Intro: Sallie Mae Reviews

Paying for college is a costly endeavor that few can afford to fork over the cash for immediately. Scholarships and grant money will only cover so much of your tuition before you have to investigate the much dreaded student loans.

Depending on how much debt your college will force you to incur, you could be paying those loans off for quite some time. Do a little research on the companies out there that offer student loans before making a commitment to any particular one.

We’re here to help out with our Sallie Mae Bank review, where we will take a look at the different programs they have to offer and a more in-depth look at Sallie Mae student loan reviews.

You should understand exactly how this company works before making a years-long commitment to doing business with them. We’ll answer questions that you might have like, “What is Sallie Mae?” and “What about Sallie Mae student loan reviews?”

Before we’re finished, you’ll have a clearer picture of whether or not Sallie Mae is the best choice for you to help fund your education.

See Als0: Best Banks in New York | Ranking of Banks in NYC, Buffalo, etc.

What Is Sallie Mae?

A fair place to start would be to answer the very basic question, “What is Sallie Mae?” Sallie Mae, also referred to as the SLM Corporation, is a full financial services company that specializes in student loans in the United States.

Image Source: Sallie Mae Bank

They also offer banking services, credit cards, investments, and various types of insurance aimed at the college-aged and young adult crowd, but they are primarily recognized for educational loans.

Sallie Mae reviews boast that they have serviced loans to more than 30 million students for undergraduate, graduate, and professional studies. They currently represent over $150 billion in student loan debt, almost one-fifth of the debt for this category nationwide.

When the company first began in 1973, they were government-sponsored but opted to incorporate early in the 21st century. They still offered the Federal Family Education Loan Program, which assisted in paying for college educations with loans that were offered by private companies and backed by the government. Sallie Mae was a well-known originator for these types of loans. This created the perception that they were still a government-sponsored entity, even though their official ties had been cut years ago.

When the United States government ended the Federal Family Education Loan Program in 2010, Sallie Mae began to transform their image to represent themselves as a private financial company. They then began to focus on creating two distinct entities within their business models: one focused on educational loans and the other on personal banking.

Don’t Miss: Best Banks in Illinois | Ranking | Banks in Chicago, Aurora & Other IL Cities

What Is Sallie Mae Bank?

Sallie Mae Bank is the smaller branch of the overall business that specializes in offering personal banking, including savings accounts, money market accounts, CDs, and credit cards.

A Sallie Mae Bank review from Credio labels it as a “good choice for those prefer paper-free banking and no face-to-face interaction” because it has no physical presence.

Customer service options include online chats or via phone with a representative.

Some Sallie Mae reviews would consider this a bonus, as it does not limit the potential reach of the institution. Another Sallie Mae Bank review from Money Rates points out that they can use the savings from traditional brick and mortar locations to invest in higher-interest savings accounts that better serve their clients.

If you’re primarily looking to invest your money into a savings account that can accrue high levels of interest instead of visiting a banker in a physical location, Sallie Mae Bank might be a good option for you.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Sallie Mae Credit Card Review

As part of its personal banking services, Sallie Mae Bank also offers its own credit card program that works hand-in-hand with Upromise. A Sallie Mae credit card review from Doctor of Credit lists benefits of the card, including 5% cash back on purchases for certain categories and a $0 annual fee.

Unfortunately, the bonus rewards are limited to pretty narrow categories, including online purchases made through the Upromise website, as well as participating restaurants and travel providers. Department stores and theaters will earn you 2% cash back, but the remainder of your purchases will earn only 1%.

According to a Sallie Mae credit card review from Nerd Wallet, you have plenty of flexibility in what you choose to use your rewards for.

Image Source: Sallie Mae Credit Card Review

You can opt to contribute to a Upromise college savings account, deposit it directly into one of the Sallie Mae Bank high-yield savings accounts, pay down your loan and receive some money back while you’re still in school, or redeem it for a simple check.

While the Sallie Mae credit card may not have all the features of cards offered by other banks, our Sallie Mae credit card review would point out that if you’re in college or headed back to school in a few years, taking advantage of the rewards offered by this card might be in your best interest.

Related: Go Bank Reviews – Everything You Want to Know (Review of GoBank.com)

Sallie Mae Student Loan Reviews

Is an education loan through Sallie Mae’s more well-known educational lending program the right option to help you fund your education? At the end of 2014, Sallie Mae renamed their loan division Navient to differentiate it from their personal banking, but it still operates much the same.

