2017 RANKING & REVIEWS

TOP RANKING BEST BANK OF AMERICA CREDIT CARDS

The Right Bank of America Credit Card

Are you in the market for a new plastic addition to your wallet? Adding a Bank of America credit card could be a step in the right direction. You get the backing of a large and well-known financial institution, as well as all the rewards they have to offer you.

Because of their large and varied consumer base, Bank of America credit cards come in a number of types and varieties. Whether you prefer travel rewards points, a cash back program, or simply a Bank of America student credit card, there are options for everything from personal credit cards to business credit cards.

Award Emblem: Top 6 Best Bank of America Credit Cards

Evaluate what matters most to you in your next financial decision. Bank of America credit cards can offer anything you desire from no annual fees to low interest rates and lengthy introductory 0% APR offers.

Where are you with your personal finances, and what will benefit you most at this exact moment (or in the months to come)?

In order to help you make sense of all the Bank of America credit cards available to you, AdvisoryHQ compiled this detailed Bank of America credit card review. To see which ones made our list of the best Bank of America credit card choices, keep reading through the sections below!

See Also: Top Best Credit Cards for Miles | Ranking | Best Miles Credit Card Reviews

AdvisoryHQ’s List of the Top 6 Best Bank of America Credit Cards

List is sorted alphabetically (click any of the credit card names below to go directly to the detailed review section for that credit card):

- BankAmericard Better Balance Rewards®

- BankAmericard Cash Rewards™ Credit Card for Students

- BankAmericard® Credit Card

- BankAmericard Travel Rewards® Credit Card

- Platinum Visa® Business Credit Card

- Travel Rewards World MasterCard® for Business Credit Card

Top 6 Best Bank of America Credit Cards | Brief Comparison & Ranking

Credit Card Names | Annual Fee | APR | Type of Card |

BankAmericard Better Balance Rewards® | $0 | 12.24%-22.24% | Personal |

BankAmericard Cash Rewards™ Credit Card for Students | $0 | 13.24%-23.24% | Student |

BankAmericard® Credit Card | $0 | 11.24%-21.24% | Personal |

BankAmericard Travel Rewards® Credit Card | $0 | 15.24%-23.24% | Personal |

Platinum Visa® Business Credit Card | $0 | 9.49%-20.49% | Business |

Travel Rewards World MasterCard® for Business Credit Card | $0 | 11.49%-21.49% | Business |

Table: Top 6 Best Bank of America Credit Cards | Above list is sorted alphabetically

What Types of Bank of America Cards Are Available?

Deciding which type of best Bank of America credit card you want to apply for is one of the largest and most important considerations you’ll need to make. How can you decide which of the choices is right for you without knowing all of the Bank of America credit card options available to you?

Image source: Pixabay

To help you weigh which type of Bank of America credit cards would suit your needs the best, we’re going to include a brief summary of the types of credit cards you’ll encounter in our Bank of America credit card review:

- Standard credit cards – Standard credit cards have few bells and whistles that accompany them, and that includes rewards programs. These are usually ideal for consumers who want to focus on building credit or who do not need high credit limits.

- Premium credit cards – This type of best Bank of America credit card is also sometimes referred to as a “platinum credit card.” It typically features higher credit limits than standard cards and more benefits. This is a type of intermediate step between standard Bank of America cards and rewards cards.

- Rewards credit cards – A rewards credit card can come with either cash back rewards or with airline miles that can be redeemed for travel accommodations. Consider how often you would use either of these features and how much you generally spend on your credit card to determine if these features could be a good fit for you.

Bank of America secured card options do exist as well, which require a deposit that is typically equal to your credit limit. The deposit serves as collateral in case you do not make prompt payments on the card itself. These are generally reserved for individuals who have no credit or need to do some serious repair work on their credit scores.

