Bank of The West Reviews

Headquartered in San Francisco, California, Bank of the West is a financial services holding company that provides a wide range of business and personal services for its valued customers. With over 600 branches in the Western and Midwestern United States, it is the fifth-largest bank in California and a prominent bank nationwide.

Image Source: Bank of the West

You may have heard about the bank in recent financial news. It was lauded in 2015 with a number of distinguished awards. Among other notable honors, it received both the Best Commercial Bank and the Best Private Bank in the Western United States awards by World Finance Magazine, based on reader nominations and judges’ review.

But don’t just take their word for it; this guide will provide you with a comprehensive, unbiased Bank of the West review so that you can make an informed decision about its services and whether they’re right for you.

While the best way to find out more is to go to a local branch and speak to employees, it is often more convenient to do some research online first. However, online reviews only allow you to learn about a fraction of the banking experience, and they may be biased by previous experience or personal opinions.

Rather than scrolling through hundreds of individual Bank of the West reviews online, all of the relevant information you need about the bank’s personal financial services and reward programs is compiled here. We will also highlight Bank of the West wealth management options.

With this balanced Bank of the West review, we hope to equip you with the knowledge you need to make important decisions about your personal finances.

See also: Go Bank Reviews – Everything You Want to Know (Review of GoBank.com)

A Golden History

When Bank of the West was first established in California in 1874 as Farmers National Gold Bank, it was one of only 10 banks that could issue paper currency. As more people flocked to the area, the bank was a driving force for business and community growth with its meticulous management and responsible lending practices.

Image Source: BigStock

The bank became First National Bank of San Jose in 1880, and amidst the turmoil of the early 20th century, it managed to grow into one of the most prominent banks in the Bay Area. Its named changed to Bank of the West in 1979 to reflect its desire to expand beyond California and provide its services across the United States. It is a subsidiary of BNP Paribas, and it has spread throughout the nation with strategic growth and acquisitions.

Financial Services at Bank of the West

Bank of the West is a full service bank and therefore provides a plethora of financial options that can be tailored to your needs. To begin, we will review the different options for personal checking, savings, CD, and IRA accounts.

Please note that you can only utilize the services of the Bank of the West if you live in one of the following 19 states:

- Arizona

- California

- Colorado

- Idaho

- Iowa

- Kansas

- Minnesota

- Missouri

- Nebraska

- Nevada

- New Mexico

- North Dakota

- Oklahoma

- Oregon

- South Dakota

- Utah

- Washington

- Wisconsin

- Wyoming

Unfortunately, the bank does not accept applications from individuals or businesses that are not located in these states.

Don’t Miss: BMO Harris Bank Reviews – Everything You Need to Know (Credit Card Rewards, Private Banking, & Review)

Checking Accounts

There are six types of checking accounts offered at Bank of the West, and each offers different benefits to you. This large number of options ensures that your account will be personalized to your needs. The checking account types include Easy, Signature, 55 Plus, Choice Interest, Student, and Premier.

All of the accounts include the option for online and mobile banking, a debit card, and add-ons like overdraft protection programs. Many of the accounts have low minimum opening balances (starting at $20 for the Student account), and the Premier and Signature accounts can accrue interest at an APY (annual percentage yield) of 0.01–0.03%.

The accounts have monthly service charges, but these can be waived based on how much money you keep in the account or the number of purchases made during the month. The Premier account option comes with additional Bank of the West rewards, which will be discussed later in the article.

While you can apply online for any of these accounts, it may be best to go to a branch and talk to a banker to determine the best option for your personal situation. However, if you know which account you want, you can complete your online application in about 15 minutes. Dedicated support staff is just a phone call away if you need any assistance as you complete the application.

Savings Accounts & CDs

If you are more interested in saving than spending, then Bank of the West has solutions for you as well. The bank offers two types of savings accounts: Classic and Choice Money Market Savings (CMMS). Both accounts compound interest daily and pay it monthly, but they have different opening deposit requirements and APYs. You can either apply online or at a branch for a savings account.

The interest for the Classic Savings account is standardized at 0.01% APY, while the interest for the CMMS account can range between 0.03 – 0.25% APY, depending on the balance in the account and the checking relationship. According to a report by CNN Money, the average savings account has an APY of 0.06%, so the Classic Savings account at Bank of the West is rather low. On the other hand, the CMMS APY is above average, but you can only open a CMMS in conjunction with a Signature or Premier checking account.

CDs (certificates of deposit) can also be acquired at Bank of the West; however, you must apply for them in person at a branch. The Flexible-Term CD has the smallest minimum deposit ($1,000) and can be active for terms as little as 32 days or as long as 59 months. The Premium Money Market CD has specified terms with higher APYs (up to 1.75% if the CD is 60 months long). This rate is near, but still below, the top 20 5-year CDs available nationwide.

For shorter terms, the Relationship CD has the best APY (0.20%), which starts at the minimum deposit. Like the CMMS account, the Relationship CD is only available to those with a Signature or Premier account.

Individual Retirement Account (IRA) CDs are available at a fixed interest rate for specific terms. They allow you to get the tax benefits of an IRA without the insecurity of investing your IRA money in stocks or mutual funds.

When you choose to open any of the personal accounts at Bank of the West, you will have access to the tools at its Financial Education Resource Center. This includes tools and calculators to help you build and manage a budget, protect your financial information, and save for retirement.

