2017 RANKING & REVIEWS

TOP HSBC BANK CREDIT CARDS

Intro: What Are the HSBC Credit Card Benefits?

Before delving into the specifics of the leading HSBC credit cards including the top HSBC credit card and an overview of the HSBC corporate credit card, it’s first valuable to explore exactly what makes HSBC bank distinctive.

HSBC is one of the largest banking and financial services companies in the world, with more than 45 million customers throughout the globe. Along with offering HSBC bank credit card options, this financial services organization has four core areas of business. These are retail banking and wealth management, commercial banking, global banking and markets, and global private banking.

The HSBC network includes 71 countries throughout most of the world, and there are about 4,400 worldwide offices of HSBC.

Award Emblem: Top 5 Best HSBC Credit Cards and HSBC Business Cards

According to HSBC, the company is committed to building long-term relationships with all clients, which means rigorous standards in terms of internal governance and having an understanding of the wider impact of their actions on society. It’s this approach that guides the development of HSBC credit card options, designed to create value and offer benefits for both individuals and businesses.

There are several HSBC credit card options for personal, consumer customers, as well as an HSBC business credit card that is reviewed on this ranking. Also, while not included in the ranking, there is some brief information included about the HSBC corporate credit card as well.

The similarities of each HSBC card are highlighted, as are the distinctive features that could make one HSBC card more valuable than another to a particular customer.

See Also: Top Credit Cards for Low Credit Scores | Reviews | Best, Fastest Ways to Build Credit

AdvisoryHQ’s List of the Top 5 HSBC Bank Credit Cards

List is sorted alphabetically (click any of the credit card names below to go directly to the detailed review section for that credit card):

- HSBC Advance MasterCard® Credit Card

- HSBC MasterCard BusinessCard® Card

- HSBC Platinum MasterCard® Credit Card

- HSBC Platinum MasterCard® with Rewards Credit Card

- HSBC Premier World MasterCard® Credit Card

Top 5 HSBC Bank Credit Cards | Brief Comparison

HSBC Credit | Intro APR | Length of Introductory | Minimum Variable APR on Purchases After Introductory Period |

| HSBC Advance MasterCard® Credit Card | 0% | 12 months | 13.24% |

| HSBC MasterCard BusinessCard® Card | 0% | 6 months | 9.99% |

| HSBC Platinum MasterCard® Credit Card | 0% | 18 months | 13.24% |

| HSBC Platinum MasterCard® with Rewards Credit Card | 0% | 12 months | 13.24% |

| HSBC Premier World MasterCard® Credit Card | n/a | n/a | 13.24% |

Table: Top 5 Best HSBC Credit Cards | Above list is sorted alphabetically

How Should You Choose an HSBC Credit Card?

Whether you’re choosing an HSBC bank credit card or a credit card issued by another bank, there are some important things to keep in mind.

The first is that as you compare HSBC credit cards, think about fees, interest rates, and how much the card will cost you to maintain and use. Some of the fees that are charged on not just HSBC bank credit cards, but any credit cards, can include annual fees, fees for going over the limit, and also fees for foreign transactions, among others.

Image Source: HSBC

One reason HSBC credit cards are so popular among consumers is because they tend to have relatively low fees, and also competitively low interest rates.

You might also want to consider specific benefits when you’re choosing an HSBC credit card. For example, do HSBC credit card benefits include a rewards program that pays you or gives you incentives for using the card?

If you do choose one of the HSBC bank credit cards with rewards, are they rewards that are going to be useful for your lifestyle? For example, if you want an HSBC bank card with dining or entertainment rewards, is that something that’s relevant to you?

Finally, before settling on an HSBC credit card, is it a card that you qualify for? Many of the cards included in this HSBC credit card review require good credit, so it’s important to research and make sure you’re a good candidate for the HSBC card before applying.

What Are the Differences between Personal HSBC Credit Cards and HSBC Business Cards?

