Intro – State Farm Federal Credit Union Reviews & Ranking

AdvisoryHQ recently published its list and review of the top credit unions in Illinois, a list that included State Farm Federal Credit Union.

Below we have highlighted some of the many reasons State Farm Federal Credit Union was selected as one of the best credit unions in Illinois.

Click here for a detailed review of AdvisoryHQ’s selection methodology: AdvisoryHQ’s Methodology for Selecting Top Banks and Credit Unions.

State Farm Federal Credit Union Review

Since 1936, State Farm Federal Credit Union has been serving the financial and banking needs of all U.S. State Farm employees, including agents, retirees, and some of their immediate family members. This is a unique credit union, compared to most of the other names on this list, because there are not only branch locations in Illinois but also many throughout the country.

State Farm Federal Credit Union is well-capitalized, with assets of nearly $4 billion, offering a sense of stability and security for members.

Image Source: State Farm Federal Credit Union

Key Factors Leading Us to Rank This Firm as One of This Year’s Top Credit Union Firms

Upon completing our detailed review, State Farm Federal Credit Union was included in AdvisoryHQ’s ranking of this year’s best credit unions based on the following factors.

State Farm Federal Credit Union Review: Budget Workbooks

Each year, this credit union publishes a budget workbook designed to help members and their families achieve their dreams, whatever they may be. This workbook includes a section for outlining goals and also to highlight how you’ll achieve these goals.

Other sections included in the workbook are the following:

- Calculating your debt-to-income ratio

- Tips for building a budget and taking control of your finances

- A master budget worksheet to highlight income, income taxes withheld, household expenses, and more

- There’s a month-by-month calendar that also includes monthly tips such as, “Put your credit cards on a New Year’s diet with an SFFCU debt consolidation loan.”

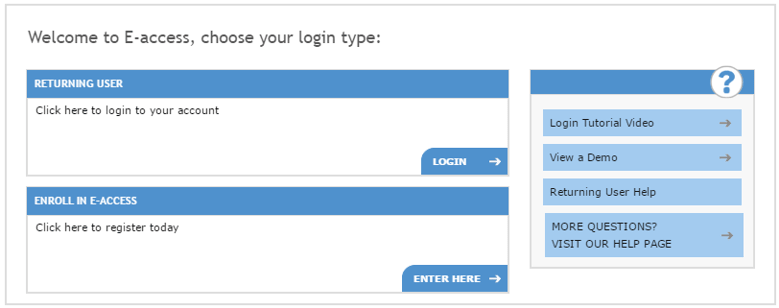

State Farm Federal Credit Union Review: E-access

E-access is the online banking platform from State Farm Federal Credit Union that lets members not only quickly, easily, and efficiently manage their accounts, but they can also use this portal to apply for loans.

Image Source: State Farm Federal Credit Union

Users can transfer money between their credit union accounts and external accounts with the Account-to-Account Transfer feature, open additional savings accounts, and request a check from existing savings accounts.

State Farm Federal Credit Union Review: Personal Lines of Credit

One of the many loan products available to members of this Illinois credit union is personal lines of credit.

These flexible loan options can be used for anything from taxes to home improvements or even debt consolidation.

When members use this loan option, they can have loan payments deducted from their check, with up to $50,000 per member available. Payments are based on 60-month repayment terms.

State Farm Federal Credit Union Review: Vehicle Loans

Another competitive and valuable lending option from State Farm Federal Credit Union are vehicle loans, which feature the same excellent rate whether you’re purchasing a new or used vehicle. These loans can be protected with the Member Protection Program and can be used to buy cars, trucks, and vans.

You can refinance from other financial institutions and get up to a 100% payoff or NADA retail value, whichever is the greater of the two. You can also get preapproved before you start shopping for a new vehicle.

Payments can be deducted automatically from your paycheck, so you never miss a payment.

In addition to reviewing the above State Farm Federal Credit Union review, you can click on any of the links below to browse exclusive reviews of AdvisoryHQ’s top rated banking firms & credit unions:

Top Rated Banks

Top Banking firms

Review of Top Mortgage Firms

Bank Reviews

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.