2017 RANKING & REVIEWS

BEST CREDIT CARDS FOR CASH BACK

Why Should You Have One of the Top Cash Back Credit Cards?

Cashback offers aren’t exactly a new concept. In fact, they’ve been around for about 15 years or more, but cash back credit card offers continue to grow in value and popularity.

The concept of the best cashback credit cards is simple. The consumer spends on their card as they normally would, and they earn a type of rebate for that spending. In some cases with cashback offers, there are specific spending categories that the cardholder must spend in to receive cash back.

For example, some cards will give cash back only for gas and grocery purchases. Other cash back credit card offers may feature higher cash back percentages for certain spending categories, such as 5% or 3% for gas and grocery spending, and then a flat 1% cash back rate for everything else, just as an example.

The best cash back cards not only vary in terms of spending categories but also in how the cash can be redeemed. Most of the top cash back credit cards will offer a variety of redemption options so the cardholder can select what works best for them, such as having it credited to their statement or directly deposited into an existing checking or savings account.

Award Emblem: Best Cash Back Credit Cards

Consumers with great credit scores are more likely to qualify for the highest cash back credit card offers, although it is important to note that some of the top cash back credit cards do charge an annual fee.

Some of the best cash back cards will also offer a bonus for new cardholders, or for meeting certain spending criteria, such as $100 for spending a particular amount of money within a certain time frame, like three months after opening the account.

Along with looking at the highest cash back credit card offers, it’s important to also consider the costs associated with cash back credit cards, including the annual fee mentioned above, as well as the interest rate.

The following ranking of the best credit cards for cash back highlights not only the specifics of the cash back credit card offers but also other features of the cash back credit cards that allow them to rank well.

See Also: Top Credit Cards with No Balance Transfer Fee (15–21 Months with Zero Balance Fees)

AdvisoryHQ’s List of Top 11 Best Credit Cards for Cash Back

List is sorted alphabetically (click any of the credit card names below to go directly to the detailed review section for that credit card):

- BankAmericard® Cash Rewards™ Credit Card

- Barclaycard CashForward™ World MasterCard®

- Blue Cash Everyday® Card from American Express

- Blue Cash Preferred® Card from American Express

- Chase Freedom® Unlimited℠ Credit Card

- Chase Freedom® Credit Card

- PNC CashBuilder® Visa® Credit Card

- Quicksilver® from Capital One

- TRIO℠ Credit Card

- U.S. Bank Cash+™ Visa Signature® Card

- Upromise World MasterCard®

Top 11 Best Cashback Credit Cards| Brief Comparison

Credit Card | Annual Fee | Annual Fee | Cash Back Bonus | Cash Back Bonus |

| BankAmericard® Cash Rewards™ Credit Card | None | None | $100 | $500 |

| Barclaycard CashForward™ World MasterCard® | None | None | $100 | $500 |

| Blue Cash Everyday® Card from American Express | None | None | $150 – $350 | $500 |

| Blue Cash Preferred® Card from American Express | $95 | None | $250 – $450 | $1,000 |

| Chase Freedom® Unlimited℠ Credit Card | None | None | $150 | $500 |

| Chase Freedom® Credit Card | None | None | $150 | $500 |

| PNC CashBuilder® Visa® Credit Card | None | None | $100 | $1,000 |

| Quicksilver® from Capital One | None | None | $100 | $500 |

| TRIO℠ Credit Card | None | None | $100 | $1,000 |

| U.S. Bank Cash+™ Visa Signature® Card | None | None | $100 | $500 |

| Upromise World MasterCard® | None | None | $50 | First purchase – No amount specified |

Table: Top 11 Best Cash Back Cards | Above list is sorted alphabetically

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best Cashback Credit Cards

Below, please find the detailed review of each card on our list of top cash back credit cards. We have highlighted some of the factors that allowed these credit cards with cashback to score so well in our selection ranking.

Don’t Miss: Top Credit Cards With No Foreign Transaction Fees | Ranking | Credit Cards Without Foreign Transaction Fees

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

BankAmericard® Cash Rewards™ Credit Card Review

Bank of America is a global financial services company based in Charlotte, N.C., working with not only individual consumers but also businesses and institutions. The company has been serving customers and communities for more than 200 years, and the company has been consistently leading the way in terms of credit cards.

In fact, Bank of America introduced the first modern credit card, which went on to become known as the Visa.

Currently, Bank of America has an extensive number of credit card options, including not only cash back credit cards but also travel rewards cards, business cards, and options designed for consumers who want low interest on purchases and balance transfers.

Key Factors That Led to Our Ranking of This as One of the Best Cash Back Cards

Detailed below are features of the BankAmericard Cash Rewards™ card that led to its inclusion on this cashback comparison of the best credit cards for cash back.

