Intro – Citadel Federal Credit Union Reviews & Ranking

AdvisoryHQ recently published its list and review of the top credit unions in Pennsylvania, a list that included Citadel Federal Credit Union.

Below we have highlighted some of the many reasons Citadel Federal Credit Union was selected as one of the best credit unions in Pennsylvania.

Click here for a detailed review of AdvisoryHQ’s selection methodology: AdvisoryHQ’s Methodology for Selecting Top Banks and Credit Unions.

Citadel Federal Credit Union Review

Established in 1937 as the credit union for employees of Lukens Steel Company, Citadel Federal Credit Union has been proudly serving the citizens of Pennsylvania for more than seventy-five years. Their unwavering commitment to serving their customers and the communities in which they live has helped shape them into the top notch Pennsylvania credit union they are today.

Today, Citadel Federal Credit Union serves more than 184,000 members and holds over $2.6 billion in assets. This class A credit union in PA realizes that it is the people and communities they serve that drive their success, and they remain committed to serving their financial needs with world class customer service for many years to come.

Image Source: Citadel Federal Credit Union

Key Factors Leading Us to Rank This Firm as One of This Year’s Top Credit Union Firms

Upon completing our detailed review, Citadel Federal Credit Union was included in AdvisoryHQ’s ranking of this year’s best credit unions based on the following factors.

Citadel Federal Credit Union Review: Citadel Class Service

Image Source: Citadel Federal Credit Union

Citadel Class Service is Citadel Federal Credit Union’s pledge to its members to provide them with outstanding customer service. At Citadel, they consider Citadel Class Service to be more than just a phrase, but rather a pledge that they will help their members fulfill every one of their financial needs every day.

The Citadel Class Service Pledge states that this Pennsylvania credit union promises to deliver superior banking products by providing Citadel Class Service. They state that their passion goes beyond just meeting their customers’ banking needs, but rather to exceed their expectations with every interaction.

This steadfast commitment to making sure that each and every one of their customers is highly satisfied with their services is one of the reasons Citadel Federal Credit Union ranked as one of the best credit unions in PA.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Citadel Federal Credit Union Review: Credit Cards

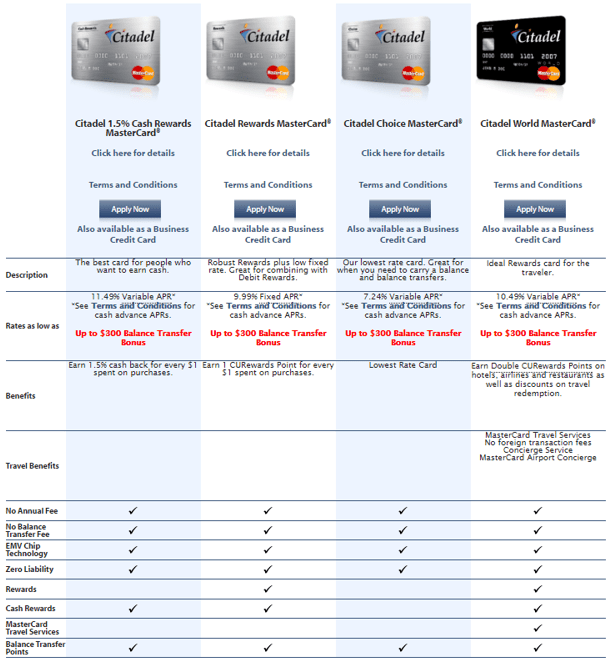

Citadel Federal Credit Union has many great credit card options for members to choose from. All of their credit cards are available as either a personal or business credit card.

All Citadel credit cards come with no annual fee and no balance transfer fees. They also feature EMV chip technology making them a safe and secure way to make purchases.

Image Source: Citadel Federal Credit Union

As an added bonus, all of this Pennsylvania credit union’s credit cards also feature up to $300 in bonuses for transferring balances from higher interest credit cards.

Image Source: Citadel Federal Credit Union

Whether you are looking for a card that features rewards or just want one with a low rate, this credit union in Pennsylvania has what you are looking for.

Credit card options at Citadel Federal Credit Union are:

- Citadel Cash Rewards MasterCard: earn 1.5% cash back on every dollar spent, 11.49% variable APR

- Citadel Rewards MasterCard: earn one reward point for every dollar spent, 9.99% fixed APR

- Citadel Choice MasterCard: great for those who need to carry a balance or make balance transfers, 7.24% variable APR

- Citadel World MasterCard: rewards card for active travelers, 10.49% variable APR

Citadel Federal Credit Union Review: Investment and Wealth Management Services

In addition to traditional banking products such as deposit accounts and loans, Citadel Federal Credit Union is a credit union in PA that also offers an array of investment and wealth management services to help their members reach their financial goals.

They offer financial planning services for individuals and those in pre-retirement status as well as small business owners.

Investment and wealth management services offered include:

- Investment advisory services

- Personal financial planning

- Advanced social security strategies planning

- Retirement and retirement income planning

- College education planning

- Estate planning and wealth planning

- Tax reduction strategies

- 401(k) plans

- Deferred compensation plans

In addition to the above Citadel Federal Credit Union review, you can click on any of the links below to browse exclusive reviews of AdvisoryHQ’s top rated banking firms & credit unions:

Top Rated Banks

Top Banking Firms

Review of Top Mortgage Firms

Bank Reviews

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.