | As low as 7.90% APR |

This top Florida credit union also has competitive options for members who are interested in purchasing a new home. Listed below is a sampling of their mortgage products and rates:

Conventional Fixed Real-Estate Loans | Loan Rates (As of April 2017) |

| 15-Year | As low as 3.125% APR |

| 20-Year | As low as 3.625% APR |

| 30-Year | As low as 3.875% APR |

Popular Article: Top Credit Unions in Austin | Ranking | Review of the Best Austin Credit Unions

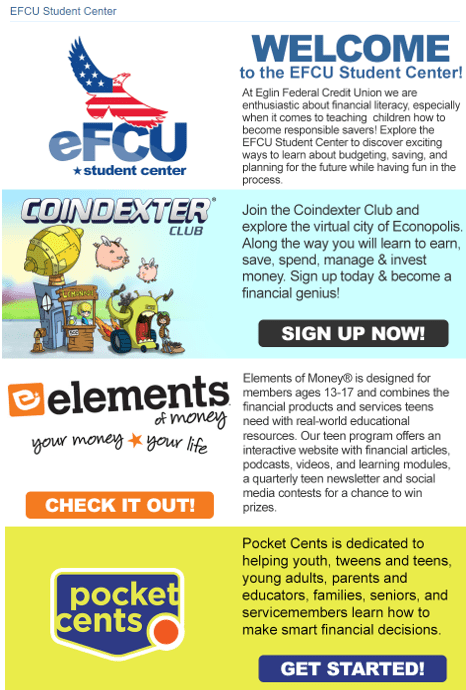

The EFCU Student Center

When it comes to money and management, we can all use some support. For young people, learning financial skills early on can mean the difference between wealth and debts later on in life.

The EFCU Student Center is unique among Florida credit unions and provides resources, education, links, and account information specific to youth and members of the EFCU community.

Below is a snapshot showing a sampling from the EFCU Student Center:

Photo courtesy of: Eglin Federal Credit Union

Safe Loan

The Salary Advance for Emergency (SAFE) Loan is an alternative to payday loans. Rather than resort to payday stores or pawn shops, SAFE loans offer credit union customers a truly safer alternative.

Loans are given for up to $500, and borrowers are able to request as much as half of their monthly salary (up to the $500 maximum).

To qualify, borrowers are required to complete the BALANCE Money Management Counseling course prior to receiving their second SAFE Loan. BALANCE is a free and confidential service offered to Eglin FCU members that provides financial counseling and education.

Other Safe Loan rules and qualifications:

- The borrower must have an account with the credit union and the account must be in good standing.

- The borrower must have been with their current employer for at least two months.

- Payroll must be direct deposited to the borrower’s Eglin FCU account.

- You can only have one SAFE Loan at a time. It must be paid off before applying for another loan. Only four SAFE Loans are allowed during one calendar year.

- The repayment period for the loan is 120 days; APR is 16.9%.

Read More: Top Ranked Best Credit Unions in America | Ranking & Reviews | Best U.S. Credit Unions

Space Coast Credit Union Review

Space Coast Credit Union (SCCU) began as Patrick Air Force Base Credit Union in 1951 to serve the military personnel stationed there. Space Coast Credit Union is a member-owned, not-for-profit financial cooperative.

It serves its membership with a full array of financial products and services, including auto loans, mortgages, checking accounts, credit cards, savings accounts, and business services for small and mid-size firms.

Today, SCCU serves more than 290,000 members and is the third largest of Florida credit unions with over $3 billion in assets. Space Coast Credit Union has 58 branch locations spanning Florida’s east coast, from Flagler to Miami-Dade counties.

According to the website of this top 15 best credit union in Florida, “Like a bank, we accept deposits and make loans, but unlike banks we place the interests of our members above making profits for stockholders. We return profits to members in the form of better rates, lower fees, and enhanced services.”

Key Factors That Enabled This Firm to Rank as One of the Top Credit Unions in Florida

Below are key factors that enabled Space Coast Credit Union to be rated as one of this year’s top credit unions in Florida.