Cash Back Rewards

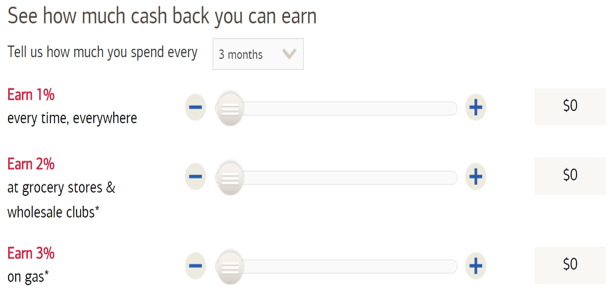

While there are many advantages to the BankAmericard Cash Rewards™ card for consumers searching for the best cash back cards, this ranking begins with details of the actual cashback offers it features. This card includes 3% on gas, 2% at grocery stores, and 1% cash back on every purchase for the first $2,500 in qualifying purchases each quarter.

Bank of America customers can also get a 10% customer bonus every time they redeem their cash back into a Bank of America checking or savings account.

The amount can increase even more for Bank of America Preferred Rewards clients. The bonus can increase anywhere from 25% to 75%.

Image source: Bank of America

Bonus Offer

As mentioned in the introduction to this cashback comparison of the best cashback credit cards and the highest cash back credit card offers, many card companies will offer not only their standard cashback rates but also the opportunity for new account holders to earn an additional bonus.

With the BankAmericard Cash Rewards™ card, there is the opportunity as of this writing to earn $100 in a cash reward bonus after making at least $500 in purchases in the first 90 days after opening the account.

This is a great bonus rate, particularly because the spending threshold is comparatively very low to earn the cashback bonus.

Fee and APR

When creating this ranking of the best cash back cards and the best cash back credit card offers, it was important to consider not just the actual offers, but also other things that can make a credit card good or bad from the perspective of the consumer.

Two of the main criteria consumers should consider are the annual fee of a card and the APR.

The BankAmericard Cash Rewards™ performs well in both areas, making it not just one of the best cash back cards, but an all-around great credit card.

First, there is no annual fee at any time to use this card.

Also, the card features an introductory 0% APR for the first 12 billing cycles for purchases and balance transfers made within 60 days of opening the account. After the introductory period, the card includes a low variable APR.

Card Features

The BankAmericard Cash Rewards™ card is one of the top cash back credit cards on this cashback comparison and just an all-around good card to have. The card has numerous built-in security features, which include the following:

- Bank of America automatically blocks potential fraud if patterns are detected

- The card includes a $0 Liability Guarantee for fraudulent transactions

- The ShopSafe service is free and easy to use, and it makes online shopping more secure and keeps the card number private and protected

- The card is chip-enabled

- This card can be linked to an eligible Bank of America checking account for additional overdraft protection

- The card can be used with digital wallet technology, including Apple Pay, Android Pay, or Samsung Pay

Barclaycard CashForward™ World MasterCard® Review

Barclaycard is a credit card provider backed by the scope and financial security of Barclays PLC. Barclaycard has a history of working with consumers for more than 50 years, and this credit card company partners with some of the top businesses to provide personalized services and innovative products. Barclaycard also donates 2% of their annual profits to local communities.

Barclaycard has a strong reputation of introducing innovative concepts and products to the credit card market, having created the first full-service credit card in Europe as well as the first no-fee travel rewards card.

Key Factors That Led to Our Ranking of This as One of the Top Cash Back Credit Cards

When comparing the best cashback credit cards, the following are details of why the Barclaycard CashForward™ World MasterCard® is included on this list as a best credit card with cash back.

Cash Rewards

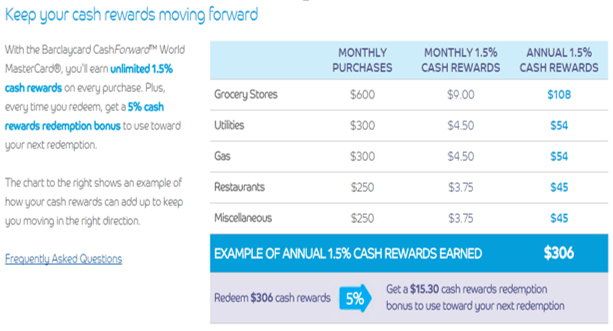

There are several components of the cashback offers that come with the Barclaycard CashForward™ World MasterCard® that make it broadly appealing. To begin, the card includes a competitive cash back earnings rate of 1.5% on every purchase.

Also, every time a cardholder redeems their cash back, they get a 5% cash rewards redemption bonus. That bonus can then be used toward the next redemption.

There is also a cash rewards bonus of $100 that’s included with qualifying transactions. The rewards bonus is available when a new cardholder spends $500 in purchases in the first 90 days after they open the account.

Simple Structure

As mentioned in the introduction to this cash back comparison of the leading credit cards with cash back, some card offers include a specific structure. For example, there might be higher cash back earnings on grocery store or dining purchases, and some cards also feature quarterly categories where consumers can choose to spend to earn higher rewards.

