RANKING & REVIEWS

TOP PERSONAL FINANCE SOFTWARE

Top 5 Best Personal Finance Software Apps for Mac, iPhone, Android, and Windows

Practicing effective personal finance management is an ongoing struggle for Americans, especially when it comes to budgeting, saving, and planning for the future.

In fact, a recent Gallup poll showed average daily spending at the highest it’s been in the past decade, with most Americans spending $103 daily in June.

With high levels of spending, maintaining a budget and practicing effective personal finance management is crucial—but according to Gallup, only 30 percent of Americans are actively using long-term financial tools for budgeting and saving.

Despite the importance of maintaining a budget and practicing effective personal financial management, there’s no doubt that managing your finances can be tedious, complicated work.

Thankfully, with the help of personal finance software and money management software, attaining effective personal finance management can be just as simple as opening a web browser or downloading a mobile app.

If you’re considering using money management software or budgeting software for the first time, how do you know which is the best personal finance software to choose? What’s the difference between free personal finance software and subscription-based personal financial software?

Even further, how can you tell which financial planning software or personal finance app is dependable enough to provide a reliable, accurate, and holistic view of your financial state?

Award Emblem: Top 5 Best Personal Finance Software

Knowing what to look for—and comparing the best personal finance software programs against each other—is a great way to find the best money management software to meet your individual needs.

After conducting an extensive level of due diligence research and analysis, we have identified five of this year’s top personal finance apps and financial planning software that are poised to provide high levels of value for years to come.

This complete ranking presents this year’s most noted and powerful personal finance software, allowing users to easily monitor transactions, plan for their financial future, and access powerful budgeting tools.

If you’re interested in what the best personal finance software could do for your own personal finance management, stay tuned—this review will show you everything you need to know about the best personal finance software to consider using this year.

AdvisoryHQ’s List of the Top 5 Best Personal Finance Software

List is sorted alphabetically (click any of the software names below to go directly to the detailed review section for that personal finance software):

Top 5 Best Personal Finance Software | Brief Comparison & Ranking

Best Personal Finance Software | Cost | Highlighted Features | Best For |

| Mint | Free | Create personal budget and pay bills | Individuals |

| Personal Capital | Free | Monitor and manage all aspects of your finances, including investments | Individuals, investors |

| QuickBooks | $10-$50 per month, Free 30-day trial | Powerful payroll and tax tools | Businesses, self-employed individuals |

| Quicken | $39.99-$119.99 | Customized budgeting tools | Individuals, businesses, and landlords |

| You Need A Budget | $50 per year, 34-day free trial, | Dynamic, in-depth budgeting support | Individuals, college students |

Table: Top 5 Best Personal Finance Software | Above list is sorted alphabetically

Essential Features to Look for When Searching for the Best Personal Finance Software for Mac, iPhone, Windows, & Android

If you aren’t used to evaluating personal finance apps and financial planning software, it’s hard to know where to begin.

Some important features to consider when searching for the best personal finance software or personal finance app to meet your budgeting, financial planning, and savings needs include:

- High-level security

- Fast, real-time execution

- An easy-to-use interface

- Powerful, customizable features

- Easy categorization of transactions

- Reliable performance via desktop or app

Based on the wide-ranging spectrum of financial planning software platforms available, how can you find time to conduct the detailed research needed to identify the best financial software with the most valuable financial tools?

Luckily, we’ve done the hard part for you when it comes to finding the best personal finance software. Our financial software review is expertly poised to address the following consumer questions about budgeting and financial software:

- Which tool is the best personal finance software to use?

- What is the best money management software for budgeting?

- What is the best personal financial software for Mac, desktop, Android, iOS, etc.?

- Can personal accounting software also manage investments?

- Which financial software is easiest for beginners to use?

Additionally, one of the most common consumer questions is about free personal finance software. If you’re worried about costly personal budget software, don’t stress—effective financial planning software doesn’t have to come with a hefty price tag!

While not every personal finance software comes free of charge, each financial planning software highlighted here comes packed with affordability, efficiency, dynamic financial tools, and high overall value for a wide range of users.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best Personal Finance Software

Below, please find a detailed review of each personal finance software on our list of top financial apps. We have highlighted some of the factors that allowed these financial tools to score so high in our selection ranking.