One of the HSBC credit cards included in this HSBC credit card review is a business card. It can be valuable for consumers to understand what makes an HSBC business credit card distinctive from other options.

The following are some key ways HSBC business cards are different from personal credit cards:

- One of the primary ways an HSBC business credit card is unique from a personal card is the fact that in most instances these cards don’t impact the personal credit score and report of the cardholder. However, depending on the agreement the business owner has with the card company, they may be personally responsible for paying back the card.

- If the business card includes a rewards program, it is typically more geared toward the specific needs of businesses. For example, the business may earn more points when they spend at stores that are thought of as being more useful for businesses, such as office supply stores.

- These cards, including HSBC business cards, are designed to help business owners separate these expenses from their personal expenses, which is useful for many reasons including when it comes to taxes and accounting.

- With many business cards, owners can issue separate cards for employees that allow them to monitor their spending and set specific limits for them.

Don’t Miss: Top Best Frequent Flyer Credit Card Offers | Ranking | Best Credit Cards for Travel Rewards

What Are Corporate Cards?

Aside from personal and business cards, another card category available in terms of HSBC credit cards is the HSBC corporate credit card. It’s not included in this HSBC credit card review because the terms aren’t defined, and they’re based largely on the needs and scale of the corporation that will be using the card, but it can be important to think about the features of not just the HSBC commercial card specifically, but corporate cards in general.

First, the HSBC corporate credit card and others like it are in a separate grouping from business cards. Corporate cards like the HSBC commercial card are often used for business-related expenses, which are typically travel. An HSBC commercial card or HSBC corporate credit card will usually be issued in the name of the corporation but will also display the name of the individual employee using it.

There can be a lot of negotiation in the process of obtaining an HSBC corporate credit card, and the terms can widely vary.

Source: HSBC Corporate Card

Some of the specific features available with the HSBC corporate credit card include lots of flexibility, the ability to receive detailed monthly statements for each cardholder and options to set maximum spending and transaction limits for each cardholder. The HSBC corporate credit card is available in GBP or euros, and there isn’t an HSBC USA credit card specifically for corporations.

There is a per-card annual fee to use the card, but it comes with benefits such as the ability to view statements and reports online, protect against employee misuse with inclusive liability waiver protection, and use technology like contactless payments.

The HSBC corporate credit card is also valuable for managing cash flow, as it features up to 56 days interest-free credit.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review—Top Ranking HSBC Credit Cards and HSBC Business Cards

Below, please find the detailed review of each card on our list of top HSBC USA credit card options and HSBC business cards. We have highlighted some of the factors that allowed these HSBC bank credit cards to score so well in our selection ranking.

HSBC Advance MasterCard® Credit Card Review

The HSBC Advance MasterCard® Credit Card is one of the leading HSBC credit cards. This HSBC card features some exclusive rewards and benefits, and the primary objective of this card is to deliver rewards to cardholders, simply for making their everyday purchases.

The HSBC credit card benefits that come with this include things like the opportunity to earn bonus points right after opening the account, dining and entertainment rewards, and a special introductory interest rate.

Key Factors That Led to Our Ranking of This as a Top HSBC Bank Card

Key elements of the HSBC Advance MasterCard® leading to its inclusion on this HSBC credit card review and ranking of the best HSBC bank credit cards are named below.

Unlimited Rewards

The HSBC Advance MasterCard® has some of the best available HSBC credit card benefits, thanks to the rewards program. Cardholders receive 2x Rewards Program Points on certain dining and entertainment purchases. This card features unlimited rewards and flexibility as well. The points never expire, and there are no caps.

The cardholder earns two points for every net dollar spent on dining and select entertainment purchases made, and for all other purchases, the cardholder gets one point for every dollar in new, net purchases.

This HSBC bank credit card lets cardholders choose the rewards they want and that are well-suited to their lifestyle ranging from entertainment options to brand-name merchandise, or they can opt for cash back.