This may work well for some consumers, while other people are searching for a simpler, more direct cashback structure.

This card is for the consumers who want simple. There are no categories, and the cash back rate is the same across every purchase.

This makes it easy to know how much you’re earning, and you don’t have to think about categories.

Then, cash rewards can be redeemed as a deposit into a bank account, used as a statement credit, or redeemed for gift cards. They don’t expire as long as the account is active and in good standing.

Image source: Barclaycard CashForward™ World MasterCard

Introductory APR

The Barclaycard CashForward™ World MasterCard®, one of the best cashback credit cards, features not only a competitive APR on purchases, but for balance transfers, there is an introductory APR.

For 15 months there is a 0% APR on balance transfers made within 45 days of opening the account. This card is excellent not only because it’s one of the best credit cards with cash back, but also for balance transfers.

New cardholders have a great opportunity to consolidate their existing debt onto a low-cost card and earn cash back rewards while doing so.

This card is also a good value because it never has an annual fee.

Card Features

In addition to being one of the best credit cards for cash back on this cashback comparison, the Barclaycard CashForward™ World MasterCard® also has other features built-in that make it secure and convenient.

The card includes $0 Fraud Liability protection, so the cardholder isn’t responsible for unauthorized charges reported to the card company.

This card also features Chip card technology for more secure transactions at chip-enabled terminals around the world, and the card includes free online access to the cardholder’s FICO credit score so they can maintain their credit and check for any changes on a regular basis.

Related: Top Hotel Rewards Programs & Hotel Credit Cards | Ranking and Reviews

A global leader regarding credit card services, American Express is the world’s largest credit card issuer by purchase volume, and they also offer small business cards and tools, customer loyalty programs that lead the industry, and American Express operates one of the largest travel networks in the world.

American Express is also a credit card company that’s recognized as being one of the most innovative in the world, with millions of transactions processed daily. From premium cards for high-spending members to concierge services, many cards and services make American Express a standout among credit card providers and servicers.

Key Factors That Led to Our Ranking of This as One of the Top Cash Back Credit Cards

Among the highest cash back credit card offers and the overall best cash back cards, the following list highlights reasons the Blue Cash Everyday® Card ranks well.

Cash Back Structure

The Blue Cash Everyday® Card ranks well for its credit card cash back program for several reasons, including the fact that it’s particularly valuable for people who make a lot of purchases at grocery stores. The cash back rate for U.S. supermarket purchases is 3%, up to $6,000 per year in purchases. After the $6,000 threshold is reached, it goes to 1%.

It’s not just supermarket purchases that are part of the cashback offers with this card, however: 2% cash back is earned at certain U.S. department stores and U.S. gas stations. There is a 1% cash back rate on other purchases.

Cash back is received as Reward Dollars that can then be redeemed as a statement credit.

Special Offers

The Blue Cash Everyday® Card is included in this cashback comparison of the best cashback credit cards not only for the standard cash back rates and structure but also because of the special offers featured by American Express.

For example, the current promotional offer from American Express for new cardholders who sign up for this account is earnings of up to $450 back. First, for new applicants, there is the potential to earn 10% back on Amazon purchases made on the card in the first six months of card membership up to $200.

Then, new cardholders can earn an additional $250 back when they spend $1,000 in purchases on the card within the first three months of card membership.

Value

It’s important to be careful to check the costs of using cash back credit cards, because even though the cashback offers might sound great, there can often be fees and high interest rates associated with the cards. For the purposes of this ranking of the top cash back credit cards and the highest cash back credit card offers, we also took into account the fees and interest rates of each named card.

The Blue Cash Everyday® Card has no annual fee.

It also has a 0% introductory APR on not only purchases but also balance transfers for 12 months. After that, the APR is variable and ranges from 13.24% to 23.24% at the time of this writing.

Other Benefits

This leader among cash back credit cards features another opportunity to earn and accelerate the credit card cash back offer. Rewards can accumulate faster when the cardholder adds additional cards for family and friends.

Cash back can also accelerate when the card is used for monthly spending, such as paying a phone bill.

This card also features a variety of travel, shopping, and entertainment benefits.

For example, there is the availability of travel accident insurance and car rental loss and damage insurance. Cardholders can take advantage of extended warranties offered by American Express, and like the other cards from this top company, cardholders can also use American Express service to gain access to entertainment events.

Popular Article: Top UNSECURED Credit Cards to Rebuild Credit | Ranking | Unsecured Cards to Build Credit for Bad, Poor, & No Credit Individuals

Blue Cash Preferred® Card from American Express Review

As mentioned above, American Express is a global leader in the provision and development of valuable credit card products, and in particular cash back credit cards and rewards cards. Consumers often prefers American Express because of their extensive customer loyalty programs and comprehensive rewards programs that allow them to earn not only credit card cash back, but travel miles and more.

