Guide to the Best Banks That Offer Student Loans

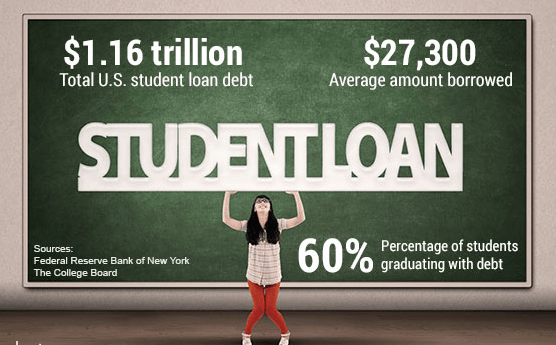

Are you looking for banks that offer student loans and feeling utterly overwhelmed? It’s understandable to feel this way when examining the subtle differences among endless student bank loan options.

These days, the competition for places in tertiary education is fierce, and securing student loans from banks only adds to the stress.

So, if you’re wondering about what banks offer student loans, look no further. In this guide to banks that offer student loans, we will break down all the things you need to know in order to secure the best bank student loans for your needs.

See Also: Student Loan Forgiveness Program | Things to Know If You Want to Get Rid of Your Student Loan

What Banks Offer Student Loans?

Here are just a few options compared, to help you get the best possiblestudent loan from a bank. Online tools like Credible or SimpleTuition might help determine the best banks for student loansif you want a wider selection of options, but these are our picks!

Citizens Bank is our first of the best banks for student loans. With fixed or variable rate loans available, borrowers with good credit (or with co-signers with good credit!) are eligible for bank student loans. Undergraduates or graduates who take out one of these loans can defer payments until after school, or just pay off the interest.

Citizens Bank are just one of the banks that offer student loans, offer an upfront 0.25% discount on your interest rate if you already have an account with them, something to make use of! They are one of the banks that offer student loans who will offer an additional 0.25% discount if you set up automatic payments.

Loans can be made from $1000 to $170000, dependent on your needs. There are 5, 10 or 15 year terms of repayment available, allowing flexibility upfront when determining your interest rates and intended pay-back period.

Note that Citizens Bank is one of the banks that give student loans that doesn’t offer loan consolidation, and look for annual income over $12,000. Despite this, it’s one of the best banks for student loans, as there are three repayment types available – immediate (which is the lowest-cost option), interest-only whilst in school, or deferred repayment.

The latter will offer you a no-repayment period of 6 months after you graduate, though it comes with higher interest rates. Citizens Bank will offer you the option to take a year of break from full repayments after your 6-month grace period is over, moving to interest-only instead for this period, a flexible offer amongst student loans from banks.

Their new Parents loan comes with fixed rates and a 5 or 10 year repayment plan. They guarantee a lower interest rate than the federal alternative. Citizens Bank is a great choice for those concerned about interest rates, when tossing up what banks offer student loans.

2. Sallie Mae

Sallie Mae are another of the banks that offer student loans, offering fixed and variable rate interest loans to borrowers, and interest-only payments for 12 months after the end of your grace period (which is 6 months). This gives a little extra wiggle room before you have to start making serious repayments on your student loan from a bank.

If you decide to go back to school later, Sallie Mae will let you defer your loan repayments, and they do also offer forbearance in 3 month increments, up to 12 months total. If you need a break from repayments on your bank student loansbecause of any external circumstantial changes, this can be very handy.

Source: Bankrate.com

The flexibility of this bank’s options is a particular standout, making it one of the best banks for student loans. Repayment options include interest-only repayments, a flat $25 per month repayment, or full deferral until after you leave school. For this bank, your interest-only payments will have the lowest rates attached.

Sallie Mae also release your co-signer after 12 months, if you’ve graduated and successfully made on-time payments for 12 months. To qualify for this, ensure you have not selected full deferment or forbearance on your existing student bank loans. It’s worth noting that Sallie Mae’s parent loans tend to attract higher rates than other banks that give student loans.

