2017 RANKING & REVIEWS

BEST CREDIT CARDS FOR EXCELLENT CREDIT AND GOOD CREDIT

How Can You Find the Best Credit Cards for Excellent Credit?

Not all credit cards are created equally. In fact, there are some significant differences, and most consumers are looking for top credit card offers and good credit card deals, particularly if they have good or excellent credit.

When you have good credit, it opens up more doors in terms of the top credit cards you may be eligible for.

These top-rated credit cards typically have many benefits that come with them, including the most competitive interest rates, cashback and rewards offers, and even deals like introductory 0% APRs on purchases and balance transfers.

Before exploring the specifics of the best credit cards for excellent credit and the best credit cards for people with good credit, it’s important first to think about what exactly is meant by good and excellent credit.

Award Emblem: Top 10 Best Credit Cards for People with Good Credit

While all credit card companies and top credit card offers are going to have different standards for rating the creditworthiness of applicants, usually any score above 700 is considered the baseline for “good” credit. Some other lenders may consider anything from 690 up to around 719 as being good credit as well.

Generally, anything above a FICO score of 720 ranks as excellent credit. When you have good or excellent credit, you have many of the top credit card offers available to you, and you may also be eligible for the best cashback credit cards for excellent credit.

The following ranking of the top 10 credit cards focuses on those cards where you need to have at least good credit to qualify, if not excellent credit.

Each of these top ten credit cards feature great rewards, low interest rates, and other perks that make them valuable for consumers.

See Also: Top Best Gas Credit Cards | Ranking | Best Credit Cards for Gas Rewards & Points

AdvisoryHQ’s List of the Top 10 Credit Cards for Good and Excellent Credit

List is sorted alphabetically (click any of the credit card names below to go directly to the detailed review section for that credit card):

- BankAmericard Cash Rewards™ Credit Card

- BB&T Spectrum Rewards® Card

- Blue Cash Everyday® Card from American Express

- Cash Rewards Credit Card by SunTrust

- Chase Freedom UnlimitedSM credit card

- Discover it® Miles travel credit card

- HSBC Platinum MasterCard® with Rewards credit card

- PNC Points® Visa® Credit Card

- Capital One® Quicksilver®

- Wells Fargo Cash Wise Visa® Card

Top 10 Best Credit Cards for People with Good Credit| Brief Comparison

Credit Card Name | APR Purchases % (Min) | APR Purchases% (Max) | Rewards |

| BankAmericard Cash Rewards™ Credit Card | 13.24% | 23.24% | Yes |

| BB&T Spectrum Rewards® Card | 10.40% | 19.40% | Yes |

| Blue Cash Everyday® Card from American Express | 13.24% | 23.24% | Yes |

| Cash Rewards Credit Card by SunTrust | 10.49% | 21.49% | Yes |

| Chase Freedom UnlimitedSM credit card | 14.24% | 23.24% | Yes |

| Discover it® Miles travel credit card | 11.24% | 23.24% | Yes |

| HSBC Platinum MasterCard® with Rewards credit card | 13.24% | 23.24% | Yes |

| PNC Points® Visa® Credit Card | 12.24% | 22.24% | Yes |

| Capital One® Quicksilver® | 13.24% | 23.24% | Yes |

| Wells Fargo Cash Wise Visa® Card | 12.40% | 26.24% | Yes |

Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Credit Cards for Excellent Credit and Best Credit Cards for People with Good Credit

Below, please find the detailed review of each card on our list of the top 10 credit cards. We have highlighted some of the factors that allowed these top credit cards to score so well in our selection ranking.

BankAmericard Cash Rewards™ Credit Card Review

Bank of America has more than 47 million customers that include not just individuals but also businesses and institutions. Based in Charlotte, NC, Bank of America strives to improve the financial lives of customers and empower them throughout many areas of their lives, including not just day-to-day financial management but also in how they invest and plan for the future.

Bank of America offers quite a few different credit card options, and they’re broken down into categories including cash rewards, travel rewards, and lower interest rate cards. There are also student credit cards and options for people who want to build their credit. Bank of America also features several top-rated credit cards and good credit card deals for people with good to excellent credit.

Key Factors That Led to Our Ranking of This as One of the Top 10 Credit Cards

Among the good credit cards and top credit card offers for people with excellent credit, the following are primary reasons the BankAmericard Cash RewardsTM Credit Card ranks well.

Rewards

The BankAmericard Cash Rewards™ Credit Card ranks well as one of the good credit cards to apply for if you’re searching for the best credit card offers for excellent credit.

One reason is the straightforward, valuable rewards program that this card is known for. This top credit card is designed to give cardholders more cashback earnings opportunities for the things they buy most frequently.

