Guide: Investing in a High Yield CD (Best CD Rates)

Consumers and investors that want to open a high yield certificate of deposit (CD) account normally ask the four questions below:

- Which bank offers the highest CD interest rates?

- Should I invest in a 3-, 6-, 12-, 18-, 24-, 36-, 48- or 60-month CD?

- What are the best CD rates available to me?

- How can I compare CD rates (CD rate comparison)?

Finding the right CD term and best high yield CD rate that match your specific needs are extremely important because as soon as you invest in most CDs, you will generally be locked into the specified CD term and will end up paying a penalty fee if you sell your CD before the term expires.

Image source: Pixabay

CD terms range from 3 months to as high as 10 years.

Depending on your needs, risk appetite, and expected rate of return, there is a wide range of high interest CDs available to you.

The Best CD to Invest in

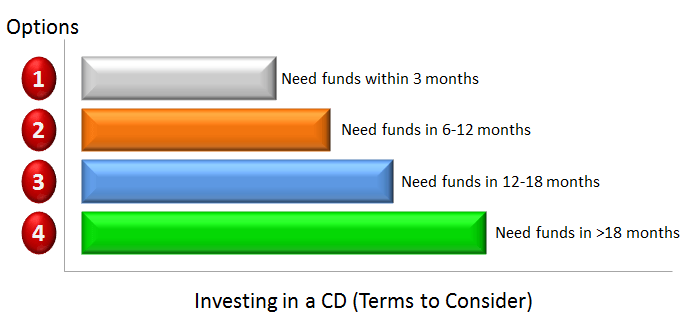

To determine which CD is best for you, a rule of thumb to use is this: “If you lose your job today or are no longer receiving income, when would be the absolute last date that you’d need this money back that you are investing in this CD?”

Image source: AdvisoryHQ

If your option is #1 above, meaning you’ll need the funds within 3 months, it might be better to keep the funds in a high yield savings or checking account or invest in a 3-month CD.

If you think you’ll need these invested funds between 6 and 18 months (options #2 and 3), then you might want to consider investing in medium-term CDs. These are the 6-month to 18-month CDs.

If you are looking to invest in a CD for the longer term (option #4), then you’ll want to consider a 2-, 3-, 4-, 5-, 7- or 10-year CD.

However, you would probably earn a much higher return if you invested the funds in the stock market versus in a 5-, 7- or 10-year CD.

Best CD Rates

This article presents a detailed comparison review of the best CD interest rates available and also an additional overview of the banks offering these rates.

The types of CD rates presented include:

- 60-Month (5-Year) CD Rates

- 48-Month (4-Year) CD Rates

- 36-Month (3-Year) CD Rates

- 30-Month (2.5-Year) CD Rates

- 24-Month (2-Year) CD Rates

- 18-Month (1.5-Year) CD Rates

- 12-Month (1-Year) CD Rates

- 9-Month CD Interest Rates

- 6-Month CD Interest Rates

- 3-Month CD Interest Rates

Click on any of the above links to be taken directly to that section.

Note: As CD rates do not frequently change on a daily basis, AdvisoryHQ will update these CD rates on a bi-weekly or monthly basis.

So make sure to bookmark this page and check back often to see the most updated CD interest rates.

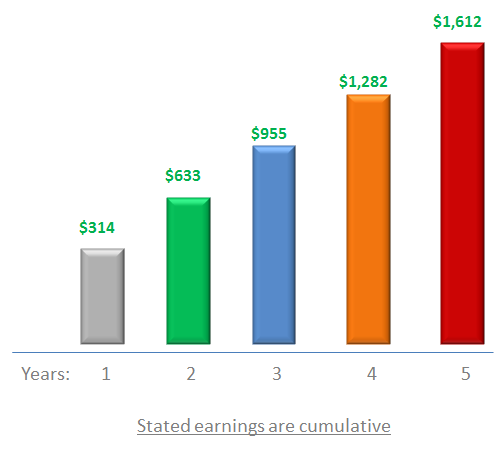

Potential Savings for $25,000

APY: 1.25%, monthly fee: $0, compounded: daily, 60-month CD.