See Also: Tips for Getting the Most out of Acorns Investing (Review)

Mint Review

Mint is a powerful personal finance software which allows users to create budgets, pay bills, and gain better control over their finances.

As one of the top personal finance apps, it provides comprehensive personal finance management beyond simple budgeting, including the ability to monitor credit score and track your investment portfolio.

After two short years, Mint was acquired by Intuit for $170 million, bringing this personal finance app alongside leading personal finance software like QuickBooks, Quicken, and Turbo Tax.

Key Factors That Led to Our Ranking of This as One of the Top Finance Apps

Below, please find a detailed list of the features which led to our selection of Mint on this list of the best personal finance software and personal budget software.

Free Personal Finance Software

For those who are looking for the best money management software that won’t cost an arm and a leg, Mint is a great option.

Not only is Mint’s personal accounting software available free of charge, but it also comes with a range of powerful financial tools that easily compete with high-priced money management software.

Although this personal finance software is currently available only for U.S. citizens, the widespread popularity of Mint’s personal accounting software could point to a global expansion in the years to come.

Device Compatibility

Is Mint a great personal finance software for Mac users? Absolutely. It’s also one of the best personal finance software options for Windows, or any kind of PC.

When it comes to using Mint’s money management software, it doesn’t matter what type of device you are using. This personal finance software is readily available through any internet browser.

If you would prefer to use a personal finance app to access your finances on the go, Mint is fully mobile. Mint has free personal finance apps for both phones and tablets, including iOS and Android users.

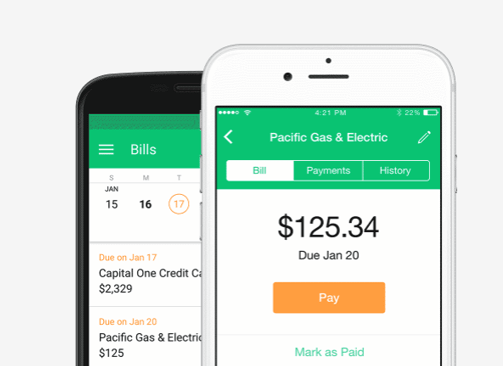

Track & Pay Bills

For some users, remembering to pay bills on time is a major part of effective personal finance management.

With Mint Bills, money management software will monitor upcoming due dates, credit card statements, and bank statements to ensure that nothing slips through the cracks.

You can even use Mint to pay bills online, eliminating the need to visit multiple websites and enter multiple log-ins each time.

Along with paying bills and getting due date reminders, Mint Bills also lets you see available cash and credit alongside your upcoming payments, so you’re never in the dark about what you have to spend and what you need to pay.

Budgeting & Categorization

Mint has some of the best budgeting software around, using intuitive categorization to help users identify problem areas, see spending patterns, and create workable budgets that they can stick to.

Based on spending patterns, Mint’s personal finance software will suggest a budget that users can customize as they please.

Using money management software from Mint can help you gain greater control over your personal finance management, providing the ability to plan ahead and see exactly where your money is going.

Categorization is a huge part of what makes this personal budget software so effective—there are hundreds of naming categories to choose from, helping users personalize each and every transaction.

With Mint’s user-friendly financial software, it’s easy to re-name, re-categorize, split transactions, and even apply category rules for future purchases.

High Security

Since this best money management software comes from the makers of TurboTax and QuickBooks, there are strong security measures in place to protect sensitive data.

Mint uses the same 128-bit SSL encryption that is used by major banks, and it is continuously verified and monitored by VeriSign, an online security firms.

Our Mint review found that this money management software also uses multi-factor authentication to protect each account, which includes:

- 4-digit user code

- Touch ID enabled

- Security questions or code sent to email or text

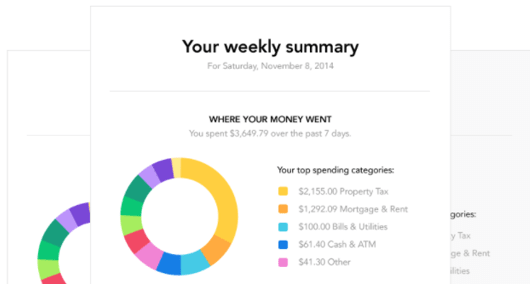

Efficient Reporting

Part of using the best financial software means finding money management software that you can count on to keep you knowledgeable about your finances.