In our ranking of the best Bank of America credit card choices, no Bank of America secured credit card choices made the list. However, they do exist if you feel that you may need that stepping stone before applying for other Bank of America credit cards in the future.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best Bank of America Credit Cards

Below, please find the detailed review of each credit card on our list of best Bank of America credit card options. We have highlighted some of the factors that allowed these Bank of America cards to score so highly in our selection ranking.

Don’t Miss: Top Best Travel Credit Card Offers | Ranking | Best Credit Cards For Travel (Reviews)

BankAmericard Better Balance Rewards® Review

This BankAmericard Better Balance Rewards® card is not to be missed in any thorough Bank of America credit card review. It has low rates and a one-of-a-kind specialty to help you pay down your debt faster.

Source: BankAmericard Better Balance Rewards®

Program Details

Uniquely designed to assist you in paying down your debt, the BankAmericard Better Balance Rewards® card is one of the best Bank of America credit card choices. These Bank of America cards give you cash incentives when you take the initiative to pay down the balance on your card.

Each quarter, you can earn $25 when you pay more than the minimum monthly payment. Over the course of the year, you could total up $100 in cash rewards simply for working on paying off your Bank of America cards. You’ll get an extra $5 per quarter when you have a separate checking or savings account through Bank of America as well.

Rates and Fees

In an effort to assist you with paying down your balance, you may want to consider rolling your balance over from a high interest credit card to this best Bank of America card. While you will still have a 3% balance transfer fee (or a minimum of $10), you’ll receive a great introductory rate. Any balance transfers made within 60 days of opening your account are eligible for a 0% APR introductory rate for the first year.

After the introductory period, balance transfers will be subject to the same interest rates as new purchases. These rates range from 12.24% to 22.24% depending on your current level of credit.

There is no annual fee to concern yourself with on these BankAmericard Better Balance Rewards® cards, either. Overall, this is certainly one of the best Bank of America credit card options for those hoping to take a more responsible approach to getting out of debt.

BankAmericard Cash Rewards™ Credit Card for Students Review

Students will love being able to skip over a Bank of America secured card in favor of this BankAmericard Cash Rewards™ Credit Card for Students. They’ll love the cash back rewards and low rates, combined with great introductory offers.

Program Details

When you’re a student who needs to build up their credit or repair their existing credit, you might think that you need a Bank of America secured credit card. Instead, you’ll find that they have programs specifically oriented toward helping you improve your credit while you study.

The BankAmericard Cash Rewards™ Credit Card for Students not only helps you become more fiscally responsible by managing your due dates and utilizing text alerts, but it also allows you to earn cash back. With every purchase that you make, you will earn a certain percentage back (depending on the spending category):

- 1% cash back on every purchase

- 2% cash back at grocery stores and wholesale clubs

- 3% cash back on gas

The higher level rewards categories are subject to a $2,500 spending limit for the two categories combined. You can use this best Bank of America card to your advantage by gaining an additional 10% bonus for redeeming cash into a BoA savings account or checking account.

This Bank of America student credit card also comes with a $100 bonus for making at least $500 worth of purchases in the first 90 days.

Rates and Fees

The BankAmericard Cash Rewards™ Credit Card for Students comes with an appealing introductory offer. You can transfer the balance from another card or make new purchases within 60 days of your account opening and maintain 0% APR for the first twelve months. Bear in mind that balance transfers on this Bank of America student credit card will cost you 3% of the transferred amount or a $10 minimum.

After the introductory rates, you’ll find the rates to be relatively reasonable, especially when you consider that this student option is not a Bank of America secured card. Rates will range from 13.24% to 23.24%APR with no annual fee.

Related: Top Best Credit Cards for Students with No Credit or Bad, Poor or No Credit History

BankAmericard® Credit Card Review

Unlike many of the Bank of America cash rewards card choices, this BankAmericard® Credit Card offers simple programs and features to allow you to focus on financial responsibility. You can really cut costs with the lowest rates on any of the Bank of America cards.

