2017 RANKING & REVIEWS

BEST COMPOUND INTEREST ANNUAL & MONTHLY CALCULATORS

2017 Guide: Finding the Top 5 Best Annual and Monthly Compound Interest Calculators

If you are looking to open a new savings account or loan account, understanding how the bank will use its interest rate is important. An interest rate can be calculated with two methods: simple and compound.

Simple interest is calculated only on the principal amount, whereas compound interest continues to build on the principal plus interest. Compound interest can be calculated daily, weekly, monthly, or annually.

Of course, if you are using any financial product where compound interest is used, like a savings account or loan, you will need to have a basic understanding of interest compounded monthly or annually. These are two of the most common time frames banks use to compound interest.

Award Emblem: Best Annual & Monthly Compound Interest Calculators

Fortunately, you do not have to memorize the monthly compound interest formula or annual compound interest formula. The compounded monthly formula and annual formula are handy to know, but if you need a fast calculation when choosing between accounts to open, a compounded monthly interest calculator or annual calculator can help.

A monthly or annual compound interest calculator will tell you how much money you will pay on a loan or how much you will have in savings after a specific time period. The compounded annually or compounded monthly interest formula built into the calculator will use your inputted principal amount, contributions, and other factors to provide the end result.

Our list of 5 best interest compounded monthly or annually calculators have all been tested for accurate results with the compounded monthly interest formula and annual formula. They also ask for the most important information necessary to create the most accurate result.

See Also: Top Best Gas Credit Cards for Bad Credit, Poor, Fair, & No Credit | Ranking & Reviews

AdvisoryHQ’s List of the Top 5 Best Compounded Monthly Interest Calculators and Compounded Annually Calculators

Top 5 Best Annual and Monthly Compound Interest Calculators | Brief Comparison & Ranking

| Calculator Names | Annual or Monthly | Includes Compound Interest with Monthly Contributions Formula | Provides Visuals |

| Bankrate | Both | Yes | Yes |

| Calculator Soup | Both | No | No |

| Financial Calculators | Both | No | No |

| Investor.gov | Both | Yes | Yes |

| MoneySmart | Both | Yes | Yes |

Table: Top 5 Best Annual and Monthly Compound Interest Calculators | Above list is sorted alphabetically

Why Is It Important to Understand the Annual and Monthly Compound Interest Formula?

Even if you use a calculator that computes the monthly compound interest formula or annual compound interest formula, understanding how each formula works is important. This not only helps you check the accuracy of the compound interest monthly calculator or annual calculator, but it also helps you understand how interest is calculated.

Image Source: Pixabay

You can use the same annual compound interest formula to compute a compounded monthly formula. The compound interest formula is A = P (1 + r/n)nt, where:

- A is the future value of the amount, or the end result after the period of savings or the loan

- P is the principal investment or loan amount

- r is the annual interest rate as a decimal

- n is the number of times the interest is compounded per year, which is how this formula can be both a compounded monthly interest formula or annual formula

- t is the length of time, in years, that you save or borrow

The compound interest with monthly contributions formula is a bit more complex, so we suggest using a compound interest monthly calculator or compounded annually calculator to input your expected contributions.

Which One Is Better: Compounded Monthly Formula or Annual Compound Interest Formula?

Should you choose to save money in an account that uses the compounded monthly formula or annual formula? Which formula is better for a loan?

A good rule of thumb is to remember that interest compounded monthly adds more to your principal investment or loan. When you are saving money, a compounded monthly calculator will show you that this method will provide you with a higher final value than annually compounded interest.

However, when you are borrowing money, annually compounded interest can save you money. Interest will only be compounded once per year on the amount you still owe, rather than every month. If you are still unsure of what type of interest is better for you, utilize one of these compounded monthly interest calculators or annual calculators to find the differences in final value.

Don’t Miss: Best Car Lease Calculators | Guide | How to Find Best Auto Lease Payment Calculators

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review—Top-Ranking Best Compounded Monthly Interest Calculators & Annual Interest Calculators

Below, please find a detailed review of each credit card on our list of best compounded monthly calculators and annual calculators. We have highlighted some of the factors that allowed these interest compounded monthly and annually calculators to score so high in our selection ranking.