As one of the best personal finance software options, Mint focuses on providing consistent, easy-to-understand updates on personal finance management. Users will receive a weekly summary to see how much was spent and in what categories.

Additionally, Mint uses plain English throughout their financial software, making it easy for new budgeters to adjust to this personal finance management software.

Could Mint Be the Best Personal Finance Software for You?

Mint has long been considered one of the best financial planning software and best money management software around. Not only does it come with powerful financial tools, but it’s also formatted to make personal finance management easy and accessible for everyone.

Even better, Mint continues to be offered as a free personal finance software, making it the top choice for newcomers to financial management.

Ultimately, Mint’s personal finance software has a better tracking and management algorithm than Quicken, a key reason why it was acquired by Intuit.

One key difference is that Mint is an online personal financial planning software, while Quicken’s financial planning software needs to be downloaded to your computer.

The benefit is that Mint never needs to be upgraded, while you’ll need to upgrade and maybe pay for the new version of Quicken.

Although Mint is one of the best money management software options available, it’s worth noting that there are plenty of compelling reasons to choose Personal Capital as your personal best financial software—and many believe that Personal Capital is the number one best personal finance software on the market today.

Don’t Miss: AceMoney Review – Is AceMoney Safe? (AceMoney Lite Review & Reviews)

Personal Capital Review

Personal Capital‘s free personal finance software is one of the most powerful budgeting, investing, and personal finance software, continuously revolutionizing how consumers manage their finances.

Founded in 2009 by Bill Harris (previous CEO of PayPal and Intuit), Personal Capital Finance & Budgeting Software is designed to be a highly advanced and inherently powerful personal finance software.

This intuitive, free personal finance software has not gone without industry recognition, as it has been ranked #18 on CNBC’s list of top disruptors, alongside Uber, Airbnb, SpaceX, and Dropbox.

Key Factors That Led to Our Ranking of This as One of the Top Finance Apps

Below, please find a detailed list of the features which led to the selection of Personal Capital on our list of the best personal finance software.

Free Personal Finance Software

Looking for the best free personal finance software? The financial tools available through Personal Capital are completely free of charge, making Personal Capital an extremely competitive personal finance app.

Users have access to money management software and expert personal finance software, helping to develop long-term investment and budgeting strategies completely free of charge.

The only exception to this is for investors who want to use Personal Capital’s investment advisory services. In these cases, Personal Capital charges a low annual management fee without trade commissions, hidden fees, or trailing fees.

Device Compatibility

Personal Capital is one of the best budget apps for desktop, iPad, iPhone, Mac, Android, Samsung Galaxy, Microsoft, and online users.

Using Personal Capital allows you to monitor and manage your financial transactions from anywhere, anytime.

As a free personal finance app, Personal Capital is designed to be used across all platforms and is considered one of the best personal finance software overall.

Comprehensive Account Management

From one secure platform, Personal Capital allows you to effectively manage and monitor your entire financial life. This includes financial planning, savings, investment, debt, budgeting, cash management, monthly expenses, and a wide range of other functions.

With Personal Capital’s dashboard application, you can quickly link all your accounts and view of your transactions at every point in time. This includes:

- hecking

- Savings

- 401(k)

- College fund

- Loans

- Home equity

- Mortgage

- Investments

- IRAs & CDs

- Monthly expenses

- Periodic payments

The Personal Capital dashboard allows you to see every debit or credit card transaction, all checking or savings account information, and every automated or manually scheduled payment.

This personal finance software allows you to track your daily, weekly, and monthly spending and expenses down to the penny.

Users can also pull up transaction history, perform a cash flow analysis, and set spending targets for specific categories within the personal finance app.

The personal budget software can also quickly and effectively generate spending and income reports, making it easy to track and monitor every aspect of your finances.

Budgeting Tools

Does Personal Capital also offer budgeting software? Absolutely. Using Personal Capital’s Cash Flow Analyzer tool, you can easily create a budgeting plan that comes with real-time tracking features.

Personal Capital also allows you to stay on track when it comes to managing your budget, paying your bills, and meeting your financial goals, making it a best personal budget software to consider.

