Are Bonds a Good Investment Now? Additional Fed Rate Hikes Expected | Should Investors Buy or Sell Bonds?

In 2016, the U.S. Federal Reserve announced that it will raise interest rates a quarter point by 0.25 percentage points to a range of 0.50% and 0.75%, an unsurprising move that sent the US dollar to highs not reached in nearly 14 years.

“Economic growth has picked up since the middle of 2016, and we expect the economy will continue to perform well” said Janet Yellen, the Chair of the Federal Reserve Bank.

In September of 2016, Fed officials had predicted that the Fed rate hike would only raise Fed interest rates once or twice in 2017.

But, as reported by CNN, “Now, the Fed has hinted that it could raise rates at a faster pace in 2017.” Most Federal reserve officials now project three or more Fed interest rate hikes for the 2017 year.

Analysts now expect that a substantial increase of the Fed interest rate in March is highly likely, keeping pace with a wave of economic optimism after the 2016 presidential election.

Should Investors Buy More Bonds or Sell Their Bonds Holdings?

Based on the U.S. Federal Reserve’s strategic plan to continue increasing rates, are bonds still a good investment now? What about later in 2017? In 2018?

From a forward-looking perspective, are bonds still a good buy now, or are the Fed interest rate hikes causing bonds to lose their value, in which case, should investors sell bonds now?

These are the types of questions that the AdvisoryHQ editorial team receives on a regular basis, and we’ve put together this review article to address a lot of these questions, including the ones stated below.

See Also: The Best Mutual Funds to Invest In | Guide | Well-Known Mutual Fund Companies

Key Questions (Should You Invest in Bonds Now?)

Over the last year, bonds investors have grappled with the aftermath of the Fed raising interest rates and the impact such Fed interest rate hikes would have on bond investments.

Key questions asked by investors have included: “Are bonds a good investment when the Fed raises interest rates?” “When will the next interest rate hike be?” and “Will the Fed raising interest rates continue in 2017-2018 or will it hold off based on signs of a slight slowdown in U.S. economic growth?”

Other questions received by AdvisoryHQ include:

- Should I buy bonds now?

- What are the best bonds to invest in?

- When is a good time to buy bonds?

- Where can I find a list of best bonds to buy?

- Is it a good time to buy bonds in 2017 & 2018?

- Are savings bonds a good investment?

- Should investors invest in bonds now?

To better understand why investors are asking these questions, we first need to take a step back and quickly review the key factors that are used to determine bond prices and valuations, including Wall Street’s practice of applying interest rate predictions to bond valuations.

Investing in Bonds Based on 2016–2018 Interest Rate Predictions

Major Wall Street firms, as well as institutional investors (hedge funds, trading firms, mutual funds, etc.) maintain highly complex and comprehensive financial models that estimate bond values and predict whether bonds are a good investment at various points in time.

A key variable in their bond investing valuations is Fed interest rate predictions.

In essence, financial models do not only consider current Fed interest rates, but they also consider (and try to predict) future Fed interest rate hikes with regard to the buying and selling of bonds.

The nature of being a bond investor (or any type of investor) is that you always have to look ahead–far ahead– when evaluating whether bonds are a good investment now or at any particular point in time.

So, as there are gradual increases from the Fed raising interest rates, institutional bond investors will basically take each new interest rate figure, plug that number into their financial models, and immediately start looking ahead for when the next interest rate hike will come.

The goal is to always be one step ahead of the market.

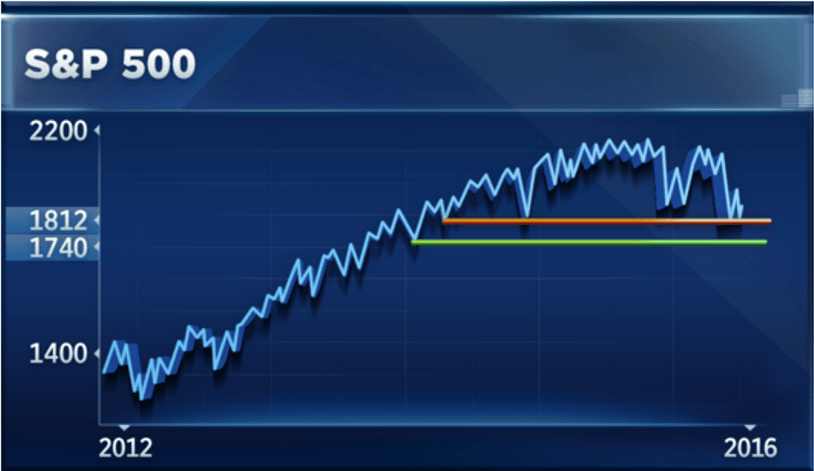

Photo courtesy of: CNBC

However, if you are an individual investor (or just someone that is interested in buying bonds), how do you determine whether bonds are a good investment now, over the next couple of months, later in 2017, 2018, 2019, etc.?

How do you perform interest rate predictions to effectively compete against hedge funds, mutual funds, and institutional bond investors?

Keep on reading to find answers to the question, “Are bonds a good investment in 2017?”

