2017 RANKING & REVIEWS

BEST RATED CREDIT CARDS

What Are the Best Credit Cards to Apply For?

Aside from interest rates, many consumers wonder what they should think about as they compare the best credit cards. What are the best credit cards available, and what makes them the best credit cards to have?

One of the first things to think about when researching the best credit cards out there are the fees associated with the usage of a particular card. For example, is there an annual fee? Are there high penalties for a late payment? What are the other charges associated with the card? Does the credit card company charge cardholders foreign transaction fees when they’re out of the country? Unfortunately, many consumers don’t think about fees and how quickly they can add up when they use their credit card.

Award Emblem: Top 12 Best Credit Cards

When finding the best credit card to have, it’s wise to think about whether or not there are differences in the interest rate for balance transfers or cash advances.

Many of the best credit cards feature not only low fees and competitive interest rates, but they’re also rewards cards. This means users of these best-rated credit cards can earn everything from points that can be exchanged for merchandise to points that can be redeemed for travel and airline tickets.

Many of the best credit cards out there also feature cash back rewards, so cardholders are rewarded simply for using their card, and if they quickly pay their balance, they may actually make money off the use of their card.

The following ranking and review of the best credit cards looks at features like the ones above, as well as many other things relevant to the consumer. Each of the best credit cards on this list excels not just in one area but in many. For example, many of the best-rated credit cards include competitive interest rates, low or no fees, and rewards programs.

See Also: Citi® Double Cash Card vs. BankAmericard Cash Rewards™ vs. Spark Cash Select vs. Blue Cash Everyday® Card

AdvisoryHQ’s List of Top 12 Best Credit Cards

List is sorted alphabetically (click any of the credit card names below to go directly to the detailed review section for that credit card):

- Amex EveryDay® Credit Card

- Bank Americard® Cash Rewards Credit Card

- Blue Cash Everyday® Card from American Express

- Chase Freedom® Credit Card

- Chase Freedom® Unlimited Credit Card

- Commerce Bank Special Connections® with Rewards

- HSBC Premier World MasterCard®

- PNC CashBuilder® Visa Credit Card

- PNC Core℠ Visa

- TD Cash Credit Card

- TRIO℠ Credit Card

- US Bank Cash+™ Signature Visa® Card

Top 12 Best Credit Cards to Apply for | Brief Comparison

Credit Card Names | Intro Annual Fee | Annual Fee | Cash Back Bonus | Interest % (Min) |

| Amex EveryDay® Credit Card | $0 | None | – | 25.49% |

| BankAmericard® Credit Card | $0 | None | – | 14.24% |

| Blue Cash Everyday® Card from American Express | $0 | None | $150 | 25.49% |

| Chase Freedom® Unlimited Credit Card | $0 | None | $150 | 25.24% |

| Chase Freedom® Credit Card | $0 | None | $150 | 25.24% |

| Commerce Bank Special Connections® with Rewards (Visa/MasterCard) | $0 | None | – | 25.49% |

| HSBC Premier World MasterCard® | $0 | None | – | 25.24% |

| PNC CashBuilder® Visa Credit Card | $0 | None | $100 | 22.24% |

| PNC Core℠ Visa | $0 | None | $100 | 22.24% |

| TD Cash Credit Card | $0 | None | $100 | 23.49% |

| TRIO℠ Credit Card | $0 | None | $100 | 25.24% |

| U.S. Bank Cash+™ Visa Signature® Card | $0 | None | $100 | 24.24% |

Table: Top 12 Best Rated Credit Cards | Above list is sorted alphabetically

Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best Credit Cards to Have

Below, please find the detailed review of each card on our list of the best credit cards. We have highlighted some of the factors that allowed these best rated credit cards to score so well in our selection ranking.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Amex EveryDay® Credit Card Review

American Express is a financial services company specializing in credit cards for business, travel, and personal use. The company itself has nearly 118 million cards in use, $32.8 billion in annual revenue and $1 trillion in business billed around the world. This company is also the largest card issuer in the world, and they specialize in offering some of the most valuable services to cardholders to improve their financial lives.

The Amex EveryDay® Credit Card features a rewards program, competitive interest rates, and more features and benefits that allowed it to rank on this list of the best credit cards to have.

Key Factors That Led to Our Ranking of This as One of the Best Credit Cards

Below are some of the standout ways the Amex EveryDay® card excels and was ranked as one of the best credit cards to own.

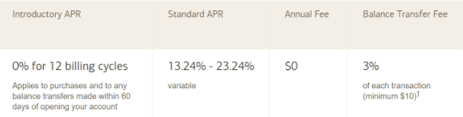

Fees and APR

When consumers are deciding on the best credit cards to apply for, their top priorities are often the fees and interest rate. These factors can play a significant role in the amount of your monthly bill. With the AmEx EveryDay® Credit Card, there is no annual fee on the main card and no annual fee for additional cards.

There is also a 0% intro APR on purchases and balance transfers for the first 12 months. After that, the APR becomes variable and currently ranges from 13.24% to 23.24%. The APR after the introductory rate is based on creditworthiness among other factors.

Membership Rewards Points

This selection for one of the best credit cards to have from American Express features participation in a Membership Rewards program. Through involvement in this program, cardholders have the opportunity to earn 20% more points, 2x points at supermarkets, and 1x points on other purchases for every dollar spent.

The 20% additional points earning bonus happens when card holders use their card 20 or more times on purchases in a billing period. The 2x points earnings at supermarkets applies to up to $6,000 a year in purchases.

