Guide to Finding the Best Mutual Funds to Invest In

If you have been looking to invest your money but were unsure what investment option made sense for you, your research might have led you to investing in mutual funds and you might have asked one of the questions below:

- Which are the best mutual funds to invest in?

- Which are the top performing mutual funds?

- What are mutual funds?

- How to invest in mutual funds

There are virtually endless investment options to choose from, but mutual funds provide a different set of benefits than other investments.

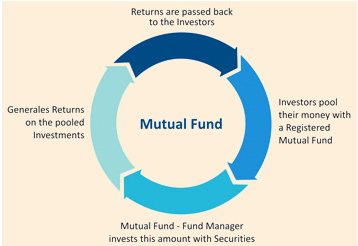

Source: MoneyChoice

Learning how to invest in mutual funds and finding the top performing mutual funds can be tricky for those new to this investment option.

A mutual fund is handled professionally rather than on your own, making it much different than other investment options that you have full control over.

But what are mutual funds, exactly? This article will explain what mutual funds are and how they differ from other types of investments, how to invest in mutual funds, and tips to find the best mutual funds for you.

See Also: Are Savings Bonds, Municipal and Treasury Bonds a Good Investment Now?

What Are Mutual Funds?

Mutual funds are defined as a collection of other investment options, like stocks and bonds, that are handled by a professional investment manager.

Mutual fund companies spread out your investment in different stocks and bonds, which lessens your risk should one investment option plummet.

What are mutual funds investment benefits? Although mutual funds may not be the best choice for every investor, they do provide significant benefits to those who choose them:

- Liquidity: Investors look for mutual funds to invest in because they can be liquidated, or turned into cash, at any time.

- Professional Management: Those who do not have the time nor desire to manage their own investment portfolios turn to mutual funds to invest in because they are handled by financial professionals. Your financial manager will take care of spreading your investment through different stocks and bonds to provide you the best mutual funds return.

- Decreased Risk: Because your investment is spread out with mutual funds, you have less risk to your investment. No matter what types of mutual funds you choose to invest in, you will not lose your full investment due to an error or failing stock.

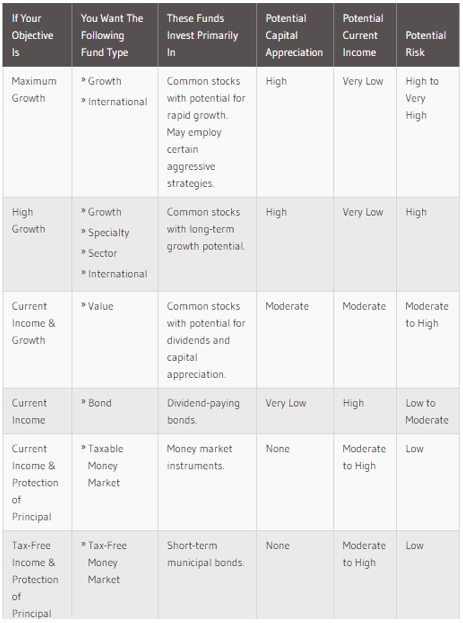

Source: The Insurance Advice

But, as with any investment option, investing in mutual funds can carry risks:

- Could be Subject to Taxes: Even the best mutual funds can be subject to various taxes, which can become costly. These can include dividend income and capital gains.

- Associated Fees: A mutual fund comparison can show you the potential fees associated with the mutual funds. Some fees are high enough that you may see little return on your mutual funds investment.

- Too Much Diversification: Some types of mutual funds may spread out your investment so much that you find it difficult to get a decent return on your investment. Smaller investments typically equal smaller returns.

Well-Known Mutual Fund Companies

If you research the best performing mutual funds, you probably will find the same few mutual fund companies popping up in your searches.

Some of the best mutual fund companies are those that offer low fees, quality professional management, top performing mutual funds and low investment minimums. Some mutual fund companies you may want to consider for managing your portfolio are:

- Charles Schwab: One of the most well-known investment firms, Charles Schwab handles mutual funds with low costs and low minimum investments. Charles Schwab is one of the most trusted mutual fund companies for its quality investment management.

- Fidelity: Fidelity is known to be one of the most competitive mutual fund companies in regards to investing expenses. A mutual fund comparison between 27 funds proved Fidelity’s lower expenses than other top companies.

- Vanguard: Vanguard boasts low fees and superior performance over other comparable best performing mutual funds. Additionally, Vanguard prides itself on its hiring of top financial managers to oversee your funds.