Advance Clients

The HSBC Advance MasterCard® is one of the high-level HSBC bank credit cards, designed specifically for Advance clients. Advance clients are part of an exclusive program with the bank, and with acceptance, customers gain more control and access to their money, robust money management tools, individualized financial support and guidance, and preferential rates and rewards.

For people who want this card, they should apply for an HSBC Advance relationship, and if they’re already an Advance client, they can log into their Personal Internet Banking to apply for this leading HSBC card.

This card has no annual fee for Advance or Premier banking customers.

MasterCard Concierge Service

This card features MasterCard Concierge service, which is designed to help Advance clients save time, and enjoy convenience along with services that are tailored to their personal needs. With MasterCard Concierge Service, a cardholder can contact the concierge team to do everything from having them make dinner reservations to purchasing tickets to events.

The Concierge Service can also be used to coordinate business travel plans and arrangements, locate items that are difficult to find, and even as a gift finding and buying service.

Advance customers can then have the cost of the goods or services they buy through MasterCard Concierge seamlessly billed to this HSBC card.

Introductory Promotions

When comparing not just HSBC credit card benefits, but all credit cards, one of the first things that is important to consider is whether the card features introductory promotional advantages. The HSBC Advance MasterCard® is included in this HSBC credit card review of HSBC bank card options because there are a couple of different introductory bonuses and benefits that come with it.

First, new customers have the opportunity to earn 25,000 Rewards Program Bonus Points after they spend $1,500 in new, net card purchases in the first three months after they open the account.

There is also a 0% introductory APR on both purchases and balance transfers for the first 12 months after opening a new account.

Related: Top Best Credit Cards for College Students| Ranking | Best College Student Credit Cards

HSBC MasterCard BusinessCard® Card Review

The HSBC MasterCard BusinessCard® Card is an HSBC business credit card designed to simplify and streamline cash management. This HSBC business credit card can be used for major purchases like making improvements to the office, to everyday expenses, and its benefits include its flexibility and versatile features that work well for a variety of businesses.

This HSBC business credit card also has unique features built in that make it easy to manage multiple employees’ spending and various account tasks, as well as including a rewards program.

Key Factors That Led to Our Ranking of This as One of the Best HSBC Business Cards

Key reasons the HSBC MasterCard BusinessCard® is ranked as a top HSBC bank card are detailed in the following list.

Cash Flow

The HSBC business credit card is specifically designed to help organizations manage and maximize their cash flow. For example, with this HSBC bank card, organizations can designate individual employee cards that are branded with their company name, much as would be the case with an HSBC commercial card or an HSBC corporate credit card.

There are individual spending limits available, with credit lines up to $25,000, and a monthly cardholder statement is issued for each user of the HSBC card.

Additional cash flow features include consolidated company-level billing to simplify reconciliation and a free year-end summary statement.

Rewards Points

For businesses searching for an HSBC credit card that allows them to earn rewards, this is an excellent option. This HSBC credit card includes the BusinessCard Rewards Program, providing points for card purchases and activity.

Features of the rewards program that come with this HSBC USA credit card include:

- Accounts receive 2,500 bonus points for enrolling

- Cardholders receive one point for every $1 in new, net card purchases, up to 10,000 points per month

- Points can be redeemed for anything from air travel and tickets to sports experiences to gift cards at top retailers and restaurants

- Points can be redeemed online at any time or by calling HSBC

- The annual fee per account is only $25 to enroll in the rewards program

APR

This HSBC business credit card includes introductory APRs for purchases. There is a 0% APR for the first six months after a business opens this account. This HSBC business credit card then includes a very low, highly competitive APR after the six-month introductory period.

Currently, the post-introductory APR is the Prime Rate + 9.99%. The APR varies based on the Prime Rate and the market.

