Guide: Finding the Best Credit Cards for Students

In 2016, students either do not want credit cards or are struggling to qualify for a credit card. These are realities that millennials now face, as they become buried in student debt and begin their adult lives in a less-than-perfect economy. However, credit cards for students can open up a lot of options for young adults in the future.

The best credit card for students, when used properly, can help college students secure a financial future. If not used properly, however, it could lead a student into further debt he or she will be stuck with upon graduating.

So, is it worth it for college students to search for the best credit cards for students? Absolutely, because there are some excellent cards made specifically for students, like the BankAmericard® Credit Card for Students, among many others.

Source: Studenomics

The best credit card for students will offer benefits specific to college students, who are newcomers to the credit card world.

For example, the Discover Student Credit Card waives your first late payment fee because it understands mistakes happen, especially when you are new to using credit cards.

This article will show you why searching for the best credit card for students is a good idea, especially in a rough economy. We have also collected information for a few of the best student credit cards and put them right here in this article to help you find the card that is best for you.

We narrowed down the best credit cards for students to these specific cards because of their benefits and availability to college students with little to no credit: Discover Student Card, Wells Fargo Student Card, Regions Student Visa®, BankAmericard® Credit Card for Students, and Chase Student Credit Card.

See Also: Top Best Gas Credit Cards | Ranking | Best Credit Cards for Gas Rewards & Points

Why Should You Apply for Student Credit Cards?

It is common to be scared of the debt you will inevitably face upon graduation. As a graduate, you will likely have thousands in student debt from the loans that funded your college tuition. This debt tends to scare college students away from applying for student credit cards. They want to avoid getting caught in a funnel of debt from various sources.

Your concerns are valid, but credit cards for students can actually be excellent tools to secure your financial future after graduation and beyond. As a new college student, you have little to no credit. The Credit Card Act of 2009 prohibited those under 21 from applying for student credit cards without a cosigner unless they have stable, and enough, income.

Source: The Balance

Undoubtedly, this made it difficult for young adults to build their credit to have a solid credit history after graduation. But, this is where the best student credit cards come in.

Cards referred to as the “best credit card for students” are so because of the benefits they provide college students with a lack of credit history. The credit card companies behind the best student credit cards make them for the purpose of helping students create a solid credit history within a few years’ time.

Many of the best credit cards for students, like the Discover Student Card, offer fairly low interest rates, low or no annual fees, the ability to monitor your credit score, and additional rewards. The best student credit cards are made to help your life as a student easier while building your credit to prepare for your future.

Don’t Miss: The Best Credit Card for Airline Miles | Guide | How to Find and Get the Best Credit Cards for Miles

What are the Features of the Best Student Credit Cards?

To be considered a “best credit card for students,” a credit card should offer benefits and services that will help college students financially. Most college students do not have steady or significant incomes because classes take up the majority of their time. They also do not have a solid credit history, so finding the best credit cards for students that allow low payments and excellent credit reporting is important.

Source: Daily Collegian

When searching for the best credit card for students, consider the following criteria a credit card should meet:

- Low interest rates: Some credit cards for students have sky-high interest rates, as many credit cards do for those with little to no credit. However, the best student credit cards offer competitive interest rates for students. The BankAmericard® Credit Card for students, for example, offers a low APR of 11.24% to students who qualify.

- Low fees: The best credit card for students has the least number of fees. Some credit cards charge annual fees, maintenance fees, late payment fees, and more. Others, like the Discover Student Card, waive the fee for your first late payment because they understand you are still learning how to use your card responsibly.

- Low minimum payments: Student credit cards with low minimum payments are the best credit cards for students to look for. You will want a card that you can use for emergencies if needed and make reasonable payments on each month if you cannot afford to pay off your purchase for a couple of months.

- Credit monitoring: Some credit cards for students keep you in the loop with credit monitoring by providing free access to your credit score each month or credit education tools. The Wells Fargo Student Card, for example, allows free access to your FICO score when you use its mobile banking system.

- Cash or point rewards program: The best credit cards for students will offer you rewards for using your card responsibly, making qualified purchases, or even being a good student. Reward programs can provide you cash back on purchases or points to choose your own rewards.

