Intro – Baxter Credit Union Reviews & Ranking

AdvisoryHQ recently published its list and review of the top credit unions in Illinois, a list that included Baxter Credit Union.

Below we have highlighted some of the many reasons Baxter Credit Union was selected as one of the best credit unions in Illinois.

Click here for a detailed review of AdvisoryHQ’s selection methodology: AdvisoryHQ’s Methodology for Selecting Top Banks and Credit Unions.

Baxter Credit Union Review

Baxter Credit Union (BCU) has been serving the needs of members for 35 years, offering a full range of accounts and resources designed to maximize your money and strengthen your financial life and future. BCU was started in 1981 by a small group of Baxter Healthcare executives, and now this Illinois credit union has a membership of more than 200 million as well as more than $2.5 billion in assets.

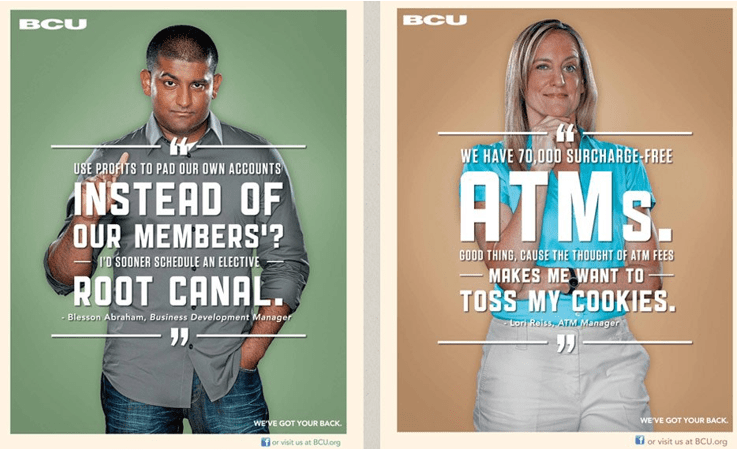

Since its original founding in 1981, BCU has grown to become one of the top 100 credit unions, and the promise of “We’ve Got Your Back” remains a guiding philosophy behind everything offered to members of this best credit union in Illinois.

Image Source: Baxter Credit Union (BCU)

Key Factors Leading Us to Rank This Firm as One of This Year’s Top Credit Union Firms

Upon completing our detailed review, Baxter Credit Union was included in AdvisoryHQ’s ranking of this year’s best credit unions based on the following factors.

BCU Review: Mobile Banking

BCU recently updated its mobile banking app to make sure it’s completely advanced and powerful in its functionality while remaining simple and effective to use. The mobile banking app features a new look and more user-friendly navigation so users can check all their account balances in one location.

Image Source: Baxter Credit Union (BCU)

It also includes Pay Anyone, which is a fast, convenient way to send money to friends and family with your Visa Debit card.

There’s a quick login feature, and the feature Deposit Anywhere has been enhanced, making it extremely fast and reliable to make mobile check deposits.

BCU Review: Business Banking

Not every credit union offers business banking services in addition to personal banking, but BCU does. This can be advantageous for members that want to consolidate all of their banking at one institution and also for those members who want the perks of credit unions to extend to their business accounts.

Products include business loans and a Visa Business Credit Card as well as accounts such as Standard Business Checking, Premier Business Checking, Business Money Markets, and Business Certificates.

BCU Review: PowerPlus Checking

An important consideration when creating this ranking of credit unions in Illinois was how much value the credit union is able to create for members. BCU ranked well in this area, particularly thanks to its PowerPlus Checking account, which is the premier account offered by this IL credit union.

PowerPlus Checking was launched in early spring 2015, and, since that time, account holders have earned more than $3 million in interest, and more than $400,000 in ATM fees have been reimbursed.

This account includes a 2% APY on balances up to $25,000 and up to $10 per month in cash reimbursement to cover non-BCU ATM fees. There is no minimum balance requirement or monthly maintenance fees associated with this account.

BCU Review: CURewards

CURewards is a program that lets members earn points which they can then exchange for travel deals, loan rate reductions or merchandise.

When users use their Travel Rewards Visa credit card, they can earn unlimited points: two points for every $1 spent on all purchases. Users can also earn one point for every $2 spent with their Visa ATM/Debit Card with Rewards.

To earn higher points, users can combine their credit and debit card points.

In addition to reviewing the above Baxter Credit Union review, you can click on any of the links below to browse exclusive reviews of AdvisoryHQ’s top rated banking firms & credit unions:

Top Rated Banks

Top Banking firms

Review of Top Mortgage Firms

Bank Reviews

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.