Guide: Finding The Best Credit Card for Airline Miles

Frequent fliers are always looking for new ways to save on the ever-increasing expense of repeated travel arrangements. With the cost of flights still on the high side, investigating the best credit cards for airline miles only makes sense.

Why not save money on flights by making purchases you were already planning? Shopping at the grocery store, dining out at your favorite local restaurant, and filling your car up with gas can all help you to afford a few more flights with the best credit card for miles.

There are dozens of these cards on the market today, all claiming to be the best credit cards for miles. What is the best credit card for airline miles? AdvisoryHQ wants to help you wade through the details so you know which option will be the best credit card for miles for your personal travel needs.

Join us for our comprehensive guide to finding and getting the best credit cards for airline miles in the sections below.

Should You Get One?

If you’re reading this article, you probably already think that you need the best credit card for air miles. However, you might not need the best credit cards for miles as much as you think you do.

You may even be better off with something other than best credit cards for miles if you don’t match these descriptors:

- You have a preferred airline: You travel often enough that you know which airline is your favorite. Whether it has to do with their roomy seating arrangements, the cost of their flights, or the availability of their scheduling, you spend a lot of time with just one airline. Your best credit card for miles option will almost certainly be tied to this specific company.

- You travel for more than vacation. If you are looking into the best credit cards for miles just for that once-a-year vacation you’ve been planning, think again. The best credit card for miles is ideal for individuals who fly more than five times each year.

- You don’t rely on just one credit card. You might have one of the best credit cards for travel miles, but you don’t want to use just this. You should also have a more general rewards credit card that can contribute to items apart from airfare. You may even be able to trade those rewards in for travel expenses, just as you would one of the best credit cards for miles.

- Your balance gets paid on time. If you routinely struggle to make the payments on your credit cards as it is, even the best credit card for air miles won’t be of much help to you. In fact, it could end up costing you even more. We wouldn’t recommend getting any of the best credit cards for miles until you’re confident you can responsibly manage your debt and pay your balance off each month.

It might seem like quite a list of qualifiers for something as simple as the best credit card for miles, but there are some definite disadvantages to an airline credit card if you’re not well-suited to it.

For example, there are typically more fees associated even with the best credit cards for miles than there are with other types of credit cards or rewards cards. Be prepared for the financial expense of even the best credit card for miles and make sure that it’s worth it to you.

Qualifying for the Best Credit Cards for Airline Miles

Once you’ve determined that you could benefit from the best credit card for miles, it’s time to evaluate whether or not you would qualify for one of the best credit cards for travel miles. Just as there is a very specific segment of the population that can most benefit from the best credit cards for miles, there is an even smaller segment that qualifies for them.

First and foremost, you should have a good to excellent credit score. This is a requirement for most of the best credit cards for miles.

A good credit score would be defined as a FICO score of between 690 and 719, while an excellent score would be a 720 or higher. If you aren’t sure where your credit rating falls, you can utilize some of the free credit score sites such as Credit Karma for a general idea of what category you may fall into.

Alternatively, if you already have a different rewards credit card, they may offer free credit reporting, which is usually available on your monthly statement. Take a look at your statement to see if it has a free FICO credit score listed to give you an idea of what you may qualify for when it comes to finding the best credit card for airline miles.

The other major stipulation for individuals who want to receive one of the best credit cards for flyer miles is paying your balance off in full at the end of each month. Many people enjoy using their credit cards to host a revolving door of debt that never seems to dissolve.

Unlike with some of the low interest credit cards that are ideal for this type of revolving debt, even the best credit cards for flyer miles should avoid this.

The best credit card for airline miles typically boasts a higher than average interest rate that doesn’t make this feasible. You won’t really be saving on the cost of travel if the money you’re saving is going toward the interest on your best credit card for miles.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Recognizing the Best Credit Card for Miles

What is the best credit card for airline miles? It can be hard to decide. Many of the best credit cards for airline miles come with a number of considerations to help you decide if they truly are the best credit card for miles for you personally.

Here a few things you should consider when weighing the various choices for the best credit card for frequent flyer miles:

- Signup Bonus: When you initially apply for the best credit card for travel miles, you will likely find that they have a signup bonus to entice you to sign up with them. These are extra points that are issued to your account, usually after you meet a certain spending requirement. The best credit cards for miles will usually issue a signup bonus between 25,000 and 50,000 points, with a common spending requirement of $3,000 in the first three months.

- Rewards Rate: The rewards rate is a critical feature to consider when you’re researching any type of rewards credit, but especially when it comes to the best credit cards for airline miles. You should see which categories qualify for higher rewards rates and what the base rate is. It isn’t uncommon to see a base rate of one percent with the higher rate coming in at two to three percent for travel accommodations and dining out.

- Benefits: Chances are that if you’re a frequent flyer, you know which services are the most important to you. Whether you prefer priority check-in, a free checked bag, or the option to upgrade your seats at a discount, the best credit card for airline miles should come with additional perks and benefits that match up with your desires and make your travel more comfortable.

- Annual Fees: It’s already been discussed that there are certain fees associated with even the best credit card for travel miles. In many cases, this comes in the form of an annual fee. Most people would prefer to find the best credit card for miles with no annual fee, but it isn’t always possible. You will want to pay close attention to this number. Many times, it is waived for the first year as an introductory offer on the best credit card for air miles. After this first year, it can range from $59 to $195 on some of the best credit cards for airline miles.