Cardholders earn cash back that includes 1% on every purchase, 2% at grocery stores and wholesale clubs, and 3% on gas for the first $2,500 in combined grocery/wholesale club/ gas purchases every quarter.

It’s a card that lets users buy the things they need on a daily basis and earn cash back for doing it.

There is no expiration on rewards and no charging categories, so it’s easy to keep track of what you’re spending and what you’re earning. This simplicity was an important factor for including this card on our list of the top ten credit cards for good and excellent credit.

Preferred Rewards

Another aspect of this card that makes it not just one of the good credit cards to have but also one of the best cashback cards for excellent credit is its eligibility for the Bank of America Preferred Rewards Program.

This program features three tiers, and it gives the opportunity for cardholders to earn even more for using their credit card and for having another account with Bank of America. The three tiers of eligibility are Gold, Platinum, and Platinum Honors.

A customer’s tier is based on qualifying combined balances through Bank of America or Merrill Lynch accounts, and he or she gets a percentage rate booster on Rewards Bonuses with a Bank of America credit card.

For example, Gold status includes a 25% reward bonus on eligible Bank of America credit cards.

Introductory and Bonus Offers

When ranking the best credit cards for excellent credit and the best credit cards for people with good credit, certain factors, including introductory and bonus offers, were important. These are two areas where top credit cards can differ from one another quite significantly, so they were important elements to consider.

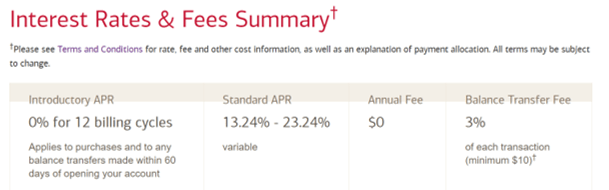

The BankAmericard Cash Rewards™ Credit Card ranked well here. To begin, the current low introductory APR offer available from this top credit card includes 0% APR for the first billing 12 billing cycles of purchases. This holds true for any balance transfers made within 60 days of opening the account.

There also a current $100 online cash rewards bonus offer available to new cardholders who make at least $500 in purchases in the first 90 days of account opening.

Source: BankAmericard Cash Rewards™ Credit Card

Security

When considering good credit cards to apply for, not only are the top credit card offers considered but so are technicalities such as the level of security provided. Bank of America excels in not only delivering good credit card deals and the best cashback credit cards for excellent credit but also in having a high level of security and service.

Some of the features of this card include the following:

- Potential fraud is blocked

- The card includes a $0 liability guarantee for fraudulent transactions

- The free ShopSafe service is available for added security when shopping online

- Chip-enabled

- Digital Wallet Technology-compatible, including Apple Pay, Android Pay, and Samsung Pay

- Can be integrated with online and mobile banking

Don’t Miss: Top Best Store Credit Cards for Bad/Poor/Fair Credit | Ranking | Department Store Cards for People with Bad-Fair Credit

BB&T Spectrum Rewards® Card Review

BB&T has a community banking history that goes back to 1872, and, as of September 2016, it’ one of the largest financial services holding companies in the U.S. BB&T is based in Winston-Salem, N.C. and has 2,220 financial centers in 15 states as well as in Washington D.C. BB&T is also a Fortune 500 company and has been named as one of the strongest banks in the world by Bloomberg Markets magazine.

In terms of credit cards, BB&T offers two main options which include the BB&T Spectrum Rewards® Card as well as the BB&T Bright® Card which is a low-interest rate card with an extended introductory APR. The BB&T Spectrum Rewards® Card is included on this list of the top ten credit cards for people with good or excellent credit.

Key Factors That Led to Our Ranking of This as One of the Top Credit Cards for People with Good Credit

Listed below are key reasons the BB&T Spectrum Rewards® Card is included on this list of top rated credit cards and the best credit cards for people with excellent credit.

Simplicity

One of the first things many people look for when selecting good credit cards to apply for are options that have rewards programs affiliated with them. This card from BB&T is one of the best cashback credit cards for excellent credit, but it’s unique because the rewards program is so streamlined and simple to understand.

Many times, even with the top credit card offers, the rewards program can be complicated and challenging to keep track of, but that’s not the case with the BB&T Spectrum Rewards® card.

Basically, dollars spent are dollars earned, and they can then be used not only for cash back but also gift cards, merchandise, travel purchases, and more.

Bonus

Along with featuring a simple, easy-to-follow rewards program, this top credit card includes one of the best credit card offers for excellent credit in terms of the amount of cash and rewards that can be earned.