This personal finance app makes it easy to see your recently paid, pending payments, and past payment information. You’ll also see upcoming bills that are due, the minimum amount due, and the total amount outstanding.

Charts & Graphs

After linking your accounts to your Personal Capital dashboard, this personal finance app aggregates information from your accounts into an advanced graphical and colorful series of charts and graphs to help you make sense of your savings and investments.

You can also monitor the performance of your stocks, bonds, and other investments on a single, easy-to-read screen.

Net Worth & Investments

As a personal finance software platform, Personal Capital is designed to offer advanced personal finance management.

Rather than just aggregating all information across your financial accounts and transactions, this best money management software goes a step further by allowing you to discover your net worth.

Personal Capital demonstrates how well your investments are performing and, most importantly, see how your investments could be doing better.

Linked to your Personal Capital dashboard is an Investment Checkup tool that examines your investments and provides objective advice on how your portfolio could potentially achieve even higher returns now and in retirement.

For additional information on Personal Capital’s Investment Checkup, sign up for a Personal Capital account.

Security

Like most financial and personal finance apps, Personal Capital is a read-only application, which means they are unable to transfer or remove funds from your accounts.

The software basically “reads” and aggregates your financial information, and then groups the information into categories for tracking and monitoring purposes. This means that you can’t move funds between any account using Personal Capital—and neither can anyone else.

The website’s encryption is rated A by the world-renowned Qualys SSL Labs, a stronger rating than most major banks or brokerages have. The company uses ECDHE key exchange for Perfect Forward Secrecy and does not allow SSLv3, RC4, or other insecure protocols or ciphers.

Could Personal Capital Be the Best Personal Finance Software for You?

It’s hard to deny that Personal Capital provides intuitive and effective financial planning software.

Personal Capital is the best personal finance, budgeting, and investment management platform for users that want an all-in-one financial app where you can manage all of finances and transactions in one place, including investments like stocks, bonds, and portfolios.

Best of all, this best personal finance software is free to use, making for a no-risk signup process. By signing up with this intuitive money management software, you have nothing to lose and everything to gain.

Related: Acorns vs Betterment – Competitors & Review (Fees & Investing)

QuickBooks Review

QuickBooks is the market leader in small business software, and has revolutionized the way people managed their small business finances and accounting.

As a leading provider of small business money management software, QuickBooks provides a comprehensive suite of features to meet a wide variety of business needs, whether you are an individual proprietor or a global merchant.

Key Factors That Led to Our Ranking of This as One of the Top Finance Apps

Below, please find a detailed list of the features which led to the selection of QuickBooks on our list of the best personal finance software.

Device Compatibility

Part of what makes QuickBooks one of the best personal finance software programs is its ability to connect with multiple devices and software programs.

Their personal finance app is available on iTunes and Google Play, and QuickBooks money management software can easily be integrated with PayPal, Square, and Shopify.

Affordable Personal Finance Software

Although QuickBooks is not a free personal finance software like Personal Capital or Mint, it is still a great option for those who want affordable financial planning software.

There are four versions of the QuickBooks Online personal financial software to choose from, and each one comes with a free 30-day trial:

- Self-Employed—$10 per month

- Simple Start—$15 per month

- Essentials—$35 per month

- Plus—$50 per month

Currently, you can opt out of the free trial and purchase their cloud-based financial planning software at a discount of up to 50 percent off for 6 months.

There are also one-time purchase desktop versions of QuickBooks money management software available, ranging from $219-$900.

Self-Employed Options

Having effective and accurate personal finance software is crucial for those who are self-employed, especially around tax season.

Keeping track of receipts, itemizing expenses, and even tracking mileage are all part of effective personal finance management for self-employed users—and having personal finance software that is specifically created for the unique needs of self-employed users can be a huge benefit.

QuickBooks Self-Employed allows users to:

- Create & send invoices

- Automatically track & save mileage data

- Organize & save receipts through the personal finance app

- Import expenses from your bank account & easy separate personal from business spending

Tax Help for Self-Employed

Using this financial planning software can make taxes much less of a burden for self-employed individuals. QuickBooks personal finance software will automatically calculate quarterly taxes payments and send reminders to help users avoid late fees.

Knowing what you’ll owe each quarter before it’s due is a great way to alleviate the stress and frustration that often comes with taxes, making QuickBooks one of the best personal finance software options for self-employed individuals.