The Membership Rewards program lets holders of the EveryDay® credit card, one of the best-rated credit cards, use their points for rewards from more than 500 brands in categories including travel, gift cards, merchandise, and entertainment. The points can also be transferred to American Express frequent traveler programs.

Introductory Points Offers

During the compilation of this list of the best-rated credit cards and the best credit cards to apply for, factors such as initial special offers and bonus offers were important. These are just additional ways credit companies create value for cardholders, and the Amex EveryDay® Credit Card is a great option for that added value.

For example, this pick for one of the best credit cards currently includes a bonus of 25,000 points after cardholders spend $2,000 on purchases on their new card in the first three months. Also, cardholders can use the points they acquire through Membership Rewards to book with American Express travel without blackout dates or seat restrictions.

Travel Benefits

American Express, in general, is often ranked as one of the companies offering the best credit cards available because of the travel benefits these cards includes. With the Amex EveryDay Card, cardholders receive the following travel benefits:

- Cardholders get double Membership Rewards points on every dollar spent on eligible travel, which can include hotels, vacation packages, and cruises when the card is used to book trips through AmexTravel.com

- Roadside Assistance is offered to cardholders when they need services like towing or changing a flat throughout the U.S., Canada, Puerto Rico, and USVI.

- Car rental loss and damage insurance come with this card when an eligible card is used to reserve and pay for the car rental.

Also available are a Global Assist Hotline and options for travel accident insurance.

Don’t Miss: Top Best Military Credit Cards | Ranking | Best Credit Cards for Military (Active & Veterans)

BankAmericard® Cash Rewards Credit Card Review

Bank of America, a leading global financial services provider and retail bank with operations based in Charlotte, N.C., offers a full lineup of credit cards, many of which offer rewards options. Some of the most popular credit cards from Bank of America include the BankAmericard® Travel Rewards card, the BankAmericard®, which is straightforward and convenient, and the BankAmericard® Better Balance Rewards Card.

Of these, the Bank Americard® Cash Rewards Credit Card is perhaps the most popular and is often rated as one of the country’s best credit cards to have. This card features a low APR offer, bonus options, and Preferred Rewards Participation.

Key Factors That Led to Our Ranking of This as One of the Best Credit Cards to Have

When comparing the best credit cards available and the best credit cards to use, the following are specific reasons the BankAmericard® Cash Rewards card is included on this list of the best-rated credit cards.

Cash Back

The primary reason the BankAmericard Cash Rewards card is on this list of the best credit cards to apply for (and the best credit cards to own) is because of the cash back program.

Cardholders receive cash back on every purchase, including 1% on regular purchases, 2% at grocery stores and wholesale clubs, and 3% on gas for the first $2,500 in combined grocery/wholesale club/gas purchases every quarter.

Cardholders of this pick for one of the best credit cards out there also receive a $100 online cash rewards bonus when they make at least $500 in purchases in the first 90 days after they open their account.

Preferred Rewards

The Preferred Rewards program is an exclusive offering available from Bank of America, and a key reason the Americard® Cash Rewards card is on this list of the best credit cards to apply for and the best credit cards available.

There are three tiers in the Preferred Rewards program, and the tier a cardholder is eligible for is dependent on qualifying balances in Bank of America banking and/or Merill Edge and Merrill Lynch investment accounts. As a person’s balances grow, their rewards do as well.

The first level is Gold, which qualifies cardholders for a 25% reward bonus on eligible Bank of America credit cards as well as perks like a 5% interest rate booster on Rewards Money Market Savings accounts. With Platinum status, cardholders receive a 50% Rewards Bonus on eligible Bank of America credit cards, and with Platinum Honors, there is a 75% Rewards Bonus on cards.

Fees and Interest Rates

In many cases, the best credit cards to apply for are those cards that have the lowest fees and interest charges. BankAmericard® Cash Rewards does well in this area. There is a 0% introductory APR currently offered with this selection for one of the best-rated credit cards. This is offered for the first 12 Statement Closing Dates following the opening of a new account.

There is also a 0% APR for the first 12 statement closing dates on balance transfers.

This card has no annual fee, and the foreign transaction fee is only 3% of the U.S. dollar amount of each transaction, which is relatively low compared to many other cards.

Cardholders aren’t charged any interest on purchases if they pay their entire balance by the due date each month.

Source: Bank Americard® Cash Rewards Credit Card

Security and Benefits

As one of the best credit cards to apply for and the best credit cards out there, the Bank Americard® Cash Rewards card features the following security components and general benefits:

- $0 liability guarantee for fraudulent transactions

- ShopSafe service protects cardholders when they shop online

- Chip technology

- Digital wallet technology to pay using Apple Pay, Android Pay or Samsung Pay

- Customizable account alerts

- Online and mobile banking

Related: Top Best Retail Credit Cards | Ranking | Best Retail Store Credit Cards for Bad Credit & Good Credit

Blue Cash Everyday® Card from American Express Review

American Express strives to help individuals and merchants access some of the most innovative payment, travel, and expense management solutions. This company is a global leader, and when consumers begin to compare the best credit cards, they will see that American Express consistently excels not only in their rewards programs and overall perks but also in customer service.

The Blue Cash Everyday® Card is a straightforward, simple-to-understand cash back rewards card that frequently includes special introductory and bonus offers to make it even more compelling for consumers.