The Blue Cash Preferred® Card from American Express has many similarities to the card ranked above but is designed for higher spenders and people who want some of the highest cash back credit card offers on certain categories. The Preferred Card is really like a supercharged version of the Blue Cash Everyday® Card.

Image source: American Express

Key Factors That Led to Our Ranking of This as One of the Best Cashback Credit Cards

Features of the Blue Cash Preferred® Card from American Express that allowed it to rank as one of the best credit cards with cash back are highlighted below.

Sign Up Offer

In addition to offering one of the best credit card cash back programs overall, the Blue Cash Preferred® Card from American Express was also included in this ranking because it has excellent sign-up offers.

The current offer includes the ability to earn up to $450 cash back. First, when new applicants are approved for this card, and they’ve applied by 1/11/17, they will earn 10% back on Amazon purchases made with their card within the first six months of card membership, up to $200.

Then, there is the opportunity to earn $250 cash back after spending $1,000 on purchases on the card in the first three months of having the account.

The cash back is received as a statement credit.

APR

There is an annual fee of $95 to use this card, although many consumers find it’s offset by the card having some of the highest cash back credit card offers.

Despite the fact that there is a yearly fee for the Blue Cash Preferred® Card from American Express, some of the cost of this card is offset by the availability of an introductory APR rate. New cardholders gain the advantage of a 0% introductory APR.

The 0% APR is valid on purchases and balance transfers for 12 months, and after that, it goes to a variable rate.

Cash Back Tiers

One aspect of the Blue Cash Preferred® Card from American Express that indicates it has one of the highest cash back credit card offers available is the 6% cash back rate on grocery store purchases, up to $6,000 per year.

After the $6,000 threshold is reached, it goes to 1%. As one of the credit cards with cashback rewards on supermarket purchases, this can be an excellent option for a family with high food costs. The cash back is received as Reward Dollars, which can then be redeemed as a statement credit.

It’s not just a 6% cash back rate on groceries that comes with this card, however. There’s the opportunity to earn 3% cash back at U.S. gas stations and certain department stores.

For all other purchases, the Blue Cash Preferred® Card from American Express features 1% cash back.

Shopping Benefits

One of the unique things about American Express cards, including the best cash back cards offered by this company, are the extensive benefits that come standard with each product. For example, there is a suite of shopping benefits that come with this best credit card for cash back. These benefits include:

- Extended Warranty: With this service, the length of a warranty may be matched up to an additional year when an American Express Card is used for eligible purchases. The purchases must come with an original U.S. manufacturer’s warranty of five years or less.

- Return Protection: If a customer tries to return an item purchased with their card within 90 days from the date of purchase and the merchant won’t take the return, Return Protection may provide a refund on the eligible item.

- Shoprunner: This service delivers free 2-day shipping on qualifying purchases from more than 140 online stores and over 1000 brands.

Read More: Top Credit Cards for Very Bad Credit | Ranking | Cards for Damaged, Horrible, and Really Bad Credit Histories

Chase is part of the JPMorgan Chase company, and this bank offers checking accounts, savings accounts and CDs, and mortgages, among their many other products and financial services. Chase has 5,200 nationwide branches as well. Chase isn’t just known for being a bank, however. They also have one of the widest selections of credit cards available, including cash back credit cards.

Image source: Flickr

There are also rewards cards featuring partnerships with some of the world’s leading brands, like Disney, Marriott, Hyatt, United, and Southwest Airlines. Chase strives to provide not only the best cash back cards but also the best overall cards to suit a variety of lifestyles.

Key Factors That Led to Our Ranking of This as One of the Top Cash Back Credit Cards

When looking at the best credit cards for cash back and the best cash back credit card offers, the following are details of why the Chase Freedom® UnlimitedSM Credit Card is included in this cashback comparison.

Simplicity and Ease of Use

When you start to read in customer reviews what they like about the Chase Freedom® UnlimitedSM Credit Card and why they would call it one of the top cash back credit cards, simplicity and ease of use are often at the top of the list.

This leader among the best cash back cards is accepted nearly anywhere, and the cashback offers are direct and easy to understand.

There are no spending categories with this card or different cashback offers for various types of purchases. Instead, the cashback percentage rate is the same regardless of the purchase, and it’s automatic. Cashback can then be redeemed at any time and in any amount.

Unlimited Cashback

In addition to a cashback program and structure that’s simple and offered on every purchase automatically, the program is also well-rated because the credit card cash back is unlimited.

This means cardholders earn an unlimited 1.5% cash back rate automatically on every purchase.

Many of even the best cash back cards will have limits on the amount of spending a cardholder can earn cashback on, but that isn’t the case with this card, which is a big part of the reason it’s included on this list of the best credit cards for cash back.

Bonus

Along with the opportunity to take advantage of unlimited, automatic cash back without limitations based on spending or categories, the Chase Freedom® UnlimitedSM Credit Card also includes a bonus offer, another reason it’s one of the best credit cards for cash back.