Don’t Miss: Best ETFs | Finding the Best Dividend & High-Yield ETFs

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Are Bonds a Good Investment Now, or Should You Sell Your Bond Holdings?

To determine whether to invest in bonds now, there are a couple of variables that you should consider in addition to learning how to effectively conduct interest rate predictions.

Key variables to consider include:

- Bond yield: How much total return you can expect to get from buying a bond

- Bond rate: The stated bond rate determines the coupon amount that is paid out periodically

- Bond prices: Present-day value of the bond if you sell or buy the bond today

- Fed interest rate outlook & predictions: This impacts the bond yield

- Market outlook: How are financial markets currently performing? (impacts the bond price)

Bond Yields & Their Correlation with Fed Interest Rates

Bond yields have a direct correlation with current Fed interest rates and also on anticipated future interest rate hikes.

The reason why the outlook of rates (interest rate predictions) is very important is that investors do not wait for the Fed to raise rates before they decide whether to buy or sell bonds that they already own.

As mentioned above, being a bond investor requires you to always be proactive and stay one step ahead of the bond investing crowd.

Waiting until the next Fed rate hike before you act might be acting too late.

Starting in January of 2015 (a full 12 months before the Fed announced its first rate hike since the Great Recession), bond investors were aleady taking action by bidding up 10-Yr and 30-Yr bond yields in anticipation of a Fed rate hike.

Across financial markets, the below situation – where yields are rising based on interest rate predictions – is referred to as “making a bet on the interest rate outlook.“

Why do bond investors bid up bond yields based on the interest rate outlook?

To better understand the process above, we need to take a look at how bonds are valued (pricing bonds).

Bonds Pricing & the Impact from Interest Rate Hikes

The price you would pay to buy a bond today (also known as the bond’s present value) is based on the following elements:

- The bond’s coupon payments

- The number of overall payments

- The bond’s maturity value

All of these elements are discounted to the present day based on a set interest rate.

The bond yield (i) used to discount a bond to its present-day value (what the bond is selling for today) is impacted by the future outlook on rates.

In order for a bond to remain competitive as an investment vehicle, the yield on that bond needs to be attractive enough to make investors want to buy the bond.

As such, when bond investors see that the Fed is raising rates, or if they expect Fed funds interest rates to rise, they start requiring (bidding up) higher bond yields at that moment. The opposite holds true when investors expect rates to fall.

The above happens because of how investors derive the present value (PV) of a bond investment: the sum total of all future payments discounted by a constantly-changing bond yield (i).

Related: The Best Bond Funds | Finding the Best Municipal, High-Yield, and Corporate Bonds

Should You Buy/Sell Bonds Today? Are Bonds a Good Investment Right Now?

So, back to the questions: Are bonds a good investment now? Should you sell any bonds you currently have? Or should you buy bonds?

The best answer to all of these questions is, “It depends.”

Yes, Sell Bonds Now

Here is the “SELL” viewpoint:

If you want to invest in bonds with the sole expectation that bond prices will go up (allowing you to earn a return on the capital gains), then bonds might not be a good investment right now.

As seen above, the overall trend (and expectation) is for bond yields to go up during 2016 and 2017. This increase in bond yields is expected to continue as the Fed executes further interest rate hikes.

As explained above, bond prices and bond yields have an inverse relationship. An increase in bond yields leads to a decline in bond prices and vice versa.

This means that, in a few weeks or months (if/when global markets halt their declines), bond yields will continue their overall upward trend while bond prices will continue their overall downward trend.

This results in limited opportunities to make a capital gain (selling your bonds at a higher price than what you paid for them).

In this case, it may be time to sell some of your bond holdings (if you have any) and rotate the money into other investments – like dividend-paying or high-growth stocks.

As mentioned above, bond prices drop when yields go up, demonstrating an inverse correlation.

Bonds are a Good Investments, So Buy Bonds Now

Here is the “BUY” viewpoint:

If you believe that financial markets will be negatively impacted by a slowing global economy, combined with the increases in interest rates and other economic forces, then selling your bonds now may be premature.

If global markets experience huge declines, then bond prices will definitely increase as more and more investors sell their losing stock holdings and rush in to buy bonds. In such a situation, bonds might remain a good investment for you.

Next Couple of Quarters – Fed Hikes and Opportunities to Buy Bonds

Interest rates have been rising, and according to the Fed, these rates don’t seem to be decreasing any time soon.

Since the Great Recession nine years ago, when the Fed reduced the base Fed rates to near 0%, low rates have made bonds relatively unattractive and the stock market comparatively more attractive.

Now that interest rates are going up, investors are likely to start moving money from stocks into bonds, which will cause bond prices to go up.

Popular Article: Where to Buy Savings Bonds? Are Savings Bonds a Good Investment This Year?

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: Should You Buy or Sell Bonds Now?

In either case, whether you determine to buy or sell bonds, the trick is to always hold a diversified portfolio.

To conclusively answer the question, “Are bonds a good investment?” it’s important to consider portfolio diversification.

From a portfolio diversification perspective, bonds will always hold a valuable place in any portfolio and will always be a good investment.

Just exactly how much weight should bonds have in any portfolio? This depends on your individual investment circumstances as well as in the (rising or declining) trends of interest rates.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.