Based on the Sallie Mae student loan reviews, it seems they have a lot to offer through their programs. Students who are eligible for loans under their programs have the option of borrowing up to the full amount of their college tuition. This is an attractive offer to keep all of your debt in one place instead of needing to consolidate it down the road — another service that Sallie Mae does offer.

The standard for many student loans, their only term length for fifteen years, but they do not charge a pre-payment penalty. So if you end up a little ahead of yourself financially, take advantage of the ability to get out of debt faster without fear of incurring additional expenses.

Sallie Mae reviews point out that there are a lot of unique benefits to the programs offered through their educational loan program:

- Co-signer release: If you didn’t qualify for a private student loan on your own, you can choose to release your cosigner after only 12 months of steady payments following your graduation and by maintaining a strong credit score. Other loans also offer this feature, but Sallie Mae reviews argue that it is typical to see it offered much further into repayment of the loan.

- Loan offerings: Sallie Mae loan reviews boast that their educational loans can be used for expenses that many programs won’t cover. They can assist with payments for professional training, medical residency costs, the bar exam, or paying for your child’s private school. The downside to this offering is the variable interest rates that are subject to change on a monthly basis.

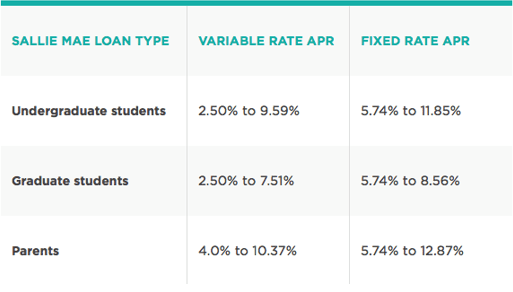

- Parent loans: A Sallie Mae review would be remiss if it didn’t point out that student loans aren’t necessarily just for students anymore. Family members or friends who wish to help their students cover the cost of tuition can also take out “parent loans.” These can have higher interest rates, particularly for variable rate loans (4% to 10% versus 2.5% to 9.5% for students) but are a unique offering from Sallie Mae.

Image Source: Sallie Mae Reviews

- Rate-reduction: If you set up an automatic payment with a debit card, you can score a 0.25% rate-reduction, a huge bonus with Sallie Mae reviews.

Popular Article: TCF Bank Reviews – What You Want To Check Out! (Overdraft Protection & Bank Review)

Sallie Mae Smart Option Student Loan

According to Sallie Mae loan reviews from LendEDU, the most popular option they offer is their Smart Option Student Loan. This option can be used to pay for any aspect of college that you need financial assistance with books, lodging, materials, or the tuition itself. It boasts low-interest rates (anywhere from 2.25% to 8.56%), no origination fees, and several repayment options.

The flexible repayment options are great because they allow students to select which one works best for them. According to Credible, offering another Sallie Mae review, all three options will be good for at least a six-month grace period following your graduation date:

- Deferred Repayment: No payments are due as long as you are still enrolled in school. You can choose to wait to begin repayment until after graduation or pay as much as you would like while you study.

- Fixed Repayment: To help reduce your interest, you’ll pay just $25 each month while in school, which saves you more than 10% on the loan over the deferred repayment option.

- Interest Repayment: Pay the interest only on your loan while you’re still enrolled to save (on average) more than 20%.

The downside to a student loan through Sallie Mae? Customer service is hard to come by because, according to the Sallie Mae loan reviews from Top Ten Reviews, support is only available over the phone. If you prefer to deal face-to-face with lenders, this is definitely something to consider.

While Sallie Mae doesn’t offer loan forgiveness, they do offer a reduction or halt in payments for up to twelve months for those in forbearance. If you want a little bit of security in case you end up facing financial hardship after graduation, it’s good to know what options are available for you through Sallie Mae’s student loan program.

Free Wealth & Finance Software - Get Yours Now ►

Conclusion

After reading this review, you are ready to confidently answer “What is Sallie Mae?” when it comes time to apply for your student loans. Positive Sallie Mae reviews are abundant for this long-time lender, even as its business structure has changed over the last decade. Sallie Mae student loan reviews love the flexibility that the various repayment options give new graduates and the flexibility to use the money to cover things that many traditional student loans won’t take into consideration, like books or more advanced technology.

A thorough Sallie Mae bank review also gives good consideration to their high-yield savings accounts and a credit card program that can help you save even more on college, whether you’re looking to attend now or years down the road. Whether you’re looking for financial assistance with higher education or just a good credit card program, Sallie Mae reviews would argue that this company has something to offer everyone.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.