Cardholders can currently get the following earnings and bonuses when they use their Spectrum card:

- 3% cash back on all net-qualified purchases within the first 90 days of opening the account

- After that, it’s 1% cash earnings on all net-qualified purchases

- Cardholders earn a 5% anniversary bonus on cash earned every year

- Cardholders can qualify for an additional 30% bonus on cash earned when they spend $50,000 or more in a year on their card

Pricing

Using a credit card can be expensive when everything is accounted for, including fees and interest rates. That’s why it’s important to look for good credit cards that are also inexpensive to use. This card is an excellent example, with competitive pricing that’s paired with rewards for purchases.

The BB&T Spectrum Rewards® includes a 0% introductory APR for 12 months, not only on purchases but also balance transfers. It’s one of the best cashback credit cards for excellent credit as well as a good credit card for consolidating existing balances for an overall lower rate.

Additionally, after the introductory APR ends, the interest rates remain very low, currently starting at a competitive 10.40%.

Finally, this is one of the top ten credit cards and top credit card offers that carries no annual fee.

Account Protection

As one of the good credit cards to have if you want value, rewards, and service, this option from BB&T also features extensive account protection features, making security a top priority.

These features include the following:

- The Visa Zero Liability program protects cardholders against fraud and unauthorized use

- Visa Checkout adds an additional layer of security and protection when making online purchases

- There is warranty protection on purchases

- If a card is lost or stolen, there is rapid delivery of replacement cards or emergency cash available

- The card is chip-enabled

- BB&T customers can take advantage of optional overdraft protection that links their card to their eligible BB&T checking account

Related: Top Best Credit Cards with Travel Insurance, Roadside Assistance, & Travel Rewards | Ranking & Comparison Reviews

Blue Cash Everyday® Card from American Express Review

American Express is a worldwide financial services company that offers products for customers who want something distinctive. The company itself has more than $160 billion in total assets and is ranked number 88 on Fortune 500’s list. This company also has an annual revenue of $32.8 billion.

American Express is known as one of the leaders in providing the best credit cards for excellent credit as well as some of the best cashback credit cards for excellent credit. Its cards are also packed with bonuses and perks like concierge service. American Express also frequently offers additional top credit card offers to make its products even more enticing for consumers.

Key Factors That Led to Our Ranking of This as One of the Top Ten Credit Cards for Good and Excellent Credit

When comparing credit cards for excellent credit, the following details point to why the Blue Cash Everyday® Card from American Express was included in this ranking of the top 10 credit cards.

High Cashback Rates

Among the best credit cards for people with good credit and best cashback credit cards for excellent credit, the Blue Cash Everyday® Card from American Express ranks well for many reasons such as its cashback program.

When shopping at U.S. grocery stores, the cashback rate is highly competitive, at 3% up to $6,000 per year. After that, it goes down to 1%. There is also 2% cash back at U.S. gas stations and certain department stores and 1% cash back on other purchases.

That cash back is then received as Reward Dollars, and these can be redeemed for statement credit.

Payment Flexibility

Many of the top credit cards and even the best credit cards for excellent credit will limit how cardholders make payments each month. For example, they may need to pay their balance in full every month to take advantage of certain rewards or offers.

One of the perks of this card from American Express that led to its inclusion on this list of credit cards for excellent credit is its payment flexibility.

With this top credit card, cardholders can either carry a balance with interest or pay in full every month. This makes this card ideal for those looking to help manage their monthly expenses or, on the other hand, if they need to make a large purchase. There’s flexibility and continued rewards earnings.

Accelerated Cash Back

The Blue Cash Everyday® Card from American Express is one of the best credit card offers for excellent credit for many reasons including the base earnings potential of the cashback program.

Additionally, this top credit card includes the ability to accelerate the already competitive cashback earnings that come with it.

Cardholders can earn rewards faster when they link an additional card to their account for their family or friends.There’s also the option to get cash back for monthly spending, such as paying a phone bill.

This all comes along with a card that has no annual fee, making it one of the top 10 credit cards for people with good and excellent credit.

Travel Benefits

There are a couple of things American Express is known for. One is the provision of some of the best rewards programs for cardholders. The other is travel. American Express excels in offering cards and programs designed for travelers such as its concierge service.

The Blue Cash Everyday® Card from American Express comes with built-in travel benefits, which is another reason it’s not just one of the good credit cards to have but one of the best credit card offers for excellent credit.

