2017 RANKING & REVIEWS

BEST CREDIT CARD CONSOLIDATION LOANS

2017 Guide: How to Consolidate Debt with a Credit Card Debt Consolidation Loan

Most people have felt the weight of credit card debt at some time in their lives and may have wondered about a credit card debt loan and how it works. When you have multiple payments to make monthly on bills and loans, it can feel overwhelming and as if you’ll never get ahead. But a credit card consolidation loan can be your ticket out.

According to NerdWallet, the average U.S. household with debt carries about $15,675 in credit card debt, so it’s safe to say that many people may be looking for a way to get out from under that burden with a loan to consolidate credit cards.

Award Emblem: Best Credit Card Consolidation Loans

Loans to pay off credit card debt can offer you a chance to get a handle on your monthly bills and combine several monthly payments into just one that is more manageable.

Depending on the credit card consolidation companies you might use, you could also end up reducing the overall interest you pay on the debt.

Now, there are some things to watch out for when you’re considering credit card loan consolidation, such as high interest or stiff penalties for late payments. As with any type of financing, you want to know what you’re getting into before you sign. We’re going to tell you exactly what to watch out for and where to find the best credit card consolidation loans.

In this 2017 ranking of the top credit card consolidation loans, we will explain the pros and cons of a securing a loan for credit card debt, the difference between a secured and unsecured loan, and provide a detailed comparison of the top 6 best ranked companies that offer credit card debt consolidation loans.

See Also: Top Cards & Best Ways to Apply for Credit Cards with Bad Credit or No Credit

AdvisoryHQ’s List of the Top 6 Best Credit Card Consolidation Loan Companies

List is sorted alphabetically (click any of the credit card consolidation loan companies names below to go directly to the detailed review section for that company):

Top 6 Best Credit Card Consolidation Companies | Brief Comparison & Ranking

| Company Names | APR Range | Loan Amounts | Loan Term |

| Avant | 9.95%–35.99% | $2,000–$35,000 | 24–60 months |

| Discover | 6.99%–24.99% | $2,500–$35,000 | 36–84 months |

| LendingClub | 5.32%–35.89% | $1,000–$40,000 | 36–60 months |

| LightStream | 4.99%–14.49% | $5,000–$100,000 | 24–84 months |

| Upstart | 4.89%–29.99% | $1,000–$50,000 | 36–60 months |

| Wells Fargo | Not disclosed | $3,000–$100,000 | 12–60 months |

Table: Top 6 Best Ranked Credit Card Consolidation Loans | Above list is sorted alphabetically

Credit Card Loan Consolidation | How It Works

With a loan to consolidate credit cards, you’re basically taking out a personal loan in order to pay off several credit cards to consolidate the payment into just one, on the new loan. People often consider credit card debt consolidation loans as part of a debt management plan and to reduce their overall monthly out-of-pocket expense.

People with severe debt issues looking for more help than just a personal credit card consolidation loan to bad credit risk individuals, may want to look into a debt management program. These go a step farther by offering advice on how to get out of debt, and you pay them one monthly payment, and they pay your credit cards and other debts for you.

Image Source: Upstart Best Credit Card Consolidation Loans

Here are a few pros and cons of securing credit cards consolidation loans.

Credit Card Loan Consolidation Pros:

- You can save money on interest charges

- Your monthly payment is usually less

- Your credit cards could be paid off sooner

- You can avoid damaging your credit

- One payment is easier to manage than several

Credit Card Loan Consolidation Cons:

- There may be up-front loan fees

- A secured loan could put your assets at risk

- You may be tempted to charge more on your cards

- Some credit card consolidation companies may not be trustworthy

- You could end up taking longer to get out of debt

Don’t Miss: Best American Express Credit Cards | Ranking & Reviews | Top AMEX Credit Cards

What’s the Difference between a Secured and Unsecured Credit Card Debt Consolidation Loan?

When you are reviewing credit card consolidation loans, you will often see both secured and unsecured loans mentioned. When you are getting one of the loans to pay off credit card debt, it is really just a personal loan, and how good your credit score is often determines whether you need some type of collateral to secure the loan for credit card debt.

