Overview: What You Need To Know About GoBank

Online banking can be intimidating to new users. With so many GoBank reviews on the internet, it can be hard to know which ones are accurate.

Our GoBank.com reviews dig deep. We’ve done the research so that you don’t have to. We’ll tell you everything you need to know in one comprehensive GoBank Review.

What is Go Bank?

Founded in 2012, GoBank.com is an online bank, headquartered in Provo, Utah. There aren’t any physical locations for GoBank; all transactions are done over the telephone or online. They offer paper-free banking from the comfort of your home or office, without the need for face-to-face transactions. You may sometimes hear GoBank referred to as “Wal-Mart Bank” because of its integration with the department store.

Image Source: GoBank.com

All GoBank assets are protected by the FDIC (Federal Deposit Insurance Corporation). That’s good news for clients, because it means that even if the bank went belly-up, your funds won’t. With FDIC protection, your money is safe.

GoBank is a straightforward, checking-based bank. They do not offer savings accounts, CDs, mutual funds or other investment options. They do not pay interest on account balances, but there are reported plans to do so in the future.

GoBank was launched by Green Dot Financial Corp., a provider of reloadable, pre-paid Visa and debit cards. Green Dot also operates Green Dot Bank, one of the financial institutions available with Wal-Mart.

See Also: Best Free Checking Account Banks – No Fees, Best Yields

How Does GoBank Work?

There are three ways to get started:

1. Wal-Mart

Thanks to its association with Wal-Mart, you can open an account by purchasing a “starter kit” the next time you visit any participating Wal-Mart store location. The starter kit costs $2.95 and will require that you make an initial deposit of $20 to activate the account. As part of your starter kit, you receive a temporary debit card. After activating your account, input the number on your temporary debit card via their website or app. You can now use your MasterCard debit card for purchases. No waiting. No delays.

2. GoBank.com

Go directly to the GoBank.com website. In the upper right corner, click on the “Open An Account” link. Follow the instructions to provide some essential details for identity verification and make a deposit (minimum $20). That’s it. Your account is now active and ready for immediate use. A MasterCard debit card is sent to you via mail.

3. Use the App

If you’re one of their target mobile users, you’ll enjoy the ease of setting up an account with their sleek mobile app. The app requires the same information as the website. Also, similar to the website activation, the account is ready for use as soon as you make your initial deposit. A MasterCard debit card will arrive via USPS within two weeks.

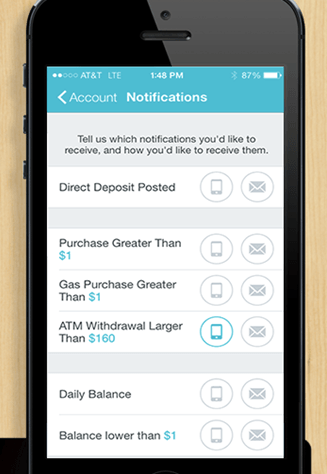

Image Source: GoBank Apps

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Key Features

Whether online, in-store, or the app, GoBank offers an array of helpful features.

Balances and ATMs

- A minimum balance is not required, but an initial deposit of at least $20 is necessary to open a checking account with GoBank.

- The maximum you can deposit into your GoBank account is $50,000.

- The account does not carry any associated fees to complete any transaction.

- Free ATM cards are provided to every account holder.

- You also have the choice to purchase a personalized debit card that will contain your photo for extra security. The photo debit card comes with a $9 one-time price tag.

- Withdrawals from any of their 40,000 ATMs nationwide are free, regardless of the amount of withdrawal.

- You can also get cash back from any participating store when you make a purchase.

- If you withdraw funds from an ATM that is not part of the GoBank.com network, you will incur a $2.50 fee for the out-of-network withdrawal.

Checks

If you need to send someone a check, simply fill out an electronic or digital check online. GoBank will then send a paper check to the person or organization to whom you wrote the check. This is a free service.

Don’t Miss: Best Bank for Small Business Banking (Best Business Bank Accounts)

Mobile App Features

The app has a quick peek feature allowing you to check your balance without having to log into the actual account.

Customizable Alerts

The app allows for customization when setting up alerts. You can choose from settings such as:

- Direct Deposit Posted

- Balance Lower Than $ (you choose the dollar value from between $1 and $5,000)

- Purchase Greater Than $ (you choose the dollar value from between $1 and $5,000)

- Budget Reminder: Money Going Out (can be set for one or five days before)

- Gas Purchase Greater Than $ (you choose the dollar value from between $1 and $5,000)

Image Source: GoBank.com

Customer Support

The research for our GoBank.com reviews found a whole slew of customer service options available to users. To connect with a customer service representative you can:

- Email a detailed message or request

- Live chat with an agent

- Speak one-on-one with a telephone representative between the hours of 6:00 a.m. and 6:00 p.m. PST

- Refer to their comprehensive FAQ section for answers to the most commonly asked questions

- You can even send them a letter via snail mail (postal address available on the “Contact Us” page)

Tech-Savvy, Fee-Conscious Clientele

Because of its highly mobile design, GoBank.com is aiming to be the online bank of choice for those who want to do their banking on the go. With no minimum account balance, they are also looking at modest to mid-income customers and anyone who is unhappy with traditional “big bank” financial institutions.

