Overview—What You Need to Know about BBVA Bank and Online Banking

In a world where online banking options and choices are nearly endless, finding the perfect bank to open an account with is of the utmost importance. These days, one of the most discussed banks happens to be BBVA Compass.

Those who are familiar with the BBVA online banking experience have noted the ease of use with their BBVA Compass online banking account.

Through their desktop and mobile BBVA online banking account, BBVA Compass has provided their clientele with easily accessible banking and money management.

However, there is a wide range of BBVA compass reviews available on the Internet. Below, we present a more detailed review of BBVA compass online banking, including the many factors that you should consider before using BBVA Bank.

This BBVA Compass review article provides an in-depth overview of the services provided by BBVA Compass Bank, as well as the pros and cons of using the BBVA Compass online banking site.

Although there are dozens of BBVA Compass reviews on the web, we’ll offer a concise yet detailed BBVA Compass review, including providing an overview of what this bank has to offer.

See Also: Best Savings Accounts for Kids | Ranking & Review

BBVA Compass—What You Need to Know

Image Source: BBVA Compass

Originally founded under the name Compass Bancshares in 2007, the bank announced an acquisition by Banco Bilbao Vizcaya Argentaria (BBVA). BBVA Bank, at the time, was the second largest bank in Spain. After the successful merger of the two banks, the bank became known by its current name, BBVA Compass.

BBVA Bank is one of the top 20 largest and leading banks in the United States and ranks 17th in Global Finance magazine’s list, “World’s 50 Safest Banks.” The BBVA Bank extends across the Sunbelt region and includes branches located in states such as Alabama, Arizona, California, Colorado, Florida, New Mexico, and Texas.

In addition, a quick BBVA Compass review reveals that BBVA Bank has won 10 excellence awards, including seven in the small-business segment. BBVA Compass also leads the way in small-business lending, strengthening local communities.

BBVA Compass offers clients 3 major business units:

- Commercial banking

- Retail banking

- Wealth management

According to many BBVA Compass online reviews, customers found that no matter what their financial situation, BBVA Compass offered an extensive and personalized solution. No matter if the customer was looking into pension plan management, mortgages, home equity lines, or financial counseling, the customer’s needs were always catered to by BBVA Bank.

With such stellar BBVA Compass online reviews available from highly satisfied customers and a truly outstanding track record, it is no wonder that BBVA Bank has been a top choice amongst customers with all sorts of different financial situations.

Leading in countries around the globe, such as Spain, Latin America, China, France, Germany, Italy, Japan, Switzerland, Turkey, and the United Kingdom, the BBVA Bank influence continues to find success in financial matters worldwide.

BBVA Compass Online Banking

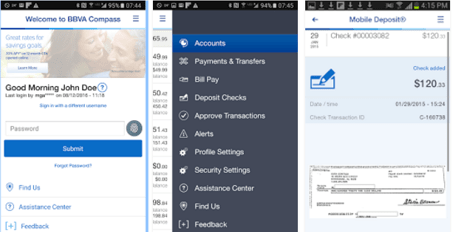

Image Source: BBVA Compass Online Banking

In our technology-driven world, online banking has all but replaced many conventional methods of managing our finances. With automated ATMs replacing tellers and easy-to-use online banking systems replacing the inconvenience of heading into the bank in-person, the use of technology has, in fact, driven us forward.

In terms of online banking, the BBVA Compass online banking system truly makes the entire experience simple and stress-free. With access to all of your account necessities in one place, the BBVA Compass online banking system allows you to pay all your bills online, set account alerts, and even access goals and budgets.

The BBVA online banking system is incredibly secure as well, as the interface provides customers with fraud protection and high security features.

With the BBVA online banking system, enjoy cash back bonuses, “Remember Me” technology that instantly recognizes your previously used devices, and the “Popmoney” feature that allows you to send and receive money to and from anyone in the United States, regardless of where they bank.

Don’t Miss: Finding the Best Student Accounts | What You Should Know

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Compass Bank Online Mobile App

A recent update to the Compass bank online has been their stunning new 4.0 mobile app version. The Compass bank online mobile app is a brand-new and polished way to virtually take care of one’s banking needs.

The remodeled mobile Compass bank online features a highly intuitive interface, allowing you to access all of your major online banking needs on just one simple-to-access menu. Paying off your credit cards and transferring money to different accounts has never been easier than with the new “Easy Payments and Transfers” section available on the BBVA Compass online banking system.

The app allows you to access everything from your Compass online bank desktop version in the palm of your hands. Video demos are also available for BBVA Compass bank users that are unfamiliar with the mobile banking application.

Just like the desktop version, BBVA Compass reviews have noted that security is a top-notch priority for the BBVA Compass online banking system. Touch-ID fingerprint login allows you easily and securely login to your account with just the touch of your finger.

BBVA Compass Reviews

According to the American Banker, bank customers are looking for a bank that they can trust. Customers want a bank that provides excellent customer service, helps them save money, and can assist them in accomplishing financial goals. A bank that can help them carry out a mortgage and avoid overdraft fees is the kind of bank that customers look for.

So, what do the customers who have used the BBVA Bank services have to say in their BBVA Compass reviews? Do they trust that BBVA Compass has their best interests at heart? What do they claim to value most about the BBVA Compass online banking system?