Source: American Express

Key Factors That Led to Our Ranking of This as One of the Best Rated Credit Cards

During the process to compare the best credit cards, the following are some reasons the Blue Cash Everyday® card is ranked as one of the best credit cards to apply for and the best credit cards to have.

Cash Back

When consumers are searching for the best credit cards to have, and they start to compare the best credit cards, cash back can be a particularly appealing feature. The Blue Cash Everyday® Card has excellent cash back earnings opportunities.

Cardholders of this leader among the best credit cards can receive 3% cash back at U.S. supermarkets up to $6,000. They can earn 2% cash back at U.S. gas stations and certain department stores, and 1% cash back on all other purchases.

Cash back is received as Rewards Dollars that can then be redeemed as a statement credit.

This card also features regular extra bonus offers. For example, as of this writing, applicants can earn 10% back on Amazon.com purchases made on their card within the first six months of card membership.

Payment Flexibility

With this card, a leader among the best credit cards, users have payment flexibility. This means that they have the option to either carry a balance with interest each month or paying their balance in full.

This is helpful when cardholders have to manage their monthly expenses or make a large purchase. It provides them with a level of flexibility that they might need in a particular spending situation, but they can continue to earn rewards at the same time.

Cardholders can keep earning cash back on purchases that they receive in the form of Reward Dollars, and that can also be redeemed as a statement credit. This card also has no annual fee.

Shopping and Entertainment Benefits

The Blue Cash Everyday® Card isn’t just a best credit card to get because of the cash back and rewards. It also, like so many of the other best credit cards to own from American Express, features other perks, including some aimed at shopping and entertainment.

For example, the Extended Warranty program offered by American Express matches the length of manufacturers’ warranties for up to an extra year when an American Express Card is used on eligible purchases.

If a qualifying item bought with a card is returned within 90 days from the date of the purchase and the merchant won’t take it back, Return Protection may provide a refund.

Also available is Shoprunner. With Shoprunner, cardholders can get free two-day shipping on qualifying purchases at more than 140 online stores and more than 1000 brands. The membership is complimentary to eligible cardholders.

Account Access

In addition to providing some of the best credit cards available, robust rewards program, and excellent cash back options, American Express also excels because of the amount of transparency and access they provide cardholders.

For example, when you have the Blue Cash Everyday® Card from American Express, you can quickly log onto your online account and find information on your spending, balances of your Reward Dollars, and options to redeem your rewards.

American Express also provides cardholders with a Year-End Summary. This helpful statement shows cardholders all of their spending for the entire year, which allows them to review their annual spending. This can help cardholders see where their money is going, how the card is delivering valuable rewards, and how to make improvements to your budget.

Chase Freedom® Card Review

Chase is part of the JPMorgan Chase company, which is one of the oldest financial institutions in the U.S., with a history that goes back more than 200 years. The JPMorgan Chase company has assets of $2.4 trillion, operations in more than 100 countries, and they serve consumers, small businesses, corporations and institutions with investment banking, consumer and small business-driven financial services, asset management, and credit cards.

One of the most popular and best credit cards to apply for and best credit cards to have from Chase is the Chase Freedom® card. This card is one of the best credit cards to apply for and a best credit card to use because of things like bonus offers, cash back, and competitive APRs.

Key Factors That Led to Our Ranking of This as One of the Best Credit Cards to Have

During the process to compare the best credit cards, the following are some of the key reasons the Chase Freedom® was included on this list of the best-rated credit cards and the best credit cards to have.

New Card Member Offers

When consumers are in the process of looking for the best credit cards available and the best credit cards to apply for, it’s smart to look for offers specifically designed for new applicants. Many credit card companies, including Chase, will incentivize applying for a new credit card by offering special deals for opening a new account.

With the Chase Freedom® card, a selection for one of the best credit cards to apply for and one of the best credit cards to own, the current new offer includes a $150 bonus after spending $500 in the first three months from opening the account.

Cardholders can also earn an additional $25 bonus when they add their first authorized user to their card and make the first purchase within the same three-month period.

Source: Chase

5% Cash Back

The Chase Freedom® card includes a unique cash back program where cardholders of this selection for one of the best credit cards receive 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter. In addition to bonus categories, cardholders also earn unlimited 1% cash back on all other purchases.

Chase creates a yearly Cash Back Calendar for consumers with the Freedom® card. It’s broken down into quarterly segments, and each quarter represents a different opportunity for cardholders to receive 5% cash back.

For example, in 2016, the first quarter of the year included 5% cash back at gas stations, and the second quarter included grocery store and wholesale store purchases.

Redeeming Cash Back Rewards

When we set out to compare the best credit cards and rank the best credit cards to apply for, the options and processes for redeeming rewards were important factors. A rewards program isn’t of much use if there aren’t great opportunities for redeeming points.

Chase Freedom® is one of the best-rated credit cards on this list because they make the options and process for redeeming rewards flexible and easy.

To begin, cardholders can redeem their rewards for cash back starting at $20. They can choose to receive a statement credit or direct deposit into their checking or savings account. Users can also shop Amazon and instantly redeem their cash back rewards points to pay for their orders at checkout.

Another option includes redeeming rewards for gift cards and certificates, and cardholders can also book their travel with Chase Ultimate Rewards to receive competitive rates on travel and flexible payment options.

Service and Protection

It’s not just rewards programs and low fees and interest rates that can be appealing to consumers as they look for the best credit cards to apply for and the best credit card to get. It’s also a matter of customer service, security, and protection.

