2017 RANKING & REVIEWS

THE BEST INCOME TAX CALCULATOR TOOLS

Best Income Tax Calculators in 2017. But First, When Would You Really Need an Income Tax Calculator?

An income tax calculator is an important financial tool, since income taxes are inevitably part of all of our lives. For the purposes of this review of the best income tax return calculator and income tax refund calculator tools, we’re referring to income taxes at the individual level. You pay income taxes on the money you earn, in most cases regardless of how it’s earned.

In addition to federal income taxes, most states also impose income taxes on residents, at levels set by the state, although some states have no income tax.

Often, people have questions about the calculation of income tax, which is one of the primary reasons they use a federal income tax calculator or some other type of specific tax calculator.

Award Emblem: Top 6 Best Income Tax Calculators

The federal income tax system is defined as “progressive,” so this means as your income increases, so do your tax rates. The marginal tax rates currently range from 10% to 39.6%.

You can use a federal income tax calculator to determine your marginal and effective tax rates, and see how much you will pay in taxes. You can also use an income tax calculator to compare your income before and after taxes, or even to see the percentage of your total income that goes towards all of the taxes you’re required to pay.

The following review and ranking includes a variety of income tax calculator tools. This ranking features a self-employed income tax calculator, an income tax refund calculator, and a federal income tax withholding calculator, as well as several other useful income tax calculator options.

See Also: Top Credit Cards to Build Credit | Ranking & Reviews | Credit Cards for Building Credit

Comparing State and Federal Income Tax

As mentioned at the start of this review of the best tools to use as an income tax calculator or an income tax return calculator, people in most states are responsible for paying income taxes at the state and federal levels.

Regardless of the state you live in, you’re required to pay federal taxes, and as mentioned, the U.S. has a tax system where the highest tax rates are imposed on the earners at the highest levels.

Most people in the U.S. pay their taxes by having it withheld from their paycheck, and that money is then sent directly to the IRS. It’s important that you have the right amount withheld so that you’re not overpaying or underpaying, which is why a federal income tax withholding calculator can be useful.

If you have your taxes withheld from your paycheck, and you didn’t pay enough throughout the year, you will owe it to the IRS by the tax deadline in April. If you paid too much throughout the year, you would receive a refund for the difference, which is why people use an income tax refund calculator.

State taxes are entirely separate from federal taxes, and each state’s rates and system are different from one another. Most states have a progressive tax system similar to what’s found at the federal level, while a few states have a flat tax, and some states have no income tax at all.

How Much Should You Have Withheld?

Having taxes withheld from your check is also called payroll withholding, and as mentioned, this means you have your taxes automatically withheld from your check. Your employer then sends that money to the IRS.

Image Source: Pixabay

When you start a new job, your employer gives you a W-2 form or a W-4, and filling out this form is what determines how much will be withheld from your check each pay period.

The common belief is that it’s better to have too much taken from your check each time, and then you receive a refund, but this isn’t necessarily a good move financially because the IRS is holding your money interest-free until you receive your refund.

At the same time, if you do an incorrect assessment of how much should be withheld, and you underpay, you’ll be responsible for making up the difference in April.

The best thing to do is use a federal income tax calculator and federal income tax withholding calculator to ensure you’re as accurate as possible in determining your tax responsibility.

It’s also important that you use an income tax calculator whenever there are major life events that could impact your taxes so that you can make the necessary changes to your W-2 or W-4. Life changes could include marriage, the birth of a child, or receiving a raise.

What Are Self-Employment Taxes?

In addition to covering standard tax calculators for employees who have taxes automatically withheld from their paycheck, this review and ranking also includes a self-employed income tax calculator.

Even if you don’t work for someone else, you’re required to pay self-employment taxes. This applies to people who have a business or operate as a sole proprietor or independent contractors.

A self-employment tax is something designed to cover social security and Medicare taxes since these are things employees at other businesses would have deducted from their paycheck. The self-employment tax rate is 15.3%.

If you receive a 1099, or you’ve received any income not subject to payroll taxes, you’re responsible for paying self-employment taxes.

Something else that’s important to note is that with self-employment taxes, you’re often required to make quarterly payments to the IRS. This means you would estimate income tax throughout the year and pay the IRS four times to avoid penalties and interest.

Then, if you overpaid you would receive a refund, and if you underpaid you would be responsible for the remainder when you actually file your tax return.

Using a self-employed income tax calculator is an excellent way to estimate more accurately when you pay quarterly taxes.