Image source: Pixabay

Let’s take a look at the main differences between these two types of credit card debt loans:

Unsecured Credit Card Consolidation Loan

An unsecured loan for credit card debt is pretty common, and it means you do not have to back the personal loan with any collateral. The loan is approved based upon your creditworthiness, and often the interest rate will be lower the better your credit score. An unsecured loan can have a higher interest rate than a secured one.

Secured Credit Card Consolidation Loan

With a secured credit card debt loan, you are backing up the loan with an asset that the lender can take possession of if the loan is defaulted on. This could be a vehicle title, savings account, or certificate of deposit. Lenders offer a credit card consolidation loan to bad credit clients who can’t get a secured loan. A plus with a secured credit card debt loan is that you can sometimes get a better interest rate and longer loan term.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review — Top Ranking Best Credit Card Consolidation Companies

Below, please find a detailed review of each firm on our list of credit card debt consolidation loan companies. We have highlighted some of the factors that allowed these firms that offer a loan to consolidate credit cards to score so high in our selection ranking.

Avant Review

Avant is an online lender that came on the scene in 2012. Their mission is to lower the barriers and costs of borrowing. They have locations in Chicago, IL; Los Angeles, CA; and London, England; and employ more than 800 people.

When looking to find loans to pay off credit card debt, Avant is a company you’ll want to consider due to their A+ rating at the Better Business Bureau (BBB), with a composite score of 3.82 out of 5 stars.

Key Review Factors for Credit Card Consolidation Loans and What You Can Find at Avant Include:

- No prepayment fees

- Fast approvals, money as fast as next business day

- APR range of 9.95% to 35.99%

- Loan amounts from $2,000 to $35,000

- Loan terms from 24 to 60 months

- Late payment fee of $25.00

- Administration fee range from 0.95% to 3.75%

Check out their credit card debt consolidation loans here.

Related: Capital One vs Citi® Secured MasterCard® | Comparison, Reviews, and Tools | Tips

Discover Review

Discover is best known as a credit card company, and they first began in 1986. Since that time, the company has expanded to offer multiple financial services, including credit cards consolidation loans, and their networks cover multiple countries around the world.

We chose Discover for our list of the best credit card consolidation loans both for their excellent reputation and wide range of other services. They also have been rated the “Highest in Customer Satisfaction with Credit Card Companies, Three Years in a Row” by J.D. Power.

Key Review Factors for a Credit Card Debt Consolidation Loan and What You Can Find at Discover Include:

- No prepayment fees

- Fast approvals, money as fast as next business day

- APR range of 6.99% to 24.99%

- Loan amounts from $2,500 to $35,000

- Loan terms from 36 to 84 months

- Late payment fee of $39.00

- No administrative fee

Check out their credit card consolidation loans here.

LendingClub Review

LendingClub is based in San Francisco, CA, and was founded in 2006. They say they are the “world’s largest online credit marketplace,” facilitating personal and business loans. Their goal is to make the LendingClub experience friendly, transparent, and empowering.

The list of awards and recognitions earned by LendingClub is impressive and is a reason that you may want to consider them when looking for a credit card debt consolidation loan. They also have an A+ rating with the Better Business Bureau and a score of 4.15 out of 5 stars.

Key Review Factors for Credit Card Consolidation Loans and What You Can Find at LendingClub Include:

- No prepayment fees

- Fast approvals, money as fast as “a few days”

- APR range of 5.32% to 35.89%

- Loan amounts from $1,000 to $40,000

- Loan terms from 36 to 60 months

- Late payment fee of $15.00

- Administration fee range from 1.0% to 6.0%

Check out their credit card consolidation loans here.

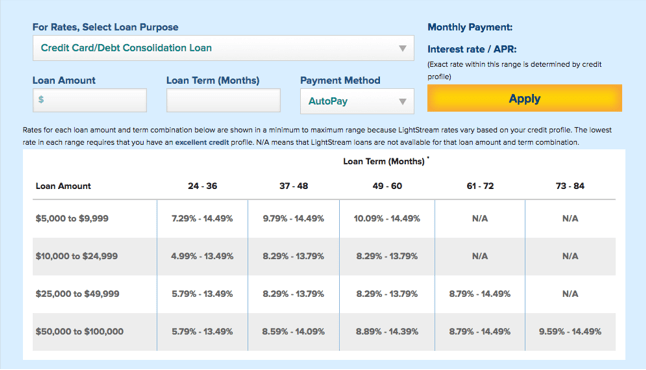

LightStream Review

LightStream is a division of SunTrust Bank and represents the consumer lending arm of that company. SunTrust Bank charts its history way back to 1891, and the company is headquartered in Atlanta, GA.