Your total savings will be $1,612.33

Image source: AdvisoryHQ

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

What Exactly Is a Certificate of Deposit (CD)?

We all have an idea of what a CD is, but what is it really? A CD is a time deposit.

When you open a CD with a financial institution, you are entering into an agreement that you will not withdraw the funds until the maturity date (or term), and in return, the bank will pay you a specific rate (the stated CD interest rate).

Can I Close My CD Before the Term Is up?

Yes, you can close a CD before the term ends. However, you will have to pay an early withdrawal penalty for doing so.

What Is the Penalty for Early Withdrawal?

- In general, for a CD term that is 12 months or less, the penalty is 3 months of interest regardless of when, prior to maturity, you make a withdrawal.

- For a CD term that is longer than 12 months, the penalty is generally six months of interest regardless of when, prior to maturity, you make a withdrawal.

- Some banks charge additional penalty fees – in addition to the typical 3–6 months of interest penalty.

- However, there are a few exceptions. In addition to your regular standard type of CD, there is also a no-penalty type of CD. In general, no-penalty CDs have lower rates than regular CDs.__

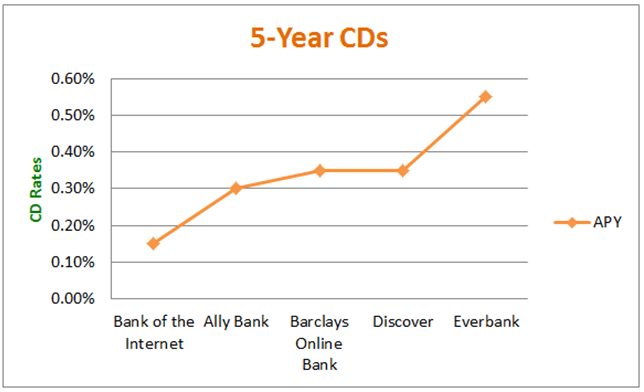

60-Month CD Rates – Comparison

Below is a comparison review of some of the highest 5-year CD rates available in the market.

Bank | APY | CD Terms (Months) | CD Terms (Years) | Min. Deposit |

| Barclays Online Bank | 2.25% | 60 Months | 5 Years | No Min. |

| Synchrony Bank | 2.20% | 60 Months | 5 Years | $2,000 |

| CIT Bank | 2.20% | 60 Months | 5 Years | $1,000 |

| Sallie Mae Bank | 2.10% | 60 Months | 5 Years | $2,500 |

| Capital One 360 | 2.10% | 60 Months | 5 Years | No Min. |

| Everbank | 2.01% | 60 Months | 5 Years | $1,500 |

| GE Capital Bank | 2.00% | 60 Months | 5 Years | $500 |

| Ally Bank | 2.00% | 60 Months | 5 Years | No Min. |

| Discover Bank | 2.00% | 60 Months | 5 Years | $2,500 |

| American Express | 1.70% | 60 Months | 5 Years | No Min. |

| Bank of the Internet | 1.35% | 60 Months | 5 Years | $1,000 |

Image source: AdvisoryHQ

Click here (5-year CDs) for additional information and features on these banks.

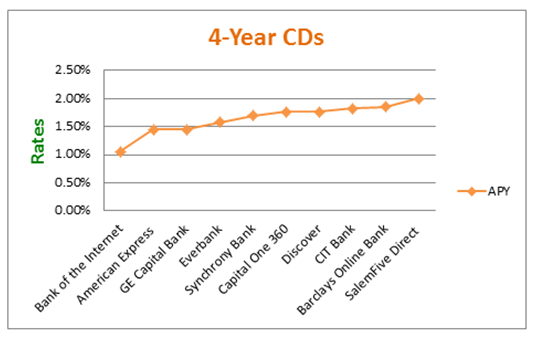

48-Month CD Rates – Comparison

Below is a comparison review of some of the highest 4-year CD rates.