Source: BankAmericard® Credit Card

Account Features

Among Bank of America credit cards, it would certainly seem that the BankAmericard® Credit Card is one of their most basic offerings. However, that doesn’t exclude it from making our ranking of the best Bank of America credit card options.

You can benefit from all of the standard features associated with BoA credit cards, including their online, mobile, and text banking programs. It qualifies you for overdraft protection when you link the BankAmericard® Credit Card to an eligible checking account.

You even have all of the security features you would anticipate with all Bank of America cards. The BankAmericard® Credit Card has a $0 liability guarantee, online shopping security, and digital wallet technology. But if all of these features are standard on Bank of America cards, what makes the BankAmericard® Credit Card stand out?

Rates and Fees

Simply put, the BankAmericard® Credit Card shines with some of the lowest fees available and the longest introductory offers. For the first 18 months from your account opening, you will have a 0% APR introductory offer, which is also valid for balance transfers made in the first 60 days. Like most Bank of America credit cards, these are subject to a 3% balance transfer fee ($10 minimum).

Afterward, you’ll enjoy some of the all-around lowest interest rates ranging from 11.24% to 21.24% APR depending on your creditworthiness. They boast that this is the lowest APR among all of the BankAmericard® Bank of America credit cards they offer.

It gets even better when you take into account the $0 annual fee, making this card simple to use, convenient, and cost-effective. Where it lacks as a Bank of America rewards card, it shines with basic features and low rates.

BankAmericard Travel Rewards® Credit Card Review

For those consumers who are looking for a top rewards card that isn’t a Bank of America secured credit card, this BankAmericard Travel Rewards® Credit Card might be just the thing. With no annual fee and an award-winning travel rewards program, you’ll love this if you’re a frequent flier.

Rewards Program

Out of all the Bank of America rewards card choices, this BankAmericard Travel Rewards® Credit Card is one of the top picks for frequent fliers. What makes it worth noting in a Bank of America credit card review?

For starters, this best Bank of America credit card has already been named the Best Travel Rewards Credit Card in Kiplinger’s 2015 ratings as well. You earn unlimited points at a rate of 1.5 points per dollar spent across all spending categories. Your points have no expiration date, allowing you to redeem them whenever you want for flights, hotels, vacations, cruises, car rentals, and more without blackout dates or restrictions.

You can make even more of your Bank of America rewards card with Preferred Rewards. Bank of America cards that have Preferred Rewards allow you to increase your usual 10% bonus (claimed by depositing cash back into a BoA checking or savings account) to a 25% to 75% bonus when you’re a Bank of America Preferred Rewards client.

This best Bank of America credit card also allows you to take advantage of a 20,000 online bonus point offer when you make $1,000 in purchases over the first 90 days of opening your account.

Rates and Fees

Unlike many of the BoA credit cards we included on our ranking, this Bank of America rewards card includes an introductory offer that applies to new purchases. You will receive a 0% APR introductory rate for the first year on new purchases. Balance transfers and purchases after the first twelve months are subject to fees ranging from 15.24% to 23.24% APR.

The BankAmericard Travel Rewards® Credit Card also has no annual fee, which means that you’ll have very few excuses for not adding this offer to your wallet.

Popular Article: Top Best Credit Cards (Comparison & Ranking) | Compare Credit Card Rewards, Travel Points, Rates & Benefits

Platinum Visa® Business Credit Card Review

Businesses in need of BoA credit cards with low interest rates, no annual fee, and prime travel benefits will love the Platinum Visa® Business Credit Card. It may not be a Bank of America cash rewards card, but it still has plenty to offer.

Program Details

Consumers looking for a Bank of America business credit card will enjoy the basic features offered by the Platinum Visa® Business Credit Card as well as these introductory incentives. New accounts are eligible for a $200 statement credit when you spend at least $500 within the first 60 days of your account opening.

You receive access to the MyReport center to manage the Bank of America credit cards that you give to your employees. These employee Bank of America cards are unlimited in number and come at no additional cost to you. Even more convenient, you can also schedule electronic payments with automatic bill payment.