When a new cardholder signs up for an account, they’re eligible for a $150 bonus after spending $500 on purchases in the first three months from opening the account. They can also earn a $25 bonus when they add their first authorized user to the account who then goes on to make their first purchase within the same three-month introductory period.

This offer is only available to people who don’t currently have this card and who haven’t received a new cardmember bonus for this card in the past two years.

Fee and APR

Among the best cashback credit cards and the cash back credit card offers included in this ranking, most do not have an annual fee. That is the case with the Chase Freedom® UnlimitedSM Credit Card, which requires no fee to use.

Also, this card is a good value and is included on this list of the top cash back credit cards because there is an extended introductory APR offer. The 0% intro APR lasts for 15 months, which is longer than most other cards offer, including many of the names on this list of the leading credit cards with cash back.

This introductory APR period is applicable on both purchases and balance transfers.

Related: Top Cheap Credit Cards | Ranking | Best Low Credit Card Interest Rates (Cheapest & Lowest)

Chase Freedom® Credit Card Review

Chase is known for offering some of the best credit cards on the market. One example is the Chase Freedom® UnlimitedSM credit card, which is ranked and profiled above on this list of the best credit cards for cash back. Other popular cards from Chase include the Chase Slate® credit card, which is great for balance transfers because there is an introductory balance transfer opportunity to save on interest, and the Chase Sapphire Preferred® credit card, which has some of the highest rewards on travel and dining.

In terms of cashback comparison, along with the Chase Freedom® Unlimited℠, the Chase Freedom® credit card is one of the best credit cards for cash back, with some similarities to and some differences from the Chase Freedom® Unlimited℠.

Key Factors That Led to Our Ranking of This as One of the Best Credit Cards to Have

The Special Connections card was included on this list of the best credit cards to apply for and the best credit cards to own for the reasons listed below.

Spending Categories

This card is unique from many of the other best credit card cash back products even on this cashback comparison because it offers bonus spending categories.

These cashback offers make this card one of the highest cash back credit card offers available.

With this card, you have the chance to earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter. Then, there is unlimited 1% cash back on all other purchases outside of the selected bonus categories.

In 2016, for example, January-March offered bonus cashback on gas station purchases, while April through June was grocery stores, and in July through September, the bonus category was restaurants.

Image From: Chase Credit Cards

New Cardmember Bonus

As one of the best credit cards for cash back, this card also features a new cardmember offer.

Currently, along with the 5% cash back on up to $1,500 in combined purchases in bonus categories that are activated each quarter and 1% unlimited cash back on all other purchases, new cardholders can get a $150 bonus after spending their first $500 on purchases in the first three months from account opening.

There is also the opportunity to earn an additional $25 bonus for adding the first authorized user to the card and making the first purchase within the same three-month period.

Flexible Redemption Options

When cardholders take advantage of the Chase Freedom®, one of the best cash back cards, they have flexible redemption options and cashback offers they can take advantage of.

For example, one option is to receive a statement credit or direct deposit, which can be made into most U.S. checking and savings accounts, starting at $20.

Another option is to link the Chase Freedom with an Amazon account. Then, the cardholder can instantly redeem their rewards to pay for some or all of their eligible orders at checkout, including taxes and shipping.

Also available is the option to redeem for gift cards and certificates or to book travel with Chase Ultimate Rewards.

Extended Introductory Period

As is the case with the Chase Freedom Unlimited, another one of the best credit cards for cash back on this cashback comparison, the Chase Freedom card features an extended introductory APR period, which is one of the prime advantages of this leader among cash back credit cards.

Cardholders can take advantage of a full 15 months of no interest on both purchases and balance transfers.

This card also has no annual fee, making it an excellent value among credit cards with cashback.

PNC features retail banking solutions to individual consumers and business clients across 19 states and Washington D.C. PNC is also the creator of the Virtual Wallet, which is an award-winning platform designed to help people save and spend smarter while avoiding fees. They also created Cash Flow Insight, aimed at helping small businesses track and manage their cash flow.

In terms of cards, PNC features some of the best cash back cards and cash back credit card offers, including the PNC CashBuilder® Visa® Credit Card.

Key Factors That Led to Our Ranking of This as One of the Best Credit Cards for Cash Back

Among credit cards with cash back, the following are some of the key features of the PNC CashBuilder® Visa® leading to its inclusions on this ranking of top cash back credit cards.

Tiered Cash Back

What’s unique about the PNC CashBuilder® Visa® compared to other cashback offers and cash back credit cards is the tiered structure of the cash back earning potential.