Bank | APY | CD Terms (Months) | CD Terms (Years) | Min. Deposit |

| Salem Five Direct | 2.00% | 48 Months | 4 Years | $10,000 |

| Barclays Online Bank | 1.85% | 48 Months | 4 Years | No Min. |

| CIT Bank | 1.82% | 48 Months | 4 Years | $1,000 |

| Capital One 360 | 1.76% | 48 Months | 4 Years | No Min. |

| Discover Bank | 1.76% | 48 Months | 4 Years | $2,500 |

| Synchrony Bank | 1.70% | 48 Months | 4 Years | $2,000 |

| Everbank | 1.58% | 48 Months | 4 Years | $1,500 |

| GE Capital Bank | 1.45% | 48 Months | 4 Years | $500 |

| American Express | 1.45% | 48 Months | 4 Years | No Min. |

| Bank of the Internet | 1.05% | 48 Months | 4 Years | $1,000 |

Image source: AdvisoryHQ

Click here (4-year CDs) for additional information and features on these banks.

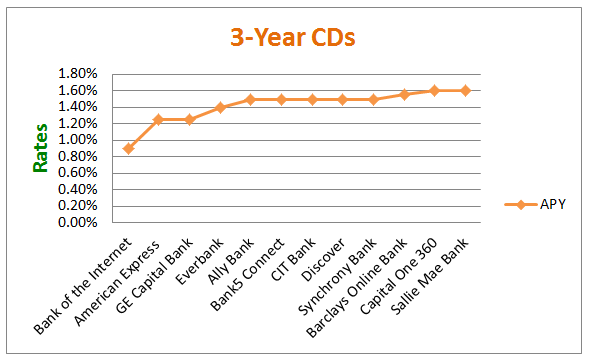

36-Month CD Rates – Comparison

Below is a comparison review of some of the highest 3-year CD rates.

Bank | APY | CD Terms (Months) | CD Terms (Years) | Min. Deposit |

| Sallie Mae Bank | 1.60% | 36 Months | 3 Years | $2,500 |

| Capital One 360 | 1.60% | 36 Months | 3 Years | No Min. |

| Barclays Online Bank | 1.55% | 36 Months | 3 Years | No Min. |

| Synchrony Bank | 1.50% | 36 Months | 3 Years | $2,000 |

| Ally Bank | 1.50% | 36 Months | 3 Years | No Min. |

| Bank5 Connect | 1.50% | 36 Months | 3 Years | $500 |

| Discover Bank | 1.50% | 36 Months | 3 Years | $2,500 |

| CIT Bank | 1.50% | 36 Months | 3 Years | $1,000 |

| Everbank | 1.40% | 36 Months | 3 Years | $1,500 |

| GE Capital Bank | 1.25% | 36 Months | 3 Years | $500 |

| American Express | 1.25% | 36 Months | 3 Years | No Min. |

| Bank of the Internet | 0.90% | 36 Months | 3 Years | $1,000 |

Image source: AdvisoryHQ

Click here (3-Year CDs) for additional information and features on these banks.__

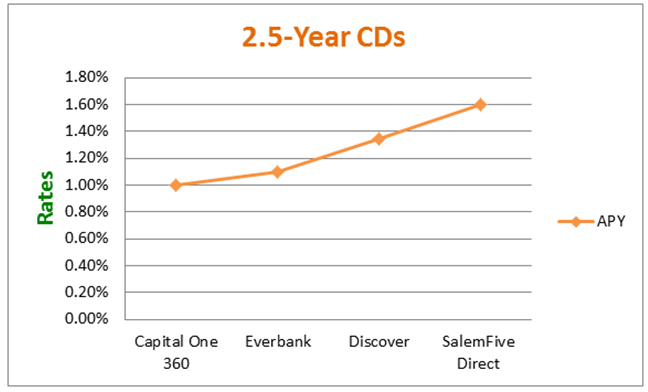

30-Month CD Rates – Comparison

Below is a comparison review of some of the highest 2.5-year CD rates.

