Guide: 6 Tips to Finding the Best Budget Apps for iPhone

The market for the best budgeting apps for iPhone users is very competitive. There are many different iPhone finance apps from which to choose.

Every iPhone budget app offers unique features and services, which can make finding the best budget apps for iPhones a little difficult.

Many people searching for the best iPhone budget app encounter the following questions:

- What is a budget planner app?

- How can I know which are the best personal finance apps for the iPhone?

- Does it matter if I use free budgeting apps, or should I purchase iPhone finance apps?

With the right information, finding the best budget apps for iPhone users is simple and easy. It is important to compare your needs with the features of the iPhone finance apps available and keep in mind your own financial goals.

The best budget apps for iPhone users will meet your financial needs and streamline your life.

Only you can know which budget planner app is best for your life, but the right information can help you choose the best money management app with confidence.

See Also: Learnvest vs. Mint | Ranking, Comparison & Competitors

6 Tips to Finding the Best Budget App for iPhone

With so many available choices, there’s no denying that finding the best budget apps for iPhone can be an intimidating process.

Our review will look at the most important factors to consider when choosing the best iPhone budget app, including free budgeting apps and paid versions.

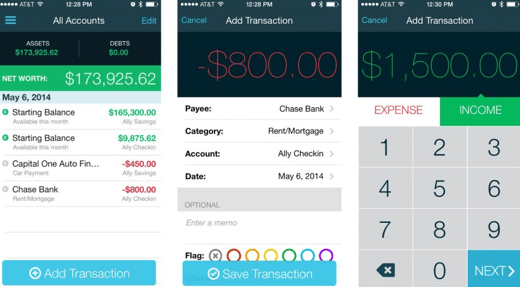

Image Source: Best Budget Apps for iPhone

Before looking for your next iPhone budget app, use these tips as a guide to help you find the budget planner app that will best suit your needs and help you accomplish your financial goals.

1. Understand the Budgeting App

The iPhone has revolutionized many things about day-to-day life for many people.

With the right apps, your iPhone can transform into a personal trainer, nutritionist, travel agent, or, with the best iPhone budget app, it can be a top-notch financial advisor.

The best budget apps for iPhone will put systems and tools right into the palm of your hand that will help you understand your finances.

Before you can search for the best budget app for iPhone users, it is important to understand what a budget planner app is and what you can expect it to do for you.

There are many factors to consider when choosing an iPhone budget app, and a foundation of good information will help you find the best iPhone budget app available.

There are many different kinds, but the best budget apps for iPhone users will have a few things in common.

The best budget apps for iPhone allow you to see a breakdown of your finances in real time. These best budgeting apps can help you avoid overdraft fees, keep track of your spending habits, reach savings goals, and take control of your finances in general.

The best budget apps for iPhone users make it much easier to keep track of your money because they can automatically log your spending for you.

Some of the best budget apps for iPhone can sync with your bank account and keep track of your income, purchases, and bills. These personal finance apps will even send you notifications if you are spending more than you have budgeted.

With some budgeting apps for iPhone, you can set it and forget it because it will keep track of your money and let you know if you are drifting off course.

With subtle reminders from the best budgeting apps, you can start to build better spending habits and a better financial future.

Don’t Miss: YNAB Review—What Is YNAB? How to Use YNAB (Free Trial & Reviews)

2. Understand the Benefits

When people think about budgeting, there is a classic image that usually comes to mind.

This is the image of papers and calculators strewn across a kitchen table while a desperate, stressed-out person spends all night trying to make sense of their finances.

Using a best budget app for iPhone takes this classic image and eliminates it completely. These budgeting apps for iPhone users allow anyone to easily access their finances at any time so that they can stay on top of their earning and spending.

The best finance apps for iPhone users are going to help you understand your money and organize it in a way that works for you.

Because personal finances can be so complicated, the best budgeting apps will help you to consolidate your information and break it down into bits that are easy to understand and track.

Finance apps for iPhone users will do the hard work of tracking and analyzing your money so that you can focus on making smart financial decisions.

3. Use Customer Reviews and Ratings

A best budget app for iPhone users can be purchased or downloaded from the App Store. A good way to learn more about the best budget apps for iPhone that you can purchase is to look at customer ratings and reviews.

Any iPhone budget app can be reviewed, which means that anyone who downloads personal finance apps through the App Store can rate it with 1 to 5 stars. They can also write a review detailing their experience.

This makes it easy to find the best finance apps for iPhone users, as you can learn which apps work well and read detailed explanations as to why.

There are some advantages and disadvantages to choosing the best budget app for iPhone users based upon customer reviews.

On one hand, you can listen to real-life accounts of how finance apps for iPhone work, and easily search through the App Store for the best budget app for iPhone users based on the highest ratings.

However, you may have to spend a significant amount of time sifting through customer reviews before you find finance apps for iPhone users that will work for you.

Related: Best Payroll Software for Small Business Firms | Ranking & Reviews

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

4. Consider Your Needs

Every person’s financial needs are unique. There is also a huge range of personal finance apps for your iPhone currently on the market.

Each budget planner app offers something a little different from the rest, and it is important to consider your needs and finances as you search for the best budget app for iPhone users.

Factors that might affect how you identify the best money mangement app include:

Financial Goals

One budget planner app may be focused on building savings, while another will be focused on organizing your finances. It is important to select bugeting apps for iPhone that will help you achieve your goals.

Access to Online Banking

Some of the best budget apps for iPhone users require access to an online bank account in order to work. If you do not have an online bank account, this is important to keep in mind as you select the best finance apps for iPhone users.