- Frequent credit line increases: One of the main purposes for applying for a best credit card for students is to create a solid credit history. A credit card that offers frequent credit line increases as a reward for timely payments and responsible card use will boost your credit faster and prove your creditworthiness in the future.

Now that you know what features the best student credit cards typically have, we will introduce you to some of the best credit cards for students to help you build a solid credit history while attending school.

Related: Top Best Credit Cards in Canada | Ranking | Compare the Best Cash Back, Travel, and Top Cards

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Discover Student Credit Card

The Discover Student Credit Card is praised as one of the options for best credit card for students because of its rewards program and 0% introductory APR for the first 6 months.

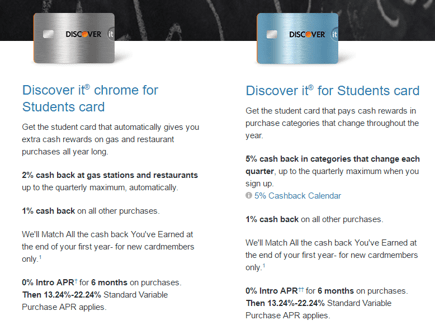

The Discover Student Card actually has two options: Discover it® Chrome for Students and Discover it® for Students. Both options are very similar as far as APR and fees, but they offer different reward programs.

Source: Discover

The Discover student card, Discover it® Chrome for Students, offers 2% cash rewards on gas and restaurant purchases throughout the year and 1% cash back on any other purchase. For college students who often eat out and want to save on food and gas, this is an excellent reward system to earn money on those purchases.

The Discover student credit card, Discover it® for Students, instead offers 5% cash back on purchases in varying categories through the year, and 1% cash back on other purchases. Your cash back amounts can be higher with this card, but qualifying purchases change throughout the year.

One of the features that makes the Discover card options two of the best credit cards for students is its reward system for good grades. Discover will give you $20 each school year, up to 5 years, that you keep your GPA at 3.0 or above.

Chase Student Credit Card

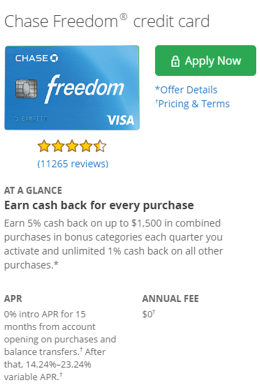

Although Chase does not have a specific Chase student credit card, the Chase Freedom® card can still be considered one of the best student credit cards if you plan on using a co-signer.

This credit card can be a little more difficult for a student with no credit history to qualify for, but a co-signer will help secure the credit required. Think of Chase Freedom® as a Chase student credit card because of the excellent bonuses it offers for new cardholders, 0% introductory APR and reasonable APR after 15 months, and 5% cash back on qualifying purchases.

Source: Chase

This best credit card for students has no annual fee, which means no extra, unnecessary money out of your pocket. You are also eligible for 0% APR for 15 months after opening your account, which allows you to save a lot of money while building your credit history for over a year.

This Chase student credit card also offers a bonus of $150 if you spend $500 within your first 3 months of opening the account. Are you planning on spending a few hundred for textbooks or dorm room supplies? You will easily spend the $500 needed to earn $150 if you are considering using your student credit cards for these bigger purchases.

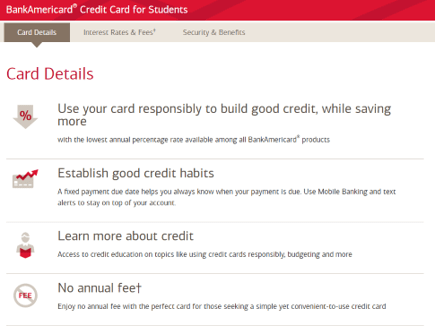

BankAmericard® Credit Card for Students

The BankAmericard® Credit Card for Students is praised over and over as one of the best student credit cards, and it is easy to understand why. Bank of America provides excellent benefits to students who want to build credit and learn how to use their credit responsibly.

Source: Bank of America

The BankAmericard® Credit Card for Students also boasts some of the lowest interest rates, as low as 11.24% if you qualify. For a student with little to no credit history, this interest rate can truly help you afford your credit card and build your credit history.

