2017 RANKING & REVIEWS

TOP RANKING BEST CREDIT CARDS

(COMPARISON & REVIEW)

Find the Right Personal Credit Card with a Credit Card Comparison

Hunting for the best credit card comparison can be a time-consuming task, but it’s too important to leave to chance. How do you know which of the personal credit cards available through today’s lenders are going to offer you the exact programs and fees that you need and want? How you begin to compare credit card rewards?

You have infinite options for programs, benefits, and rewards, whether you want travel benefits, cash back rewards, or simply the lowest rates when you do a credit card interest rates comparison.

Award Emblem: Top 6 Best Credit Cards (Comparison & 2017 Ranking)

Putting the right plastic in your wallet is critical to saving you money and allowing you the benefit of choosing what suits you. Not sure exactly which options give you what you’re looking for? Chances are, it’s time for you to compare credit cards and compare credit card rewards to evaluate which one is the perfect fit for your personality and spending habits.

AdvisoryHQ has responded to consumer interest in which personal credit card tops the list: we created this top credit card comparison to help you to make the wisest decision possible.

Ready to find out which card wins in our credit card comparison? Take a look at all of the choices and detailed reviews in the sections below!

AdvisoryHQ’s List of the Top 6 Best Credit Cards (Comparison & Review)

List is sorted alphabetically (click any of the credit card names below to go directly to the detailed review section for that credit card):

- BB&T Bright® Card

- Citi Diamond Preferred® Card

- PNC Core℠ Visa®

- PNC Points® Visa® Credit Card

- Regions Premium Visa® Signature

- SunTrust Cash Rewards Credit Card

Top 6 Best Credit Cards (Comparison & Review)| Brief Comparison & Ranking

Credit Card Names | Annual Fee | APR | 0% Intro APR Duration |

BB&T Bright® Card | None | 8.40% – 17.40% | 15 months |

Citi Diamond Preferred® Card | None | 12.24% – 22.24% | 21 months |

PNC Core℠ Visa® | None | 10.24% – 20.24% | 15 months |

PNC Points® Visa® Credit Card | None | 12.24% – 22.24% | 12 months |

Regions Premium Visa® Signature | $125 | 12.24% | 12 months |

SunTrust Cash Rewards Credit Card | None | 10.49% | 15 months |

Table: Top 6 Best Credit Cards (Comparison & Review)| Above list is sorted alphabetically

What’s Important When You Compare Credit Cards?

What features should you really be honing in on when you are taking a look at an in-depth credit card comparison? Just understanding all of the jargon and associated fees, rates, and being able to compare credit card rewards with each individual card can be stressful.

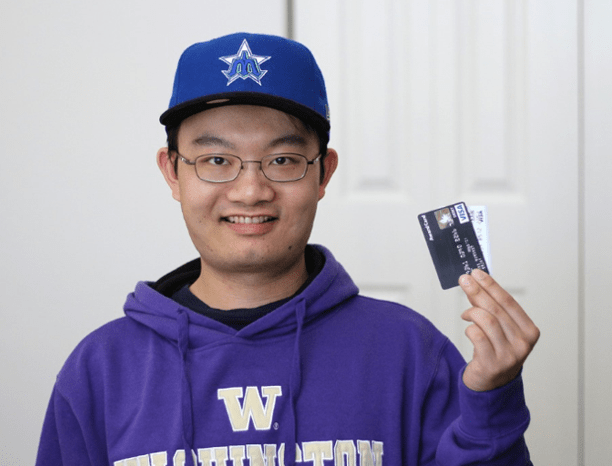

Image Source: Best Credit Cards

In order to assist you and keep you from getting bogged down in the details, here are the key points you should be look at when you compare rewards credit cards:

- Rewards Programs: Each cardholder is privy to certain perks depending on the specific card program. When you compare credit card rewards, it is imperative to note which ones offer cash back rewards and which ones simply have great benefits such as car rental insurance or lost baggage insurance. Do you want a card that earns points or cash back? Then you may need to compare travel credit cards or compare rewards credit cards.

- Interest rates: You need to compare credit card rates on each and every personal credit card you consider, even if it isn’t included on our credit card comparison. Does it feature low interest rates in a credit card interest rates comparison? Even more, you need to keep an eye on introductory offers that boast no interest for a specific period of time. You should know exactly what to expect from your interest rates after that time period ends.