The credit card cash back structure is outlined in the following way:

- With the PNC CashBuilder® Visa®, there is a 1.25% cash back rate on net purchases in the next billing cycle after the cardholder makes adjusted purchases totaling $1,999.99 in the billing cycle prior

- Cardholders can earn 1.50% cash back on net purchases in the next billing cycle after making adjusted purchases totaling $2,000-$3,999.99 in the previous billing cycle, or if they have a Performance Checking account or Virtual Wallet with Performance Spend and meet minimum balance or direct deposit requirements

- For 1.75% cash back, cardholders have to make adjusted purchases totaling $4,000 or more in the prior billing cycle or maintain a Performance Select Checking account or Virtual Wallet with Performance Select and meet minimum balance or direct deposit requirements

Flexible Cash Back Options

With some credit cards with cash back and cashback offers, there are rigid requirements and program restrictions. The PNC CashBuilder® Visa® ranks well on this list of the top cash back credit cards and premier credit cards with cashback because the program is flexible.

For example, cardholders earn the same cash back rate on all categories. This includes spending on travel, groceries, gas, and everything else. There’s also the unlimited potential to earn cash back, and it can be redeemed with only a $50 accumulation.

The cash back rewards earned from the PNC CashBuilder® Visa®, one of the top cash back credit cards, don’t expire, and it can be credited directly to the credit card account or deposited into a PNC savings or checking account.

Introductory Offer

The PNC CashBuilder® Visa® packs a punch for consumers not only regarding being one of the leading credit cards with cash back, but it also includes a great introductory offer and a low variable interest rate.

This leader among credit cards with cashback includes an introductory 0% APR on balance transfers for the first 12 billing cycles after the account is opened. The balance must be transferred within the first 90 days after the account is opened to take advantage of this offer.

Once the 12-month introductory period ends, the variable APR currently ranges from 13.24% to 22.24%, based on the market and creditworthiness.

Additional Features

As well as great credit card cash back features, this card is also included on this cashback comparison because it boasts a suite of other perks and benefits for cardholders. Some of these benefits include:

- Integration with PNC Online Banking and Virtual Wallet

- No annual fee

- A dedicated customer service team based in the U.S. available 7 days a week

- Electronic bill payment options for easy, on-time payment

- Online account tools to manage rewards, transactions, payments, and balances

- Protection from credit and identity fraud

- $0 Fraud Liability

- Travel and emergency protection

Don’t Miss: Top Credit Cards in Canada | Ranking | Compare the Best Cash Back, Travel, and Top Cards

Along with offering some of the industry’s most competitive cash back credit cards and cash back credit card offers, Capital One also features a wide variety of other valuable rewards credit cards. For example, with options like the Venture from Capital One Card, cardholders get unlimited 2x miles, which means 2 miles for every dollar spent on purchases.

One of the top cash back credit cards in the industry is the Quicksilver® from Capital One, which offers flexibility, great cashback offers, and many other benefits that are valuable to consumers with good credit.

Key Factors That Led to Our Ranking of This as One of the Best Cashback Credit Cards

When comparing the highest cash back credit card offers and the best credit cards for cash back, the following are top reasons the Quicksilver® was listed on this cashback comparison.

Unlimited Rewards

The Quicksilver®, as one of the best credit cards for cash back, offers some of the most flexible and simple to use cashback offers. The credit card cash back plan that comes with the Quicksilver® includes 1.5% cash back on every purchase, every day.

This card is excellent for someone who’s looking for cash back credit cards that are easy to use and don’t have different spending categories.

In addition to having a straightforward and best credit card cash back plan, the Quicksilver also features unlimited cash back. The 1.5% earning potential isn’t subject to any spending limitations, so as long as you’re making purchases, you can keep earning.

Cash Bonus

During the process of ranking the highest cash back credit card offers and the best cash back cards, one of the most essential things considered was whether or not they provided any cashback bonus offers on top of the standard credit card cash back plan.

The Quicksilver® does have a bonus, and that bonus carries with it a relatively small purchase requirement to earn it.

The Quicksilver® card includes a $100 cash bonus for new cardholders who spend $500 on purchases within the first three months after opening the account.

As well as one of the best credit card cash back bonuses, this card also has no annual fee, which are both key reasons it was selected as one of the top cash back credit cards.

Visa Signature® Benefits

As the Quicksilver® leads the way among credit cards with cash back, this valuable card also comes with built-in Visa Signature® Benefits. These include:

- Complimentary travel upgrades

- Special savings at hotels, resorts, and spas when booked with the card

- Complimentary concierge service with Visa Signature Concierge

- Special access and preferred seating at events, including sports, golf, and concerts

- Shopping discounts at top retailers

- Extended warranty protection at no charge for items purchases with the card

- 24-hour travel assistance services

Introductory APR

The Quicksilver®, like the other cards on this list of the best credit card cash back programs and the best cashback credit cards, represents excellent value for the consumer. There is no annual fee for the Quicksilver®, but that’s not the only financial benefit of owning this card.

The Quicksilver® has an introductory 0% APR for nine months on all purchases. After that, the APR remains very low.

Along with an introductory APR rate on purchases, this leader among cash back credit cards also features a 0% APR on transfers for nine months.

The TRIOSM Credit Card is unique from most of the other top cash back credit cards included on this cashback comparison because it’s from Fifth Third Bank, which is a smaller bank. Most of the other cash back credit card offers and credit cards with cash back featured on this ranking are from very large national and international financial services companies.

