2017 RANKING & REVIEWS

TOP RANKING BEST CREDIT CARDS FOR LOW CREDIT

What Is the Best Way to Build Credit? Top 6 Credit Cards to Build Credit Fast

If you’ve ever had to deal with building credit either due to a low credit score or from having no credit at all, you may not realize that having the right credit card can help a lot.

You can apply for a credit card with no credit or a low credit score, and it can be one of the best ways to build credit so you can buy a car, get a home mortgage loan, or just have the money to meet your family’s needs in an emergency.

When you have a decent credit score from building credit, it can make a big difference in your life and save you from having to make huge purchases out of your cash reserves. If you build credit fast, it can give you the ability to buy needed furniture on credit, qualify for a health care credit card, or get approved for a loan to buy your dream home. Without good credit, your options are much more limited.

Award Emblem: Top 6 Credit Cards for Low Credit Scores

There are several ways to build credit over time; some take longer than others, but the fastest way to build credit is through the right credit card. There are specific credit cards for low credit scores that can help you build credit fast — some of them in a little less than a year — and positively impact your credit score.

In this article, we will take a look at six of the best credit cards for low credit, how to apply for a credit card with no credit, and a comparison of the good credit cards for no credit and how fast they can help you in building credit and getting to a FICO score that will allow you to be considered credit worthy for many types of loans or other forms of credit.

See Also: Top Navy Federal Credit Cards | Ranking | Best NFCU Secured, Rewards, Cash Back Credit Cards

AdvisoryHQ’s List of the Top 6 Best Credit Cards for Low Credit Scores

List is sorted alphabetically (click any of the credit card names below to go directly to the detailed review section for that credit card):

- Citi® Secured MasterCard®

- Discover it® Secured Credit Card

- nRewards® Secured Credit Card

- Capital One® QuicksilverOne®

- Capital One® Secured MasterCard®

- Wells Fargo Secured Credit Card

Top 6 Best Credit Cards for Low Credit | Brief Comparison & Ranking

Credit Card Names | Minimum Security Deposit Needed | Annual Fee | APR Intro Rate | APR After Intro |

| Citi® Secured MasterCard® | $200 | None | None Offered | 22.24% |

| Discover it® Secured Credit Card | $200 | None | None Offered | 23.24% |

| nRewards® Secured Credit Card | $500 | None | None Offered | 9.24% |

| Capital One® QuicksilverOne® | None | $39 | 0% | 23.24% |

| Capital One® Secured MasterCard® | $49 | None | None Offered | 24.99% |

| Wells Fargo Secured Credit Card | $300 | $25 | None Offered | 19.24% |

Table: Top 6 Best Credit Cards for Low Credit | Above list is sorted alphabetically

How Fast Can You Build Credit with Credit Cards for Low Credit?

When you apply for a credit card with no credit or poor credit, it does take time to start building credit to a FICO credit score that is considered “good” or better so you can more easily secure a loan. When using a credit card as the best way to build credit, the time it takes to positively affect your credit score will vary, but some people can begin to see a difference in as little as 6 months.

Image Source: Best, Fastest Ways to Build Credit

Of course, it is important to use the credit cards for low credit scores wisely once you secure one, to ensure it sends your credit score in the right direction. Here are a few tips that will help you build credit fast with one of the credit cards for low credit:

- Charge a little each month

- Pay off the balance each month

- Don’t overextend yourself with too many cards

- Keep other bills paid on time

- Don’t carry a large or maximum balance on the cards

Fastest Way to Build Credit | Secured Versus Unsecured Cards

There are a few key differences between what is considered a “secured” credit card and an “unsecured” credit card, which is really just the typical type of credit card issued. Many of the good credit cards for no credit are secured cards, meaning they need a desposit or collateral given up front.

When using a secured credit card to build credit fast, you must make a deposit as collateral; this allows you the ability to secure credit cards for low credit scores, but also gives the credit card company security if the payment is defaulted. Generally, if you make regular payments on the card, then your credit limit will be raised without the need to deposit any more collateral.

The unsecured credit card does not require an upfront security payment, but you do have to meet a certain credit level to be approved for a non-secured credit card in most cases. So, when you apply for a credit card with no credit or bad credit, often an unsecured card is more difficult to get than a secured card.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Don’t Miss: Top Gas Credit Cards | Ranking | Best Credit Cards for Gas Rewards & Points

Detailed Review – Top Ranking Best Way to Build Credit

Below, please find the detailed review of each credit card on our list of good credit cards for no credit. We have highlighted some of the factors that allowed these credit cards for low credit to score so highly in our selection ranking.