- Annual fees: When you compare credit cards, the annual fee associated with being a cardholder is a critical consideration. While many of the top personal credit cards do not come with annual fees, some may have a higher annual fee to balance out a stellar rewards program. How much are you prepared to pay on a yearly basis to maintain your personal credit card? Does the card warrant such a high annual fee when you compare credit card rewards?

While these are just the basic points to examine in a credit card comparison before making a long commitment to a specific card, you should do as much research as possible. Be sure to read all of the fine print before you sign to ensure that you can afford the payments, penalties, and usual rates and fees.

You may also consider taking a closer look at the qualifications for a specific card. In a credit card comparison, you will find that some companies and lenders prefer to only issue cards to those with good to excellent credit, while others are more lenient for poor to average credit. Know where you stand and what you can qualify for you before you begin the application process.

See Also: Top Credit Cards for College Students| Ranking | Best College Student Credit Cards

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best Credit Cards (Comparison & Review)

Below, please find the detailed review of each credit card on our list of credit cards comparison. We have highlighted some of the factors that allowed these credit cards to score so highly in our selection ranking.

BB&T Bright® Card Review

It would be hard not to include the BB&T Bright® Card in a credit card comparison, even as a relatively basic option. They feature some of the lowest rates when you compare credit card interest rates and advantageous rewards.

Source: Bright® Card – BB&T

Rewards

When it comes to a credit card rewards comparison, the BB&T Bright® Card doesn’t particularly shine here. You do get a few perks for maintaining an account here, especially in basic credit card comparison.

You have no liability for unauthorized purchases, as well as purchase security and a warranty manage service. While you may not be able to rank this card in a travel credit card comparison or to compare credit card rewards, you do have the added benefit of travel and emergency assistance services as well as travel accident insurance.

Rates and Fees

In a close credit card comparison, the BB&T Bright® Card easily maintains a spot at the top of the pack with its low interest rates. When you compare credit cards, low interest rates often come in at the very top of the list of desirable features in a personal credit card. Here, you’ll find low introductory APR on both purchases and balance transfers, as well as a reasonable rate thereafter.

- 0% introductory APR for fifteen months (for purchases and balance transfers)

- 8.40% to 17.40% APR depending on your application, credit history, and banking relationship after the introductory period

- 22.40% APR for cash advances

Even better, the BB&T Bright® Card doesn’t make up for these low interest rates in annual fees. When you compare credit card interest rates, you will sometimes find incredibly low rates but a high annual fee. In comparison, the BB&T Bright® Card has no annual fee.

Don’t Miss: Top Frequent Flyer Credit Card Offers | Ranking | Best Credit Cards for Travel Rewards

Citi Diamond Preferred® Card Review

If you enjoy exclusivity combined with low interest rates, you’ll love the Citi Diamond Preferred® Card when you look at a credit card rewards comparison. Their Citi Private Pass is a unique program that will make you want to pack your bag and head to these special events.

Source: Citi Diamond Preferred® Card

Rewards

When you compare credit card rewards, it’s important to determine exactly what is the most important to you. The Citi Diamond Preferred® Card doesn’t necessarily have a cashback rewards program like those that would be included in a credit card rewards comparison, but it does have some unique offerings exclusive to their cardholders.

For example, if you enjoy having special access to events (including concerts, sporting events, dining experiences, and movie screenings), their Citi Private Pass is one reward you won’t want to miss. With the Citi Diamond Preferred® Card, you gain access to tickets that aren’t available elsewhere, including presale ticks and VIP packages.

In addition, you also need to consider their other credit card benefits comparison, some of which can easily come close when you look at a top travel credit card comparison:

- Identity theft solutions

- Worldwide car rental insurance

- Worldwide travel accident insurance

- Travel and emergency assistance

- Trip cancellation and interruption protection

- Extended warranty

Rates and Fees

Among the options listed in our credit cards comparison, the Citi Diamond Preferred® Card offers the longest 0% introductory APR on purchases and balance transfers. At 21 months, you have plenty of time to pay off new purchases and manage your existing balances on other high-rate credit cards before their usual APR kicks in.

