2017 Guide: 6 Ways to Get the Best Credit Cards to Rebuild Credit (Best Secured & Unsecured Credit Cards for Rebuilding Credit)

Those with bad credit are easily tempted to give up trying to rebuild credit. The process may seem useless as you get turned down by creditors left and right.

But did you know that the right credit card can actually help you rebuild credit? Those with less than perfect credit histories can turn to secured credit cards to rebuild credit.

The best credit cards to rebuild credit are usually secured credit cards. However, unsecured credit cards to rebuild credit are also available to those working toward a better credit score.

Your personal credit history will determine the type of card you should choose and which one you may qualify for.

Image Source: ConsumerFU.com

This guide will help you find the best secured credit cards to rebuild credit, the best unsecured credit cards for rebuilding credit, and how to use your new credit card wisely to create a consistent, healthy credit history to regain your creditworthiness.

See Also: Top Airline Credit Cards | Ranking | Best Airlines Miles Credit Cards (Reviews)

What Causes Bad Credit?

There are a lot of factors that can negatively impact your credit score and leave you searching for the best secured credit cards to rebuild credit.

However, before jumping into applying for a secured credit card to rebuild credit, you should understand why your credit might be damaged.

This can help you plan for the future and not make the same mistakes twice. Some of the most common reasons your credit could be damaged, leaving you to search for the best secured credit card for rebuilding credit, are:

- Failing to pay on time (or at all). One reason you might search for the best secured credit card to rebuild credit is because you not make timely payments or any payments at all on your current accounts, leaving you with a damaged credit score. One or two missed payments will not significantly affect your score, but frequent missed payments will.

- Defaulting on a loan. Is your credit suffering because you stopped paying off your loan? Before searching for the best secured credit cards for rebuilding credit, come up with an organized system to help you keep track of payments, or your credit will continue to suffer.

- High credit card balances. Even if you have a secured credit card to rebuild credit, you will want to understand how a high balance to credit limit ration affects your score. Your credit card debt can affect about 45% of your credit score.

- Applying for too many unsecured or secured credit cards to build credit. Applying for one secured credit card to build credit will not hurt your score, but applying for several at a time or over a certain time period can. Aim to find the very best secured credit card to build credit and apply for that one.

- Having only one type of credit. The more types of credit you have, such as loans or unsecured credit cards to rebuild credit, the better your potential credit score. Creditors want to see various types of credit for a rich credit history, and this factor affects about 10% of your overall credit score.

- Closing old accounts. You might be tempted to close old credit card accounts that you do not use, but this affects your credit history. When you apply for the best secured credit cards to rebuild credit, creditors will want to see how long you have had your accounts open. The longer, the better your chances of obtaining credit.

Remember to check your credit reports at least once per year to better understand what is specifically hurting your credit score.

How to Rebuild Your Credit

Many people shy away from attempting to open up new credit cards if they already have bad credit, for fear that they will just get turned away by credit card companies. However, there are several credit cards made just for people with bad credit. Here are a few tips to help you find the best secured credit card for rebuilding credit.

Image Source: CreditCards.com

1. Use Secured Credit Cards to Rebuild Credit

What are the differences between the best unsecured and best secured credit cards for rebuilding credit? And why do most people tell you to apply for secured credit cards to rebuild credit?

Because it is true. Secured credit cards are those with a credit line that you secure yourself. With a bad credit history, you are also a greater risk to creditors. A secured credit card to build credit requires you to make a deposit that acts as your credit line.

Usually, the deposit for secured credit cards to build credit is nothing more than a few hundred dollars. But it acts as a way to prove yourself to the credit card company and other creditors.

If you continue to use your secured credit card regularly and make timely payments, your credit history can improve over time.

Unsecured credit cards for rebuilding credit, on the other hand, are much more difficult for those with bad credit histories to get approved for. An unsecured credit line is one given to you by the credit card companies, and most will not want to run the risk of giving credit to a customer with a rough history.

Don’t Miss: The Best Prepaid Credit Cards | Guide to Finding Top, Free, Online Prepaid Credit Cards

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

2. Find the Best Secured Credit Card to Rebuild Credit Online

Finding the best credit cards to rebuild credit is an easy process when you search online. You can choose to specifically search for the best secured credit card to rebuild credit and narrow down your choices from there.

There are several online comparison websites to help you search for the best secured credit card to build credit.

However, make sure that the website you choose to use for your search is unbiased toward any credit card company. Stick to general financial websites rather than specific credit card company websites.

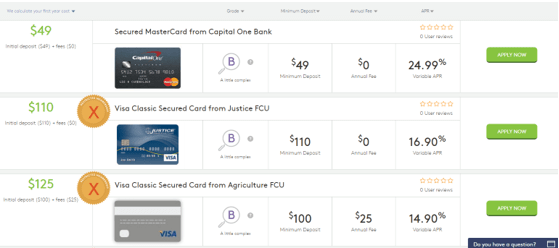

Image Source: Magnify Money

Magnify Money, for example, displays a comprehensive comparison table of some of the best secured credit cards for rebuilding credit without bias toward any credit card or company.

