Review: Is the BillGuard App One of the Best Mint Alternatives?

There are a number of money management and budgeting apps on the market. Mint is one of the best budgeting apps, but there are several Mint alternatives.

These programs are designed to help consumers track their spending, plan their expenses, and save money.

One in particular, BillGuard, has caused quite a stir. BillGuard reviews continue to proclaim the software as one of the best Mint alternatives, although these two best budgeting apps serve different functions.

Rather than create budgets and track spending, the BillGuard app focuses on helping users save money by monitoring their debit and credit cards to check for fraudulent charges and hidden fees.

Mint Alternatives—Most Popular Alternatives to Mint.com

When most people think of monitoring, they only think of fraudulent activity. There are other unwanted, yet legal charges that consumers may be unaware of, and the BillGuard app keeps an eye on them.

These are known as gray charges. Gray charges include things like forgotten subscriptions and hidden fees.

Normally, consumers only check their statements to verify large purchases; they rarely look at their statement in detail.

As a result, smaller charges go unverified, and as everybody knows, small charges can add up.

Rebranding BillGuard As the Prosper Daily App

What the BillGuard app does is pretty straightforward. It monitors your account activity and alerts you to the presence of any fraudulent or unwanted charges.

This BillGuard review will explain how it works, its effectiveness, and how satisfied customers are with the product.

An important fact to note in this BillGuard app review is that Prosper Marketplace recently acquired BillGuard. In turn, the BillGuard app has been rebranded as the Prosper Daily app.

So, if you look up the BillGuard app to download, it will redirect you to the Prosper Daily app instead. Along that same line, searching for BillGuard reviews online may also redirect you to Prosper Daily instead.

There’s no need for confusion since the Prosper app and the Billguard app are one and the same.

See Also: Best Budget Apps | Budgeting Software Reviews

BillGuard Review (Prosper Daily App)

According to a report released by BillGuard, 9 out of 10 people do not check their statements or only skim them—and skimming is not very effective for noticing smaller charges.

BillGuard flags purchases that are irregular. It essentially handles the fine-toothed examination of statements that not many people do.

One of the innovative features of the BillGuard app is how it alerts users to purchases made from vendors that have recently suffered from data breaches.

This bill management app also uses information gathered by its users to catalog questionable companies that should be flagged if they come up on a user’s credit or debit card statement.

The BillGuard app works by receiving permission from users to gain read-only access to the websites that display their credit or debit card statements.

Naturally, users get to choose which cards they would like to have monitored by the bill management app.

BillGuard reviews this data daily to analyze your transactions and determines whether a transaction is potentially fraudulent. Users receive an emailed report once a month.

The BillGuard app (Prosper Daily app) is available for both iPhone and Android operating systems.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Direct Vendor Communication through the BillGuard App

What is BillGuard’s next step when it flags a potentially fraudulent charge? It notifies the user, who can then verify the charge with a single click.

The BillGuard app (Prosper Daily app) presents detailed information about the transaction and the vendor, including the reliability of the merchant and where the transaction was carried out, empowering users with as much information as possible.

If BillGuard reviews your statements and flags a charge that turns out to be fraudulent, the bill management app does not leave you to handle the process of removing that charge on your own.

Users can send a request to the merchant through the BillGuard app (Prosper app) to remove the charge, saving BillGuard customers from irritating phone calls to deal with the situation.

Additionally, if a purchase is flagged, but a user is not entirely sure about it, they can send a request for more information to the vendor through the app.

This feature makes the BillGuard app (Prosper Daily app) one of the best Mint alternatives to consider for those who value direct communication.

Don’t Miss: Best Asset Tracking Software and Systems—Top Reviews

This Bill Management App Helps Spot Sneaky, Not-Quite-Fraudulent Charges

Small charges add up, but we tend not to scrutinize a $6.99 transaction. As a result, consumers lose money they could have used for more productive purposes.

There is a category of charges, known as gray charges, which are not necessarily criminal but that are unwanted all the same. Our BillGuard review found that the BillGuard app addresses these kinds of charges.

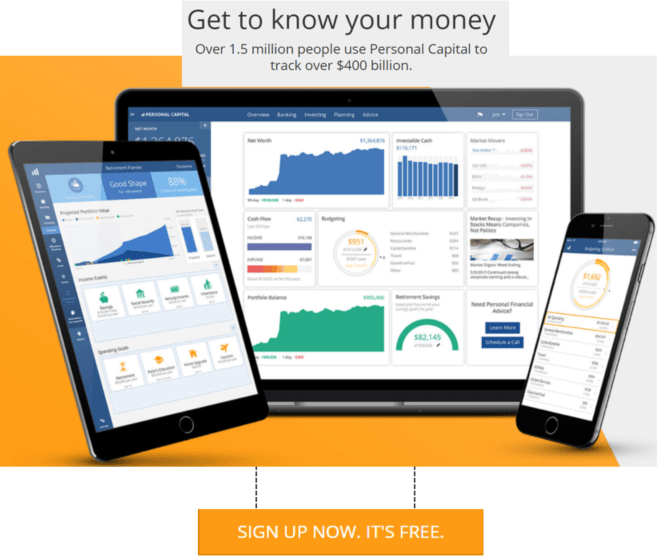

A Retirement Calculator Like No Other—Start Planning with Personal Capital

BillGuard & Prosper Daily App Review

The BillGuard app (Prosper Daily app) brings gray charges to users’ attention. Gray charges can be any number of things, including:

- A forgotten subscription

- A free trial that automatically switched over to a paid subscription

- Hidden fees for service in the fine print

- Incremental service fee increases

If you have multiple debit or credit cards, closely reading one card statement can be tiring to think about, let alone doing the same for three or four.