Don’t Miss: Best Debt-to-Equity Ratio Calculators | Guide | How to Calculate Debt-to-Equity Ratios & Top Calculators You Can Use

AdvisoryHQ’s List of Top 6 Best Income Tax Calculator Tools

List is sorted alphabetically (click any of the calculator names below to go directly to the detailed review section for that income tax calculator):

- ADP Salary Paycheck Calculator

- Bankrate Self Employment Tax Calculator

- Kiplinger Tax Withholding Calculator

- Smart Asset Federal Income Tax Calculator

- TaxACT Tax Calculator

- TaxCaster from TurboTax

Top 6 Best Income Tax Calculator Tools | Brief Comparison & Ranking

Income Tax Calculators | Used For | Inputs | Best For |

| ADP Salary Paycheck Calculator | Calculating gross vs. take home pay | Gross pay, state tax information, federal status and allowances, local tax information | Someone moving to a new job or reevaluating their current withholding |

| Bankrate Self-Employment Tax Calculator | Estimating self-employment taxes | Net business income or loss (options for net farm income or loss, church employee income, and employer paid income) | Self-employed people who want to estimate income taxes for quarterly or annual payments |

| Kiplinger Tax Withholding Calculator | Calculating federal withholding | Filing status, taxable income for the year, amount of refund | People who have federal income taxes withheld from their paycheck |

| Smart Asset Federal Income Tax Calculator | Calculating total income tax amounts including state and local | Household income, location, filing status | Anyone who wants to know not only how much they will pay in total taxes but also their tax rate |

| TaxACT Tax Calculator | This is an income tax return calculator primarily | Basic info, income, deductions and credits | This is a useful income tax calculator if you think you will be due a refund or want to determine your tax bracket more easily |

| TaxCaster from Turbo Tax | Used to calculate tax refunds or income tax owed | Your income, other income, business income, deductions, credits, and payments | This is a flexible option to calculate estimated tax refunds or payments due |

Table: Top 6 Best Income Tax Calculator Tools | Above list is sorted alphabetically

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review—Top Ranking Income Tax Return Calculator and Income Tax Calculator Tools

Below, please find the detailed review of each account on our list of the top tools for income tax computation. We have highlighted some of the factors that allowed these income tax calculator tools to score so well in our selection ranking.

ADP Salary Paycheck Calculator Review

ADP is a national payroll service working with small, midsized, and large businesses. In addition to payroll services, ADP also offers services related to taxes, benefits, insurance, and more. They also have a variety of free calculators and tools for businesses and their employees.

The Salary Paycheck Calculator is an in-depth income tax return calculator that can help with calculation of income tax quickly and easily.

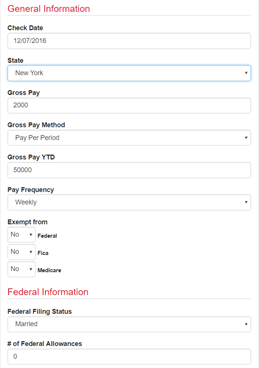

Image Source: ADP

Key Factors That Led to Our Ranking of This as a Best Salary Income Tax Calculator

Listed below are reasons this Salary Paycheck Calculator is ranked as one of the best income tax calculators.

Features and Use

This income tax calculator is a salary income tax calculator designed to show users how much of their paycheck or salary they take home during each pay period, versus how much they pay in taxes. It also provides a breakdown of where each area of taxes taken from the user’s salary are going.

For example, it shows the federal, FICA, Medicare, and state taxes being paid.

The inputs for this salary income tax calculator include:

- State

- Gross pay

- Gross pay method (for example, pay per period)

- Gross pay YTD

- Pay frequency

- Exemptions

- Federal filing status

- Federal allowances

- Additional federal withholding

- Round federal withholding

- Voluntary deductions

Benefits

First and foremost, this salary income tax calculator is a great tool if you simply want to see how your taxes break down. It’s one of the most detailed income tax computation tools on this ranking in terms of showing you exactly where your withheld taxes are going.

It’s also a good income tax calculator if you want to compare your pre- and after-tax earnings.

The inputs on this salary income tax calculator are highly specific, yet also easy to understand, and you get a comprehensive report as well as the option to print that report.

Who It’s Good For

This salary income tax calculator is excellent for someone who wants to assess their current income tax withholding and see if adjustments need to be made.

It’s also ideal if you live in a state where there is an income tax, or you live in a local area that imposes significant taxes because it will break down how much you’re paying in taxes into a very detailed report.

If you’ve had a major life event, such as a change in income, this is a good state and federal income tax calculator to see how that’s going to impact withholding at the federal, state, and local levels.

Other groups who may find this salary income tax calculator helpful include people who are changing jobs or people who are moving to a different state and want to see the impact the move will have on their take-home pay.

Related: Best FD Interest Calculators | Guide | How to Find and Use the Top Fixed Deposit Calculators

Bankrate Self Employment Tax Calculator Review

Bankrate is one of the best online resources for all things related to finances, interest rates, loans, and more. They have a suite of excellent free financial calculators that range from options to calculate loan payments, to income tax return calculator options. For this ranking, we selected the Bankrate Self-Employment Tax Calculator.