Travel benefits include the following:

- Car rental loss and damage insurance are available when the card is used to reserve and pay for eligible vehicle rentals

- When a cardholder travels more than 100 miles from home, he or she has access to around-the-clock medical, legal, financial, and assistance services as a card member

- Roadside assistance services allow for easy access to emergency services such as towing

- Travel Accident Insurance coverage is available with this card in certain circumstances

Popular Article: Top Best Credit Cards in Canada | Ranking | Compare the Best Cash Back, Travel, and Top Cards

Cash Rewards Credit Card by SunTrust Review

SunTrust had total assets of more than $191 billion as of the end of 2015, making it one of the most secure financial institutions in the country. There are around 1,400 SunTrust retail branches around the country, and, in addition to offering some of the top credit cards, SunTrust also features products and services that include mortgages, investments, and deposit accounts.

Regarding top credit cards, SunTrust offers the Cash Rewards Credit Card, designed to provide straightforward cashback opportunities, as well as the Travel Rewards Card and Prime Rewards Card which locks in a prime interest rate for three years.

Key Factors That Led to Our Ranking of This as One of the Top Ten Credit Cards for Good Credit

The Cash Rewards Card from SunTrust is included on this list of the top 10 credit cards for people with either good or excellent credit because of the reasons that follow.

Introductory Cash Back

Perhaps one of the biggest reasons consumers select this as a top credit card and consider it among the good credit cards to apply for with excellent credit is because of the high introductory cashback rate. For the first 12 months after opening an account, cardholders can receive a highly competitive 5% cashback rate on up to $6,000 spent on gas and grocery qualifying purchases.

In addition to the 5% cash back opportunity, this card also includes 2% unlimited cash back on gas and grocery purchases after the introductory period and 1% unlimited cash back on all other qualifying purchases all the time.

It’s a simple yet valuable cashback program, with an extended introductory period for maximizing how much cash back you can earn.

Cashback Bonus

With the credit card market growing increasingly competitive, many of the good credit cards available offer not just cash back and rewards but opportunities for additional earnings on top of the base rewards.

The SunTrust Cash Rewards Card is one of those cards.

On top of the regular cash back, cardholders can get a cashback bonus of 10%, 25% or more (depending on their overall deposit relationship with SunTrust) when their cash back is redeemed directly into a SunTrust account, including checking, savings or a money market.

Fees

Already mentioned in this review of the best credit cards for excellent credit is the importance of considering fees when you’re searching for good credit cards. Fees can be charged just for using a card, and it can raise the cost of that card significantly, outweighing potential benefits, such as rewards earnings and cash back.

The SunTrust Cash Rewards Card alleviates that concern for consumers.

This card not only has no annual fee for using it, but it also carries no foreign transaction fees, so you don’t have to pay just to use your card in a foreign country. It also features a 0.0% APR on both purchases and balance transfers made in the first 15 months after opening the account.

Free Monthly FICO Score

SunTrust’s Cash Rewards Credit Card, one of the top ten credit cards for good credit consumers, features the opportunity to monitor your credit over time and make sure your score remains high.

The FICO Score Program is included along with this credit card for free, and consumers can view their score online which is updated monthly. The program also includes up to 12 months of FICO score history, and it will list two factors that impact the consumer’s score each month.

There are also FICO education tips and FAQs, and it can all be accessed by visiting the credit card portal that’s part of SunTrust Online Banking.

Read More: Top Cheap Credit Cards | Best Low Credit Card Interest Rates (Cheapest & Lowest)

Chase Freedom UnlimitedSM Credit Card Review

One of the country’s top financial services providers, Chase features some of the best credit card offers for excellent credit and other top credit cards as well. Chase is part of JPMorgan Chase & Co which serves almost half of all households in America. Financial services include not only some of the top credit cards but also personal banking, mortgages, small business services, and personal lending.

Among the cards offered by Chase, the Chase Freedom UnlimitedSM is one of the most popular along with options like the Chase Slate® credit card which is ideal for balance transfers.

Key Factors That Led to Our Ranking of This as One of the Best Credit Cards for Excellent Credit

When comparing good credit cards to have or good credit card deals, the following are some reasons this was named as one of the best credit cards for people with excellent credit.

New Cardmember Offer

Often, top-rated credit cards, including credit cards for excellent credit, will feature special, limited-time offers for new cardmembers. This card from Chase currently has an excellent opportunity for new members.

When you sign up for a Chase Freedom UnlimitedSM credit card right now, you can receive a $150 bonus after spending just $500 on purchases in the first three months after the account is opened.

This offer may eventually change, but Chase tends to have some of the best new cardmember offers, which was an important reason it was included in this ranking of the top ten credit cards.

Cardholders can also earn a $25 bonus when they add their first authorized user to their account and make their first purchase within three months.