Customers rank the Chase Freedom® card well in terms of the overall level of customer service and assistance they say they receive.

This card also features Zero Liability Protection so that cardholders aren’t responsible for unauthorized charges made with their card and Purchase Protection, which covers new purchases for 120 days against damage or theft of up to $500 per claim and $50,000 per account.

This card is appointed with Price Protection, so if a card purchase made in the U.S. is advertised for a lower price within 90 days, the cardholder can be reimbursed the difference up to $500 per item, $2,500 per year.

Popular Article: Compare Credit Cards | Ranking | Top Credit Cards (Comparison & Reviews)

Chase Freedom Unlimited Card Review

As mentioned above, Chase excels in offering some of the very best credit cards to apply for and the best-rated credit cards in general. In addition to the Chase Freedom® Card, another one of their best credit cards to own is the Chase Freedom® Unlimited. Like the Freedom® Card, the Freedom® Unlimited is well-rated by consumers because of its excellent cash back and rewards-earning opportunities.

This card is generally offered to applicants with a credit score that’s anywhere from good to excellent. If you meet that criteria, it’s flexible and packed with plenty of benefits and rewards. It also frequently carries special offers for new cardholders.

Key Factors That Led to Our Ranking of This as One of the Best Credit Cards

The Chase Freedom® Unlimited Card ranks as one of the best credit cards out there and the best credit cards to have for reasons like the ones listed below.

Unlimited Cash Back

With some credit cards that feature rewards points and programs, there may be a limit to what a cardholder can accrue. These caps mean that cardholders might not be able to maximize their rewards point earnings, but the Chase Freedom® Unlimited is unique, and that’s where the “unlimited” in the name comes from.

This card stands out as one of the best credit cards to have for many reasons, including the fact that cash back is 1.5% and unlimited on every purchase.

The cash back earnings opportunities with the Freedom® Unlimited are also automatic, so not only are cardholders able to maximize the use of their card, but they can do so effortlessly and easily. They can then redeem their rewards earnings for cash anytime and in any amount.

Extended Introductory APR

Typically with credit cards, there will be an offer to have a low or 0% introductory APR for the first six months to a year after the new account is opened. One of the many ways Chase Freedom® Unlimited is unique among even many of the other best credit cards available is the extended introductory APR period.

This card includes a 0% introductory APR for a full 15 months on both purchases and balance transfers after the account is initially opened. This gives consumers about three months longer with no interest than what they would get with most other cards.

This extended zero introductory period was an important reason the Chase Freedom® Unlimited is included on this list of the best credit cards out there.

Introductory Bonuses

In addition to an excellent and long introductory APR period, there are also bonuses available to consumers when they first open a Freedom® Unlimited card account, and those bonuses are similar to what’s available with the Chase Freedom® card. New card member offers were a key reason both cards were named to this list of the best-rated credit cards and the best credit cards to have.

Currently, Chase is offering a $150 bonus to new cardmembers after they spend$500 in the first three months from account opening.

There is also the opportunity to earn an additional $25 bonus when an authorized user is added, and the cardholder also makes their first purchase within the same three-month period.

Flexible Rewards Redemption

Another similarity between the classic Chase Freedom® Card and the Chase Freedom® Unlimited Card that led to their inclusion on this ranking of the best credit cards is the flexibility and ease that comes with redeeming cash back rewards.

Speaking of bonuses, here’s another: the Chase Freedom® Unlimited Card rewards don’t expire. Then, cardholders can choose the redemption method that works best for them, with options including:

- Cardholders can opt to receive their cash back as a statement credit or direct deposit into their checking or savings account

- Users can spend their rewards directly on Amazon.com as they make purchases

- Rewards can be used to purchase gift cards for everything from shopping to entertainment

- When cardholders of the Chase Freedom® Unlimited Card, one of the best credit cards, book travel through Chase Ultimate Rewards, they can use their cash back and get competitive rates on travel

Read More: Top Bank of America Rewards Cards | Ranking & Reviews | Bank of America Travel, Cash, Rewards Cards

Commerce Bank Special Connections®

with Rewards Review

Commerce Bank might be one of the lesser-known banks in terms of name recognition on this ranking of the best-rated credit cards, but they have some of the country’s best credit card options. One of the best credit cards from Commerce Bank is the Special Connections® with Rewards, which is available as a Visa or MasterCard. Commerce is a community bank offering a wide variety of products paired with superior customer service.

There are more than 200 full-service branches throughout the nation; they also have a robust online banking platform, and as mentioned, some of the best credit cards out there.

Key Factors That Led to Our Ranking of This as One of the Best Credit Cards to Have

The Special Connections® card was included on this list of the best credit cards to apply for and the best credit cards to own for the reasons listed below.

Visa or MasterCard Options

One of the many ways this card is unique, and therefore included as one of the best credit cards to have, is because consumers have the flexibility to choose between either a Visa or MasterCard.

Both versions of the card carry valuable rewards and competitive interest rates, but you can select the type of card that is most appealing to you. Visa and MasterCard have different security advantages and perks available to cardholders, so the decision as to what works best for you as a consumer is entirely yours.

The Special Connections® card is one of the only on our list of the best credit cards to own that offers this option.

Source: Commerce Bank

Low APR

The Special Connections® Card, both the Visa and MasterCard version, has one of the most competitive interest rates of even the names on this list of the best credit cards to own. This competitively low APR is a key reason it’s considered a best credit card to use by many consumers.