There is also a 0% APR for six months after account opening for other APRs which include cash advances and balance transfers. Then, the APRs with this HSBC business credit card would vary based on the market and the Prime Rate as well.

HSBCnet

Both personal and HSBC business cards allow cardholders and organizations to maintain the utmost in control and visibility when it comes to company spending. One way this is done is through the integration with HSBCnet, which is the online banking platform used by HSBC business credit card customers.

HSBCnet includes the ability to stay on top of fraud trends, and there are safeguards and information to help HSBC business credit card customers stay safe. It includes enhanced SecureAnywhere functionality, and cash management solutions that let businesses stay on top of their day-to-day processes.

There are local and global tools including online trading and analytics, and access control so companies can determine how they want their organization to be able to access certain financial information related to their HSBC business cards.

Popular Article: Top Best Credit Cards to Rebuild Credit | Ranking & Reviews | Best Cards for Rebuilding Credit

HSBC Platinum MasterCard® Credit Card Review

The HSBC Platinum MasterCard® Credit Card is a simple, straightforward HSBC card that’s designed to give cardholders a sense of peace of mind when they use it, flexibility, and also competitive rates and pricing. In general, some of the benefits of this card include not only a low overall APR but also an extended period of the special introductory APR.

Consumers also find this card appealing in its simplicity and the fact that the fees are low as well. It should be noted, however, that this card does not have an affiliated rewards program, so for consumers searching for that, they should look at other HSBC credit cards included in this ranking.

Key Factors That Led to Our Ranking of This as a Top HSBC Bank Credit Card

When comparing each HSBC bank credit card, the following are reasons the HSBC Platinum MasterCard® is included in this ranking of the best HSBC bank credit cards.

Fees

As mentioned above, the HSBC Platinum MasterCard® is the ideal HSBC bank card on this HSBC credit card review for consumers who are searching for low fees and minimal costs. One of the primary problems many consumers have with credit cards are the high fees, and this isn’t the case with this HSBC card.

This particular HSBC credit card includes no fee for adding additional cards for family members and no annual fee.

This HSBC USA credit card also includes no foreign transaction fees on card purchases made in a foreign currency, so it’s perfect for travelers looking for a low-cost HSBC credit card solution.

Introductory APR

When creating this HSBC credit card review of HSBC business cards and personal HSBC bank credit cards, introductory APR offers were important. This particular HSBC bank credit card has one of the best introductory APR offers available.

This card not only includes no annual fee, but it also features a 0% introductory APR for the first 18 months on both purchases and balance transfers. This is an extended offer since most consumer credit cards offering a special intro APR will only offer it for anywhere from 6 to 12 months.

After that, the current minimum variable APR is only 13.24%.

Safety Protection

This leading HSBC credit card includes many protections and security features automatically built in. Some of these are geared toward shopping specifically.

For example, HSBC card includes a $0 liability protection against unauthorized, fraudulent purchases that might be made on the card. It also includes purchase protection for eligible purchases that are damaged or stolen.

With Identity Theft Resolution, cardholders have access to the assistance they need if they become the victim of identity theft.

Also, if the card is lost or stolen, cardholders can get emergency card replacement or a cash advance within 24 hours in the U.S., and within two business days when they’re in any other global location.

Personal Internet Banking

HSBC offers not only some of the best credit cards including HSBC commercial card options and personal HSBC credit cards, but they are also known for excellent online options through their Personal Online Banking Platform. The HSBC Platinum MasterCard® can be integrated and managed through Personal Internet Banking.

This includes mobile banking functionality, eStatements, and money management tools. With HSBC Money Management Tools, cardholders can get a complete view of their finances by having access to all of their HSBC accounts in one location. They can track and categorize their spending, create savings goals, and design personal budgets.