Streamlined Reward Structure

Top credit cards that have rewards earnings opportunities can sometimes be difficult for consumers to use efficiently. The reward structure may be complicated, or you may feel like you have to use one card for gas, another for groceries, and yet another for everyday purchases. With the Chase Freedom UnlimitedSM card, this isn’t a problem.

This card has a basic yet valuable rewards structure that automatically includes 1.5% cash back on every purchase. Cardholders tend to like this because they don’t have to worry about what cards to use or signing up for quarterly cashback offers.

The rewards can then be redeemed for cash back in any amount and at any time.

Flexible Rewards Redemption

Another unique element of this card that led to its inclusion on this list of the top credit cards and the best credit cards for excellent credit are the flexible redemption options. Once you accrue cash back, it’s really up to you how you redeem it.

You can take advantage of the following options:

- Redeem rewards for a statement credit

- Set up a direct deposit of cashback rewards into most U.S. check`ing and savings accounts

- Link your card to your amazon.com account and redeem rewards to pay at checkout, including tax and shipping

- Redeem for gift cards and shopping, dining, and entertainment certificates

- Use rewards to get competitive rates and flexible payment options when you book travel with Chase Ultimate Rewards

APR and Fees

To begin, the Chase Freedom UnlimitedSM credit card has no annual fee which makes it a terrific option in terms of value for anyone looking for the best credit card offers for excellent credit.

In addition to carrying no annual fee, this card also has a 0% APR introductory rate, and instead of the typical 12-month term, cardholders get 15 months of zero interest from account opening. This is offered on both purchases and balance transfers.

After the introductory period, the APR remains competitively low, making it a great choice for someone searching for good credit card deals.

Related: Top Best Credit Cards for Very Bad Credit | Ranking | Cards for Damaged, Horrible, and Really Bad Credit Histories

Discover it® Miles Travel Credit Card Review

Discover is a financial services company offering not only top credit cards but also loans and general banking services. Discover has been a long-time leader in terms of offering good credit cards, having introduced the first rewards card in 1986. Other specific products available from Discover include cashback checking, CDs, personal loans, savings accounts, debt consolidation options, and home equity loans.

The Discover it® Miles travel credit card is the signature top credit card from Discover, and it features certain benefits that include travel perks and other features.

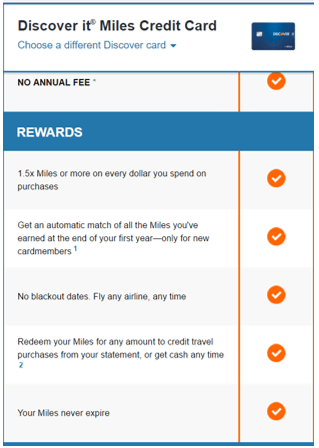

Annual Fee

An important factor in the ranking of the top credit card offers and best cashback credit cards for excellent credit on this list was the annual fee. We ranked most highly those top credit cards with no annual fee, and the Discover it® Miles travel credit card meets that criteria.

This leader among the best credit cards for excellent credit also has a 0% introductory APR for 12 months on purchases.

After the one-year introductory period, the interest rate remains low, with the current minimum rate being 11.24%.

Miles

This isn’t just one of the best credit cards for excellent credit. It’s also an outstanding travel card. To begin, cardholders earn 1.5x unlimited miles on every dollar they spend on purchases.

Then, Discover matches all of the miles the cardholder accumulates by the end of their first year. This means someone who has accumulated 20,000 miles throughout the first year would then automatically end up with 40,000 miles.

Miles can be redeemed in any amount for a travel credit issued to the card statement that covers travel purchases. Also, the miles can be redeemed for cash at any time.

Source: Discover it® Miles travel credit card

Travel and Security Benefits

One of the exclusive travel benefits that comes along with this card is in-flight Wi-Fi. The card company reimburses customers up to $20 for their in-flight Wi-Fi purchases each year.

The reimbursement comes in the form of automatic credit made to the cardholder’s statement.

There is also no foreign transaction fee, another perk that can be particularly valuable for travelers searching for good credit cards to apply for. Furthermore, if a card is lost or stolen, Discover will provide free overnight shipping for a replacement.

Financial Value

Having no annual fee isn’t the only reason this card was selected as one of the top 10 credit cards. There are other ways the Discover it® Miles travel credit card creates value for cardholders searching for top-rated credit cards. These reasons include the following:

- There is no fee charged for going over your limit

- Cardholders receive their FICO Credit Score for free each month on their statements, and it’s also available online

- There is no late fee charged for the first late payment a cardholder makes

- Paying late doesn’t lead to an increase in APR

- $0 fraud liability means cardholders aren’t responsible for unauthorized purchases made on their card

HSBC Platinum MasterCard® with Rewards Credit Card Review

HSBC is one of the biggest banking and financial services groups in the U.S. It has a presence in 71 countries and territories around the world, with over 45 million customers and 4,400 international offices. HSBC was established in 1865 in Hong Kong. Today, it’s one of the top financial resources for individual and business clients and also offers several top-rated credit cards as well as some of the best credit cards for excellent credit.

