Intro: Finding the Best ETFs (Dividend ETFs, High-Yield ETFs, and other Top Performing ETFs

If you are like many individuals, you want to invest in your future. You might have considered many investment options, like 401(k), stocks, or mutual funds.

But have you considered ETF investing? Investing in ETFs is one of the lesser-known but profitable options to invest in your future.

Finding the Best Dividend

In a world of rapidly-rising unemployment, higher living costs, and rising age of retirement, ETF trading could be the perfect option for you.

This guide will introduce you to ETF investing, how ETFs work, how ETFs compare to mutual funds, and the best ETF to buy, including high-dividend ETFs, or high-yield ETFs. This guide is best for beginning ETF investors, but it will be helpful for anyone interested in investing in ETFs.

First, let’s answer “What are ETFs?” because, to beginners, they can be confusing.

See Also: Are Bonds a Good Investment Now? State of Heighten Market Volatility – Buy or Sell Bonds?

What Are ETFs?

ETF stands for Exchange Traded Fund. Investing in an ETF is usually replaced my more traditional forms of investing, like stocks and bonds.

However, a dividend ETF or the popular high-yield ETF can be very solid forms of investments. This guide will later delve further into the different types of ETFs, like the high-dividend ETF.

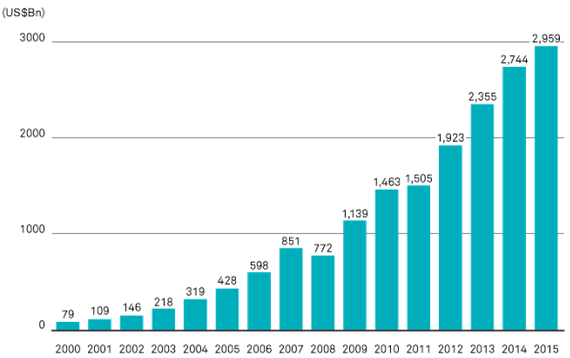

Image Source: Growth of ETF use from 2000 to 2015

Stocks, bonds, and commodities make up ETF funds. So, just as stock prices fluctuate daily according to the stock market, ETF prices do as well. ETF investing can, therefore, be somewhat tricky and unpredictable.

However, ETF trading allows you to buy and sell your funds when you want to, unlike other investment options.

ETF investing is very similar to investing in stocks, so you might be off to a good start if you have some experience with stocks. But, if you are looking for the best ETF to buy, you will want to answer the questions, “What are ETFs?” and “How do they work?” However, ETF information on the web can be extremely confusing for beginners. So, let’s explain ETF trading in simple terms.

How Do ETFs Work?

Before looking for ETFs to buy, you should understand how they work. Money management groups create ETFs by bundling the stocks, bonds, and commodities they are made from. The ETFs can then be purchased by the consumer as shares through an ETF investing broker. The shareholder indirectly owns the underlying assets of the ETF.

Since ETF trading is done on the stock market, ETF investing is fairly flexible. Shareholders can track their investments in real-time to buy or sell if needed. ETFs are tied to a stock index, so when the stock goes up or down, the ETF price fluctuates with it.

Some of the best ETFs are popular because of their investment strategies and asset allocations. ETFs are professionally managed, so when looking for the best ETF to buy, you should also consider the management group.

The management group handling your high-dividend ETF should make your dividend ETF work for you in a way that makes sense for you and your finances.

Don’t Miss: How to Buy Corporate Bonds – What You Need to Know (Prices, Bond Market, Rates, and Sale)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

What Are Dividend ETFs and High-Yield ETFs?

During your search for the best ETFs, chances are you have found a lot of unfamiliar terminology. You might see ETFs referred to as a dividend ETF, high-yield ETF, or high-dividend ETF. But what do these all mean, and are they any different from each other?

A high-dividend ETF is basically another name for a dividend ETF, and these terms are sometimes used interchangeably. However, high-yield ETFs are different from dividend ETFs. When looking for ETFs to buy, either option is a wise investment for different purposes.

A dividend ETF combines dividend-paying stocks. What is a dividend-paying stock? Basically, it is one that pays you the profits of your shares regularly, usually quarterly. So, if you invest in this ETF option, you will receive any profits from your ETF regularly. Think of it as regular, passive income if your ETF does well.

A high-yield ETF, on the other hand, is much like the name suggests: It typically yields higher profits than others of its type.

Although most of these ETFs are dividend-paying ETFs, they differ in that they are bundled with known high-yielding stocks. However, with high yield can come high risk if the stocks were to suddenly plummet.

The main difference between arguably the two best ETF options is the risk factor. A dividend-paying ETF has lower risk, but your profits might be lower. High-yield ETFs can yield a greater profit but also bring a higher risk to your investment.

Related: Are Municipal Bonds a Good Investment This Year? How to Buy Muni Bonds

How Do ETFs Compare to Mutual Funds?

Now that you know more about what ETFs are and investing in ETFs, we will compare ETFs with mutual funds. Often, when you search for information about the best ETFs to invest in, you might find information about mutual funds as well.

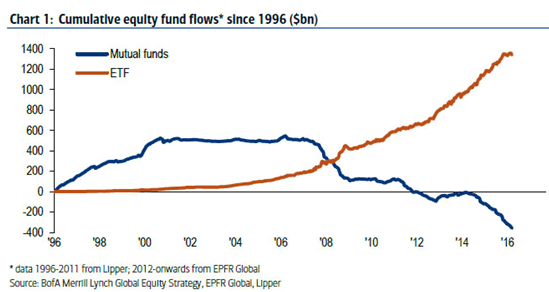

This is because ETFs and mutual funds are similar in many ways. Mutual funds have been a more traditional way of investing over the past several years, but ETF investing is rapidly becoming more popular.