The BillGuard app (Prosper Daily app) does that work for users so that they are simply left to verify the purchases it points out, making it a primary choice amongst Mint alternatives.

Related: Best Financial Apps | Financial Planning Software Reviews

The BillGuard App Keeps Up With Data Security News So That You Don’t Have to

Hackers continually target financial information, and even large retailers are vulnerable. Consumers may be unaware or unwilling to keep up with the latest security news and standards.

Thankfully, our BillGuard review found that the BillGuard app (Prosper Daily app) stays up to date of security breaches using the web and user feedback.

This information allows them to flag purchases made at a vendor whose security has been compromised. This watchdog element of the app provides users with additional peace of mind.

BillGuard Review of User Experience

While customers generally report positive feedback about the BillGuard app, there are sprinkled criticisms about the user experience.

Since the BillGuard app was rebranded as the Prosper Daily app, Billguard reviews and satisfaction have remained relatively consistent.

The Prosper app is one of the best budgeting apps on iTunes, with a 4.3 rating. Prosper Daily gets a slightly higher rating on Google Play, with a rating of 4.4 stars.

The Prosper Daily app (Billguard app) has been effectively integrated into mobile platforms, but there are certain navigational issues that make using the app irritating at times.

Relatively speaking, these issues are minor. Users looking to save with Prosper Daily can easily enjoy the same budgeting features of this alternative to Mint through a desktop or mobile platform.

Effectiveness and Security of the BillGuard App (Prosper Daily app)

It’s only natural that people hoping to use the best budgeting apps would ask, “Is BillGuard safe?” Our BillGuard review (Prosper Daily) has determined that yes, the app is entirely safe to use.

In order for the app to work, it does require access to the bank accounts in question. Their access is read-only, and they do not sell data to any third parties.

The BillGuard app uses bank-level security, which includes AES 256-bit encryption. They have around-the-clock security staff, daily audits, and regular penetration testing.

Additionally, BillGuard’s read-only status means that even if somebody managed to hack into your BillGuard account, they would be unable to carry out any transactions with your debit or credit accounts.

They also do not store your login information that you initially use to link your bank accounts.

The amount of information this alternative to Mint can see is just enough to allow it to do its job properly. This includes charge descriptions, transaction amounts and dates, as well as the type of card that is being monitored.

Personally identifying information is not made available to the BillGuard app. They do not request access to information like your social security number or bank account number, which means your chances of identity theft are not increased by using the app.

Basically, if you trust traditional banks enough to use their online banking services, then there is no additional harm in using the BillGuard app (Prosper Daily app).

Since its inception, this alternative to Mint has used the same security standards employed by major banks.

Now, as the Prosper Daily app, our BillGuard review has found no evidence which suggests a change in this high standard of security.

Popular Article: Mint Alternatives—Most Popular Alternatives to Mint.com

BillGuard as One of Many Mint Alternatives

Mint is a budgeting app that allows users to monitor their spending across multiple bank accounts. The BillGuard app also monitors several bank accounts, but where these two apps differ is what they do with this monitoring.

Mint provides users with a picture of their financial situation, a breakdown of their spending, and tools for creating budgets and working toward specific money goals.

Mint also provides a free credit score; however, this is not your FICO score, which is the credit score that most lenders use.

Mint also provides customized alerts, which let you know if you are overspending, are using too much money in a certain category, or need to pay a bill.

It lives up to its name as one of the best budgeting apps by allowing you to pay bills through debit or credit cards you have linked to Mint. Users can also track their progress toward specific financial milestones.

Mint is free, and its business model is designed so that it makes money through advertisements and referrals to financial products. For a free service, it’s quite effective and has certainly done well for itself.

With so many benefits, it seems like finding Mint alternatives would be unnecessary. But, there are a few drawbacks that might make Mint alternatives desirable to some.

For starters, the categorization of expenses is quite blunt, meaning spending is often categorized incorrectly.

As the app becomes more popular, there are increasing issues with syncing up bank accounts, causing lags between when you spend and when the purchase is reflected on Mint.

There also is not much in the way of an investment infrastructure, which may make Mint alternatives more desirable.

Conclusion: Budgeting & Learning to Save with Prosper (BillGuard)

The next step for people who have grown their money is finding a way to make it work on its own. Finding a simple investment platform is one key reason people will search for Mint alternatives, like Betterment.

Our BillGuard review found that the unique selling point for BillGuard (the Prosper Daily app) is its focus on tackling pesky gray charges.

While it does monitor accounts for fraudulent charges, it does not market itself as providing identity theft protection.

The Prosper Daily app also does not try to be more than it is by promoting complex budgeting solutions and savings tips.

Instead, it does what it promises to do as a bill management app, and that promise is to make monitoring more convenient.

It also allows users to save with Prosper by looking at budgeting from a different—and often neglected—angle.

While you can certainly think of an app like BillGuard as an alternative to Mint, perhaps “bill management app supplement” is the best description.

The FinTech industry is booming with innovative approaches to banking, and the Prosper Daily app (formerly BillGuard) is one that takes the monotony out of money management.

Image Source:

https://www.bigstockphoto.com/image-56822720/stock-photo-handcuffs-on-laptop-keyboard

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.