Leading the way, regarding good credit cards and top credit card offers, is the HSBC Platinum MasterCard® with Rewards credit card which pairs convenience with excellent and highly competitive travel rewards.

Key Factors That Led to Our Ranking of This as One of the Best Credit Cards for Excellent Credit

When comparing good credit cards to have and the best credit cards for people with excellent credit, the following list highlights why the HSBC Platinum MasterCard® with Rewards was included in this ranking of the top 10 credit cards.

Unlimited Rewards

Even when good credit cards feature some of the best rewards deals, they may not be unlimited. This isn’t the case with this HSBC card. The points never expire, and there’s no limit to the amount a customer can earn.

Points can then be redeemed for 1% cash back, or cardholders may choose from hundreds of redemption options, including gift cards, merchandise or flights on major airlines.

This level of flexibility and unlimited earnings potential, as well as no expiration date, were an important aspect of why the HSBC Platinum MasterCard® with Rewards was selected for this ranking of the best credit cards for people with excellent credit and good credit.

Competitive Rates

No one wants to spend more than they have to on their credit card, and the top-rated credit cards on this list of the best credit cards for excellent credit tend to have competitive rates and either low or non-existent fees.

This is the case with this HSBC card. It does not have any annual fee, and there are no foreign transaction fees on card purchases made in a foreign currency.

This leader among the best credit cards for people with good credit also includes a 0% introductory APR on both purchases and balance transfers for the first 12 months, and after that, the variable APR remains low.

Additional cards can also be given to family members at no extra charge.

Bonus Rewards

Often, the top credit card offers from the best credit cards for people with excellent credit will include bonus points opportunities. This is the case with the Platinum MasterCard with Rewards from HSBC.

New cardholders currently have the opportunity to earn 15,000 Rewards Program Bonus Points after spending only $500 on new, net card purchases in the first three months after opening a new account.

Like the other reward points available from this top credit card, these Bonus Points don’t expire.

Service and Security

A defining characteristic of many of the top credit cards, including the top 10 credit cards included in this ranking, is the level of service and security they provide cardholders.

Some of the service and security features that come with this card, one of the best credit card offers for excellent credit, include:

- Cardholders can contact an expertly-trained MasterCard Global Service Representative at any time, in any language

- Emergency card replacement or cash advance is available within 24 hours in the U.S. and within two business days in other locations

- Roadside Assistance coverage is included with the card

- Purchase Protection is included to protect the cardholder if he or she buys something that’s damaged or gets stolen

- Identity Theft Resolution provides cardholders of this top credit card with an ID Theft Affidavit

Don’t Miss: Top Best UNSECURED Credit Cards to Rebuild Credit

PNC points® Visa® Credit Card Review

PNC is a bank and financial services company known for innovative banking solutions like its Virtual Wallet products. PNC is also known for offering a wide variety of good credit card options, regardless of the goals of the consumer. Some of the categories of top credit cards available from PNC include low interest, rewards, cashback, and travel cards.

PNC points® Visa® Credit Card is one of its top-rated credit cards, featuring simplicity, low costs for using the card, and opportunities to earn valuable rewards. Other well-received top credit cards from PNC include the PNC CoreSM Visa® Credit Card and the PNC CashBuilder® Visa® Credit Card.

Source: PNC points® Visa® Credit Card

Key Factors That Led to Our Ranking of This as One of the Best Credit Cards for Excellent Credit

Among the top-rated credit cards, the following details show why the PNC points® Visa® Credit Card is included in this ranking of the best credit card offers for excellent credit as well as best credit cards for people with good credit.

Bonus Points

In addition to being one of the overall top ten credit cards, this card from PNC also leads the way in terms of being one of the good credit cards to have due to its rewards program. The rewards program that is affiliated with this card offers opportunities to earn bonus points in addition to earning 4 points for every $1 in qualifying purchases.

Bonus point earning potential includes the following:

- Cardholders earn 25% bonus points when they maintain a Virtual Wallet from PNC and meet minimum balance or direct deposit requirements

- There’s the potential to earn 50% bonus points for customers who maintain a Performance Checking account or Virtual Wallet with Performance Spend and meet certain account requirements

- Users of this top credit card can earn 75% bonus points for maintaining a Performance Select Checking account or Virtual Wallet with Performance Select

Introductory Offer

Introductory offers are one of the top things to consider when searching for the best credit cards for excellent credit and also looking for the best cashback credit cards for excellent credit. The top credit card offers can add an extra layer of value to cards for consumers.