Before committing to such a huge decision as signing up with BBVA Compass, we thought we’d help potential customers feel more informed in their decision-making process. By providing customers with a complete BBVA Compass review that incorporates users’ voices from all over the Internet, we hope to leave readers with a better understanding of what BBVA Compass has to offer its customers.

Detailed below, we’ll help to create a thorough and comprehensive BBVA Compass review of the BBVA Bank and their BBVA online banking system.

Is BBVA Bank Right for You? Pros & Cons

According to BBVA Compass reviews left from users on WalletHub, many customers have found that BBVA Bank has some of the most convenient online banking.

Various BBVA Compass reviews have stated that the bilingual BBVA Compass online banking system has been a valuable and ingenious improvement. The English/Spanish bilingual system of the new mobile Compass bank online has benefitted many customers who previously had trouble with their online banking experience.

Another positive BBVA Compass review revolved around the BBVA Compass policy toward overdraft fees. One BBVA Compass review from a user on Wallethub stated that BBVA Compass went out of their way to refund an overdraft fee that the user had unintentionally garnered.

Customer BBVA Compass reviews on Banks Credio also favored the BBVA Bank for a number of reasons. BBVA Bank was said to have lower overall fees than other major competitors. Another BBVA Compass review found that BBVA Compass offers lower checking account rates than other competitor banks.

Banks Credio also found that customers were especially pleased with number of branches BBVA Bank has available to clients. When compared to other major bank competitors, users that left a BBVA Compass review stated that BBVA Compass included more branches per state.

However, with the positive BBVA Compass reviews also come the more negative BBVA Compass reviews. According to a BBVA Compass review on NerdWallet, one of the biggest drawbacks with BBVA Bank is their lack of account options.

BBVA Bank doesn’t seem to offer many viable options outside of the usual checking and savings accounts. Another complaint brought up by a BBVA Compass review centered on the low interest rates associated with the savings accounts. Clientele leaving a BBVA Compass review felt that BBVA Compass did not offer high enough interest rates in their basic savings accounts.

However, clients did note in a similar BBVA Compass review that BBVA Bank did allow customers the ability to avoid $15 quarterly maintenance fees in their basic savings accounts if the customer held a minimum daily balance of at least $500.

Related: How to Choose a Bank | Guide on Choosing the Right Bank for You

The BBVA Compass ClearSpend Card

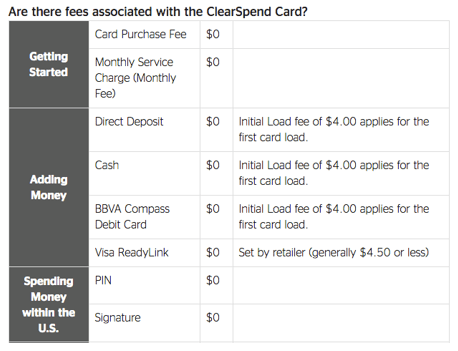

One attribute of this bank that many online BBVA Compass reviews miss out on is that there seems to be no other bank other than BBVA Compass that offers as few fees on their prepaid debit card.

The BBVA Compass ClearSpend Card is a reloadable prepaid debit card that takes the hardship out of managing your money. This prepaid BBVA Compass debit card is great for anyone looking to manage his or her money more efficiently. The minimum balance for the prepaid card is $25.

Image Source: BBVA Compass ClearSpend

Image Source: BBVA Compass ClearSpend

Many BBVA Compass reviews have also overlooked the fact that the BBVA Bank ClearSpend Card offers:

- A $0 card purchase fee

- A $0 monthly service fee

- A $0 fee on uploading money onto the BBVA Bank prepaid debit card

What really makes the BBVA Bank ClearSpend Card stand out, however, is the lack of overdraft fees. If you happen to partake in a purchase outside of your original spending limit, BBVA Bank will simply deny your transaction instead of hitting you with a ton of expensive overdraft fees.

The BBVA Bank ClearSpend Card also allows you to create financial budgets based on how much you wish to spend, helping you to stay on top of your finances and avoid overspending. All of these features are available to customers on the BBVA Bank ClearSpend app, available for both iOS and Android devices.

This greatly overlooked aspect in many BBVA Compass reviews is highly unfortunate, as the BBVA Bank prepaid debit card has been a customer favorite for years. The lack of overdraft fees and the alluring finance budgeting all work together to help BBVA Compass customers save and manage their funds.

Conclusion : BBVA Bank Reviews

BBVA Compass is a leading bank in the Sunbelt region of the United States. Residents who live in the corresponding states have found themselves heading to BBVA Bank for many of their financial situations. With dozens of BBVA Compass reviews praising BBVA Compass for their customer service, reliability, security, and BBVA online banking, BBVA Compass reviews have all contended that BBVA Bank is a reliable banking option for customers with all different kinds of financial situations.

If you’re looking for a bank that offers great customer service, money management options, a simple-to-manage prepaid debit card, and easy-to-use BBVA online banking with accompanying mobile app, then BBVA Compass may be an option you would like to consider.

Popular Article: Types of Bank Accounts | What You Should Know Before Opening an Account

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.