Citi® Secured MasterCard® Review | Best Way to Build Credit

This CitiGroup issued card is one of the best credit cards for low credit and requires a deposit of between $200-$2,500 when submitting the application. Once approved, your credit limit while building credit will initially be equal to the amount that you deposited for security. The security deposit is held for 18 months.

This is one of the best ways to build credit because if you have zero or bad credit, the collateral you put down as a security will allow you to build credit through CitiGroup and will positively affect your credit score over time.

The Citi® Secured MasterCard® can be one of the fastest way to build credit, and the card also has other important features as well, explained below.

Credit Cards for Low Credit Features:

- Identify theft protection

- Worldwide travel accident insurance

- Worldwide car rental insurance

- Trip cancellation and interruption protection

- Extended warranty

- Damage and theft purchase protection

- $0 liability for unauthorized charges

- Roadside assistance dispatch service

- 24/7 account access

- Worldwide acceptance

Ways to Build Credit with the Citi® Secured MasterCard®: Apply here

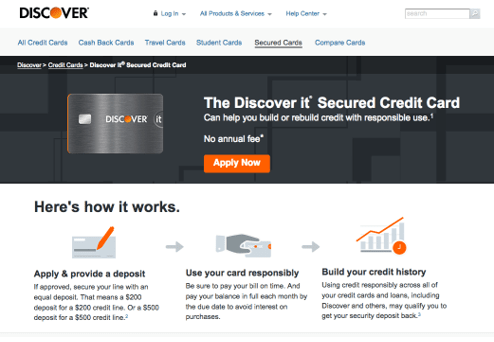

Discover it® Secured Credit Card Review | Best Way to Build Credit

This Discover Financial Services issued card is one of the good credit cards for no credit and requires a deposit of at least $200 when submitting the application. Your initial credit limit while building credit with this card will be equal to the amount deposited as security.

Image Source: Discover it Build Credit Fast

When you use this card as one of the best ways to build credit, you’ll have two options for the return of your security deposit:

1. They do automatic monthly reviews, beginning one year after you begin using this card to build credit fast in order to see if your account qualifies to “graduate” after showing responsible use of your credit over time.

2. When you close your account and pay in full, they will return the security deposit to you, which can take up to two billing cycles plus ten days.

The Discover it® Secured Credit Card can be one of the fastest ways to build credit, and the card also has other important features as well, explained below.

Credit Cards for Low Credit Scores Features:

- Cashback rewards

- Cashback match

- Identity theft protection

- Get FICO Credit Score for free

- Free overnight card replacement

Ways to Build Credit with the Discover it® Secured Credit Card: Apply here

Related: Top Good Credit Cards for Excellent & Good Credit | Ranking & Reviews | Top Rated Best Credit Cards

nRewards® Secured Credit Card Review | Best Way to Build Credit

This Navy Federal Credit Union issued card is one of the best credit cards for low credit if you have a military or DOD affiliation. It requires a deposit of at least $500 into a qualifying Navy Federal savings account before submitting the application. Your initial credit limit while building credit with this card will be equal to the amount deposited as security. The $500 is held throughout the duraction of your nRewards® Secured account.

When you use this card as one of the best ways to build credit, you can enjoy some of the lowest regular APRs offered of any of the cards reviewed in our Best and Fastest Way to Build Credit 2017 Review. This card has an APR as low as 9.24% and up to 18.0%.

The nRewards® Secured Credit Card can be one of the fastest ways to build credit, and the card also has other important features as well, explained below.

Credit Cards for Low Credit Scores Features:

- Rewards points

- Collision damage waiver

- Online Member Mall

- Digital wallets

- Discount coupons from Visa

- Fraud monitoring and notification

- Zero liability for unauthorized purchases

Ways to Build Credit with the nRewards® Secured Credit Card: Apply here

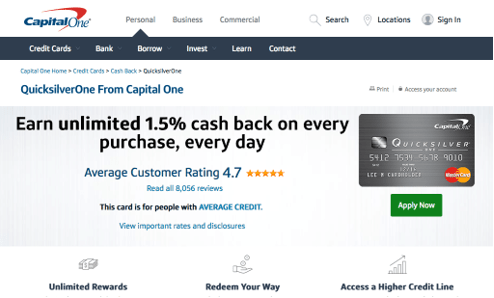

Capital One® QuicksilverOne® Review | Best Way to Build Credit

This Capital One issued card is one of the good credit cards for no credit or low credit if you do not want to put down a deposit like you do with a secured card. This is the only card on our credit cards for low credit list that is not a secured credit card.

When you use this card as one of the best ways to build credit, you may have to at least start with average credit to qualify, but you can then begin building credit without going through a security deposit phase while owning the card.

