Overview: TCF Bank Reviews

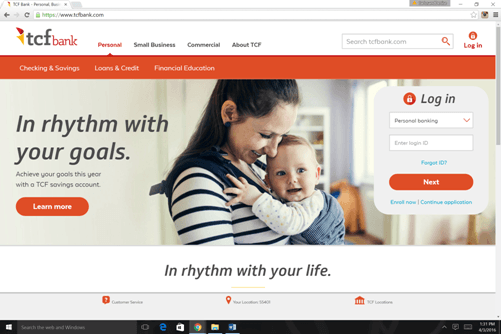

TCF Bank reviews tell the story. Part of the TCF mission is “to consistently deliver superior performance…to enhance the rhythm of customers’ lives and help them achieve their goals.” And while this bank continues its trend of rapid growth, this high rate of expansion and its impressive portfolio of product offerings do not necessarily reflect customer satisfaction. More often than not, TCF Bank reviews are less than stellar.

What is TCF Bank?

Image Source: TCF Bank

See Also: Best Credit Unions in the U.S. (Top Ranking List and Reviews)

Established in 1923 in Minneapolis, MN, TCF Bank is a full-service banking and lending financial institution. It is a subsidiary of TCF Financial Corporation and offers a wide range of commercial and retail financial services including:

- Personal and business checking

- Savings (savings and money market accounts, CDs, IRAs)

- TCF overdraft protection

- Mortgage and home equity loans

- Personal and small business loans

- Capital funding

- Corporate banking

- Commercial real estate loans

- Equipment and inventory financing

- Credit cards

- Online banking services

TCF Bank is headquartered in Wayzata, MN, and has 375 branch locations primarily in the Midwestern region of the U.S. in the following states:

- Illinois

- Minnesota

- Michigan

- Colorado

- Wisconsin

- Arizona

- South Dakota

- Indiana

TCF also provides commercial leasing, equipment finance, and auto finance services in all 50 states and conducts commercial inventory finance business in all 50 states and Canada.

What does TCF Stand for?

The initials TCF are a derivative of the original name of the bank, Twin City Federal. The name was shortened to TCF when the company went public in 1986.

Image Source: BigStock

Don’t Miss: Best Free Checking Account Banks – No Fees, Best Yields

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

TCF Bank Reviews

Personal Banking Services

TCF Bank is a full service banking institution providing customers with a wide range of personal banking product and service options.

- Savings

TCF offers a variety of savings account options, from basic savings to money market accounts, CDs and IRAs. The most basic savings account requires a minimum deposit of $25.00 and the account must maintain a minimum balance of $100 in order to avoid the $4.00 service fee. The highest yielding saving/money market accounts come with a monthly fee of $10.00, which is $5.59 higher than the national average.

All of the TCF savings accounts (Premier, Power Savings, Growth Savings, Money Market, Growth Money Market, Power Money Market, et al) earn an annual percentage rate of 0.01% which is lower than the national average rate of 0.06%.

- Checking Accounts

TCF has several checking account varieties. The most basic checking account includes no monthly fees, no minimum balance, $25.00 minimum opening deposit, and a debit card with free ATM withdrawals at TCF locations.

Premium and Special checking accounts carry monthly fees as high as $15.00. To avoid the monthly fees, individuals with a Premium checking account must carry a minimum combined balance of $10,000, and Special checking accounts require a $15,000 minimum combined balance.

TCF checking accounts are interest bearing with the most popular account—Basic—earning an Annual Percentage Yield of 0.02%, which is lower than the 0.07% national average.

- Mortgage/Home Equity Loans and Lines of Credit

Personal mortgage and home equity loans/lines of credit are also offered by TCF. They offer competitive rates which of course are available on a case by case basis and subject to each individual’s ability to qualify.

- Personal Loans/Credit Cards

TCF offers personal installment loans at competitive rates and with flexible terms.

They also offer three personal credit cards: Maximum Rewards Visa, Platinum Edition Visa, and a Secured Visa Card.

- TCF Overdraft Protection

Like most banks, the TCF Bank overdraft policy does include substantial fees for account overdrafts and for items being returned due to nonsufficient funds. TCF Banks offer overdraft protection. It currently offers two forms:

TCF Overdraft Protection Transfer Service

TCF Overdraft Protection Line of Credit

The TCF Overdraft Protection Transfer Service is an “opt-in” service that links the checking and savings accounts together. If the checking account is overdrawn, TCF automatically transfers the necessary funds from the savings account to cover the shortage and the overdraft fee will not be charged. If the funds exceed the amount of available funds in the savings account, TCF’s services and overdraft fees are applied.

The TCF Overdraft Protection Line of Credit is a pre-approved emergency line of credit where funds are transferred to the checking account in the event the account is overdrawn. This is a loan that accrues interest. The monthly interest charges are usually less than overdraft and insufficient fund charges; nevertheless, the consumer must be aware that it is—indeed—a loan.

- Corporate and Commercial Services

TCF offers a wide range of corporate and commercial services. They include commercial real estate lending, corporate banking, capital funding (targeting the lower-middle market), equipment and inventory financing, and private banking services.

