2017 RANKING & REVIEWS

TOP RANKING BEST CREDIT UNIONS

Intro: Changing How You Bank with Illinois Credit Unions

Every month, you receive your statement from your bank only to find the fees you’re charged have gone up. There continues to be small print added to your banking services, changing the way you receive service. The interest rates you earn on your money are pervasively low while interest rates you’re paying on loan and credit accounts feel sky high. You feel like you have no control over your money or how you bank.

If any of these situations sound familiar, you’re not alone. These are common issues most consumers have with their bank, and yet they feel stuck or as if there’s nothing they can do to change the situation.

This doesn’t necessarily have to be true, however. Consumers around the country are increasingly turning to credit unions around the country, as well as credit unions in Illinois, as opposed to standard banks, and they’re finding the benefits are significant and include stronger, more community-driven customer service along with better rates on loans and deposit accounts and lower fees.

Award Emblem: Top 15 Best Credit Unions in Illinois

The following list highlights the advantages of credit unions in general and also ranks and reviews the best credit unions in Illinois. Each of these Illinois credit unions is unique in its offerings, but they have many things in common as well, which have led them to be some of the most relied-upon, member-owned, financial cooperatives in the state.

AdvisoryHQ’s List of the Top 15 Best Credit Unions in Illinois

- 1st MidAmerica Credit Union

- Abbott Laboratories Employees Credit Union (ALEC)

- Baxter Credit Union

- Chicago Patrolmen’s Federal Credit Union

- Citizens Equity First Credit Union (CEFCU)

- Consumer’s Credit Union

- Corporate America Family Credit Union

- Credit Union 1

- Deere Employees Credit Union

- Great Lakes Credit Union

- I.H. Mississippi Valley Credit Union

- Motorola Employees Credit Union (MECU)

- Scotts Credit Union

- State Farm Federal Credit Union

- Vibrant Credit Union

This list is sorted alphabetically (click any of the above names to go directly to the detailed review for that credit union).

Related (Please Review):

- Permission to Use Your FREE Award Emblems

- Promoting Your “Top Ranking” Award Emblem and Recognition

- Can Anyone Request a Review of a Credit Union?

- Do Credit Unions Have a Say in Their Review & Ranking?

- Can Credit Unions Request Corrections & Additions to Their Reviews?

Best 15 Credit Unions in Illinois (Statewide)

Credit Union | Location |

| 1st MidAmerica Credit Union | Bethalto |

| Abbott Laboratories Employees Credit Union (ALEC) | Gurnee |

| Baxter Credit Union (BCU) | Vernon Hills |

| Chicago Patrolmen’s Federal Credit Union | Chicago |

| Citizens Equity First Credit Union (CEFCU) | Peoria |

| Consumers Credit Union | Gurnee |

| Corporate America Family Credit Union | Elgin |

| Credit Union 1 | Rantoul |

| Deere Employees Credit Union | Moline |

| Great Lakes Credit Union | Bannockburn |

| I. H. Mississippi Valley Credit Union | Moline |

| Motorola Employees Credit Union (MECU) | Schaumburg |

| Scotts Credit Union | Edwardsville |

| State Farm Federal Credit Union | Bloomington |

| Vibrant Credit Union | Moline |

Table: Top 15 Best Credit Unions in Illinois | Above list is sorted alphabetically

Methodology for Selecting Top Banks and Credit Unions

Many consumers wonder how we create our lists of the top banks and credit unions. For this ranking of the best credit unions in Illinois, we began by outlining criteria that would be important to a broad set of consumers. Some of these factors included fees, convenience and accessibility, availability of online and mobile banking, and the diversity of services offered.

We then reviewed each IL credit union within the context of this set of criteria, based on widely available public information and resources. From there, we were able to narrow down the selections and create the ranking of the top credit unions in Illinois that follows.