Image Source: Mutual funds vs. ETFs

Some similarities between the best mutual funds and ETFs to buy include:

- Professional management. The best mutual funds and ETFs to buy are handled by professional management groups. The management groups track your investment for you so you can have as much or as little control as you want to over your investment. The best ETF managers will help you decide what the best dividend ETF is for you and what underlying assets to include.

- Both have underlying assets. A mutual fund and high-dividend ETF both invest in stocks, bonds, or other assets. This presents less risk to the shareholder by dividing the high yield ETF or mutual fund between assets, rather than investing in one asset.

- Net asset value, or NAV. A dividend ETF and a mutual fund are similar in that they both have a net asset value (NAV). The net asset value is calculated using the total value of the underlying assets, the cost of fees, and the total number of shares of the mutual fund or dividend ETF.

So, there are important similarities between the best ETFs and mutual funds. However, these investment products are not created equal, and they should not be treated as such. Investors seem to be torn on which product is the best.

However, this depends on the investor and what he or she is looking for in an investment. Before you begin searching for the best dividend ETF, ensure that you understand the important differences between the best ETFs and mutual funds to find the best product for you.

Although a mutual fund and dividend ETF seem fairly similar, let’s take a look at the important differences between the two investment products.

How to Find the Best ETFs to Buy

This guide has explained what ETFs are, how they work, the differences between two popular ETF options, and how ETFs compare to mutual funds. If you think that ETFs are a good investment option for you, you should consider what the best ETFs to buy for your particular needs are and learn how you can find them.

Do you already have investments? If so, you should consider ETF investing that will round out the investments you have in place. For example, if you already own a few high-yield ETFs, consider investing in the best dividend ETF that works for you and your assets. This way, you will have multiple types of assets of different values for minimum risk.

It is also in your best interest to check financial websites regularly to keep up-to-date on ETF news and new ETF products. For example, Yahoo! Finance has a search feature so you can search for information about your particular ETF, a company, or a stock. If you are torn between two or three ETFs, these websites may also give you the information you need to narrow down your choices for the best ETFs to buy.

Additionally, to know the best ETFs to buy, you should stay abreast of the current market. Understanding intraday indicative value can give you an idea of a fund’s net asset value.

This value helps you see if an ETF is either being heavily sold or bought. The best time to buy is when the ETFs are being sold, and the best time to sell is when the ETFs are being bought.

Finally, when searching for the best ETFs for you, consider the cost. The lower the cost, the lower the risk to you. Sure, higher-cost ETFs could land you a quicker, higher profit, but you also risk losing your investment completely. There is less risk in holding more lower-cost ETFs than a few higher-cost ETFs.

Popular Article: Where to Buy Savings Bonds? Are Savings Bonds a Good Investment?

What Are Some of the Best ETFs to Buy?

As we previously mentioned, what constitutes the “best ETFs” on the market is subjective. Each investor is looking for what makes sense for his or her finances. Still, you want to ensure you find the best dividend ETF, or whatever type of ETF investing you are most interested in, for you.

Therefore, we put together a list of some of the most popular dividend ETFs, high-yield ETFs, and overall top-rated ETFs for current investors.

Dividend ETFs

A promising dividend ETF is the iShares Dividend Select ETF. Its year-to-date return percentage is currently over 17% and averaging good daily percentage rise. It is in the higher price range, but its return percentage is promising.

The ALPS Sector Dividend Dogs ETF is another popular option at a much lower price point. It invests in the 10 highest-yield stocks in the Dow Jones market and currently holds over $1 billion in assets.

High-Yield ETFs

The iShares 0-5 Year High-Yield Corporate Bond is the #1 highest-ranking high-yield ETF by US News. Although its price has flip-flopped through the year, its daily change has consistently increased. U.S. News gives it an excellent rating for its holdings diversity between 10 diverse stocks. PowerShares Fundamental High Yield Corporate Bond ETF is ranked #2 by U.S. News because of its low cost, excellent bid/ask ratio, and excellent holdings diversity. This best ETF to buy invests in stocks in the airways, electronics, and oil industries, to name a few.

Other Top-Rated ETFs

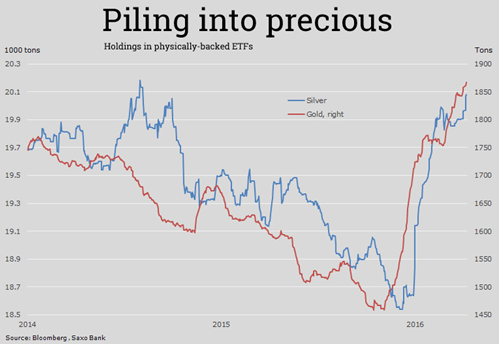

Image Source: Gold and silver mining ETFs

ETF.com says that this year has been an overall good year for the financial market, with both U.S. and International ETFs finding success. The top-performing ETF category, however, is the gold and silver mining industry by a landslide. ETF investing in this category has shown the highest yields to investors.

The PureFunds ISE Junior Silver ETF has the highest returns thus far by investing in small silver miners. IShares MSCI Global Silver Miners ETF is also showing returns of about 80%. In the current market, it seems that the best ETFs to buy fall within this sector.

Read More: How to Buy Municipal Bonds – Complete Guide (Rates, How-to, Definitions, Investing)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.