Expect your interest rates to range from 12.24% to 22.24% APR depending on your creditworthiness, with 25.49% APR for cash advances. In a credit card interest rates comparison, these are relatively low and extremely competitive rates, especially when combined with no annual fee.

Related: Top Credit Cards for Low Credit Scores | Reviews | Best, Fastest Ways to Build Credit

PNC Core℠ Visa® Review

The PNC Core℠ Visa® is accompanied by extremely low rates and tempting introductory offers, including a cash back bonus and low introductory APRs, causing it to rank highly on a credit card rewards comparison.

Rewards

The PNC Core℠ Visa® comes with a handful of features that make it appealing in a credit card rewards comparison, including U.S.-based customer service, online account management tools, travel and emergency protection, no fraud liability, and electronic bill payment. However, the most appealing reward is their initial bonus offer.

In a credit card rewards comparison, the PNC Core℠ Visa® comes in near the top with an easily achievable bonus that results in quick cash back. If you intend to shop often with your new personal credit card, you’re in for a great deal: you receive a $100 cash bonus after your first $1,000 in purchases within the first three months.

This bonus applies to all accounts opened prior to the end of 2016 and must be completed within 90 days of opening the account.

Rates and Fees

The PNC Core℠ Visa® doesn’t come with ongoing rewards (as the PNC Points® Visa® Credit Card does), but that doesn’t mean that you can’t compare credit card rewards in other ways. Many of the benefits of this credit card when you look at a credit card comparison lie in the rates and fees, with PNC Core boasting that it has their lowest introductory rates and best ongoing APRs.

- 0% introductory APR for the first 15 months (purchases and balance transfers)

- 10.24% to 20.24% APR based on credit worthiness

- 22.24% APR on cash advances

- No annual fee

When you look at a credit card interest rates comparison, the PNC Core℠ Visa® clearly comes in near the top of the list for lowest rates, even if it doesn’t rank so highly in a credit card benefits comparison.

PNC Points® Visa® Credit Card Review

When you compare credit cards, the PNC Points® Visa® Credit Card and the PNC Core℠ Visa® Credit Card are often top choices. You’ll enjoy more benefits when you take a closer look at the credit card rewards comparison between the two.

Rewards

It’s important to note that there is a special introductory offer on rewards points that also applies to the PNC Points® Visa® Credit Card versus when you compare credit card rewards on the PNC Core. After your first $750 worth of purchases, you receive 50,000 bonus points (must be completed within the first three months of account opening for all accounts opened by December 31, 2016).

For ongoing purchases, you have to compare rewards credit cards based on the rate at which you earn additional points and how you can redeem them. The PNC Points® Visa® Credit Card grants you four points for each dollar you spend with no maximum on the number of points you can earn. They are easily redeemed for cash, merchandise, gift cards, and even travel accommodations, making this a card to note when you compare travel credit cards as well.

Even better, a good credit card rewards comparison should also note the ability to earn bonuses when you have a qualifying checking account under certain conditions. You can get bonuses up to 75% on your base points with PNC Virtual Wallet with Performance Select or a PNC Performance Select Checking Account.

Rates and Fees

We’ve already seen how the PNC Core℠ Visa® stacks up in our credit cards comparison, but will PNC Points® Visa® Credit Card come close? Their introductory offer is almost equivalent, but the duration of the offer is slightly shorter (12 months instead of 15 months).

Not only that, but you will face slightly higher interest rates, likely an attempt to balance out the rewards program. The PNC Points® Visa® will come in two points higher on both the minimum and maximum when you compare credit card interest rates, ranging from 12.24% to 22.24% APR. The cash advance APR comes in at 22.24% as well.

They also have no annual fee, making the credit card comparison equal in that respect.

Popular Article: Top Interest-Free Credit Cards | Ranking | Best Zero Interest Credit Cards (Reviews)

Regions Premium Visa® Signature Review

The Regions Premium Visa® Signature card is a top choice in a credit card comparison for its great rewards program, the credit card benefits comparison, and low interest rates.