Related: NatWest Banking – Should You Use Its Services? A Complete Guide (Business, Mortgage, & Review)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Get the Most Out of Your Money: Bank of the West Rewards

Another reason it is important to read a complete Bank of the West review is because individual reviewers might not have experience with the type of account you are interested in. For example, a person who only has a Classic Savings account or a Student Checking account could not comment on the following Rewards programs.

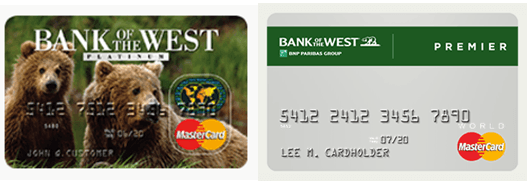

For an individual, there are two primary ways to get rewards at Bank of the West: with a Platinum Rewards MasterCard or with a World MasterCard as part of a Premier account.

Image Source: Bank of the West

The Platinum Rewards MasterCard offers one reward point for every $1 you spend, and points can be redeemed on rewards ranging from gift cards to travel to cash rebates. While the introductory APR (annual percentage rate) is 0.00% for the first six months, the regular APR of 19.24% is slightly high compared to the average APR for other rewards cards. However, if you make payments on time, then the relatively high APR will not be a problem. There is also no annual fee for this card.

We mentioned the Premier Checking account earlier in this article, and now it is time to delve into its specifics. When it comes to Bank of the West Rewards, signing up for the Premier account is the most efficient way to benefit.

As a Premier client, you get the highest level of service available; this translates to special interest rates, discounts on loans, waived ATM fees, higher spending limits, and specialized customer service agents. A deposit of only $500 is required to open an account. However, to avoid a monthly service charge, you must maintain a balance of at least $50,000 in your Bank of the West combined accounts.

The World MasterCard is where you will discover the best of the Bank of the West Rewards. For every dollar you spend, you will get three rewards points. That means you can earn rewards three times as fast as the Platinum Rewards Card. The World MasterCard also gives you a 0% APR for the first six months, and the interest rate afterwards (15.24%) is reasonable.

The Bank of the West offers competitive rewards program options. It is especially convenient that you do not have to join the Premier program in order to use a card with rewards. The option that is best for you will be based on your personal finances and spending behavior.

Secure Your Financial Future With Bank of the West Wealth Management

The Wealth Management services at Bank of the West have been available since 1963. The program guarantees a client-centric, holistic approach to protect, manage, and increase your assets and help you plan for the future.

When you engage the Bank of the West Wealth Management services, you will be assigned a Private Client Advisor. Your advisor can assist with a number of services and will also review your portfolio and provide guidance in its growth.

Image Source: BigStock

Image Source: BigStock

He or she can advise upon using credit strategically to gain flexibility or help manage business transitions. Depending on what stage of life you are in, the advisor can assist in planning your legacy through trusts and endowments, in the transition to retirement, or in financing the education of your children and grandchildren.

If you are looking for long-term solutions, then the personalized service at Bank of the West Wealth Management may fit your needs. With over half a century of expertise and a recent award from Private Asset Management, it is certainly worth speaking to a Bank of the West representative if you are interested.

Additional Services

For the sake of brevity, not every financial option offered at Bank of the West will be included in this review. We have primarily focused on personal banking options, but the bank also offers services for small businesses and commercial industries.

Checking, savings, and credit options for small businesses are available, in addition to a number of types of business-specific loans. Commercial banking is also an option, and getting in contact with a Relationship Manager is the best way to determine how the bank can help you.

For more detailed information on these types of banking options, the Bank of the West website is an excellent resource.

Bank of the West Reviews and Feedback

Now that you have read a broad assessment of the services the bank can provide, it is worth mentioning some of the Bank of the West Reviews and feedback from customers online. It would not be fair if we did not acknowledge that some customers have struggled with Bank of the West’s services.

On CreditKarma.com, the bank is rated at 2.1/5 after 14 reviews. Most of the negative reviews involve customer service at specific branches. While this is something to take into account, it might be best to experience firsthand the customer support at the specific branch you will use most. Positive reviews praise the bank’s use of online, paperless banking, as well as its quick response and professional handling of fraudulent charges.

A report on the Bank of the West by Credio states a customer rating of 1.6/5 based on only 8 reviews, but the site assigns it a Smart Rating of 94/100 based on fees, size, return rates, expert reviews, and financial stability.

The website Consumer Affairs hosts a page of complaints against the bank. Many of the complaints are issues with specific ATMs, branches, car and RV financing, and fees.

While it is not a bad idea to read through these, one should keep in mind that people are much more likely to leave a review when they have a negative experience than a positive one.

Popular Article: Union Bank Reviews – What You Will Want to Know! (Mortgage, Credit Card, & Reviews)

Is Bank of the West Right For Me?

When you are making decisions regarding your finances, it is important to do your homework. Hopefully, this guide has relieved some of that pressure by doing most of the work for you.

In sum, Bank of the West is an accredited national bank insured by the FDIC and is an Equal Housing Lender. It can provide you with many financial services if you live in one of the states in which it operates.

Most of its rates are competitive, but you should compare the specific options that apply to your financial situation with the equivalents at other banks before making a decision. Its presence is not as pervasive nationwide as some other banks. However, if you live near a convenient branch (and the customer service at that branch is satisfactory), then it would be worthwhile to speak to a bank representative and consider making an account at the Bank of the West.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.