Bankrate Review

The Bankrate annual and monthly compound interest calculator is one of the most comprehensive compounded monthly interest calculators for calculating compounded interest on your savings. It is also extremely easy to use, even if you do not understand much about compound interest.

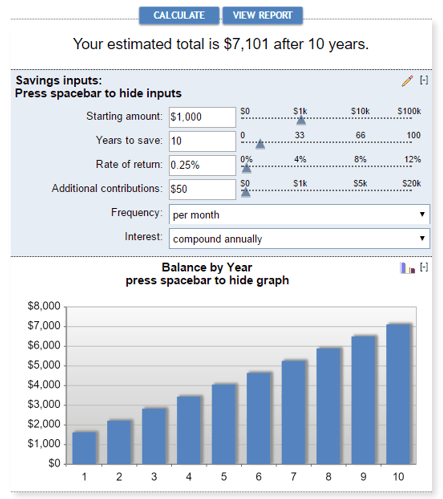

Image Source: Bankrate

This compound interest calculator can be used as both an annual compound interest calculator or compound interest monthly calculator. You can use the slider to choose your principal amount of savings or type in the exact amount. Then, input your interest amount and type.

Benefits of Bankrate Compound Interest Calculator

One of the best features of this monthly compound interest calculator is its ability to use the compound interest with monthly contributions formula, which some calculators do not utilize. This helps you get a more accurate result for your final value if you plan on making monthly contributions to your savings account.

You can also use this compounded annually calculator or monthly calculator for visuals of your savings account over the period of savings. Once you input your information and calculate results, Bankrate provides a bar graph to display your increasing value over the life of your savings.

Calculator Soup Review

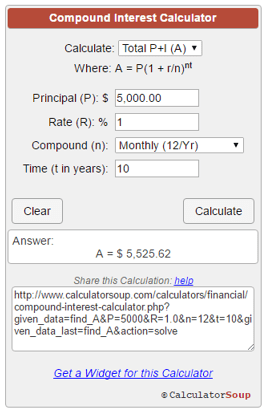

Calculator Soup offers a simple calculator you can use as a compounded annually calculator or compounded monthly interest calculator.

Image Source: Calculator Soup

As a compound interest calculator, Calculator Soup asks for a principal amount, interest rate, the frequency of compounded interest, and the period of time for savings. A simple press of the “calculate” button offers your final value results. This compound interest monthly calculator is incredibly streamlined for a quick calculation.

Benefits of Calculator Soup Compound Interest Calculator

This calculator offers something other compounded monthly interest calculators do not offer: the ability to not only calculate a final value, but also an interest rate, principal, or time period.

This is especially helpful if you want to calculate specific variables that can help you reach your savings goals faster. With the Calculator Soup annual or monthly compound interest calculator, choose which variable you need to calculate and plug in the necessary information.

For example, you can find out the principal amount you would need to reach a final savings goal of $10,000 in 5 years at a specific interest rate.

Related: Best Loan Payoff Calculators | Guide | How to Find the Best Loan Payoff Calculators

Financial Calculators Review

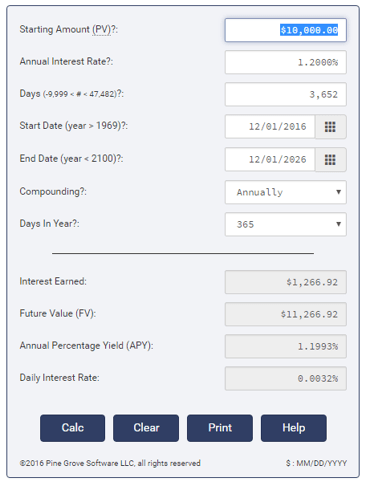

The Financial Calculators compounded interest monthly calculator or annual calculator does not offer several extras, but it has everything needed to make an accurate calculation.

Image Source: Financial Calculators

At first glance, the calculator looks confusing, but it provides valuable information in the results that you cannot find in other monthly or annual compound interest calculators.

Benefits of Financial Calculators Compound Interest Calculator

The only information you need to input into this calculator is the start and end date, frequency of compounding interest, principal amount, and interest rate. The monthly compound interest calculator does the rest for you, including displaying the number of days of the time period you input.