Desire to Pay for an App

There is a huge range of prices for the best budget apps for iPhones. There are free budgeting apps, but there will also be budget planner apps that charge for their use.

If you do not want to pay for a budget planner app, there are still plenty of options for you, but be aware of the cost of each iPhone budget app as you browse for the best budget app for iPhone users.

Manual vs. Automatic Activity Updates

A number of budgeting apps for iPhone users require that you manually record each of your financial transactions.

Some people might find this very helpful in keeping them aware of their cash flow, but some might find it to be too much to keep track of each day.

Make sure you are choosing the best finance apps for iPhone by taking style and memory into account.

Larger Financial Picture

There are finance apps for iPhone that allow you to focus on the larger financial picture by helping you track your credit score or investments.

If this is a feature that is important to you, closely examine the scope that each budget planner app will allow you to access.

5. Choose a Free or Paid App

Some people might ask, “Can the best free budgeting apps for the iPhone compete with paid apps?” The answer to that question is a resounding yes.

Many of the best free budgeting apps for the iPhone are just as highly, or even better, rated as the paid apps. When questioning the caliber of finance apps for iPhone, price is not necessarily an indicator of quality.

When it comes to choosing the best budget app for iPhone users, keep in mind that there can be a large gap in price, depending upon the budget planner app you choose.

Some are completely free of charge, some offer a free version and a more advanced version for a charge, and some cost as much as $50.

Because price is not always an indicator of quality, it is not always necessary to break the bank for a great budget planner app, especially when many of the best budget apps for iPhone are free.

The choice between a free and paid budget planner app is a personal one.

It all depends on whether or not you want to spend money on the best iPhone budget app, and it depends on which iPhone budget app is best for you.

There is an obvious benefit to using a budget planner app that is free to download, but above all, make sure finance apps for iPhone users that are best for your individual needs.

Popular Article: Best Financial Apps | Financial Planning Software Reviews

6. Consider the Wide Variety Available

There is a huge amount of variety in the features and services offered by the best budget apps for iPhone users.

This is a very good thing because managing your finances is an individual matter. Before choosing the best finance apps for iPhone, it is important to consider the wide range of products available.

A few examples may help to illustrate the kinds of features available:

Spendbook

Spendbook is not a free app; it can be purchased from the app store for $1.99.

This is a budget planner app that does not sync with your bank account, which makes it a good option for people who do not have online banking.

This best budget app for iPhone has a variety of expense category options, which allows users to be specific about their purchases.

It can track income and expenses and can create daily or monthly summaries of your finances, complete with charts. Spendbook has a 4-star rating on the App Store.

You Need A Budget

You Need A Budget, or YNAB, is one of the best budget apps for iPhone that approaches finances in a more holistic way.

While it does have features to help you make a budget, it is designed to help you learn about your finances and help you build a better financial life for yourself.

This iPhone budget planner app has systems to help you learn to account for and put all of your money to work, plan for emergencies, not become overwhelmed by slip-ups, and live on monthly earnings.

YNAB is a paid app, but it does offer a free 34-day trial so that you can decide if this best budget app for iPhone will work for you. Overall, YNAB has a 4-star rating on the App Store.

Image Source: Imore

PocketGuard

PocketGuard is an example of a finance app for iPhone that can be downloaded for free.

It syncs with your online bank account to automatically show you how much money you have coming in, going out, and available to spend.

PocketGuard can track your reoccurring expenses and help you plan for your regular payments. It can detect your cash flow and help you balance income and expenses.

This best budget app for iPhone users offers simple charts to help you identify spending problems by showing you how you tend to spend and displaying specific budget categories.

PocketGuard has a 4.5-star rating on the App Store.

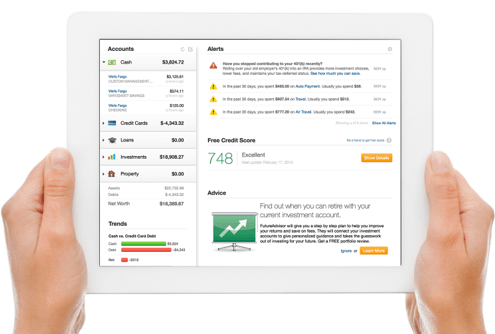

Mint

Mint is a free budget planner app that can sync with your bank account and use that information to help you create a realistic budget.

It allows you to make detailed budgets with customizable categories and can send notifications if you are approaching a budget limit. Mint can also display your credit score.

Image Source: Mint

The same company that developed TurboTax and Quicken produced this app. A big selling point for them is that have many years of experience working to keep their customers’ sensitive online information protected.

Mint has a 4.5-star rating on the App Store.

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: How to Find the Best App for Your Needs

Finding the best budget app for iPhone users can be an opportunity for you to examine your finances in a new light.

To make the best choice for your needs, it is important to consider your financial needs and goals. It is also key to explore what features will make you feel the most organized and in control.

To help you choose the best budget app for iPhone, keep our tips in mind:

- Understand the budgeting app

- Understand the benefits

- Use customer reviews and ratings

- Consider your needs

- Choose a free or paid budget planner app

- Consider the wide variety available

The old adage “knowledge is power” certainly rings true with personal finances. The more you know about your money and how it is moving, the better equipped you are to make important financial decisions.

The best finance apps for iPhone will help you to keep your information organized and at your fingertips so that you can be empowered and in control of your money.

Read More: Moneydance Review—What Is Moneydance? (Help, How To Use & Reviews)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.