Intro – Freedom Credit Union Reviews & Ranking

AdvisoryHQ recently published its list and review of the top credit unions in Pennsylvania, a list that included Freedom Credit Union.

Below we have highlighted some of the many reasons Freedom Credit Union was selected as one of the best credit unions in Pennsylvania.

Click here for a detailed review of AdvisoryHQ’s selection methodology: AdvisoryHQ’s Methodology for Selecting Top Banks and Credit Unions.

Freedom Credit Union Review

Freedom Credit Union is among the more established Philadelphia credit unions, having served the area since 1934. As a not-for-profit organization, they tend to offer better rates, lower fees, and more helpful service than many Philadelphia banks do.

Freedom Credit Union currently serves more than 60,000 members and holds more than $600 million in assets. This Pennsylvania credit union strongly believes in giving back to its members and improving the communities in which they live and work.

The Philadelphia credit union is a full-service financial institution offering an array of financial products to consumers and businesses, including deposit accounts and lending options.

Key Factors Leading Us to Rank This Firm as One of This Year’s Top Credit Union Firms

Upon completing our detailed review, Freedom Credit Union was included in AdvisoryHQ’s ranking of this year’s best credit unions based on the following factors.

Image Source: Freedom Credit Union

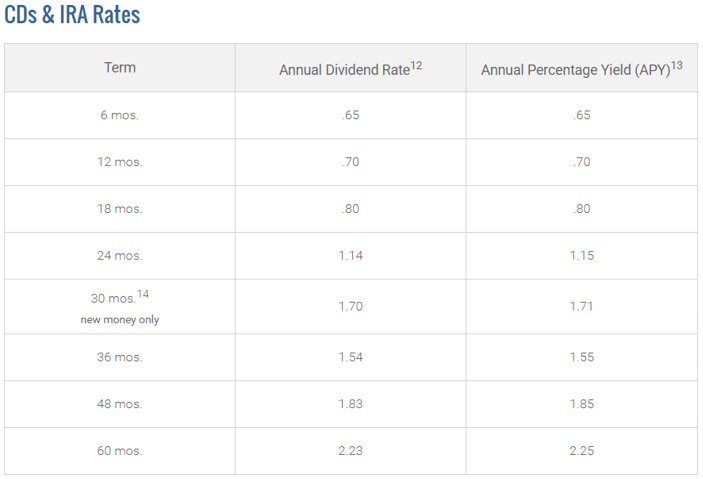

Freedom Credit Union Review: Share Certificates of Deposit

For those who wish to earn a guaranteed rate of return at a higher rate than a regular savings account, a share certificate of deposit may be the right choice. With a locked-in rate of return and flexible terms ranging from 6 months to 5 years, a share certificate of deposit from Freedom Credit Union is a great way to kick your savings up a notch.

Freedom Credit Union is also one of the credit unions in Philadelphia that allows members to add funds to their CD any time after opening the account, allowing for greater growth of funds.

Those members aged 25 and under have a $250 opening deposit requirement and those members aged over 25 have a $500 opening deposit requirement.

Dividends on certificates are paid monthly and rates vary by term length, but they are extremely competitive compared to most banks.

Share certificate annual dividend rates by term are:

Image Source: Freedom CU Rates

The 30-month, high-yield CD is a special offer for members of this Pennsylvania credit union to help jump start their savings. The special offer applies to new money only.

Freedom Credit Union Review: Freedom Visa Card

Freedom Credit Union offers three types of Visa credit cards to members so they can choose the card that best fits their lifestyle. All credit cards from this credit union in PA come embedded with an EMV chip, no annual fee, and competitive rates.

Visa card options from Freedom Credit Union are:

- Visa Cash Back Card: 1% cash back on all purchases automatically credited to primary savings account, 0.99% intro APR for first six months then APR as low as 9.90%

- Visa Gold Card: rates as low as 8.90% APR

- Student Visa Card: $1,000 credit limit and rates as low as 11.90%

Image Source: Freedom Credit Union

All these cards have the added benefits of no fees for balance transfers, cash advances, or foreign transactions.

Freedom Credit Union Review: Loans for Investment Properties

Not all credit unions in Philadelphia are open to financing investment properties for entrepreneurs, but Freedom Credit Union provides support to those who wish to invest in real estate.

This Pennsylvania credit union offers competitive rates on investment real estate property financing as well as options for refinancing existing loans. All investment real estate loans at Freedom Credit Union are serviced locally by actual people and not the automated service that many of the big banks use.

Features of Freedom Credit Union’s investment real estate loans are:

- Competitive rates

- Option to refinance an existing loan at a lower rate

- Familiarity with the Greater Philadelphia market

- Local decision-making leading to quick approvals and efficient processing

- Friendly and attentive service from Freedom Credit Union’s expert staff

In addition to the above Freedom Credit Union review, you can click on any of the links below to browse exclusive reviews of AdvisoryHQ’s top rated banking firms & credit unions:

Top Rated Banks

Top Banking Firms

Review of Top Mortgage Firms

Bank Reviews

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.