Image Source: LightStream Loan to Consolidate Credit Cards

We chose LightStream as one of the best credit card consolidation companies both for the solid foundation of its parent company and because it offers some of the lowest interest rates you can find on a personal loan for credit card debt, as long as you have a $5,000 minimum and have good to excellent credit.

Key Review Factors for Credit Card Debt Consolidation Loans and What You Can Find at Lightstream Include:

- No prepayment fees

- Fast approvals, money as fast as same day

- APR range of 4.99% to 14.49%

- Loan amounts from $1,000 to $50,000

- Loan terms from 24 to 84 months

- No late payment fee

- No administration fee

Check out their credit card consolidation loans here.

Popular Article: The BEST Unsecured Credit Cards for Bad Credit with No Deposit | How to Find Bad Credit Unsecured Credit Cards

Upstart Review

Upstart was founded by ex-Googlers in 2012 and touts Mark Cuban as one of their key investors. They say that they go beyond the FICO score to finance people based on other signals and factors using a proprietary underwriting model to identify high-quality borrowers despite limited credit history.

Because they use identifiers beyond the usual credit score, Upstart is an excellent company to consider for a credit card consolidation loan for bad credit or those that don’t yet have a credit history. The San Carlos, CA,–based company has an A+ rating at the Better Business Bureau with an overall score of 3.68 out of 5 stars.

Key Review Factors for Loans to Pay Off Credit Card Debt and What You Can Find at Upstart Include:

- No prepayment fees

- Fast approvals, money as fast as next business day

- APR range of 4.89% to 29.99%

- Loan amounts from $1,000 to $35,000

- Loan terms from 36 to 60 months

- Late payment fee of $15.00

- Administration fee range from 1.0% to 6.0%

Check out their credit card debt consolidation loan here.

Free Wealth & Finance Software - Get Yours Now ►

Wells Fargo Review

Wells Fargo is the well-known bank with the horse-drawn carriage often seen in their commercials. The company, which is headquartered in San Francisco, CA, was founded in 1852, and has been one of the most well-known names in banking for more than a century.

When people are considering a credit card consolidation loan, it’s easy for them to overlook the larger, well-known banks. But Wells Fargo caters to the needs of individuals for personal loans to pay off credit card debt that can be either unsecured or secured by a CD or savings account.

Key Review Factors for Credit Card Consolidation Loans and What You Can Find at Wells Fargo Include:

- No prepayment fees

- Fast approvals, money as fast as same day (unsecured) or next business day (secured)

- APR based on “specific characteristics of credit application”

- Loan amounts from $3,000 to $100,000

- Loan terms from 12 to 60 months

- Late payment fee is not specified

- Administration fee of $75 for secured, none for unsecured

Check out their credit card debt consolidation loan here.

Conclusion—Top 6 Credit Card Consolidation Companies

If you’ve been looking for a way to get out from under a mountain of credit card debt, then taking a look at credit card consolidation loans could help improve your financial state. Exchanging several monthly payments for just one can also improve your state of mind by simplifying your monthly obligations.

Image Source: Credit Card Consolidation Companies

Not all credit card consolidation companies will have your best interests at heart, so you need to review them carefully so that you don’t end up in a worse financial situation down the road.

Factors to consider when researching the best credit card consolidation loans are:

- Ratings with the Better Business Bureau and other agencies

- Fees charged for early payment, administration/origination, and late payments

- Whether the overall interest rate is less than what you were already paying

- The length of the payment term offered

- How your credit score will impact your loan qualification

- The reputation and reviews of the credit card consolidation companies

- Whether you prefer a secured or unsecured loan

The good news is that you have some excellent choices when looking into credit card consolidation loans. From hot start-ups like Avant or Upstart to well-known banks like SunTrust and Wells Fargo, you can select a credit card loan consolidation from a company that has a trusted reputation and flexible options.

A credit card consolidation loan doesn’t have to be a negative experience at all. In the long run, it can help simplify your life and be a smart financial move as well. You can get started on your research by checking out these 6 best credit card consolidation loans to learn more about your options.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.