To begin, new cardholders get an introductory 0% APR for six monthly billing cycles after opening an account, but that’s not where the interest rate advantages end.

After the introductory period ends, cardholders get a 10.49% APR-20.49% APR, depending on creditworthiness and other factors. This represents a very low interest rate compared to most other credit card offers.

Unlimited Rewards

Yet another way the Special Connections® card stands out and stacks up better compared to the competition as one of the best-rated credit cards is because of the unlimited rewards-earning options. Cardholders can earn unlimited 1% cash back on purchases, and then they can earn 2% or 3% cash back on purchases made in certain categories.

Also notable about this card and a reason it’s on this list of the best credit cards to apply for is because rewards can be earned on accumulated interest as well as purchases.

Those points can then be easily redeemed for not only cash but also merchandise, travel, gift cards, and more.

Fees

As a final note, the Special Connections® card doesn’t have a current bonus or offer for new cardholders when they open their account, which can be something some consumers don’t like, but they do make up for this with their lack of fees.

This card is ranked as one of the best credit cards available because there is no annual fee. Also, the foreign transaction fee is quite a bit lower than what’s found with many other credit cards, at just 2.00%.

As a final note, while you do need good credit to open the Special Connections® card, in most cases, that credit range starts at 690, which can make this card an option for more people than some other cards that require excellent credit.

Free Wealth & Finance Software - Get Yours Now ►

HSBC Premier World MasterCard® Review

HSBC is a bank that represents one of the largest financial services organizations in the world, serving the needs of more than 45 million customers. There are four main divisions of the HSBC business: Retail Banking and Wealth Management, Commercial Banking, Global Banking and Markets, and Global Private Banking.

There are around 4,400 offices around the world, and the HSBC network has coverage in 71 countries and territories. One of the leading credit cards offered by HSBC is the Premier World MasterCard®, touted as a card that fits the global lifestyle of users.

Key Factors That Led to Our Ranking of This as One of the Best Rated Credit Cards

When researching the best credit card to use, the following are key criteria that led to the HSBC Premier World MasterCard® being included on this list.

Rewards Program

As with the other names on this list of the best credit cards to apply for and the best credit cards out there, the Premier World MasterCard® includes an excellent Rewards Program. This Rewards Program lets new customers earn 40,000 Rewards Program Bonus Points after they spend $2,500 in new, net card purchases in the first three months after they open their account.

Points can then be redeemed for rewards that include airline tickets and frequent flyer miles, cash back, vacations packages, and more.

These Points have no expiration dates, and they’re also unlimited. Considered a best-in-class mileage and travel rewards credit card, the Premier World MasterCard®’s airline tickets also have no blackout dates.

Concierge Service

A lot of the focus when deciding on the best credit cards available and the best credit cards to have is on features like fees and rewards programs — which are very important, but so is customer service. This card was included on this list of the best-rated credit cards for many reasons, including superior customer and concierge service.

Cardholders have access to an array of services designed for convenience and to simplify their lives. With Concierge Service, cardholders can have the concierge team make dinner reservations for them, purchase event tickets, coordinate business arrangements, even find certain items and gifts.

The cost of goods and services obtained through the Premier World MasterCard® concierge service can be charged directly to the card, for even more convenience.

HSBC Premier Privileges

HSBC Premier Privileges is an exclusive offering available to cardholders with this pick for one of the best credit cards. Through this program, cardholders have access to merchant offers in categories including travel and leisure, dining, shopping, and health and beauty.

Privileges that are part of this program exclusive to the Premier World MasterCard® and HSBC cards include:

- This program gives cardholders access to global offers from hotels and resorts to airlines and providers of travel packages.

- You can experience culinary experiences across the country through the Premier Privileges program.

- Discounts are available on merchandise and products including fashion, health items, home and garden, and more.

- There are experience options available to cardholders of this pick for one of the best credit cards to have.

Safety and Security

Since the Premier World MasterCard® is considered one of the best credit cards on a global level, it also includes global-level security and safety protection, which can help protect cardholders even if they’re traveling around the globe.

If the card is lost or stolen, the cardholder has no liability for unauthorized use, and a family’s supplementary cards have the same level of protection. Other international security and safety features available with this best credit card to use include:

- Identity Fraud Expense Reimbursement

- Coverage for lost, damaged or delayed luggage

- MasterRental Insurance for car rentals

Related: Top Best Navy Federal Credit Cards | Ranking | Best NFCU Secured, Rewards, Cash Back Credit Cards

Free Budgeting Software for AdvisoryHQ Readers - Get It Now!

PNC CashBuilder® Visa Credit Card Review

A leading financial services company, PNC doesn’t just offer the consumer a widely varied selection of personal and business banking options, investment product, loans, and wealth management, but also credit cards in categories including rewards, cash back, travel, low interest, and more.

No matter what a consumer is searching for, PNC offers some of the best credit cards to have and some of the best-rated credit cards. Among even those, the PNC CashBuilder® Visa Credit Card is a standout. This rewards credit card is specifically designed to help cardholders maximize their cash back.

Source: PNC

Key Factors That Led to Our Ranking of This as One of the Best Credit Cards Available

During the process to compare the best credit cards, the following are big reasons the CashBuilder® Visa is part of this list of the best credit cards to have.