Source: Regions Premium Visa® Card

Rewards

What makes the Regions Premium Visa® Signature shine when it comes to a reward credit card comparison? First, you are able to earn points that total 1.5 points for every dollar spent on qualifying purchases toward their Relationship Rewards program. You can redeem those points for cash equal to the 1.5% of the purchases, as well as gift cards, travel, and merchandise. The ability to earn points quickly also comes into play when looking at a travel credit card comparison.

For the first 90 days of holding your account, you can also earn double points (3 points for each qualifying dollar spent) to double the amount of cash back or rewards you are eligible for. This is a pretty good deal when you compare credit card rewards.

Other important advantages to note include:

- Lost luggage reimbursement

- Purchase security

- Visa Signature Concierge

- Price protection

- Trip cancellation or interruption insurance

- Roadside dispatch

Rates and Fees

What should you expect from the rates and fees on the Regions Premium Visa® Signature Credit Card? When you look at credit cards comparison, the Regions Premium Visa® Signature comes in close to the PNC Points® Visa® with its introductory 0% APR term of just 12 months. While this is certainly a long time, it is one of the shorter offers available when you compare credit card rewards.

After this point, you can expect to face interest rates that are very competitive when you compare credit card interest rates. They will come in at just 12.24% APR across the board, if you qualify for this program. Without the variable interest rates that depend on your creditworthiness, this low APR makes it one of the top choices in a reward credit card comparison.

Unfortunately, you will face a high annual fee when you compare credit cards. This comes with a $125 annual fee, steep in comparison to all of the choices that feature no annual fee but the potential for slightly higher interest rates.

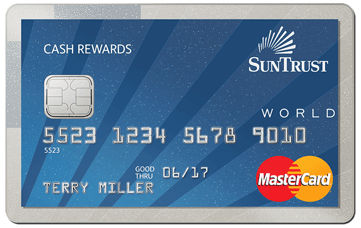

SunTrust Cash Rewards Credit Card Review

Earn significant bonuses and cash back with the rewards program on the SunTrust Cash Rewards Credit Card. You’ll also want to compare credit card rates to see their very competitive rates and fees.

Source: SunTrust Cash Rewards

Rewards

The cash back program through the SunTrust Cash Rewards Credit Card is a critical feature to note when you look at a reward credit card comparison. You’ll find introductory offers as well as great ongoing ways to save through their program:

- 5% cash back on the first $6,000 worth of gas and grocery purchases in the first year

- 2% cash back on gas and grocery purchases after the introductory offer

- 1% unlimited cash back on all other purchases

Especially with the high initial cash back rates, it is easy to see how the savings can stack up in a credit card rewards comparison. Not only does it offer this program, but it also has a few other advantageous offers you may want to make use of.

Like many of the rewards cards in our credit cards comparison, you can get bonuses when the cash back is deposited into a SunTrust checking, savings, or money market account or redeem them for gift cards, travel, and more.

Rates and Fees

When you compare credit card rates, the SunTrust Cash Rewards Credit Card does have some of the lowest fees and longest introductory periods on our credit card comparison. You’ll find the introductory APR of 0% will last for a little over a year at 15 months. After that, your interest rates will resume between 10.49% and 21.49% APR depending on your creditworthiness.

Cash advances come with a 25.24% APR.

You’ll also find that the SunTrust Cash Rewards Credit Card also has no annual fee, a significant consideration in a credit card benefits comparison.

Conclusion — Top 6 Best Credit Cards (Comparison & Review)

Which features should you be paying close attention to in a credit card comparison? Well, the answer really will be different for each individual consumer and their unique needs and desires. We’ve assembled this objective overview of the best personal credit cards to give you a starting point for identifying which ones capture your attention in a brief credit card rewards comparison or when you compare travel credit cards.

Of course, selecting the proper personal credit card is about more than simply the credit card benefits comparison. You have to weigh whether the rates and fees are worth it when you begin to compare credit card rates as well. Does the cost of the card outweigh the credit card rewards comparison? If so, then that might not be the right fit for your wallet.

Take an honest evaluation of which cards on our credit card comparison appear to offer the features and rates that you’re looking for. Your answer may be different than you anticipated, but we feel confident that you can’t go wrong with any of these choices.

Read More: Top First Credit Card for Young Adults, Teenagers, First-Timers & Beginners | Ranking and Comparison

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.