This PNC card includes an introductory offer that has 0% APR on purchases for the first 12 billing cycles after opening the account.

There’s also an introductory 0% APR on balance transfers for the first 12 billing cycles when the balance is transferred in the initial 90 days after the account is opened.

This card is an excellent option and among the top credit card offers if you want to move your existing balances from other credit cards and save money.

Online Card Management

Along with having some of the top credit cards overall, PNC is also known for its robust online and mobile banking platforms. The PNC points® Visa® Credit Card can easily be integrated and managed with online banking from PNC.

This simplifies how customers with this card, one of the best credit cards for excellent credit, can track their spending, stay on budget, and maintain the utmost in visibility over their spending.

PNC Online Banking lets customers do the following when managing the PNC points® Visa® Credit Card:

- 24/7 access to credit card accounts

- Manage checking, available credit, credit limit, and cash advance balances

- APR information is included

- Ability to transfer funds from a PNC checking account to pay off a credit card

- Request a limit increase

- Dispute a transaction

- View up to 13 months of posted transactions

- Search transactions by date/description/dollar amount

- Export information to financial software

- View card reward balances and redeem them online

Points Redemption

This card is one of the best credit card offers for excellent credit. The points system is simple to understand and manage, and the idea is that people are rewarded with points for the purchases they’re already making every day.

Uniquely, there are many ways cardholders can redeem points with this top-rated credit card.

They can shop for gift cards, pay for car rentals and airline tickets, book hotel stays, and purchase general merchandise.

Cardholders are automatically enrolled when they have a PNC points® Visa® Credit Card.

Popular Article: Top Best Hotel Rewards Programs & Hotel Credit Cards | Ranking and Reviews

Capital One® Quicksilver® Review

Capital One is one of the most highly rated, visible, and well-known credit card companies in the country, providing many top credit cards and some of the best credit cards for excellent credit. This diversified financial services company is Fortune 500-listed. Capital One’s headquarters are in McLean, Virginia, and it has clients across the U.S., the U.K., and Canada.

The Quicksilver from Capital One is one of the most popular cards available from this company. It’s ranked well not only in financial circles but also as one of the best credit cards for excellent credit among customers who actually use the card.

Key Factors That Led to Our Ranking of This as One of the Top 10 Credit Cards for Good and Excellent Credit

Reasons the Quicksilver from Capital One is included on this list of the top 10 credit cards for people with good credit and excellent credit are represented below.

Capital One Features

Along with the Quicksilver card being a top credit card and one of the good credit cards to have if you qualify, the company itself is also a leader in the industry. All Capital One cards come with a set of valuable features.

The first feature universal across all of the top credit cards from Capital One are no foreign transaction fees. Cardholders don’t pay a fee when they make purchases outside of the U.S.

All of the top credit cards also have fraud coverage if the card is every lost or stolen, and personalized security alerts are also available.

Source: Quicksilver from Capital One

Visa Signature® Benefits

The Quicksilver, a good credit card to apply for if you’re searching for the best credit card offers for excellent credit, is appointed with Visa Signature® Benefits. These benefits include the following:

- Cardholders can receive complimentary upgrades and savings opportunities at hotels, resorts, and more

- Complimentary concierge service from Visa Signature Concierge

- Special event access and preferred seating

- Shopping discounts at leading retailers and online merchants

- Extended warranty protection at no charge on items purchased with the Quicksilver card

- 24-hour travel assistance

Unlimited Rewards

The Quicksilver is one of the best credit cards for people with good credit and one of the best credit cards for people with excellent credit. It’s also one of the best cashback credit cards for excellent credit, with unlimited 1.5% cash back on every purchase.

There are no limits to how much cardholders can earn in rewards, and there are no categories to worry about.

Rewards from this top credit card don’t expire, and they can be redeemed any time and in any amount.

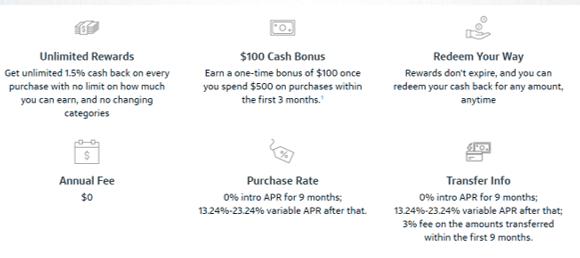

Bonus

As well as being one of the best cashback credit cards for excellent credit, new Quicksilver cardholders can also take advantage of introductory and new cardholder bonuses and offers. One of these is the one-time $100 cash bonus given to cardholders who spend at least $500 on the card in purchases during the first three months.