Balance Transfers

Balance transfers and the features cards offer to facilitate better transfers was considered in the ranking of the best credit cards to apply for and the best credit cards out there. Balance transfers are important for many consumers, as they help them consolidate and pay down other debt in a more affordable, manageable ways.

This card was selected as one of the best credit cards for several main reasons, including for its balance transfer options.

The CashBuilder® has an introductory 0% Annual Percentage Rate on balance transfers for the first 12 billing cycles following the opening of an account when the balance is transferred within the first 90 days following opening. There is a calculator on the PNC website that lets consumers see how much they could save by transferring existing balances to this best credit card to use.

Cash Back

As well as being one of the best-rated credit cards and one of the best credit cards to have for balance transfers, this is also a rewards card. The features of the rewards program include the following:

- Cardholders earn 1.25% cash back on net purchases in the next billing cycle after making adjusted purchases totaling up to $1,999.99 in the prior billing cycle.

- Earn 1.50% cash back on net purchases in the upcoming billing cycle after making adjusted purchases totaling $2,000.00-3,99.99 in the previous billing cycle or maintain a Performance Checking account or Virtual Wallet with Performance Spend and meet minimum balance or direct deposit requirements in the previous billing cycle.

- Earn 1.75% cash back on net purchases in an upcoming billing cycle after making adjusted purchases that total $4,000 or more, or maintain a Performance Select Checking Account or Virtual Wallet with Performance Select and meet minimum balance or direct deposit requirements.

Other Rewards Benefits

In addition to the tiered and high levels of cash back listed above, some other elements of the cash back program that comes with the PNC CashBuilder®, one of the best credit cards to apply for and one of the best credit cards to have, is unlimited earning potential on cash back. There are no caps on how much the cardholder can earn, and the cash back rate is the same across all spending categories, including travel, gas, groceries, and more.

Cardholders can start redeeming their rewards when they have accumulated $50, and they can have their rewards credited back to their credit card account or deposited into a PNC checking or savings account.

Also, these cash back rewards don’t expire.

Online Management

One of the things that tend to be lacking even with the best-rated credit cards and the best credit cards available is robust online management options. A lot of companies will offer cardholders the opportunity to log on and check their balances and transaction history, but they don’t go far beyond that.

PNC Online Banking can integrate with the CashBuilder® credit card account to help cardholders easily and quickly manage their daily spending and stay on top of their budget and account, even on-the-go with mobile banking and PNC Card Alerts.

Users can check their credit card accounts at any time including their balance, available credit, credit limit, cash advance balance, APR, minimum payment due and their previous statement information.

They can also see up to 13 months of posted transactions, search transactions, export information to their financial software, transfer funds, request a credit limit increase and view their reward balances and redeem them online.

Don’t Miss: Top Best Gas Credit Cards | Ranking | Best Credit Cards for Gas Rewards & Points

Free Wealth Management for AdvisoryHQ Readers

PNC Core℠ Visa Review

Another one of the best credit cards to apply for and a best credit card to use that’s offered by PNC is the Core℠ Visa. The Core Visa joins a lineup of many diverse and value-creating cards available from PNC including the CashBuilder® as well options like the PNC Premier Traveler® Visa Signature Credit Card and the PNC points® Visa Credit Card.

The Core℠ card stood out and was included on this list of the best-rated credit cards and named as a best credit card to get for quite a few reasons that relate to the rates that come with it, the simplicity of use, and the general savings opportunities cardholders can enjoy.

Key Factors That Led to Our Ranking of This as One of the Best Credit Cards

When looking at the many options to compare the best credit cards, the list below highlights some of the main reasons the Core℠ Visa from PNC was included on this list of the best credit cards.

Introductory APR

One of the key features that almost all of the cards on this list of the best credit cards to have shared in common is a 0% Annual Percentage Rate, so in addition to looking for cards that have that, also important in the ranking process was looking at the cards that carry that introductory 0% APR for the longest period of time.

This is somewhere the Core℠ Visa Card excelled. This card does have that great 0% APR, and it’s one of the longest introductory periods of the list of the best credit cards to have at 15 months. For 15 months, new cardholders pay no interest on purchases, and this also includes balance transfers when the balance is transferred within the first 90 days following the opening of the account.

After that 15-month period, the variable APR remains competitively low, with the lowest interest rate being only 10.24%.

Card Features

There is something that’s appealing about the Core℠ card regarding its simplicity. It’s specifically designed as one of the best credit cards to offer very low interest rates, and it also has no annual fee.

In addition to excellent introductory rate balance transfer options, this card also features other perks that still keep it a simple, easy-to-use, and inexpensive card but that also improve its convenience.

These include:

- PNC security and privacy tools and features to protect cardholders from credit or identity fraud

- Online account management tools

- Automatic travel and emergency protection

- $0 fraud liability, so cardholders aren’t charged for fraudulent charges on their account

Source: Core℠ Visa

Online Management

As with the other PNC card included on this list of the best credit cards, the Core℠ Card lets consumers quickly and easily manage every aspect of their account online or on their mobile device. This is essential in the selection of the best credit cards to have because consumers demand the ability to see what they’re spending, how much they’re being charged in fees and interest, and other relevant account information.

Cardholders can quickly add PNC Online Banking or Virtual Wallet to their card, giving them a greater sense of control over their account and their day-to-day spending.

They can view in-depth account details, pay their bills, view their rewards, and even transfer funds. They can also create account reminders and alerts for themselves to make sure they’re always ahead of what’s happening with their card.