The final consideration to determine which of the best credit cards for airline miles is for you is their ease of redemption. In the past, many of the best credit cards for miles were strictly affiliated with one airline.

However, now, some of the choices for the best credit card for frequent flyer miles allow users to purchase flights and other perks within their designated partner network. Your points can transfer from one airline to another, provided it is on the list of acceptable arrangements in their network.

This flexibility in redemption should be a top priority to seek out when determining which one of these is the best credit card for miles for you.

You may have just one preferred airline, but if there are no flights available, having a partnership and network of other airlines to choose from boosts your likelihood of having the best transportation and travel arrangements. Redemption should be one of the first considerations in regard to discovering the best credit cards for airline miles.

Best Credit Cards for Travel Miles

What is the best credit card for miles? Finding the best credit card for frequent flyer miles can be like finding a needle in a haystack.

There are so many options available on the market, all vying to be the best credit card for travel miles. How do you know what is the best credit card for miles? We’ve compiled a list of some of our top choices when it comes to the best credit cards for airline miles.

Gold Delta SkyMiles® Credit Card from American Express

This is one of the top choices for the best credit card for miles with no annual fee during your first year. After the first year, you should expect to pay $95. Earn 30,000 bonus miles as a signup incentive after you make just $1,000 in purchases in the first three months.

Every dollar you spend earns you two miles on purchases made through Delta, while other purchases earn you one mile per dollar.

You get a host of benefits that are appealing to avid travelers, including:

- Priority boarding

- Car rental loss and damage insurance

- Travel accident insurance

- Roadside assistance hotline

- Extended Warranty

The APR is relatively low, typically ranging from 15.49 to 19.49 percent based on your credit score and personal factors.

With more purchases and extended usages, you may find it worthwhile to upgrade to two of the other best credit cards for airline miles from American Express: the Platinum Delta SkyMiles® Credit Card and the Delta Reserve® Credit Card.

Source: American Express Credit Cards

Barclaycard Arrival Plus™ World Elite MasterCard®

Another instance of being a great choice for the best credit card for miles with no annual fee for the first year, the Barclaycard Arrival Plus™ World Elite MasterCard® charges just $89 annually after your initial year.

Receive a limited time signup bonus of 50,000 miles after spending $3,000 on the card within the first 90 days. You currently receive two miles per dollar that you spend on this card and receive five percent back in miles during your redemption.

One of the best benefits is having foreign transaction fees waived on anything you buy while outside of the country. It was named one of the Best Credit Cards by Money Magazine for 2015 and 2016, as well as the Best of the Rewards Cards from Kiplinger’s in 2015.

You receive a zero percent introductory rate on APR for the first year for balance transfers made within four days of opening the account. After this point, you could be looking at higher variable APR of 16.24%, 20.24%, or 23.24% — significantly higher than the numbers you can expect with the best credit cards for miles from American Express.

Source: Barclaycard

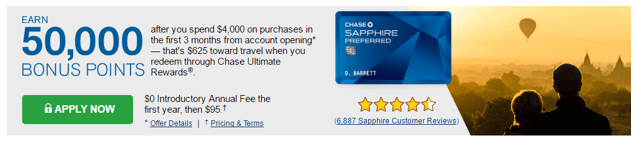

Chase Sapphire Preferred®

Long recognized as one of the best credit cards for flyer miles, the Chase Sapphire Preferred® credit card is frequently the answer to questions such as, “What is the best credit card for airline miles?” Sapphire is touted as one of the top options for the best credit card for miles with no initial annual fee. After that, it reverts to its normal rate of $95 each year.

You can also expect a 50,000 point signup bonus when you spend $4,000 in the first three months (they equate this to $625 toward travel when you redeem through Chase Ultimate Rewards).

When it comes to earning rewards points, dining and travel expenses (including hotels, taxis, trains, and airfare) will earn you twice the points of all other purchases.

Source: Chase Sapphire Preferred®

The card waives all foreign transaction fees and gives you a number of other benefits that enable us to call it one of the best credit cards for airline miles, including:

- Point transfer to participating programs for an equal value

- Auto rental collision damage waiver

- Trip cancellation or interruption insurance

- Trip delay and baggage delay insurance

- 24/7 customer service specialist access

The annual percentage rate will range from 16.24 to 23.24 percent based on your credit worthiness. This is in line with the interest rates charged by many of the best credit cards for flyer miles, but it is still more than those advertised by the Gold Delta SkyMiles® credit card from American Express.

Popular Article: The Best Prepaid Credit Cards | Guide to Finding Top, Free, Online Prepaid Credit Cards

Conclusion

What is the best credit card for miles? Digging through the various resources and the fine print of all the best credit cards for airline miles can be tedious.

If you know that selecting the best credit card for miles could present a potentially significant benefit for you, don’t waste any more time figuring out what you need to know about the best credit cards for airline miles.

Consider a few of these options and whether or not they would work for you. The best credit card for miles will differ depending on your needs, which benefits you desire, and what interest rates you can qualify for.

The signup bonuses are another factor to keep in the back of your mind, if you think you can reach the spending requirements.

A rewards credit card is a handy item to have in your wallet. Keep searching for the best credit cards for airline miles for your personal needs and see how much you can save on your travel arrangements.

Read More: Top Good Credit Cards for Excellent & Good Credit | Ranking & Reviews | Top Rated Best Credit Cards

AdvisoryHQ (AHQ) Disclaimer: Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info. Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.