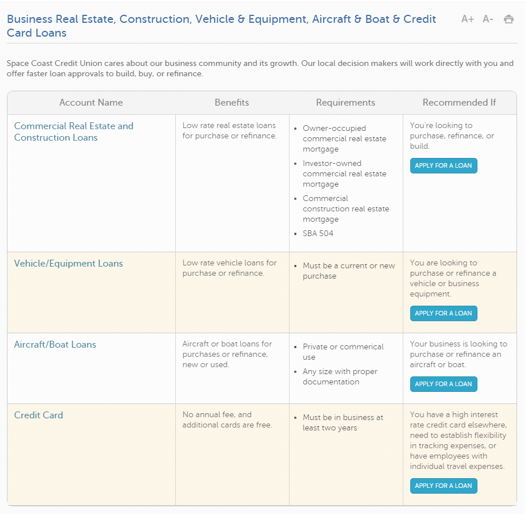

Credit and Financing

Space Coast Credit Union has a strong product set for both consumer and business financing needs.

In addition to traditional mortgage and home equity loans, SCCU also offers credit cards, aircraft and boat loans, business-development loans, as well as real estate and equipment financing.

Photo courtesy of: Space Coast Credit Union

Depth of Market

With 58 branches spanning from Palm Coast in East-Central Florida to Cutler Bay in South Florida, SCCU has the reach to attract consumers and the accessibility many credit union member desire.

Space Coast CU’s place and size in the market means that it is better equipped than most Florida credit unions to compete directly against traditional banks, making SCCU a double-threat.

The SCCU Member Discount Program

SCCU offers its members access to information and discounts on dozens of products and services, including financial products and insurance, entertainment, sports and travel, and retail items.

Below is a sample of entertainment, sports and travel discounts available on the SCCU Member Discount Program website as of April 2017:

- Andretti Thrill Park

- Best Western Hotels

- Brevard Zoo

- Calypso Kayaking

- Camp Holly Airboat Rides

- Capt. Hiram’s

- Days Inn Hotel

- Enterprise Car

- Miami Heat Basketball

- Miami Marlins Baseball

- Orlando Solar Bears Hockey

- Tampa Bay Buccaneers Football

To browse exclusive reviews of all top rated credit unions in Florida, please click on any of the links below:

- Achieva Credit Union

- CFE Federal Credit Union

- Community First Credit Union

- Dade County Federal Credit Union

- Eglin Federal Credit Union

- FAIRWINDS Credit Union

- Grow Financial Federal Credit Union

- GTE Financial

- MIDFLORIDA Community Credit Union

- Pen Air Federal Credit Union

- Publix Employees Federal Credit Union

- Space Coast Credit Union

- Suncoast Credit Union

- Tyndall Federal Credit Union

- VyStar Credit Union

Free Wealth & Finance Software - Get Yours Now ►

Conclusion – Top 15 Best Credit Unions in Northern, Central, and Southern Florida

As we conclude our review of the best credit unions in Florida, it is important to note that there are many important factors that go into choosing a financial institution for you.

Even the exhaustive analysis done by AdvisoryHQ is not a replacement for your own due diligence. We suggest you use our listing of the top 15 best credit unions in Florida as a starting point for you own research.

We will leave you with some key questions you may want to ask before deciding which Florida credit unions might be right for you. Remember that your financial future is at stake, and the time you take in doing research can reap immense benefits to you in the long-run.

We at AdvisoryHQ want to help you get the most for your financial future and provide you with helpful resources. Here are some questions to get you started on your credit union research:

- What are the credit union’s membership rules? Am I eligible to be in the credit union?

- What products and services do they feature? While credit unions can offer a wide array of products, do they have the products that I need?

- What is the geographic distribution of the financial institution? Are there branches and ATMs where I need them?

- What is the credit union doing for the community and to help its members succeed and lead happy lives? Check out the credit union’s website and their annual report to see how and if the credit union is giving back to your community — before you open an account.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.