Despite that difference, the TRIO is packed with just as many of the features and benefits of the other best cashback credit cards that set them apart and make them such a good option for many consumers.

Key Factors That Led to Our Ranking of This as One of the Top Cash Back Credit Cards

The TRIOSM Credit Card ranked well among the best credit card cash back options and credit cards with cashback for reasons like the ones that follow.

New Account Bonus

Most of the best credit cards for cash back feature new account bonuses in addition to the standard cashback offers, at least in terms of the cash back credit cards included in this ranking. The TRIOSM Credit Card is no exception. This card features a new account bonus worth $100.

To earn 10,000 in Real Life Rewards Bonus Points, which can be redeemed for $100 cash back, new cardholders simply have to spend $1,000 within 90 days of opening the account.

That’s in addition to the other perks that come with this leader among credit cards with cash back, including the fact that there is no annual fee to use it.

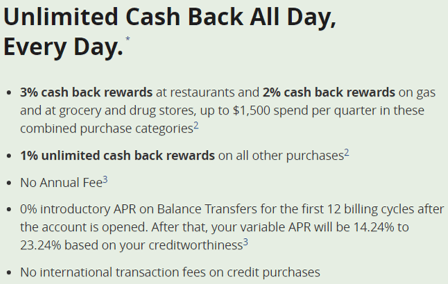

Dining Rewards

Among credit card cash back programs, the one offered by the TRIO℠ card is unique because it offers the highest percentage of cash back rewards on restaurant spending. This makes it one of the best credit cards for cash back if you frequently dine out.

There is a 3% cash back rewards rate when the card is used at restaurants. There’s also 2% cash back on gas, grocery, and drug store purchases, up to $1,500 spending per quarter in combined purchase categories.

There is an unlimited 1% cash back rewards rate on all other purchases.

Image source: TRIOSM Credit Card

Fees and Interest

The TRIO℠ card not only has excellent opportunities to earn credit card cash back, but it’s also an inexpensive card. As mentioned above, there is no annual fee for the use of this card.

There is also a 0% introductory APR on balance transfers for the first 12 billing cycles after the account is opened. This means it’s not only one of the best cash back cards, but it’s also a great option if you’re primarily interested in balance transfers.

There are no international transaction fees on credit purchases, either.

MasterCard Travel Services

This card, one of the best credit cards for cash back, features built-in MasterCard premier benefits that make it more convenient to use, and these advantages provide cardholders with a sense of security and peace of mind.

- MasterCard Priceless Cities: This is an exclusive benefit for certain MasterCard account holders where they can receive access to behind-the-scenes access, tickets, and private event invitations around the world.

- MasterCard Airport Concierge: Cardholders get their own concierge to help them through the airport more conveniently.

- MasterCard Concierge Services: This includes assistance with dinner reservations, event tickets, coordinating business arrangements, and more.

- MasterCard Travel Service: An expert travel advisor can help cardholders plan their trips.

Popular Article: Top Credit Cards with Travel Insurance, Roadside Assistance, & Travel Rewards | Ranking & Comparison Reviews

U.S. Bank not only excels at offering excellent cash back credit card offers and some of the best cash back cards available. This full-service financial company is the 5th largest commercial bank in the U.S., with more than 3,100 banking offices around the U.S. and a presence in 25 states. Along with cash back credit cards, U.S. Bank also offers deposit accounts, investments, mortgages, trust, and payment services.

Image source: US Bank

One of the leading and highest cash back credit card offers from this bank is the U.S. Bank Cash+™ Visa Signature®, which is flexible and offers plenty of choices in addition to high-level credit card cash back earning opportunities.

Key Factors That Led to Our Ranking of This as One of the Best Cash Back Cards

Among credit cards with cash back, the following are top reasons this card was selected for this cashback comparison of the best cashback credit cards.

Category Selection

The goal of the U.S. Bank Cash+™ Visa Signature® is to give cardholders a sense of choice regarding where they spend and where they earn cash back. Among credit cards with cash back, this one tends to offer a lot of flexibility.

There is a 5% cash back spending category, which is actually one of the highest cash back credit card offers even on this ranking of the best credit card cash back programs.

This is available on the first $2,000 in combined net purchases each quarter in two categories. These categories are selected by the cardholder, so you can choose the categories you spend the most in, according to your lifestyle.

Other Categories

While the 5% cash back reward opportunity is one of the most eye-catching components of this best credit card cash back program, there are other earnings opportunities as well.

The first is the ability to earn 2% cash back on the cardholder’s choice of one everyday category. For example, you might choose groceries to be that category, so you’ll earn 2% on your eligible grocery purchases.

There’s also 1% cash back on everything else.

Another standout feature of the U.S. Bank Cash+™ Visa Signature® that makes it so compelling and led to its inclusion on this list of the top cash back credit cards is the fact there are no limits on the total cash back earned.