Before searching for the best mutual funds to buy, complete thorough research on top companies to find one that fully meets your needs.

Don’t Miss: Best ETFs | Finding the Best Dividend & High-Yield ETFs

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

What to Know Before Investing in Mutual Funds

Considering what mutual funds to invest in is an important step in finding what works for you, but there are a few important points to consider before searching for the best mutual funds so you understand what you need to look for.

Source: MFEA

First, there are a few types of mutual funds and you should consider what type makes the most sense for your investment in best mutual funds. Money market funds protect your principal but do not typically provide high returns on investment. Bond funds provide consistent income to investors, but this income can vary significantly. Equity funds appreciate well over time, but are not great for those looking for a quicker, short-term investment.

Second, you should understand how to buy and sell your shares should you choose to. The best mutual funds to buy are those that are easy to contact in this situation. Even though your portfolio is professionally managed, you should have easy access to make changes if needed.

Lastly, consider the tax consequences. Learning how to invest in mutual funds comes with the responsibility to complete research to create the best financial investment for you. Even the best mutual funds typically come with income tax consequences that you will have to report each year. If this is something you are uncomfortable with, you may want to consider other investment options.

How to Find the Best Performing Mutual Funds

You have decided that investing in mutual funds is the right choice for you, but you’re not sure where to find the best performing mutual funds. Most new investors struggle with this, but fortunately, there are a few things that can streamline your search.

Before you begin your search for the best mutual funds, make sure you know the type of mutual fund you are interested in, understand your short-term and long-term financial goals, and have a specific amount of money set that you are willing to invest.

Related: Are Municipal Bonds a Good Investment This Year? How to Buy Muni Bonds

Have Good Timing and Patience

One of the most important steps in finding the best mutual funds to invest in is to take your time. Many investors get caught up in the excitement of seeing a mutual fund performing well right now or for the past few months. This, however, is hardly enough time to evaluate the true performance of the best mutual funds.

Instead, take your time to thoroughly evaluate your own needs compared to what your prospective mutual funds offer. For example, do not simply search for “best mutual funds to buy” and expect this mutual funds comparison to mean that the results are perfect for you. It can be tempting to jump on board and sign up for the most popular or best performing mutual funds. However, do they really meet your individual needs?

Sit down and create a plan, both short-term and long-term. What do you hope to get out of your potential best mutual funds to invest in? Do you want to earn money from them soon, or more money years from now for retirement? The decision should not be a hasty one. Considering top performing mutual funds is great, but you still have to ensure that they are great for you.

Try an Organized Search

Investopedia: Morningstar and the Mutual Fund Education Alliance

Once you have your goals in place, consider using an organized mutual funds search to find the best mutual funds to buy that match your criteria. The Mutual Fund Educational Alliance is an excellent website to start with. Here, you can find resources to learn about mutual fund companies and the differences between mutual fund types.

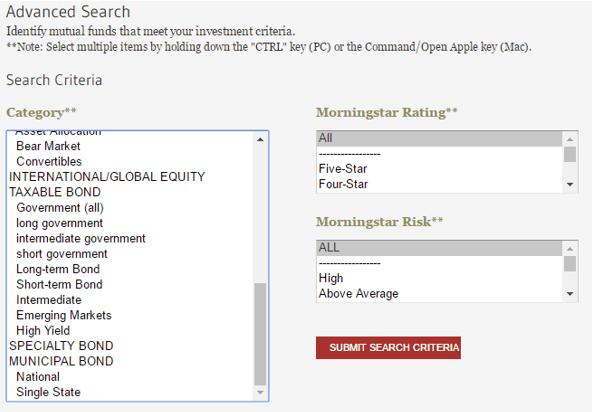

Source: MFEA

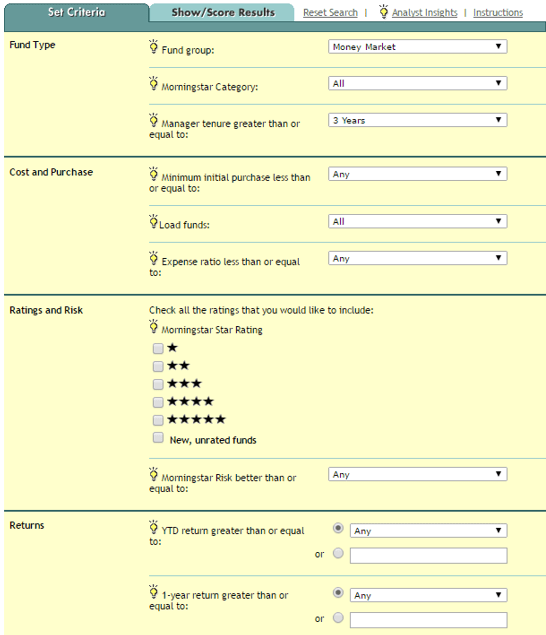

The Mutual Fund Educational Alliance (MFEA) also provides a detailed search function to narrow down the best mutual funds according to your needs. This search tool allows you to search by category, Morningstar rating and Morningstar risk.