This calculator is helpful, especially, in its results display. Below your inputted information in the compounded monthly calculator, you will see the specific amount of interest you will earn during the savings period, in addition to the final value.

The compound interest monthly calculator also shows you what the Annual Percentage Yield (APY) equates to, as well as what the daily interest works out to. This information can help you determine small differences in savings accounts and interest rates.

Popular Article: Best FD Interest Calculators |Guide | How to Find and Use the Top Fixed Deposit Calculators

Investor.gov Review

The compounded monthly interest calculator and annual interest calculator from Investor.gov has everything you need to calculate your savings and more. This calculator can be used for both monthly and annual compounded interest and includes the compound interest with monthly contributions formula so you can have a more accurate final value.

Image Source: Investor.gov

Benefits of Investor.gov Compound Interest Calculator

Investor.gov’s monthly compound interest calculator also includes a savings goal calculator. Using this will help you determine how high your interest rate, principal, and contributions should be so you can reach your goals.

This compound interest monthly calculator also provides a line graph after displaying your results, so you can see how much your savings will appreciate with the given information. The graph will also display the differences in interest rates, if you chose to use that part of the compounded monthly interest calculator.

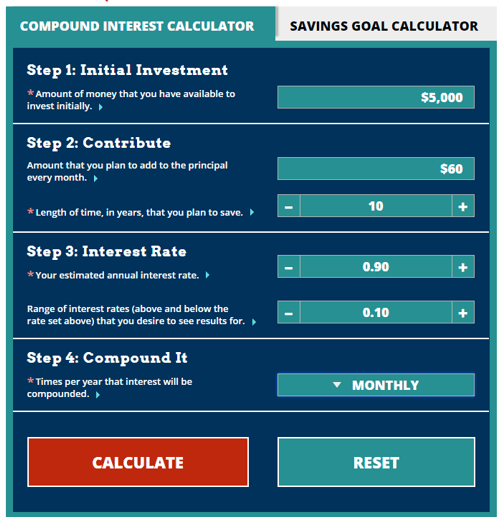

MoneySmart Review

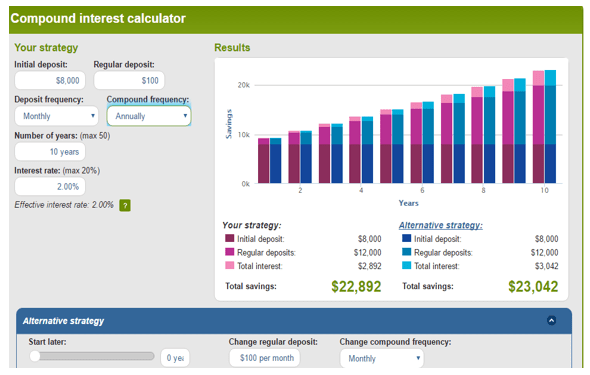

MoneySmart provides an annual or monthly compound interest calculator that provides a more in-depth look at interest compounded monthly and annually. This compounded monthly interest calculator or annual interest calculator allows you to input your principal savings amount, deposit amounts and frequency, savings term, and interest rate.

Image Source: MoneySmart

Benefits of MoneySmart Compound Interest Calculator

Where this compound interest monthly calculator sets itself apart from others is with its comparison graph. Once you plug in your information, MoneySmart presents you with a bar graph showing the results of your savings plan. It will also show you the comparison between your plan and an alternative plan.

The savings plan in the example above uses the annual compound interest formula results compared to the alternative plan using the compounded monthly interest formula. As the compound interest monthly calculator shows, the monthly compound interest formula produces more savings in this example.

Conclusion—Top 5 Best Compound Interest Monthly Calculators and Annual Calculators

If you are deciding between different savings options that utilize annual or monthly compound interest, an annual or monthly compound interest calculator can help you make a sound decision to meet your savings goals.

The best compounded monthly interest calculators include a variety of inputted information that allows you to obtain the most accurate results. Most compound interest monthly calculators use the principal, contributions, savings term, and interest rate to provide an accurate final value.

The 5 best compounded monthly interest calculators in this ranking are highly accurate calculators that can help you determine your best route to savings. In addition to including the most important information, they all have added benefits, like comparisons or graphs, to help you make an informed decision.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.