Additionally, because QuickBooks is owned by Intuit, their personal accounting software offers easy upgrades to TurboTax, which includes:

- Direct importing, eliminating manual data entry

- One federal & one state filing

- Direct export for Schedule C income & expenses

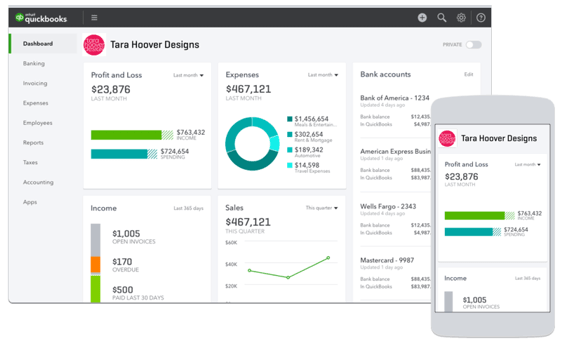

Intuitive Reporting

As a top personal finance software for business, QuickBooks offers intuitive reporting to help users gain a comprehensive view of their business profits and losses.

This personal accounting software allows you to track incoming and outgoing cash, pending invoices, customer balances, and see exactly where your business stands in real-time.

Customized reports also allow you to use personal finance software to create professional reports, send data to an accountant, create budgets, and identify trends to effectively plan for the future.

Simplified Payroll Process

Payroll can often be a daunting task for small businesses to figure out, but this best personal finance software makes paying employees as simple as possible.

Their payroll software makes the process easy by providing the following benefits:

- Updated tax rates are automatically included

- Direct deposit is free for you and your employees

- Easily create custom rules for overtime, tips, commission, sick pay, and more

- Set up deductions for health insurance, retirement, or garnishments

- Employees have 24/7 access to their paycheck information

Could QuickBooks Be the Best Personal Financial Software For You?

As a paid personal finance software, QuickBooks is designed to work efficiently and reliably for a wide range of businesses.

Additionally, QuickBooks is constantly running promotions to keep the cost of using their money management software as low as possible, which is great news for businesses looking for affordable financial planning software.

With advanced features, comprehensive business and accounting capabilities, and a wide range of integrated services and interfaces, QuickBooks is one of the best personal finance software for small businesses (and self-employed individuals) to consider using this year.

Popular Article: Best Quicken Alternatives (Ranking, Comparison & Reviews)

Quicken Review

For staying on top of a personal budget or maintaining your investments, Quicken has been a best personal finance software option since 1982.

With powerful budgeting tools and comprehensive financial management features, Quicken continues to be a top personal financial planning software.

Key Factors That Led to Our Ranking of This as One of the Top Finance Apps

Below, please find a detailed list of the features which led to the selection of Quicken on our list of the best personal finance software.

Affordable Personal Finance Software

Quicken is the best financial software for users who want a wide range of options for business or personal money management software.

There are six different versions of Quicken available for purchase, including:

- Quicken Starter Edition 2017—$39.99

- Quicken for Mac 2017—$74.99

- Quicken Deluxe 2017—$74.99

- Quicken Premier 2017—$109.99

- Quicken Home & Business 2017—$119.99

- Quicken Rental Property Manager 2017—$164.99

For those who want to add investment management to financial tools like budgeting, banking, and bill payments, Quicken’s Premier version is a great option.

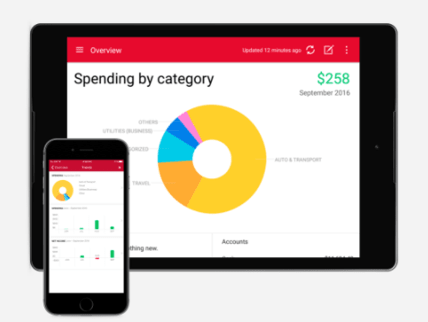

Improved Mobile App

The best personal finance software should also come with the best personal finance apps, and Quicken certainly fits the bill.

Available for iPhone, iPad, and Android devices, the Quicken personal finance app comes with powerful syncing capabilities, allowing users to connect their checking, savings, credit card, and investment accounts to show a complete picture of financial health.

The mobile app also lets users snap photos of and store receipts within the app, making it much easier to prepare for tax season.