Bank | APY | CD Terms (Months) | CD Terms (Years) | Min. Deposit |

| Salem Five | 1.60% | 30 Months | 2.5 Years | $10,000 |

| Discover Bank | 1.35% | 30 Months | 2.5 Years | $2,500 |

| Everbank | 1.10% | 30 Months | 2.5 Years | $1,500 |

| Capital One 360 | 1.00% | 30 Months | 2.5 Years | No Min. |

Image source: AdvisoryHQ

Click here (30-month CDs) for additional information and features on these banks.__

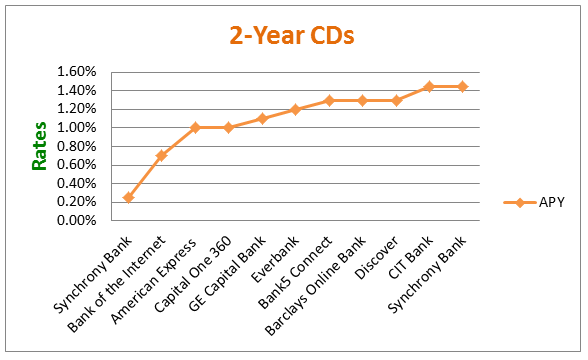

24-Month CD Rates – Comparison

Below is a comparison review of some of the highest 2-year CD rates.

Bank | APY | CD Terms (Months) | CD Terms (Years) | Min. Deposit |

| Synchrony Bank | 1.45% | 24 Months | 2 Years | $2,000 |

| CIT Bank | 1.45% | 24 Months | 2 Years | $1,000 |

| Barclays Online Bank | 1.30% | 24 Months | 2 Years | No Min. |

| Bank5 Connect | 1.30% | 24 Months | 2 Years | $500 |

| Discover Bank | 1.30% | 24 Months | 2 Years | $2,500 |

| Everbank | 1.20% | 24 Months | 2 Years | $1,500 |

| GE Capital Bank | 1.10% | 24 Months | 2 Years | $500 |

| American Express | 1.00% | 24 Months | 2 Years | No Min. |

| Capital One 360 | 1.00% | 24 Months | 2 Years | No Min. |

| Bank of the Internet | 0.70% | 24 Months | 2 Years | $1,000 |

| Synchrony Bank | 0.25% | 24 Months | 2 Years | $2,000 |

Image source: AdvisoryHQ

Click here (24-month CDs) for additional information and features on these banks.__

18-Month CD Rates – Comparison

Below is a comparison review of some of the highest 1.5-year CD rates.

Bank | APY | CD Terms (Months) | CD Terms (Years) | Min. Deposit |

| Salem Five | 1.30% | 18 Months | 1.5 Years | $10,000 |

| Synchrony Bank | 1.25% | 18 Months | 1.5 Years | $2,000 |

| Discover Bank | 1.20% | 18 Months | 1.5 Years | $2,500 |

| Ally Bank | 1.19% | 18 Months | 1.5 Years | No Min. |

| Bank5 Connect | 1.05% | 18 Months | 1.5 Years | $500 |

| GE Capital Bank | 1.00% | 18 Months | 1.5 Years | $500 |

| Everbank | 0.98% | 18 Months | 1.5 Years | $1,500 |

| Barclays Online Bank | 0.85% | 18 Months | 1.5 Years | No Min. |

| American Express | 0.60% | 18 Months | 1.5 Years | No Min. |

| Capital One 360 | 0.40% | 18 Months | 1.5 Years | No Min. |

12-Month CD Rates – Comparison

Below is a comparison review of some of the highest 1-year CD rates.