Click here for a detailed explanation of our methodology: AdvisoryHQ’s Methodology for Selecting Top Banks and Credit Unions

Detailed Review—Top Ranking Credit Unions in Illinois

After carefully considering the top Illinois credit unions, we created the following list of the best 15. As you continue reading, you’ll find detailed reviews for each of our selections as well as highlights of why these particular credit unions were selected.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

1st MidAmerica Credit Union Review

Membership at 1st MidAmerica Credit Union is available to anyone who lives or works in particular Illinois counties. These counties include Madison, Macoupin, Montgomery, Bond, Fayette, Calhoun, Greene, Jersey Pike, Morgan, Scott, St. Clair, Jefferson, Washington, and more. People who live or work in Jackson County, Missouri can also become members of this leading Illinois credit union.

1st MidAmerica is an Illinois credit union that strives to consistently provide the best services and privileges that aren’t available at other financial institutions, including higher interest on dividends. This credit union works to be the primary financial institution for all of its members and their families. The mission of 1st MidAmerica is “exceeding member expectations.”

Key Factors That Allowed This to Rank as One of the Best Credit Unions in Illinois

When reviewing criteria that define what makes for top credit unions in Illinois, the following list highlights some of the specifics of why 1st MidAmerica was included on this list.

Free Checking

Free Checking is the signature account offering available from 1st MidAmerica. It’s designed for members who want a checking account that’s accessible, convenient, and will save them money. This account includes a free personalized debit card as well as free e-statements, which means fast and safe account information delivery every month.

Online banking is available to manage this account, as is free mobile banking.

Select and Premier members can also opt to take advantage of online bill payment services when they’re a free checking account holder.

Relationship Rewards

1st MidAmerica strives to reward members for their loyalty and longevity in relationships through the member Relationships Rewards program. There are three levels of rewards available through this program. The first is Basic, followed by Select, and the highest tier of relationship rewards is Premier.

For Premier members, benefits not available to other member levels include four free withdrawals from non-1st MidAmerica-owned ATMs, special promotional offers and coupons available throughout the year, free money orders, free traveler’s checks, and free corporate checks.

Image Source: Relationships Rewards

Online Services

In the past, one of the most commonly-held beliefs about credit unions was that they weren’t as accessible as standard banks and financial institutions. Consumers were reluctant to join because they felt like there might only be a few branch locations, and they wouldn’t be able to enjoy the convenience they might have with a bank. Fortunately, with the introduction of online and mobile banking, this is no longer a significant concern.

1st MidAmerica offers a range of online account management services, available around the clock.

For example, members can do online banking, view electronic statements, pay their bills, send money to friends and family using Popmoney, and take advantage of payroll deduction and direct deposit features. There are also options to make payments on loans and quickly transfer funds between different accounts.

Ez-Budget

Ez-Budget is a convenient and innovative tool available to members of this credit union in Illinois. It provides the opportunity to view all of your financial information in one place. This includes bank accounts, investments, mortgages, and credit card information. You can then utilize powerful budgeting and cash flow management tools.

Create tags to categorize your spending, make financial goals, and set up personalized alerts so you can stay on track with your goals and personal budget. Members of 1st MidAmerica can sign up for this service by logging into their e-Teller online banking.

Chicago Patrolmen’s Federal Credit Union Review

Chicago Patrolmen’s Federal Credit Union has been serving the financial needs of police officers and their families in the Chicago area since 1938. The credit union was formed when members of the Chicago Patrolmen’s Associated wanted to pool their financial resources. The Board of Directors that administers this Illinois credit union is made up of current and former Chicago police officers.

There are more than 31,000 members of this top credit union in Illinois as well as assets of more than $381 million. The mission of Chicago Patrolmen’s FCU has remained the same throughout its long history, which is to “serve the financial needs of police officers and their families in order to help them realize their life’s goals.”

Key Factors Considered When Ranking This as One of the Best Credit Unions in Illinois

Primary reasons Chicago Patrolmen’s FCU was included on this list of top credit unions in Illinois are briefly highlighted below.

Checking

One of the deposit products available to members of this top credit union in Illinois is a signature checking account. This account is free, so members and account holders don’t have to worry about paying high fees just to access their money on a regular basis. This account includes a free ATM card or Visa Debit card, and, along with no monthly service charge, there are no minimum balance requirements.