Easy Budgeting

After connecting all spending and saving accounts, Quicken’s financial planning software automatically identifies spending trends and areas for improvement.

Users will be given a realistic, manageable budget, although Quicken’s personal finance software makes it easy to customize a budget to fit your unique financial needs and goals.

Over time, this personal finance software will track progress based on specific goals, creating an effective money management software for users who need help with budgeting.

Complete Financial Picture

The best way to practice effective personal finance management is to adopt a holistic view of your finances, something which Quicken certainly does.

As a best personal finance software, Quicken provides a complete financial picture, letting users see all of their balances, bills, and cash on hand in real-time.

Additionally, the financial planning software will also remind you when your bills are due so you can avoid late fees and stay on top of due dates.

Privacy & Security

Quicken is committed to upholding the highest standards of security to protect sensitive information inputted into their personal budget software.

Data is securely transmitted using 256-bit encryption, a security level used by major banks. Security features inside Quicken money management software also include:

- Integrity checks for all messages

- Firewall-protected servers

- Option to password protect Quicken data files

The Quicken personal finance app also has strong security measures to ensure that your financial information is safe. These security measures include:

- Secure Socket Layer (SSL) encryption

- Passwords for financial institutions are never saved on your device

- All Quicken data stored on your device is encrypted

- Certified by TRUSTe

Quicken for Mac

Quicken provides two different versions of their financial planning software—one for Windows and one for Mac.

Quicken for Mac has been routinely recognized as a best personal finance software for Mac users, and the 2017 version features a ton of new upgrades and improvements.

Users can track and pay bills without ever having to leave Quicken, eliminating the frustration of opening multiple windows and constantly logging in and out of applications.

Quicken for Mac also connects with nearly 500 financial institutions, supporting a wide array of small and large banks.

Additional improved features include a powerful mobile app, custom reports for income and spending, and a new look that makes using money management software much easier and more convenient.

Could Quicken Be the Best Personal Finance Software for You?

Quicken is the best personal money management software for those who prefer using a well-established platform.

Their personal finance software and financial planning software has been around for decades, making Quicken one of the most trusted names in financial software.

If, however, you are looking for portfolio management features, it’s worth noting that Personal Capital offers the same personal finance management tools for free.

For users who primarily want budgeting software and advanced personal finance software, either Mint or Personal Capital could easily be used as an effective—and much more affordable—alternative.

For those who still use checks, however, Quicken provides a unique benefit, since it can be used to print checks.

Read More: BillGuard Review – Is BillGuard Safe? What Is BillGuard? (BillGuard App Review)

You Need A Budget Review

You Need A Budget (YNAB) is an award-winning personal finance software that has helped thousands of users manage a budget, improve their personal finance management, and get out of debt quicker.

Founded in 2004 by Jesse and Julie Mecham, a young married couple struggling to balance college expenses with living expenses, YNAB relies on a simple four-rule system to propel users towards better money management.

This rule-based system yields impressive results—on average, new users of YNAB’s money management software save $600 by their second month, and over $6,000 in the first year!

For those who want dynamic, effective, and comprehensive money management software, YNAB is one of the best personal finance software programs available on the market.

Key Factors That Led to Our Ranking of This as One of the Top Finance Apps

Below, please find a detailed list of the features which led to the selection of YNAB on our list of the best personal finance software.

Device Compatibility

Budgeting software from YNAB is available for download across a wide range of devices, including:

- Android

- iPhone

- iPad

- Apple Watch

- Alexa

There is also a web version of YNAB for home use, making it easy to use this best money management software regardless of whether you have a Windows or an Apple computer.

Affordable Personal Finance Software

Although this top money management software is not a free personal finance software, it is still a great choice for those looking for affordable budgeting and financial management.

YNAB is available for download and use at a cost of $50 per year, or just over $4 each month. For younger users, using YNAB can be particularly beneficial, since college students get their first year free (and a 10 percent discount afterwards).

Even if you aren’t a student, trying out YNAB’s personal finance software can still be affordable. They offer a 34-day free trial and even a money-back guarantee if you feel as though YNAB is not the best personal finance software for you.

Four Rules

Part of what makes YNAB such valuable and effective personal finance software is that it operates on a uniquely simple set of budgeting principles.