Read More: Top Best Business Credit Cards | Ranking | Best Small Business Credit Card Offers (Reviews)

HSBC Platinum MasterCard® with Rewards Review

The HSBC Platinum MasterCard® with Rewards has many of the advantages and features that are so appealing about the HSBC Platinum MasterCard®, but as the name implies, this valuable HSBC credit card also includes a rewards program. This card not only offers one of the best rewards programs but is also packed with other HSBC credit card benefits.

For example, this HSBC bank card features low fees and very competitive interest rates, so in addition to the opportunity to earn rewards, consumers are also getting a good value with this HSBC USA credit card. It boasts excellent service and security protection as well, as is the case with all HSBC credit cards on this HSBC credit card review.

Source: HSBC Platinum MasterCard® with Rewards

Key Factors That Led to Our Ranking of This as One of the Best HSBC Credit Cards

Below are specifics that indicate why the HSBC Platinum MasterCard® is included in this HSBC credit card review of the leading HSBC bank credit cards.

Unlimited Rewards

The rewards program integrated with this HSBC bank credit card is an excellent opportunity to earn just for using your credit card as you would otherwise. It’s also a straightforward, flexible rewards program.

This HSBC bank card includes all of the standard HSBC credit card benefits, as well as the opportunity to earn unlimited Rewards Program Points that can be used toward a variety of redemption options.

New credit card customers can earn 15,000 Rewards Program Bonus Points after spending $500 in new, net card purchases in the first three months after opening an account. As well as being unlimited, the points never expire.

Points can be redeemed for 1% cash back, or the cardholder can choose among hundreds of other options like gift cards or flights on major airlines.

Competitive Rates

This HSBC credit card always includes competitive rates and is a great value for consumers. There is a 0% introductory APR on not only credit card purchases but also balance transfers when a new account is opened. The introductory APR is available for the first 12 months after opening the account.

After that, the minimum variable APR is currently a low 13.24%.

This card has no annual fee and no foreign transaction fees. Additional cards can also be issued to family members at no additional cost.

All of this equates to an HSBC bank credit card that features not only an unlimited rewards program and bonus rewards opportunities but also one that is consistently well-priced.

Travel Coverage

One of the reasons HSBC credit cards are such a popular option among consumers is because of the exclusive HSBC credit card benefits they include, which are then paired with benefits offered by the card servicing company, such as MasterCard benefits.

With this HSBC card, account holders receive traveling assistance and extra coverage. This includes Roadside Assistance if the account holders car needs repairs or to be towed.

It also includes Travel Assistance Services. These can be used for help with lost or stolen luggage or travel documents, and this service can be used to connect cardholders with a worldwide network of professionals including doctors and lawyers, who could be of assistance.

Security and Fraud Protection

For cardholders today, something that’s a top priority when selecting a credit card is the level of security and protection provided, particularly with so many retailers and individuals being hit with data breaches and security issues.

All HSBC credit cards include stringent security and anti-fraud protections, and that extends to the HSBC Platinum MasterCard® with Rewards card. This card not only boasts rewards and excellent value but also protects cardholders.

One security measure that’s automatically included is $0 liability, which is a guarantee that protects the cardholder in the event their card or account are used for unauthorized purchases. Also, if a cardholder does become a victim of identity theft or fraudulent activity, the card features Identity Theft Resolution services.

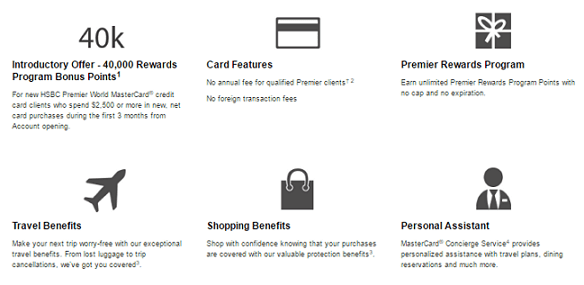

HSBC Premier World MasterCard® Credit Card Review

The HSBC Premier World MasterCard® credit card is one of the very best HSBC bank credit cards, because it offers some of the highest level HSBC credit card benefits, low fees, and is part of a valuable rewards program. There are even more available HSBC credit card benefits for Premier clients of HSBC, such as no annual fee.