Related: How to Get a Student Loan | Quick Guide to Get Money & Apply for Student Loans

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

3. Wells Fargo

Wells Fargo offer loans up to $120,000, and will lend to students and parents. Graduate students can borrow more, up to $180,000 for law students, and you can release a co-signer after 24 months of on-time repayments, scoring it amongst our best banks for student loans.

Take advantage of a 0.25% discount on interest rates if you already bank with Wells Fargo, as well as generous repayment options and flexibility if you are struggling to repay. Their Loan Modification Program is unique amongst banks that offer student loans, as it offers those in financial distress a lower interest rate (as low as 1%) for 5 or more years depending on individual circumstances.

If this is still not achievable, Wells Fargo will extend the term of your loan to make interest rates more affordable again. Unfortunately a lot of this flexibility isn’t as available upfront, with shorter terms the only ones available. You also don’t get a lower interest rate for repaying student bank loansin under 15 years.

Out of the various banks that offer student loans, they offer particularly excellent customer support, as they service their own loans, meaning you will get a dedicated customer service specialist. You can call and ask questions of the same person, so you never have to repeat yourself.

4. SoFi

SoFi is one of the biggest banks that offer student loans, known for low interest rates. SoFi will allow small loans, with a minimum of $5,000 available. Five, seven, 10, 15 and 20 year terms are available. SoFi will refinance loans at an uncapped amount, and are more generous when it comes to looking at your credit history. As long as you can demonstrate good behavior – by working and paying off bills – you’re well on your way to a loan from one of the best banks for student loans.

Take advantage of the 0.25% discount on your bank student loansfor signing up to automatic payments from a bank account. Every little bit helps!

Note that SoFi has a much shorter forbearance program, so if you’re lost your job or the ability to pay, you can suspend repayments for 3 to 12 months. CommonBond, mentioned next, is one of the banks that give student loans, and offers up to 24 months, by comparison.

An added benefit of SoFiwhen considering a student loan from a bank, is that they offer job-related benefits and members-only careers coaching, alongside networking events. A few extras from one of the best banks for student loansto help you get started in your chosen field!

Popular Article: How to Pay off Student Loans – What Is the Best Way? (Get Help Here!)

5. CommonBond

CommonBond is the last of the banks that offer student loansto be compared. They were traditionally a refinancing specialist, but now offer a variety of loans for graduate students. With 5, 10, 15 and 20 year terms, they also offer good forbearance options on student bank loans if you’re in hardship, in 3 month increments up to 12 months consecutively and 24 months all up. If you’re really stuck, CommonBond offers refinancing of student loans from banks up to $500,000 – a lot higher than its competitors.

With very low interest rates, they offer according to credit profile, cash flow and term length. Special to CommonBondare their hybrid bank student loans, a 10 year term loan. It’s fixed interest for the first 5 years, variable for the second 5 years. It’s good for people who want to pay off their loan as soon as possible, without taking on the commitment of a 5 year loan.

It can be a risky choice as you don’t know what the variable rate will be if it kicks in, so this is a great option should your intentions be to clear the debt within 5 years.

Of course, you need to have already graduated to qualify for a student loan from a bank like CommonBond, making them one of the banks that give student loans suitable only for graduate students or those refinancing undergraduate debt.

CommonBond, like SoFi, also offers networking opportunities and job hunting assistance for its borrowers. A handy extra to help you on your way out of debt.

Read More: Sallie Mae Reviews (Loan Forgiveness, Student Loans, & Account Reviews)

Conclusion

Overall, considering student loans from banks can be very tricky. Answer the upfront questions carefully and review your options amongst the student loans through banks available.

It’s a big commitment, but this can be eased with the right loan for you. Investigate student loans through banks to ensure your college years are as rewarding as you expect!

AdvisoryHQ (AHQ) Disclaimer: Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info. Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.