Image Source: Capital One Credit Cards for Low Credit

The QuicksilverOne from Capital One card can help you build credit fast, and the card also has other important features as well, explained below.

Credit Cards for Low Credit Features:

- Cashback rewards

- Access to higher credit line after 5 monthly payments

- 0% APR for 9 months

- Access to CreditWise credit monitoring tool

- Fraud coverage

- Security and account alerts

- Pick your own monthly due date

- Extended warranty

- Auto rental insurance

- Travel accident insurance

- 24/7 travel assistance

- 24/7 roadside assistance

- Price protection reimbursement

Best Way to Build Credit with the QuicksilverOne from Capital One Card: Apply here

Capital One® Secured MasterCard® Review | Best Way to Build Credit

This Capital One card is one of the best secured credit cards for low credit with one of the lowest minimum deposit requirements. You can make a required desposit of $49, $99, or $200 after submitting the application, based upon your credit worthiness. Once approved, your credit limit while building credit will initially be $200, or if you deposit more money before your account opens, can be up to $3,000.

This is the best way to build credit if you are having a hard time qualifying for a non-secured credit card, but don’t have a lot to put down as a deposit on one of the other credit cards for low credit.

The Secured MasterCard from Capital One can help you build credit fast and the card also has other important features as well, explained below.

Best Credit Cards for Low Credit Features:

- Access to higher credit line after 5 monthly payments

- Access to CreditWise credit monitoring tool

- Fraud coverage

- Pick your own monthly due date

- Extended warranty

- Auto rental insurance

- Travel accident insurance

- 24/7 travel assistance

- 24/7 roadside assistance

- Price protection reimbursement

Best Way to Build Credit with the Secured MasterCard from Capital One: Apply here

Popular Article: Best Store Credit Cards for Bad/Poor/Fair Credit | Ranking | Department Store Cards for People with Bad-Fair Credit

Free Wealth & Finance Software - Get Yours Now ►

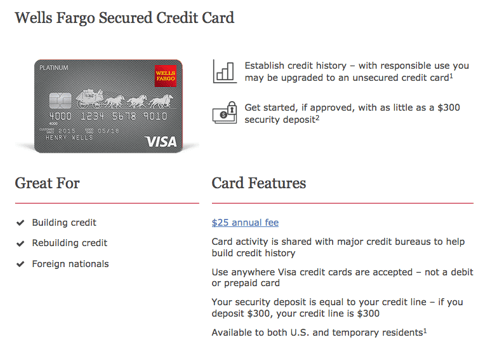

Wells Fargo Secured Credit Card Review | Best Way to Build Credit

This Wells Fargo issued card is one of the best credit cards for low credit or if you are a foreign national or temporary citizen trying to establish and build credit fast. When you apply for a credit card with no credit, this card requires a deposit of $300. Once approved, your credit limit while building credit will initially be equal to the amount that you deposited for security. Wells Fargo makes periodic account reviews and upgrades those qualified to a non-secured account.

Image Source: Wells Fargo Best Credit Cards for Low Credit

This is the best way to build credit if you are new to the U.S. or are a temporary resident and cannot qualify for another of the credit cards for low credit. One thing to bear in mind is that they only upgrade to non-secured accounts for U.S. citizens and permanent U.S. residents.

The Wells Fargo Secured Credit Card can help you build credit fast, and the card also has other important features as well, explained below.

Best Credit Cards for Low Credit Features:

- Auto rental collision damage waiver

- Emergency card replacement

- Roadside dispatch

- Travel and emergency assistance services

- Zero liability for unauthorized charges

- Overdraft protection (optional)

- Alerts for suspicious activity

- Cellular telephone protection

Best Way to Build Credit with the Wells Fargo Secured Credit Card: Apply here

Conclusion—Top 6 Best Credit Cards for Low Credit

If you are working on building credit, either from the ground up from never having a credit history or repairing poor credit, these top credit cards for low credit can offer the fastest way to build credit and improve your FICO credit score. The companies issuing the cards make regular reports to the three main credit reporting agencies where lenders go to check your credit worthiness.

While there are many things that can help improve your credit score over time, such as paying bills on time, paying down large loan balances, and reducing your overall debt, using credit cards for low credit is one of the top ways to build credit and repair and build credit fast.

We hope that our “Top 6 Credit Cards for Low Credit Scores | 2017 Reviews” gave you some options to consider if you need to apply for a credit card with no credit and want to know the best way to build credit quickly. There are some excellent credit card choices out there that aren’t only good credit cards for no credit; they also offer you extra perks and cashback rewards while you’re building credit.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.