This no annual fee card also features a 0% APR for 9 months on both purchases and transfers.

After the introductory period, the variable APR remains low and competitive with other top credit card offers and best credit card offers for excellent credit.

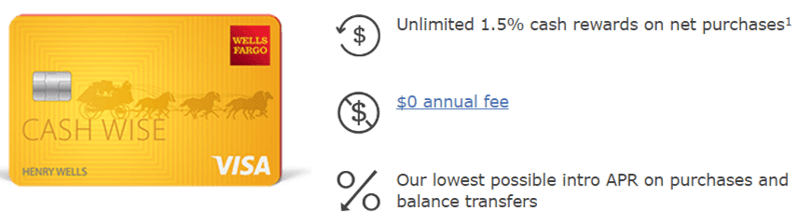

Wells Fargo Cash Wise Visa® Card Review

Wells Fargo is a full-service bank working with personal, small business, and commercial clients. Services range from offering deposit accounts to mortgages and personal loans, along with featuring several good credit card options. Most of the Wells Fargo top credit card options are divided into categories, such rewards and points cards, cash back, and cards to build credit.

A good credit cards to apply for from Wells Fargo if you want credit cards for excellent credit is the Wells Fargo Cash Wise Visa® Card.

Key Factors That Led to Our Ranking of This as One of the Top 10 Credit Cards for Good and Excellent Credit

Some of the primary criteria that led to the inclusion of this card on this ranking of good credit cards to apply for, especially as a good credit card to have with excellent credit, are detailed in the following list.

Flexibility

There are a lot of top credit cards and credit cards for excellent credit that have a rewards program, but all too frequently, these rewards are highly restrictive or there are lot of limits placed on them.

For example, cardholders might be restricted to earning rewards only in certain categories, or they might have to do quarterly signups to get rewards.

This isn’t the case with the Cash Wise card, and that was pivotal when deciding to include it on this ranking of the top ten credit cards for excellent credit.

There are no category restrictions or quarterly signups for rewards earnings, and cash rewards don’t expire while the account is open.

Source: Wells Fargo Cash Wise Visa® Card

Extended Introductory Period

Many top credit cards and leading credit cards for excellent credit will feature good credit card deals on introductory periods. One popular top credit card offer is 0% interest for a certain period of time after opening the account.

For many cards, this period is only six months,and for the majority of the best credit cards for people with excellent credit included in this ranking, that period of time is 12 months.

This card from Wells Fargo goes even beyond the 12-month period. Cardholders get a 0.00% introductory APR for 15 months on purchases and balance transfers.

Additionally, this card carries no annual fee, making it excellent regarding value for consumers searching for good credit card deals.

Cash Rewards

As one of the best cashback credit cards for excellent credit, this card from Wells Fargo makes it easy to earn.

Earnings include 1.5% cash rewards on everyday net purchases and 1.8% cash rewards on mobile wallet net purchases made with Apple Pay or Android Pay during the first 12 months after opening the account.

There’s also the option to earn more rewards when cardholders shop the Earn More Mall.

These cash rewards can be redeemed using a convenient online tool called Cash Track. Redemption options are flexible and include using a Wells Fargo debit or ATM card to withdraw cash at a Wells Fargo ATM, performing a direct deposit into a Wells Fargo checking or savings account or applying it as credit toward a Wells Fargo mortgage principal.

Security

This leader among good credit cards and credit cards for excellent credit features a suite of security protections to give cardholders peace of mind and protection.

The card is part of the Zero Liability Protection program, designed to protect against liability for unauthorized transactions that are promptly reported. Furthermore, chip technology prevents against fraud at merchant terminals.

Also, Rapid Alerts is a feature that allows cardholders to track purchases and receive notifications if there is suspicious activity happening with their account.

Conclusion—Top 10 Best Credit Cards for Excellent Credit and Good Credit

When you have excellent or even good credit, you have tremendous financial opportunities. One of the things you can take advantage of is top-rated credit cards and particularly those credit cards for excellent credit.

The top 10 credit cards on this ranking of the best credit cards for excellent credit include outstanding benefits ranging from some of the highest cashback rates available to low interest rates and introductory bonuses.

These top credit cards also feature rigorous security features so you can monitor and protect your credit and make sure it stays excellent. All of these are good credit card options that offer tremendous value, and any one of them is an ideal option for consumers searching for good credit cards to apply for and good credit card deals.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.