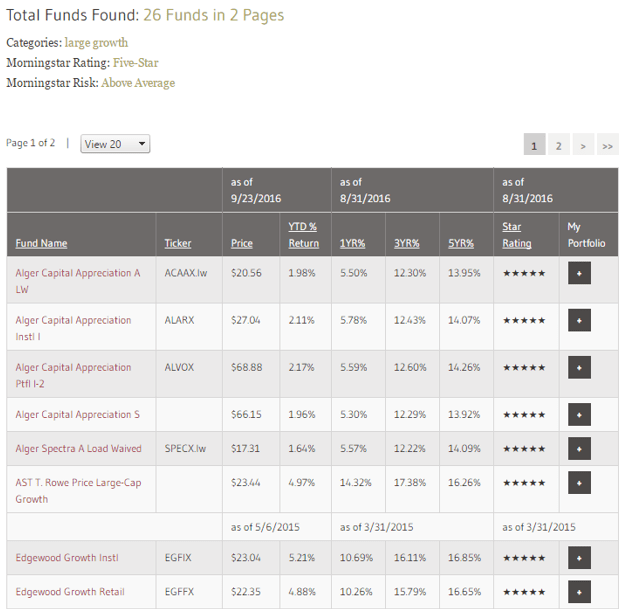

Source: MFEA

This will bring you to a table of results for a mutual fund comparison based on your criteria. You can easily compare the price of each share, its Morningstar rating, 5-year return percentage and more.

Morningstar provides an extensive knowledge base and search feature on its own website. When you sign up for a free account, you can access a wide range of information about the best mutual funds according to its ratings. If you do not want to sign up just yet, you can still access Morningstar’s free mutual fund screener.

Source: Morningstar

Morningstar allows you to search by fund category, tenure, return, and more to help you find the top performing mutual funds based on your criteria for the last year, three years, or more. Organized searches like MFEA and Morningstar are trusted ways to narrow down your options and find the best performing mutual funds for your financial goals.

Check Out the Charges and Fees

If you are investing money, you should focus on your potential return. However, remember that mutual funds need to make money, too. They do this by charging you fees. Even top performing mutual funds have fees, so this is something you should look into before settling on a mutual fund.

Some mutual funds charge a load fee. This is a fee that comes out of the investor’s pocket, either from the up-front investment or after the investor sells his funds. The law allows this fee to be as much as 8.5%, which can significantly affect your investment or return. The best mutual funds for returns are no-load funds, meaning that they do not charge a load fee of any kind.

Other funds could charge a 12b-1 fee, which can be a bit trickier for investors to discover. This fee is deducted off the share price and can be as much as 0.75% of a share. An investor should always ask about this potential fee when researching best performing mutual funds.

Popular Article: Where to Buy Savings Bonds—All You Need to Know about Purchasing Savings Bonds

Research Past Results of Top Performing Mutual Funds

New investors can easily get caught in the cycle of investing in current top performing mutual funds rather than studying their history over time. This practice, however, can be detrimental to the potential of a long-term investment.

Take some time to study potential fund managers to see their mutual fund performance history for the past year, three years, and five years. Just as top performing mutual funds five years ago may not perform well currently, the same can hold true for the best performing mutual funds in the past month.

The best mutual funds managers are those who have consistently outperformed their competitors with market returns and turnovers. However, do not fully rely on the mutual funds’ histories. Past results do not completely predict future results, so you will want to look for the most well-rounded performance portfolios to find potential mutual funds to invest in.

Conclusion

Mutual funds are an excellent investment option for those who are leery of investing money in one or two places. Mutual funds allow you to distribute your investment over a wide range of stocks or bonds for the best potential returns on investment.

The best mutual funds are ones with low and transparent fees, consistent historical performance records, and those from top performing mutual funds companies. Still, you should consider your own financial needs and goals before settling on a mutual fund. Take time to do your research to find the best mutual funds for you.

Read More: How to Buy Municipal Bonds (Good Investments?) | Where to Buy Municipal Bonds

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.