This account features overdraft protection options, monthly statements, and online bill pay.

Additionally, if your daily balance is at least $1,000, this account is eligible to earn dividends.

Debit Card Rewards

Account holders with debit cards from Chicago Patrolmen’s FCU can now earn rewards just for using their Visa Debit Card. They can earn one point for every two dollars spent. To register for this, account holders can visit the UChoose Rewards website and then register there.

Every debit card you want to enroll in the rewards program must be registered, and once your debit card is registered, it’s automatically linked to all other debit cards registered under the same account number.

This means participating members can pool their points and earn rewards faster.

Image Source: Rewards Program

CARpay Diem Loans

Available from this best credit union in Illinois are signature CARpay Diem Loans. With these loans, members get all of the perks of conventional financing with the perks of leasing as well. This low payment loan program features lower payments than conventional financing, but you still get flexibility and benefits of ownership.

There is 100% financing available with no money down, no security deposit, and no upfront first or last payment.

You can sell, trade or refinance your vehicle at any time, and you can also return the vehicle at loan maturity and walk away. There is no early payoff penalty, and yearly mileage options are flexible.

Blue Line Rewards Credit Card

With the Blue Line Rewards Credit Card, cardholders can earn 30,000 bonus points when they spend $3,000 on purchases within the first 90 days of having the card. They can also earn one point per dollar spent on every purchase, and extra points can be earned on Bonus Point Days.

This card also has no annual fee, a low non-variable APR that’s the same for purchases, cash advances, balance transfers, and a 25-day interest-free grace period on purchases.

Corporate America Family Credit Union Review

Corporate America Family Credit Union began when 15 employees of Automatic Electric Co. each made a $5 deposit in 1939. Throughout the years, the credit union has grown and now serves the needs of tens of thousands of nationwide members. CAFCU went from a federal charter to an Illinois state charter in 1997, to serve the wider needs of members.

The purpose of CAFCU is to serve people while the vision is defined as making a meaningful difference in the financial lives of members. The mission is to work as a member-owned and directed financial co-op dedicated to being the members’ primary financial institution.

Key Factors That Led to Our Ranking of This as a Top Credit Union in Illinois

Essential reasons CAFCU was included on this list of the leading credit unions in Illinois are detailed in the following list.

Fresh Start Checking

It can be difficult for consumers who have a less-than-perfect financial record to gain the opportunity they need to rebuild their credit and checking history. It’s for that reason CAFCU offers the Fresh Start Checking account. This account only requires that you’re a member of the credit union, that you maintain a minimum balance of $100 in your Regular Share Account, and that you pay a low $10 fee.

This account can also be used in conjunction with GetIn Balance, which is an online course that provides the members with the tools they need to manage their checking account more effectively.

Rewards Advantage Checking

In addition to the Fresh Start Checking Account, this Illinois credit union also offers the Rewards Advantage Checking option, which features rewards and savings opportunities. The account includes a Rewards Advantage Visa Debit card, which earns users points on signature-based transactions.

Those rewards can then be exchanged for travel or gift cards from retailers.

Other benefits of this account include free overdraft protection loan advances and free online bill pay, with the first seven monthly ATM transactions free. It also includes up to three free cashier’s checks per year and one free Visa TravelMoney card per year.

If you have a Visa credit card that’s enrolled in the Extra Awards program, you can combine points to earn even more rewards.

Specialty Share Account

A Specialty Share Account is designed to help members save for a specific purpose, generally in the short-term. For example, your goal might be to save for a vacation or to save money for the holidays. Regardless of the reason, this account can be opened with as little as $5 and includes a competitive dividend rate.

You can access your account at anytime using online banking with CAFCU, and if you set up a Holiday Club Account, there’s an automatic transfer into your CAFCU checking account in time for holiday shopping.

You can also make it easy and effortless to save by using Direct Deposit or Payroll Allocation so you don’t even have to think about saving money.

Membership Concierge Service

Membership Concierge Service from CAFCU is designed to offer members the utmost in a personalized experience. It can be used to help members open the accounts that are right for them and also to do things like setting up direct deposits and updating automatic payments.