Bank | APY | CD Terms (Months) | CD Terms (Years) | Min. Deposit |

| CIT Bank | 1.30% | 12 Months | 1 Year | $1,000 |

| Synchrony Bank | 1.25% | 12 Months | 1 Year | $2,000 |

| iGObanking | 1.25% | 12 Months | 1 Year | $1,000 |

| Sallie Mae Bank | 1.25% | 12 Months | 1 Year | $2,500 |

| Discover Bank | 1.15% | 12 Months | 1 Year | $2,500 |

| Ally Bank | 1.05% | 12 Months | 1 Year | No Min. |

| GE Capital Bank | 1.00% | 12 Months | 1 Year | $500 |

| Bank5 Connect | 1.00% | 12 Months | 1 Year | $500 |

| Everbank | 0.88% | 12 Months | 1 Year | $1,500 |

| Barclays Online Bank | 0.80% | 12 Months | 1 Year | No Min. |

| Bank of the Internet | 0.55% | 12 Months | 1 Year | $1,000 |

| American Express | 0.55% | 12 Months | 1 Year | No Min. |

| Capital One 360 | 0.40% | 12 Months | 1 Year | No Min. |

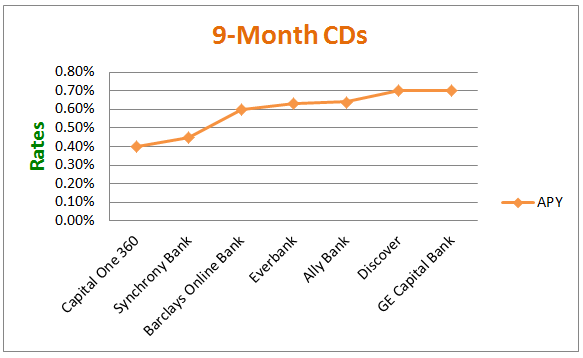

Bank | APY | CD Terms (Months) | CD Terms (Years) | Min. Deposit |

| GE Capital Bank | 0.70% | 9 Months | 0.75 Year | $500 |

| Discover Bank | 0.70% | 9 Months | 0.75 Year | $2,500 |

| Ally Bank | 0.64% | 9 Months | 0.75 Year | No Min. |

| Everbank | 0.63% | 9 Months | 0.75 Year | $1,500 |

| Barclays Online Bank | 0.60% | 9 Months | 0.75 Year | No Min. |

| Synchrony Bank | 0.45% | 9 Months | 0.75 Year | $2,000 |

| Capital One 360 | 0.40% | 9 Months | 0.75 Year | No Min. |

Image source: AdvisoryHQ

Click here (9-month CDs) for additional information and features on these CD offering banks.__

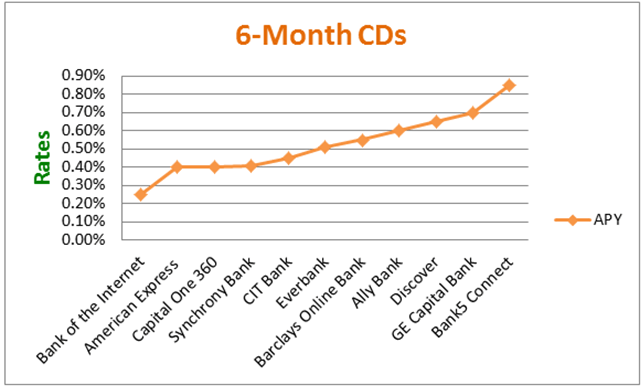

Bank | APY | CD Terms (Months) | CD Terms (Years) | Min. Deposit |

| Bank5 Connect | 0.85% | 6 Months | 0.5 Year | $500 |

| GE Capital Bank | 0.70% | 6 Months | 0.5 Year | $500 |

| Discover Bank | 0.65% | 6 Months | 0.5 Year | $2,500 |

| Ally Bank | 0.60% | 6 Months | 0.5 Year | No Min. |

| Barclays Online Bank | 0.55% | 6 Months | 0.5 Year | No Min. |

| Everbank | 0.51% | 6 Months | 0.5 Year | $1,500 |

| CIT Bank | 0.45% | 6 Months | 0.5 Year | $1,000 |

| Synchrony Bank | 0.41% | 6 Months | 0.5 Year | $2,000 |

| American Express | 0.40% | 6 Months | 0.5 Year | No Min. |

| Capital One 360 | 0.40% | 6 Months | 0.5 Year | No Min. |

| Bank of the Internet | 0.25% | 6 Months | 0.5 Year | $1,000 |

Image source: AdvisoryHQ

Click here (6-month CDs) for additional information and features on these CD offering banks.__