This level of online account integration isn’t available with every credit card, even some of the best credit cards, which is why it’s something we named as being excellent about the Core℠ Card.

Customer Service

PNC ranks well in terms of not just offering some of the best credit cards out there, but they also have strong customer service. Credit card customers at PNC report feeling like they can trust the service of the bank when they need it, including in emergency situations.

The customer service team that deals with credit card customers is entirely U.S.-based and accessible; along with phone services, there are other formats cardholders can use when they need assistance, including emails and online messaging.

The Core℠ Card is different from some of the other cards on this ranking of the best credit cards because it doesn’t include a rewards program; however, it tends to make up for that with its low cost of use, convenience, excellent customer service and support, and relevant, straightforward features.

Free Money Management Software

TD Cash Credit Card Review

TD Bank is one of the 10 largest banks in the U.S., and it calls itself “America’s Most Convenient Bank.” TD strives to offer banking products and services with a human touch, and it caters to the needs of retail and small business customers, as well as commercial clients. This bank serves the needs of more than 8.5 million customers across the country.

Key credit cards from TD Bank include options like the TD First Class℠ Visa Signature® Card, designed to offer miles on travel and dining purchases, as well as TD Ameritrade Client Rewards Credit Card. For this review, we’re covering the TD Cash Credit Card, which is one of the best credit cards to have.

Key Factors That Led to Our Ranking of This as One of the Best Credit Cards

When you’re searching for the best credit card to get or the best credit cards to apply for, the TD Cash Card is an excellent option. Reasons for that are listed below.

Unlimited Rewards

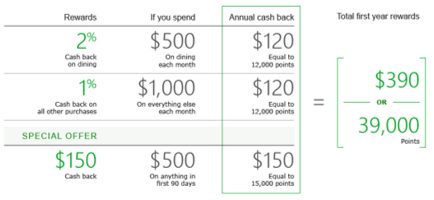

The TD Cash Credit Card, along with generally being one of the best credit cards and a best credit card to get, is excellent for anyone searching for a top-notch rewards program, and in particular, one that focuses on dining. This dining-friendly card features 2% cash back on dining for cardholders that spend $500 on dining each month. That can mean annual cash back of $120 equal to 12,000 points.

In addition to dining cash-back, there is 1% cash back on all other purchases if you spend at least $1,000 per month outside of dining.

Once you accumulate your points, you can redeem them for more than 400 options, including travel, merchandise, and gift cards, as well as cash.

Source: TD Cash Credit Card

Rates and Fees

Currently, as with many of the other best credit cards to own and best credit cards available, the TD Cash Credit Card features competitive rates and fees. To begin, there is currently a 0% introductory APR on balance transfers, making it easy for new account holders to move or consolidate their existing debt so that it’s easier to manage and less expensive. That introductory rate applies for the first 12 billing cycles after the account is opened.

After that, the APR for balance transfers remains relatively low, and the APR for purchases is similarly competitive, although based on overall creditworthiness.

Perhaps one of the primary perks of this card is fees; one main reason it was named as a best credit card to get is because there is no annual fee, and there are absolutely no foreign transaction fees, making it a good option for frequent travelers as well.

Bonus Rewards

Although they do change, there are almost always going to be additional bonus and cash back opportunities available with the TD Cash Credit Card.

The current introductory bonus promotion offers $150 cash back just for opening the card account, in addition to the cash back on dining and all other purchase.

Cardholders get the $150 bonus cash back when they spend just $500 in their first 90 days after their account opening.

Online Banking and Tools

Uniquely, the TD Cash Credit Card is one of the best credit cards that lets cardholders manage most tasks they need to do with their card through the robust TD Online Banking platform.

In addition to doing things like checking credit limits and transaction history, what’s even more unique about this card and TD Bank, in general, is the ability for cardholders to check their free VantageScore when they log onto online banking that’s integrated with their TD Cash Credit Card. As well as being able to check their VantageScore, there are free credit education tools available to cardholders.

These tools are designed to help them make smart financial decisions presently and into the future, and also to responsibly manage their credit card.

Popular Article: Top Good Credit Cards for Excellent & Good Credit | Ranking & Reviews | Top Rated Best Credit Cards

TRIO℠ Credit Card Review

Available from Fifth Third Bank, the TRIO℠ Credit Card is a cash back rewards card ideal for everyday spending. Fifth Third is a consumer-driven bank and full-service financial company headquartered in Cincinnati, Ohio. Fifth Third offers not only some of the best credit cards to have but also deposit accounts, loans and mortgages, and other leading-edge products.

As well as the TRIO Card, one of the best credit cards available and a best credit card to use, Fifth Third also offers credit card options like the Truly Simple℠ Card, which strives to offer a competitive rate and no surprise fees.

Source: TRIO℠ Credit Card

Key Factors That Led to Our Ranking of This as One of the Best Credit Cards

Main reasons TRIO℠ ranked as one of the best credit cards to apply for and a best credit card to use are detailed below.

Cash Back

If you’re looking for one of the best credit cards to own, the TRIO℠ Card might be the right option for you, particularly if you dine out frequently. This cash rewards card features 3% cash back at restaurants, but it doesn’t stop there.

TRIO℠ is also one of the best-rated credit cards because users get 2% cash back rewards on gas and at grocery and drug stores, up to $1,500 spent per quarter in these combined categories.

As a best credit card to use, TRIO℠ also features 1% unlimited cash back rewards on all other purchases.