In the above image, you can see each card’s Magnify Money grade, minimum deposit, annual fee, APR, and your first-year costs of owning the card.

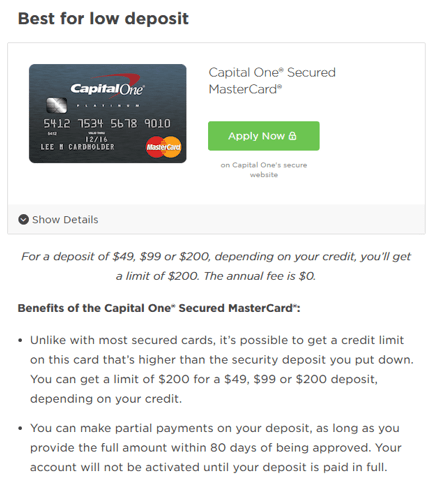

Source: NerdWallet

Or, try NerdWallet’s categorized list of best secured credit cards to rebuild credit. NerdWallet places top picks from categories like “Best for Low Deposit” and “Best for Rewards and Upgrading” so you can find the best credit cards to rebuild credit for you.

Related: Top Zero Interest Balance Transfer Credit Cards | Ranking | Interest Free Balance Transfer Cards

3. Keep Close Tabs on Your Secured Credit Card to Rebuild Credit

The best secured credit card for rebuilding credit will only help you rebuild your credit if you use it wisely. Even though your deposit is used as collateral for your credit line, you still need to ensure responsible use of the credit line from your best secured credit card for rebuilding credit.

Image Source: GADebtRelief.org

First and foremost, make sure you are not carrying a balance from month to month on your best secured credit card to rebuild credit. Use the card for making a small purchase you know you can pay off, and then pay it off when your bill comes. This proves to creditors that you know how to use your secured credit card to rebuild credit and are serious about doing so.

Make sure you also periodically monitor your credit card. The best secured credit card to rebuild credit will allow you to check your statements online and provide in-depth statements so you understand how your money is being used.

Make it a point to check your statement of your best secured credit cards to rebuild credit weekly to ensure that no unauthorized purchases are made from your account.

4. Make the Switch from Secured Credit Cards to Rebuild Credit to Unsecured Credit Cards

Once you have found the best secured credit card for rebuilding credit, you can consider making the switch to unsecured credit cards to rebuild credit.

Use the best secured credit cards to rebuild credit and get you on your feet, and then contact your credit card company to talk about switching to an unsecured credit line.

You should consider keeping your best secured credit card for rebuilding credit for at least a year before making the switch. This will show your credit card company that you are serious about rebuilding your credit and can use your credit responsibly over a good length of time.

Then, you can ask for your best secured credit card to rebuild credit to be switched to an unsecured credit card. Your credit card company will reimburse you your secured deposit and move the card to an unsecured credit line.

Unlike best secured credit cards to rebuild credit, unsecured credit cards can give you higher credit limits without using your own money as collateral. Since they are more often given to those with at least some positive credit history, unsecured cards are some of the best credit cards to rebuild credit.

Popular Article: The Best Credit Card for Airline Miles | Guide | How to Find and Get the Best Credit Cards for Miles

5. Ensure That Your Secured or Unsecured Credit Cards to Rebuild Credit Report to Credit Bureaus

The best credit cards to rebuild credit are those that regularly report to at least one credit bureau. Ideally, the best secured credit card for rebuilding credit will report to all three credit bureaus.

Image Source: The Simple Dollar

The Simple Dollar, for example, lists the Discover it Secured Credit Card as one of the best secured credit cards to rebuild credit, partly because it reports to all three of the credit bureaus regularly. If your credit history does not get reported to any credit bureau, then your responsible use of your card will go unnoticed in terms of creditworthiness.

After you find the best secured credit card to rebuild credit that reports to all three bureaus, TransUnion, Experian, and Equifax will take your payment information and store it in their records for other creditors who check your report to see. Therefore, should you eventually apply for a new credit card, your timely payment history will be displayed to new creditors.

6. Choose a Card That Keeps You in the Loop

The best credit cards to rebuild credit are those with full transparency in their rates and terms and those that give you the ability to carefully monitor your credit on a regular basis. Basically, the best credit cards to rebuild credit are those that keep you in the loop with your progress to rebuild your credit.

Find the best secured credit card to rebuild your credit that provides clear terms and outlines its rates for you to understand. Do not sign up for a card without first knowing its APR, minimum deposit, and fees information.

Additionally, you should make sure that your best secured credit card for rebuilding credit clearly states when there has been a change in terms, which can occasionally happen through the year. Your APR is subject to change, as is your type of rate (fixed or variable) and annual fee. Be sure to choose a credit card company that is quick to update you with this information.

Free Wealth & Finance Software - Get Yours Now ►

Conclusion

Bad credit takes time to rebuild, but there are best secured credit cards to rebuild credit available should you have the patience to work toward a better credit history. Make sure you understand what has caused your negative credit history in the past so you can work on rebuilding it properly in the future. Then, use the tips provided in this article to find the best secured credit card for rebuilding credit to get you on your way to a responsible credit history.

Read More: Top Credit Cards | Ranking & Reviews

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.