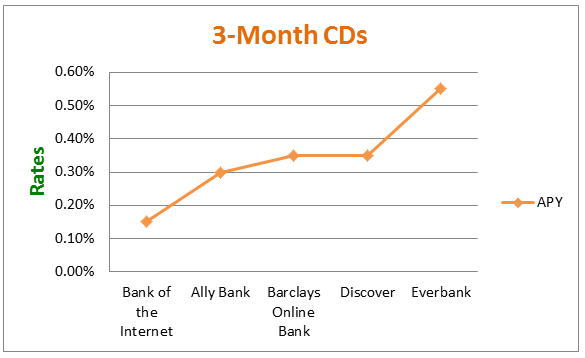

Bank | APY | CD Terms (Months) | CD Terms (Years) | Min. Deposit |

| Everbank | 0.55% | 3 Months | 0.25 Year | $1,500 |

| Barclays Online Bank | 0.35% | 3 Months | 0.25 Year | No Min. |

| Discover Bank | 0.35% | 3 Months | 0.25 Year | $2,500 |

| Ally Bank | 0.30% | 3 Months | 0.25 Year | No Min. |

| Bank of the Internet | 0.15% | 3 Months | 0.25 Year | $1,000 |

Image source: AdvisoryHQ

Click here (3-month CDs) for additional information and features on these CD offering banks.

Can You Add Funds to a CD Once It Is Opened?

No. The initial funding of a CD during the application is the primary way to add funds. If you choose to renew your CD at maturity, you may add funds during the 10 calendar-day period (grace period) following the CD maturity date.

CD Calculator

Below is an example of your earning potential if you invest $10,000 in a 5-year (60-month term) CD that compounds daily and yields a 2.275% APY (2.25% interest rate).__

Ally Bank

Ally Bank is one of this year’s top rated online banks. The bank has received accolades and recognition by leading bank rating services, like bankrate.com, for being financially strong and secure (4-star ratings) as well as having an impressive record of growth through the years.

Key features on Ally Bank’s CD account:

- No monthly fee

- 20-day maturity alert

- Automatic rollover

- IRA eligible

American Express Bank

To open and finalize your CD account with American Express, you’ll need to follow the below steps:

1. Gather the necessary information (for both primary and joint applicants):

- Social Security number

- Email address

- Date of birth

- Home address

- Account and routing numbers

- Phone number

2. Enter your email, Social Security number, and date of birth on the “Getting Started” screen.

- Next, you’ll need to select the certificate of deposit term that you are interested in.

3. Continue entering your information, and then fund your account.

4. Receive your confirmation.

- You will receive an online and/or email confirmation when your application is approved.

- Additionally, you will receive an American Express® Personal Savings Welcome Kit in the mail.

Immediately start earning interest on the business day that the bank receives your CD

Bank of Internet USA

Bank of Internet USA offers CD interest rates that consistently rank among the highest in the country. Also, your CD rates with the bank will compound daily.

Bank of Internet USA is also rated as one of the top rated online banking firms with high yield savings accounts.

Bank products and services are offered by BofI Federal Bank. All deposit accounts through BofI Federal Bank brands are FDIC-insured through BofI Federal Bank.

All deposit accounts of the same ownership and/or vesting held at BofI Federal Bank are combined and insured under the same FDIC Certificate 35546.

Bank5 Connect

Bank5 Connect is an online US bank. As an online bank, the firm has low overhead costs, which allows it to offer more competitive rates on its banking and CD products.

The minimum deposit for a Bank5 Connect CD is only $500! Your funds are also FDIC-insured for up to $250,000.

Bank5 Connect offers everything a traditional bank does, including checking accounts, savings accounts, CDs, and more.

They also offer online bill pay, e-statements, and free mobile banking.

Barclays Online Bank

Barclays’ online CD offers the stability of a fixed-rate annual percentage yield (APY) and FDIC insurance. Plus, you’ll also get:

- Interest that compounds daily

- Easy fund transfers

- No hidden monthly fees or minimum balances to open

Although there is no minimum balance to open an account, in order for interest to be posted to your account, you must maintain a minimum balance that would earn you at least $0.01.

A penalty may be charged for early withdrawal.