Shopping Features

The TRIO℠ Card was included on this list of the best credit cards to apply for and the best credit cards to own for several key reasons, including not only the cash back rewards but also the shopping protections built-in to the card.

These protections are designed to give consumers complete protection and peace of mind when they make purchases. They include:

- Price Protection: If a cardholder finds a lower price for a new item purchased with the card, they might be eligible to receive a reimbursement for the difference in price.

- Extended Warranty: With this feature, cardholders of this selection for one of the best credit cards out there will get double the original manufacturer warranty for up to two years when they pay with their card.

- Digital Payments: This card is equipped with digital payment functionality including Fifth Third Masterpass, Apple Pay, and Samsung Pay.

Travel Features

This is not only one of the overall best credit cards to apply for and one of the best-rated credit cards. It’s also ideal for frequent travelers because of offerings and built-in features.

For example, with MasterCard Priceless® Cities, cardholders can take advantage of special treatment and offerings around the world like tickets and behind-the-scene access. The MasterCard Airport Concierge feature allows cardholders to get their own concierge as they fly through airports.

This card is also appointed with MasterCard Concierge Services, which features personal assistance with everything from making dinner reservations to securing in-demand event tickets.

New Cardholder Offer

It’s important to note that new cardholder offers are subject to change or end, and the TRIO℠ Card is no exception, but this card is one of the best credit cards available and one of the best credit cards to own because there is almost always going to be some type of new cardholder offer.

The current offer provides a new account bonus worth $100. To earn 10,000 Real Life Rewards Bonus Points, a new account holder simply has to spend $1,000 within 90 days of opening an account.

Once they do that, their points can be redeemed for $100 cash back.

Also important to note about this card, selected as one of the best credit cards, is that there is no annual fee and no international transaction fees on credit purchases.

U.S. Bank Cash+™ Visa Signature® Card Review

U.S. Bank, along with offering some of the best credit cards available and the best credit cards to apply for, is a leading bank in the country. U.S. Bank has thousands of branches around America and offers not only some of the best credit cards out there, but also leading products in the areas of online and mobile banking, checking and savings, and mortgages and refinancing.

Among the best credit cards, the Cash+™ Visa Signature® Card excels for anyone searching for great perks, rewards, and relatively low fees and interest rates.

Key Factors That Led to Our Ranking of This as One of the Best Credit Cards to Have

As part of the process to compare the best credit cards, find the best credit cards available, and rank the best credit cards to have, the following details highlight some reasons the Cash+™ Visa Card is on this list.

Visa Signature Benefits

Some of the features that make this a best credit card to get and a best credit card to use are available directly from U.S. Bank, while others are Visa exclusives. This card is appointed with Visa Signature Benefits, which is a suite of luxury cardholder perks that include the following:

- Visa Signature Concierge: Holders of this best credit card to get can take advantage of 24/7 assistance including travel reservations, entertainment planning and more

- Travel: This card features complimentary discounts and upgrades at hotels, resorts, and more

- Entertainment: Holders of this pick for one of the best credit cards to own can take advantage of exclusives like move tickets and special music offers

- Fine Food and Wine: There are a variety of available food and wine experiences

Other areas where Visa Signature Benefits are available include sports, shopping, travel accident insurance, and more.

Cash Back

As with the majority of the best credit cards named on this ranking of the best-rated credit cards, the Cash+™ card has some of the highest cash back percentages of any credit card.

For example, cardholders receive 5% cash back on their first $2,000 in combined net purchases each quarter on two categories of their choosing. Then, there is 2% cash back on the cardholder’s choice of one everyday category, such as gas or groceries.

Cardholders of this best credit card to use then have 1% cash back on everything else.

Also, there is no limit on total cash back earned.

Bill Pay

Unique to this selection for one of the best credit cards to have and a best credit card to use is the ability to link it to your U.S. Bank Online Banking account and then conveniently and effortlessly pay bills. When you pay bills with your Cash+™ Visa Signature® Card, you’re eligible to receive cash back on these payments, so you’re making money by making payments.

At the same time, it’s also convenient to pay bills this way. Cardholders can eliminate the need to write checks or worry about delays in the mail when they use their U.S. Bank credit card to pay their necessary bills.

Cardholders can also sign up for account alerts through U.S. Bank Internet Banking so they can keep up with account activity, make sure there is no fraudulent activity and stay ahead of their spending.

Introductory APRs and Fees

When comparing the best credit cards to apply for, the best credit cards to own, and the best credit cards out there, it was important that they performed well in terms of APR and fees. The world of credit cards is competitive, so the names on this list of the best-rated credit cards feature competitive introductory APRs and competitive fees as well.

The Cash+™ Card is no exception.

This leader among the best credit cards features a 0% introductory APR for the first 12 billing cycles on any balances transferred within 60 days from opening. This leader among the best credit cards also has no annual fee.

Conclusion — Top 12 Best Rated Credit Cards

The world of credit cards has evolved, and that has redefined how the best credit cards to apply for and the best credit cards to have are characterized. Consumers have become more demanding and discerning than ever when it comes to comparing the best credit cards and choosing the best credit card to get.

Companies are pulling out all the stops to ensure they offer the best credit cards, from featuring excellent rewards programs with cash back to introductory 0% interest rates for more than a year in some cases.

The above list of the best credit cards to own and the best credit cards available considers the most pivotal concerns of the average consumer as they search for the best credit cards to apply for, particularly when the choices are so plentiful.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.