No Credit or Bad Credit? No Problem

Opening a checking account with GoBank.com is not dependent upon a positive credit rating, like many other banks. No potential customer will be denied the ability to open an account so long as a valid state-issued ID can be provided.

Related: Best Credit Unions in the U.S. (Top Ranking List and Reviews)

No-Fee Banking

If you set up a monthly direct deposit of at least $500, there are no fees for any transactions. The direct deposit can be from any regularly scheduled payment such as government income or benefits or from payroll deposit. Monthly direct deposit also provides customers with:

- Early payroll access (typically 1-2 days earlier than a paper check)

- Free monthly maintenance of the account

- No overdraft fees so long as the monthly direct deposit is still occurring

- No NSF fees or penalty fees

Services Available

GoBank offers their customers a wide range of online services at no additional charge, including:

- Deposit checks (simply take a photo of the check with your smartphone or iPhone and send it in)

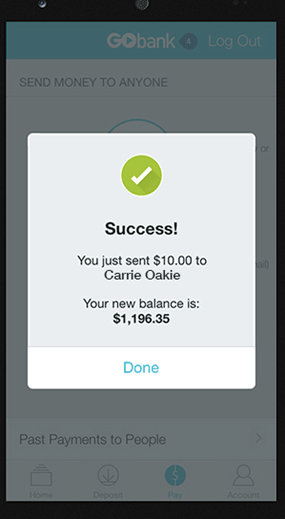

- Send money to anyone, anywhere

- Pay any bill

- Send money to a fellow GoBank.com customer via email or text messaging

- Deposit money into your account at any* Wal-Mart checkout (*not available in Vermont)

Image Source: GoBank.com

Extras

While the previous list of features is fairly familiar to most online bank customers, our Go Bank reviews found two unique features:

- Money-Vault

This is the GoBank.com savings account equivalency. It is unattached to the checking account and does not accrue interest.

- Fortune-Teller

This mobile app is like having a genie in a bottle! It helps you stick to a pre-set budget.

Deposits

You can deposit funds into your GoBank account several ways:

- Direct deposit (payroll, government payments, etc.)

- Mobile deposit (with the GoBank app)

- In-store deposits at participating 7-11s and K-mart locations

- Electronic transfers from other banks, via ACH (Automated Clearing House) payments

Image Source: GoBank.com

Limits

All good things have their limits; these are GoBank’s:

- Cash Deposit

The minimum amount you can deposit is $20, and you cannot exceed $2,500 in a single day. The thirty-day cash-deposit limit is $3,000.

- Income Tax Refunds

Income Tax refunds cannot be made later than June 2 of the year in which the taxes were filed.

- Personal Checks

Personal checks deposited into the account have a limit of $2,000 and can potentially be held for up to 10 business days before clearing.

- Government Checks

Government checks deposited into the account cannot exceed $5,000.

- Withdrawals

There is a daily cash withdrawal limit of $500 per day, which resets nightly at midnight PST.

Popular Article: Best Banks to Bank With – No Fees, High-Yield Savings, Largest Banks, and Credit Unions

Pros & Cons

Pros

- Highly Mobile

Designed with tablet and phone users in mind, GoBank offers all of its services and features in a mobile-friendly format, for both iPhone and Android.

- No Minimum Balance

You are not required to maintain a minimum balance in any of your accounts; you can actually be in an overdraft state and still have an active account.

- Replacement Debit Card

If your debit card is lost or stolen, a replacement card will be issued by GoBank upon notification. Processing time is 2-4 weeks for delivery, depending on location.

Cons

- Interest-Free Deposits

Whether you keep a single dollar or a thousand-dollar balance in your account with GoBank, you will not earn interest on any money in your account.

- Direct Deposit or Pay Fees

For any customer who has a regular income that is delivered via direct deposit, it’s fee-free banking. But if you don’t have access to a monthly income source, things can get pricey with an $8.95 monthly fee.

- Fees Outside the USA

If you’re a traveler withdrawing money from ATMs outside of the United States, you will incur an additional 3% transaction fee each time you use an ATM.

- Potentially Long Hold-Times on Personal Checks

The most significant drawback with GoBank appears to be their long hold on personal checks, with a delay of up to 10 days. Their anti-fraud measure can be frustrating for those who need faster access to their money, but they are making efforts to streamline the process. If they intend to hold your personal check for longer than three days, they will send you an email, giving you the option to cancel the deposit. This gives you the option to deposit/cash the personal check elsewhere.

Free Wealth & Finance Software - Get Yours Now ►

Conclusion

Depending on your financial situation, GoBank.com could be a dream come true–especially if you cannot (or choose not) to open a “big bank” account. A bank account without overdraft fees can be quite attractive to some customers, and the mobility of GoBank is a definite plus. If you’re struggling with a decision of whether to purchase something, the Fortune Teller app advising that it could knock your budget out of balance is an interesting and potentially helpful feature. And with so many banks charging extra for even the most basic of services, GoBank’s no-fee and free options are very appealing.

If you are someone who is dependent on personal checks, for example, a student, you may find the 1-3 day (minimum) hold limiting, but if you can build a cash cushion, the potential delay may not be overshadowed by the accessibility and convenience.

Go Bank reviews are an important step in getting the information you need to make an informed financial decision. We hope you found our GoBank reviews helpful.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.