Capital One 360

Capital One 360 promises to provide the below returns and terms to those that open a Capital One CD account:

- Bank on guaranteed returns. Plus, your deposits are FDIC-insured up to $250,000 per depositor

- Name your terms: between 6 and 60 months

- Get interested when you need it: you decide when to get interest paid – end of the term, monthly or annually

Before you start, note that you’ll need your checkbook in order to make your first deposit electronically from your existing checking account. This will create an electronic link between both accounts so you can easily transfer money.

CIT Bank

CIT Bank CD accounts come with the below features:

- No CD account opening fees

- No monthly maintenance fees

- A minimum deposit of $1,000

- Selection of CD terms to meet your needs

- Daily compounding interest to maximize your earning potential

- FDIC-insured

Discover Bank

With a Discover Bank CD account, you get flexible 3-month to 10-year terms.

Open your CD account with a minimum deposit of $2,500.

You’ll need to provide your address, phone number, email address, and Social Security number (or other taxpayer ID) to open your CD account.

You can send Discover Bank a check or transfer funds from an existing bank account to fund your CD account.

EverBank

An EverBank CD account features the following:

- Top 5% yields

- $1,500 to open

- No monthly fees

- 20-day maturity alert

- Automatic rollover

- IRA eligible

GE Capital Bank

Opening a certificate of deposit account with GE Capital Bank provides you with the below features:

- Terms from 6 months to 6 years

- Low $500 minimum deposit

- 10-day CD rate guarantee

- FDIC insurance up to the maximum allowed by law

- Choose your monthly interest disbursement

- Maximum deposit amount $1,000,000

iGObanking

Great online banking and high CD yields are some of the big advantages of having an account with iGObanking.

In addition, your CD account yields are compounded daily, so you’re always earning, no matter how much you have in your account.

Note: Business accounts are not offered by iGObanking.com.

iGObanking has received the Bankrate.com® Top Tier award for consistently offering annual percentage yields (APYs) that were among the highest reported in 100 Highest Yields® for the 4th quarter of

Salem Five

Founded in 1855, Salem Five operates 29 branches in greater Boston with assets in excess of $3.6 billion.

In addition to the high CD rates offered by Salem Five, their CD accounts provide the below features:

- Easy online account access

- No monthly fees

- Eco-friendly e-statements and other convenient account services

- FDIC and DIF insurance to protect your entire balance

Sallie Mae Bank

What you get with a Sallie Mae Bank certificate of deposit account:

- No monthly fees

- FDIC-insured

- Automatic renewal

- Guaranteed returns

- $2,500 minimum deposit

Synchrony Bank

Synchrony Bank CDs offer:

- High yielding CD rates

- Choice of terms from 3 months to 60 months

- Low minimum deposit requirement to open an account: $2,000

- FDIC insurance up to $250,000 per depositor

- Control of your money through the bank’s online banking portal

Alternatives to High-Interest CDs

A certificate of deposit is a great choice if you want to lock in a rate for a one-time deposit.

If you want more flexibility, then you’ll want to consider a high yield savings account. Some high yield accounts pay APYs that are close to or even higher than what you can earn from any of the CD APYs listed above.

Also, you can add funds whenever you want and withdraw up to six (6) times per statement cycle.

Duration Effect

With a few exceptions, the longer the term of the CD, the higher the CD interest rate will be.

That’s the simple truth behind the certificate of deposit rates (and more fixed-rate financial instruments).

Disclaimer:

- The rates presented on this page are those that have been identified by AdvisoryHQ based on a detailed level of research and due diligence. AdvisoryHQ’s proprietary CD selection methodology focuses on identifying CD rates that require the least amount of requirements and are open to the broadest range of consumers.

- Most of these types of rates are those offered by online US banks that are available to any US resident, irrespective of city, state or domicile.

- The above lists of CD rates do not include every CD rate imaginable. Please do not consider these lists as “comprehensive.”

- The above rates also reflect the minimum deposited amount. Some banks offer higher CD rates for higher deposits.

- Please consult each bank’s website for information on the most updated CD rates.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.