For consumers searching for a Bank of America business credit card that offers protection for their travels, the Platinum Visa® Business Credit Card also gives $100,000 in travel accident insurance, auto rental insurance, emergency ticket replacement, lost luggage assistance, and extended protection.

Rates and Fees

Not many Bank of America business credit card choices will feature a lengthy introductory APR. In comparison to the personal and Bank of America cash rewards card choices included in our ranking, this one is relatively short. Your company will have a 0% APR introductory rate for just the first seven months.

After this initial period ends, you’ll face rates ranging from 9.49% to 20.49% APR on all purchases and balance transfers. Cash advances are subject to a much higher interest rate at 24.49% APR.

This Platinum Visa® Business Credit Card is one of the best Bank of America credit card choices due to having no annual fee as well. You gain all of the benefits of their business card without the cost.

Free Wealth & Finance Software - Get Yours Now ►

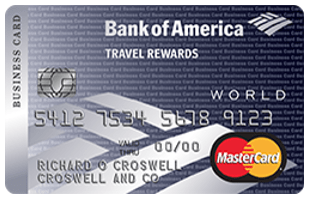

Travel Rewards World MasterCard® for Business Credit Card Review

Help your company travel for less with the Travel Rewards World MasterCard®, one of the best Bank of America credit card choices for those in need of low rates and business rewards programs.

Source: Travel Rewards World MasterCard®

Rewards Program

If your company travels frequently, you’ll enjoy this Bank of America cash rewards card for its generous airline miles. On a regular basis, you receive 1.5 points for each dollar that you spend on your purchases with the Travel Rewards World MasterCard®. Points aren’t capped at a certain amount each quarter, so you can earn unlimited points that never expire.

Make the most of what you earn by booking your travel accommodations through the Bank of America Travel Center. When you use your Bank of America credit card to book anything through this site (car, hotel, or airline), you receive three points for each dollar spent.

You also receive a large 25,000 bonus points offer when you can spend $1,000 in the first 60 days of your open account. This bonus is equivalent to a $250 statement credit made available for your next travel purchases.

Rates and Fees

The rates on these Bank of America cards are low, ranging from 11.49% APR to 21.49% APR on purchases and balance transfers made after your introductory period. However, you’ll also receive a 0% APR introductory offer for the first nine months, available on new purchases only.

While this is still short in terms of introductory offers on Bank of America credit cards, it is a longer term than other Bank of America cards for businesses.

You’ll have a hefty cash advance fee on this Bank of America credit card as well, coming in at 24.49% APR.

The good news is that the Travel Rewards World MasterCard® is not subject to an annual fee, either. This allows you to accumulate points without having to worry about offsetting the cost on this best Bank of America credit card.

Conclusion — Top 6 Best Bank of America Credit Cards

Finding the best Bank of America credit card among all of their offerings can be like finding a needle in a haystack. How do you really know which of the Bank of America credit cards is the right choice for your financial situation? Fortunately, you should be able to make some kind of a decision just by process of elimination.

Consumers searching for a card for their personal use can quickly exclude the Bank of America business credit card choices from their search. Likewise, those consumers who aren’t students can nix the BankAmericard Cash Rewards™ Credit Card for Students. After that, it will be up to you which features you desire in Bank of America credit cards.

And remember: even if your credit isn’t perfectly polished, there are plenty of choices among the best Bank of America cards without needing a Bank of America secured credit card. You can practice financial responsibility without the upfront deposit required by a Bank of America secured card.

Take inventory of what your preferences are when it comes to spending, rewards programs, interest rates, annual fees, and more. We’re confident that you’ll find one of the best Bank of America credit card choices that will work perfectly for you.

Read More: Top Best Credit Card Balance Transfer Offers & Deals | Ranking | Interest-Free Credit Card Transfers

AdvisoryHQ (AHQ) Disclaimer: Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info. Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.