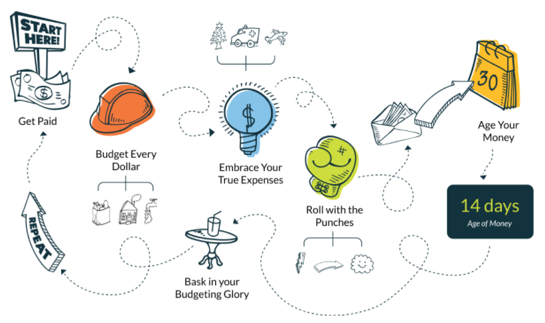

The backbone of YNAB’s financial planning software relies on four distinct budgeting rules:

For YNAB, “giving every dollar a job” means being intentional with your spending, and making sure that each decision is thought-out beforehand.

“Embracing expenses” means being practical about paying long-standing bills, like car payments, mortgages, or even future expenses like home improvements and car maintenance.

Being able to “roll with the punches” helps users feel more comfortable with changing their budget as needed. This financial planning software looks to alleviate stress and guilt that often comes with adjusting a budget, creating a truly user-friendly interface for even the most inexperienced of budgeters.

Finally, YNAB seeks to help users “age their money,” which means focusing on only spending money that was earned 30 days ago or more.

Free Workshops

Budgeting isn’t easy for everyone, especially if you have never used the tools and practices outlined in money management software.

YNAB is a personal finance software that is uniquely invested in helping all users succeed, no matter how inexperienced at budgeting they may be. As a result, they offer free online workshops that allow users to learn enhanced budgeting and money management strategies.

Offered as live webinars, these workshops are a great way to interact with financial experts, ask questions, and receive hands-on instructions alongside other people who are also in the process of learning about budgeting.

Some of their recent workshop topics include:

- “Master Credit Cards with Your Budget”

- “Aggressive Debt Pay Down”

- “Reach Your Savings Goals”

- “Break the Paycheck to Paycheck Cycle”

- “Pay for Big Expenses Without Borrowing”

User Support

YNAB is one of the best personal finance software in terms of user support, offering a wide range of resources to help new users learn about personal budget software and improving their personal finance management.

Uniquely, their support section is divided into how much time you can devote to learning about budgeting:

- Five minutes

- Your lunch break

- An evening without Netflix

Included within these categories are the webinars mentioned above, a weekly newsletter, weekly videos, podcasts, detailed guides, help docs, and the email address for the support team.

A link to contact customer support is included on every page, making it both easy and convenient to reach out to customer service if need be.

Could YNAB Be the Best Personal Finance Software for You?

YNAB is the best personal finance software for users who are looking for focused, dedicated, and effective budgeting software.

In comparison to its biggest competitors—Mint and Personal Capital—it’s important to know that YNAB is purely focused on helping users create and successfully maintain a budget. If you have investments that you want to track or manage, you will be much better off going with Personal Capital.

If the ability to get money management software for free is important to you, then using Mint’s personal finance software will likely be a much better fit.

Still, YNAB is a highly competitive force—their simplified process, extensive user support, and friendly, quirky tone makes them a great choice for young or new budgeters.

With a free trial, student discount, and a satisfaction guarantee, YNAB is an affordable personal finance software that is certainly worth trying out.

Related: FreshBooks vs QuickBooks – Rankings & Review

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: Choosing the Best Personal Finance Software for You

Searching for personal finance software can be an intimidating process, especially if you have never used money management software before.

Thankfully, the best personal finance software does not require all users to be professional investors or seasoned accountants. Not only are these top finance apps technologically advanced and financially effective, but they are also accessible and user-friendly.

Because affordability is also an important factor when choosing the best personal finance software, we’ve included the best paid and free personal finance software to help you find financial tools that fit within your budget.

While managing your finances seems like tedious, complicated work, using personal finance software and money management software can quickly turn personal finance management into a simple, effective, and highly rewarding process.

Image sources:

- https://pixabay.com/en/analytics-computer-hiring-database-2697949/

- https://www.mint.com/

- https://www.mint.com/how-mint-works/alerts#toc

- https://quickbooks.intuit.com/reporting/

- https://www.quicken.com/content/stay-connected-your-money

- https://www.youneedabudget.com/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.