Other services available to members of CAFCU include:

- Online and mobile service

- Wire transfers

- Money orders

- Financial education tools and resources

- Visa Gift Cards, travel cards, and prepaid debit cards

- Member discounts

- Insurance products

- Investment products

Great Lakes Credit Union Review

Great Lakes Credit Union was organized in 1938, with the goal of providing an institution where civil servants could borrow money at reasonable rates and also have a safe place to save their money. It was founded in a time when there was no other financial institution in the area, but, since then, GLCU has grown and led the way in innovation.

The Member Promise, which drives the products and services provided by GLCU, includes responsiveness to the needs of members, simplification of their financial lives, and the building of relationships through discovering member needs and delivering relevant products and services. It also promises to always remain knowledgeable and respectful.

Key Factors That Enabled Us to Rank This as a Best Credit Union in Illinois

When comparing information about Illinois credit unions, the following are reasons Great Lakes was included on this list of the top credit unions in Illinois.

Ultimate Checking

Ultimate Checking is a value-creating checking account with up to 3.00% APY on balances. Additionally, this account includes a free Visa Debit card, free online banking, and free mobile check deposits.

Account holders have access to thousands of ATMs, with free withdrawals at GLCU ATMs, and overdraft protection is also available.

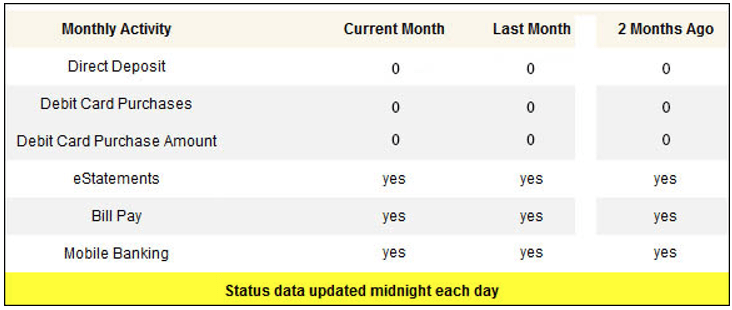

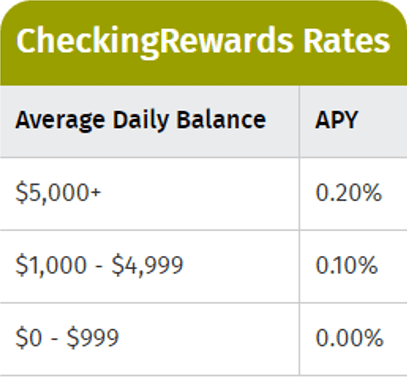

Some requirements determine how much your interest rate will be on balances, but these are relatively straightforward and easy to achieve. If you utilize online banking, you can also check each month to ensure you’re making the requirements to earn your checking rewards.

Image Source: Member Promise

Club Accounts

Club Accounts are signature offerings from Great Lakes Credit Union designed to provide members with additional benefits if they meet certain criteria.

For example, the Presidents Club is designed for members who have combined share and loan balances of $50,000 or more. Benefits include a free Ultimate Checking account, ATM rebates, bonus rates on Share Certificates, and free personal checks.

There’s also the Grand Advantage Club for GLCU members who are 60 and older, and this includes no-fee Ultimate Checking accounts and insurance options.

Skip-A-Payment

Skip-A-Payment is a member perk that lets participants skip certain loan payments. To use this option, members log into WebConnect, which is the Great Lakes online banking platform, and choose the month they’d like to skip a payment.

Eligible loans include new and used auto loans, RV and travel trailer loans, Visa credit cards, and lifestyle loans.

There is a small fee per skipped payment, but members can take advantage of this two times per loan, per year. In order to be eligible, all accounts must be in good standing, and the loan has to be open for a minimum of 12 months.

Member Rewards

In an effort to provide the maximum level of value to members, this credit union in Illinois features exclusive member benefits through the Love My Credit Union Rewards Bundle program.