This card includes the highest level of service from MasterCard as well as HSBC, shopping benefits, and excellent introductory offers, including one of the biggest bonus points of any credit card rewards program. It also includes travel benefits and security protections.

Source: HSBC Premier World MasterCard® credit card

Key Factors That Led to Our Ranking of This as One of the Best HSBC Credit Cards

The specifics of why this HSBC bank credit card is part of this HSBC credit card review are highlighted in the following list.

Introductory Offer

As mentioned above, the HSBC Premier World MasterCard® includes some of the best HSBC credit card benefits, and among these is a robust introductory offer. New cardholders who spend $2,500 or more in new, net card purchases in the first three months after opening their account qualify to receive 40,000 Rewards Program Bonus Points.

The Premier Rewards Program is unlimited, so there is no cap on the points that can be earned, and earned points have no expiration.

Points can be redeemed for airline travel with no blackout dates or seat restrictions, or for brand-name merchandise. Points can also be redeemed for gift cards or cash back. The HSBC Rewards for Miles program lets cardholders transfer points to eligible frequent flyer programs as well.

Concierge Service

This is one of the only HSBC card options with MasterCard Concierge Service, which is a premier-level offering. MasterCard Concierge Service provides personalized service options for anything a cardholder might need.

With MasterCard Concierge, cardholders can get 24/7 help whether they want to secure event tickets to an in-demand concert, they want to find the perfect gift, or they want a dining reservation at a hot new restaurant.

Aspire Lifestyles administer world MasterCard Concierge Service, and cardholders can also use this service, one of the best HSBC credit card benefits, to coordinate travel and business plans, locate difficult-to-find items, make travel bookings, and more.

Travel Rewards

The HSBC Premier World MasterCard® is not only great as a day-to-day spending card, with high levels of customer and concierge service. It’s also one of the best HSBC USA credit card options for travelers.

As mentioned, the Rewards Points that can be earned with this HSBC bank credit card can be redeemed for travel and vacation experiences.

For example, cardholders can fly on most major airlines without restrictions, but in addition to this, this HSBC bank credit card can be used for statement credit to reimburse the cost of travel. Cardholders can request a statement credit within 90 days of purchase to reimburse themselves when they book their own airfare with the HSBC Premier World MasterCard® credit card.

Rewards can be transferred into miles with participating frequent flyer programs, and miles can be redeemed for cabin upgrades and special offers available from participating airlines.

Fraud Protection

The HSBC Premier World MasterCard® credit card, like the other HSBC credit cards included in this HSBC credit card review, features excellent security and fraud protection features, giving cardholders peace of mind.

To begin, this HSBC bank card has an embedded security chip for added protection at eligible terminals around the world, and if fraud does occur, cardholders aren’t responsible for unauthorized use.

This card features mobile payment capability including Apple Pay, Android Pay, and Samsung Pay. It’s equipped with Identity Theft Resolution Services, and Identity Fraud Expense Reimbursement as well.

Identity Fraud Expense Reimbursement includes reimbursement for losses incurred as a result of identity fraud if coverage isn’t afforded by any other insurance or benefit.

Conclusion—Top HSBC Credit Cards

HSBC is often ranked among the best financial institutions in the world, and they feature a selection of value-creating HSBC credit cards. This includes HSBC commercial card options, HSBC corporate credit card products, HSBC business cards, and personal HSBC bank credit cards.

The top HSBC bank credit cards were selected for this HSBC credit card review, and the specific HSBC credit card benefits of each were highlighted.

In a general sense, HSBC credit cards are an excellent value with low fees and interest rates, many of them are ideal for travelers and people who spend money in foreign countries frequently, and they’re also great for consumers searching for the utmost in security safeguards.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.