Additionally, the BankAmericard® Credit Card for Students is eligible for use with digital wallets, like Apple Pay and Samsung Pay, for the most convenient and safe shopping experience. You can also view your account and make payments through a mobile app, making this card one of the best student credit cards on the go.

Finally, the BankAmericard® Credit Card for Students is one of the best credit cards for students to learn about their credit. It offers text alerts when you make a purchase or a payment so you can always stay in the loop with your account. You will also have access to credit education topics to learn the best strategies for building your credit and using it wisely.

Popular Article: The Best Credit Cards for College Students | Finding Best College Credit Cards

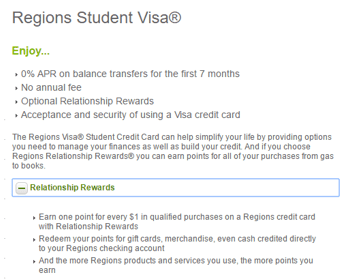

Regions Student Visa®

Regions Student Visa® is one of the best student credit cards because it offers no annual fee, an excellent rewards program, and 0% APR on balance transfers for 7 months after opening your account.

How is a 0% APR on balance transfers beneficial to you? If you are currently using a credit card with a high APR or are an authorized user on your parents’ credit card, you might consider transferring your balances to a best credit card for students option, like the Regions Student Visa®.

Source: Regions

When you transfer your balance to the Regions Student Visa®, you will have no interest for 7 months after the transfer, which gives you ample time to pay your balance to take advantage of 0% APR.

The Regions Student Visa® also offers a rewards program called Relationship Rewards. This is one of the best credit card for students rewards programs available, offering one point per dollar spent in qualifying purchases with your Regions credit card.

You can choose to redeem your points for rewards like gift cards or other merchandise, or you can accept a cash credit applied to a Regions checking account. If you currently have other Regions products in addition to the Regions Student Visa®, you qualify for more rewards.

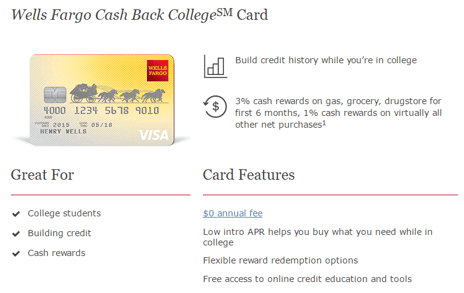

Wells Fargo Student Card

The Wells Fargo student card, Wells Fargo Cash Back CollegeSM Card, offers several benefits for college students, making it one of the best credit cards for students this year.

This student card has no annual fee and competitive interest rates beginning at 11.40%, based on creditworthiness. Wells Fargo also offers a 0% introductory APR for 6 months after opening your account, making it one of the best student credit cards for those who need to make immediate purchases that they can pay off within the 6-month timeframe.

Source: Wells Fargo

The Wells Fargo Cash Back CollegeSM Card is also considered a best credit card for students because it allows you to stay abreast of your FICO credit score, which is important for new credit users who are learning how to build and maintain a strong credit history. Using Wells Fargo’s banking system, you are able to access your score for free whenever you want to.

Furthermore, Wells Fargo’s card for students continues to remain one of the best student credit cards because the company aims to educate college students on the best practices for excellent credit.

Wells Fargo offers an online student community to discuss financial and other topics related to college. And, this best credit card for students keeps you on top of your finances with budgeting and tracking tools.

Read More: Top Cheap Credit Cards | Ranking | Best Low Credit Card Interest Rates (Cheapest & Lowest)

Conclusion

The best credit cards for students are those that truly understand what students need: low monthly payments, credit education, and rewards to get the most back from their qualified purchases.

Students enter the world of credit cards with little to no knowledge of how to use them properly, and the best student credit cards will walk students through the process of building and maintaining a good credit history.

The best credit cards for students outlined in this article offer low fees, special introductory APRs to help you make immediate purchases for lower costs, excellent reward programs, and financial education tools.

We recommend these as some of the options for best student credit cards available for this year to help you begin establishing a solid credit foundation that will take you through your undergraduate program, graduation, and beyond.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.