Related: Best Banks to Bank With – No Fees, High-Yield Savings, Largest Banks, and Credit Unions

TCF Bank Reviews (Caveat Emptor—Buyer Beware…)

The Positive

While negative reviews abound, customers have plenty of positive things to say in TCF bank reviews. Some reviews cited extended hours and professional staff as positives, while another appreciated TCF’s online banking portal.

One review from the same website explained how frustrated the customer was in trying to activate her debit card. She went to her local branch specifically to activate for free but was directed to an ATM. When she finished the process at the ATM, she was informed that she had been charged a $1.50 fee. Upset, she went home.

The next day, the branch manager called to apologize and remove the fee from her account—which the customer felt was a pretty big gesture for such a small sum.

Another customer had his identity stolen online, and his checking account was used by the culprit. TCF reimbursed him quickly and completely.

Customer Satisfaction

But, TCF Banks have also reportedly been on the receiving end of a significant number of complaints as far back as 2007. In 2013, TCF reportedly received 25 complaints per billion dollars of deposit, which is nearly three times the amount the next closest bank received.

Consumer complaints most often concern TCF’s personal banking services. Complaints often surround:

- Account management

- Credit score reporting

- Customer service

- Debt management

- Fees/billing

- Loan repayment

- Privacy issues

Bank accounts, specifically checking accounts, drew the largest number of complaints. In 2013, Money Talk News reported that 80% of complaints derived from issues surrounding personal checking accounts. The complaints involved all aspects of account management from opening and closing accounts to the general management of checking accounts.

One major point of contention among TCF clientele is the absorbent fees inactive or idle accounts can rack up in no time. Customers complain that TCF also closes accounts without notifying the customer.

Image Source: BigStock

Predatory Practices

TCF Bank was embroiled in a scandal in 2013 for what many consider an unscrupulous practice of preying on college students. ABC News reported that TCF paid the University of Minneapolis more than $1 million dollars annually in exchange for the university’s active recruitment of students as TCF customers. In fact, 85% of all incoming freshman become a part of TCF’s clientele.

Young customers are reportedly lured into opening checking accounts with TCF through of the promise of free checking. TCF advertises free checking with no monthly fees, however in the very fine print, at the bottom of the page—other fees may apply followed by the list below:

- Overdrafts

- Returned item NSFs

- Dormant account

- ATM transactions at non-TCF ATMs

- Deposited item return fee

- Stop payment fee

- Paper statements

- Check orders

- Other optional services

TCF Bank Overdraft Policy (Fees)

Many of the complaints associated with the predatory practices are in association with the TCF Bank overdraft policy—specifically the overdraft and non-sufficient fund (NSF) fees. Hundreds of complaints stem from customers—especially college students and first time account holders—complaining that they were unaware of these fees. The fees are as high as $37 for each instance.

According to the FDIC, 50% of young adults overdraw their account annually. And the ones who overdraw their account usually do it an average of seven times. TCF makes being overdrawn very costly.

TCF does not just charge an overdraft fee; they go out of their way to maximize the charges. So much so that the Consumer Financial Protection Bureau is considering filing a class action lawsuit against the bank. The lawsuit accuses TCF of going as far as reordering debits in order to charge multiple fees. The investigation uses the scenario below to illustrate TCF’s deceptive practice:

“Consider the following example:

Time 1: You have $100.00 in your bank account.

Time 2: You use your debit card at Starbucks for $20.00.

Time 3: You use your debit card at the gas station for $5.00.

Time 4: You use your debit card at the grocery store for $105.00.

Time 5: TCF Bank reorders the debits and posts the latest occurring $105 debit first, and then charges an overdraft fee.

TCF Bank then posts the $20.00 debit, and then charges a second overdraft fee. TCF Bank then posts the $5.00 debit, and charges a third overdraft fee. If the bank would have posted the debits in order in which they actually occurred, you only would have incurred one overdraft fee. Instead, you are stuck with three.”

There are also numerous complaints for TCF Bank on various review sites that state overdrafts and instances of insufficient funds were actually caused by TCF and the consumer is laden with multiple fees.

As mentioned earlier, TCF overdraft protection services are available but come at a price. If you choose to use the TCF Overdraft Protection Transfer Service, you will be charged a $10 fee each time money is transferred from the linked savings account to cover an overdraft. The TCF Overdraft Protection Line of Credit comes with a hefty 18% (or higher) annual percentage rate on outstanding balances AND a $10 fee each time money is transferred to reconcile an overdrawn checking account.

Popular Article: Best Bank for Small Business Banking (Best Business Bank Accounts)

Free Wealth & Finance Software - Get Yours Now ►

Final Word

TCF Bank expresses pride in being able to offer services and opportunities that are designed to help improve everyday life for their clientele; however, countless TCF Reviews of their everyday personal products and services oppose this idea. They offer variety but also are accused of nickel-and-diming customers. One of the primary core values is leadership with integrity, but recent incidents and customer complaints question their integral commitment.

TCF Bank Reviews in the commercial and cooperate sector are almost non-existent. It appears this market niche is where they really thrive.

Having a good personal banking experience with TCF is possible as long as you read the fine print and adhere to all of their requirements.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.