This program offers discounts and benefits at companies including:

- Allied Moving

- TurboTax

- Love to Shop

- Spring Rewards

- DirectTV Rewards

- TruStage Auto and Homeowners Insurance

- ADT Security Systems

- CU Road Pal

Vibrant Credit Union Review

Vibrant Credit Union is an Illinois credit union that strives to change the way people think about financial services and how they manage their money. To gain membership, all potential customers need is to live within 50 miles of one of the Vibrant branches and have five dollars.

Vibrant is secure and stable, with federal insurance by NCUA. Services from Vibrant include personal and business banking, insurance, and extensive online services.

Key Factors That Led to Our Ranking of This as One of the Best Credit Unions in Illinois

Listed below are details of why Vibrant was included on this list of contenders for the top credit union in Illinois.

CashBack Account

One of the primary personal checking accounts available from Vibrant is the CashBack account. This account earns you rewards each time you use your Vibrant Visa Debit card. Each November, Vibrant will look at transactions and add them up for the previous year.

Members then receive one cent for debit card PIN transactions and five cents for debit card signature transactions. After all transaction rewards have been added up, members receive cash back in exchange for these everyday purchases.

Image Source: Vibrant Credit Union

The CashBack account also includes unlimited use of Vibrant ATMs, free automatic payroll deposit, a free debit card, free online banking, and automatic overdraft protection.

Checking Rewards

Another checking option available to members of Vibrant is the CheckingRewards account. With this account, you should deposit at least $2,500 at opening in order to set the account up. Rather than cash back, you receive competitive annual dividends. As well as the high yearly dividends, account holders also have the following benefits with the use of this account:

- A free debit card

- Free unlimited use of Vibrant ATMs

- Free automatic payroll deduction

- Free online account access

- Online check ordering

- Free bill pay

- Secure online statement availability

- Three free money orders per month

- Automatic overdraft protection

Image Source: Checking Rewards

Mobile Banking

Mobile Banking from Vibrant makes it fast, efficient, and convenient to handle all of your banking needs. Vibrant Mobile Banking includes the ability to monitor your account balances at any time, pay bills, and transfer funds between accounts.

You can also make remote check deposits, send wire transfers, and even change pending transactions.

Credit card balance information and activity can be integrated with Mobile Banking as well.

Insurance

Vibrant doesn’t just offer the traditional products and services you might find at a bank or another community credit union. It also helps members and their families save money on the cost of insurance. Members can save hundreds of dollars by obtaining insurance through Vibrant.

Insurance options from Vibrant include auto, motorcycles, life, home and property, leisure and sports vehicles, and more.

Several different carriers are offered through Vibrant, including Travelers, IMT, Allied, Progressive, and ASI.

To browse exclusive reviews of all top rated banks in Illinois, please click on any of the links below.

- 1st MidAmerica Credit Union

- Abbott Laboratories Employees Credit Union (ALEC)

- Baxter Credit Union

- Chicago Patrolmen’s Federal Credit Union

- Citizens Equity First Credit Union (CEFCU)

- Consumer’s Credit Union

- Corporate America Family Credit Union

- Credit Union 1

- Deere Employees Credit Union

- Great Lakes Credit Union

- I.H. Mississippi Valley Credit Union

- Motorola Employees Credit Union (MECU)

- Scotts Credit Union

- State Farm Federal Credit Union

- Vibrant Credit Union

Free Wealth & Finance Software - Get Yours Now ►

Conclusion—Top 15 Credit Unions in Illinois

Community. It can seem like such a simple word and one that’s often included in the names of credit unions, but it’s also that one word that really signifies some of the key differences between credit unions and banks.

For example, credit unions are often small organizations that provide locally-driven service and decision-making. Rather than waiting to hear back from a home loan lender across the country or even globally, you’re often hearing from someone who lives in your own community. It’s also an intimate community that makes up the membership of most credit unions, and there’s an operational foundation based on the concept of “people helping people.”

It’s with these important things in mind that we created this list of the best credit unions in Illinois. This extensive list of the top credit unions in Illinois was based on a standardized set of criteria as well as on factors that the average consumer would find most appealing when searching for an alternative to conventional banks.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.