Other Financial Perks

This card combines so many benefits into one, which is why it’s one of the credit cards with cash back that was included in this ranking of the best cashback credit cards. Along with offering one of the highest cash back credit card offers, and flexible spending categories, the U.S. Bank Cash+™ Visa Signature® has other benefits that make it a great value.

The first is that new cardholders can take advantage of a 0% introductory APR for the first 12 billing cycles on any balance transfers that occur within 60 days of opening the account.

Also, there is no annual fee for the U.S. Bank Cash+™ Visa Signature®, one of the best credit cards for cash back on this cashback comparison.

Visa Signature Benefits

Not every Visa credit card includes Visa Signature Benefits, but the U.S. Bank Cash+™ Visa Signature® does, so it’s great from the perspective of being one of the top cash back credit cards and also in terms of overall value and perks.

One feature of the Visa Signature Benefits program is the Visa Signature Concierge, which helps cardholders receive assistance with reservations, travel planning, and more.

There are also a variety of exclusive upgrades, discounts, access, and special offers on everything from wine and food to shopping and sports.

The Upromise® World MasterCard® Review

The Upromise® World MasterCard® is from Barclaycard, and as mentioned above, this card company has a history spanning decades, leading to innovation and some of the premier offerings not only in terms of credit cards with cashback, but overall personal finance products and services.

Barclays Bank, also called Barclaycard, issues many different types of the best cash back cards and features an array of cashback offers, typically through partnerships with other leading organizations. The Upromise® World MasterCard® is a distinctive name on this list of the best cash back cards because it’s offered through a partnership with student loan lender Sallie Mae.

Key Factors That Led to Our Ranking of This as One of the Best Credit Cards for Cash Back

Cited below are reasons the Upromise® World MasterCard® is part of this listing of credit cards with cash back and the best cash back credit card offers.

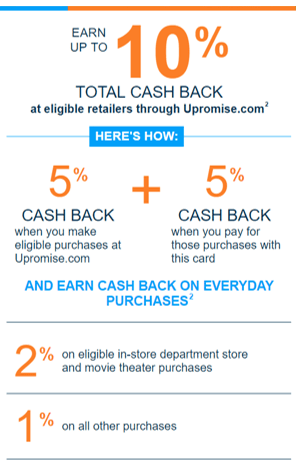

Highest Cash Back Credit Card Offers

The Upromise® World MasterCard® features what is undoubtedly one of the highest cash back credit card offers available compared to any other card, and there is the possibility to earn up to 10% total cash back through retailers listed on Upromise.com.

First, this leading credit card cash back option offers 5% cash back on eligible purchases made at Upromise.com. Then there’s the opportunity to earn another 5% cash back when those purchases are paid for with the card.

That’s not all, however. This best credit card cash back program features 2% earned on eligible in-store department store and movie theater purchases and 1% on all other purchases.

Image source: The Upromise

Redemption Options

The Upromise® World MasterCard® is unique from so many other credit cards with cashback, including the other names of the best cash back cards on this list because it’s designed for education expenses.

This card by Sallie Mae lets cardholders receive their cash the way they want, which can mean redeeming it for checks of $10 or more every month, or contributing to an eligible 529 College Savings Plan.

Cardholders can also arrange to have the cash back deposited into a Sallie Mae High-Yield Savings Account, or they can use it to make payments toward an eligible student loan.

This card isn’t just one of the credit cards with cash back. It’s a unique opportunity for families and students to earn money for college and education expenses by seamlessly incorporating it with their everyday spending. This allows for the faster, easier growth of education funds.

Introductory Rate

Along with having no annual fee to use the Upromise® World MasterCard®, this card represents excellent value for anyone searching for the highest cash back credit card offers and the overall best cash back cards.

One of the reasons is because of the introductory rate, which is longer than what’s offered with many cards, lasting 15 months. New cardholders have a 0% intro APR for 15 months on balance transfers made within 45 days of opening the account.

Other Benefits

The Upromise® World MasterCard® offers a plethora of benefits, including the ability to take advantage of one of the highest cash back credit card offers and also to save money more quickly to pay for education expenses simply by making everyday purchases.

There are also other perks that come with this card, one of the top cash back credit cards. These include:

- $50 cash back bonus after the first use of the card within 90 days after opening the account

- Chip technology

- After the initial interest rate period with the introductory rate, interest remains competitively low

This cashback comparison highlights the best cash back cards, which are all distinctive, despite their similar cashback offers. Many of the cards named on this cashback comparison offer not just the highest cash back credit card offers, but they also have other advantages, like 0% introductory APRs, bonus cashback offers, and low or nonexistent annual fees.

These top cash back credit cards are ideal for consumers who want to get the maximum value from their credit card because they’re earning as they spend.

For anyone searching for the opportunity to optimize their use of a credit card, the names on this list of the best credit cards for cash back are an excellent option.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.