This calculator is designed to help self-employed people estimate their taxes which, as mentioned above, cover social security and Medicare taxes. This self-employed income tax calculator also provides excellent resources to help people better understand their taxes, which we’ll go into more detail about below.

Key Factors That Led to Our Ranking of This as a Best Federal Income Tax Calculator

Below are some of the primary features and benefits of this self-employed income tax calculator.

Features and Use

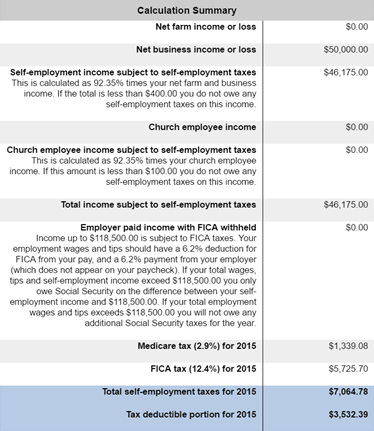

With this self-employed income tax calculator, users first begin by entering simple information related to their earnings. Input values include:

- Net business income or loss

- Net farm income or loss

- Church employee income

- Employer paid income

Once you enter that information, your self-employment taxes are estimated numerically.

You can also opt to show your self-employment taxes in graph form, with FICA and Medicare divided on the chart.

As with most Bankrate calculators, this self-employed income tax calculator also features the option to view a detailed report including a breakdown of how much of your income is subject to self-employment taxes.

Benefits

This calculator from Bankrate is one of the best self-employed income tax calculator options available. There are quite a few benefits included with this calculator that led to its inclusion on this list of the leading tools for the calculation of income tax.

These benefits include:

- This self-employed income tax calculator features simple, easy-to-understand inputs, so it takes you a matter of seconds to get your calculations.

- The reporting is also highly detailed, showing you not just what you owe in estimated federal self-employment taxes, but also how much of that goes to Medicare and how much goes to FICA. It’s also nice to have both a written report and a graph.

What’s unique about this self-employed income tax calculator is that, in addition to being able to see the figures to estimate income tax, it gives explanations as to why you would owe those amounts and what certain terms mean. It breaks everything down in clear, easy-to-understand language.

Image Source: Bankrate

Who It’s Good For

This self-employed income tax calculator is ideal for not just people who are self-employed in the traditional sense, but anyone who works as a freelancer or contractor and wants to estimate income tax for their income.

It’s also ideal for people who operate a farm or those who are church employees because there are specific input values from these sources of income as well.

You can use this self-employed income tax calculator to see how much you owe on any additional income outside of income from your employer that’s subject to payroll taxes, and it’s good if you’re unclear on any aspect of paying your taxes since it defines terms and includes detailed explanations of everything.

Kiplinger Tax Withholding Calculator Review

Kiplinger is a top online resource and hub of information for all things related to personal finance, investing, retirement, taxes, and more. Based in Washington, DC, Kiplinger publishes not only a website with personal finance resources and information but also publications including the Kiplinger Letter and the monthly Kiplinger’s Personal Finance Magazine.

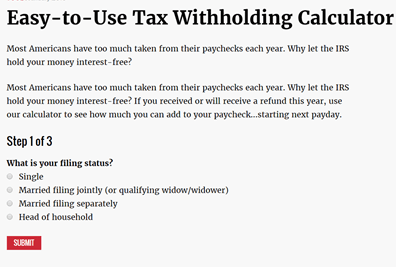

Image Source: Kiplinger

The Kiplinger Tax Withholding Calculator is an excellent federal income tax withholding calculator that’s simple to use and yet provides value and estimates that will encourage people to determine their withholding more accurately.

Key Factors That Led to Our Ranking of This as a Best Federal Income Tax Calculator

The Kiplinger Tax Withholding Calculator is part of this ranking of the best income tax computation tools to estimate income tax for the reasons highlighted below.

Features and Use

To begin using this incredibly easy federal income tax calculator, you first enter your filing status, selecting from single, married filing jointly, married filing separately, or head of household.

Then you move to the next step, which asks you enter your taxable income for the year. The next step asks users to enter how much the amount of their 2015 federal tax refund was.

The results are then shown, and they let the user know how they could increase their monthly take-home pay.

The focus of this federal income tax calculator is to show users the right number of allowances they should take. This is important because the more allowances you claim, generally the less tax you’ll have withheld, and the opposite is true of fewer allowances.

Benefits

The primary benefit of this federal income tax withholding calculator is to help employees who fill out W-2s and W-4s ensure they have the most accurate withholding amounts possible.

This is important because it helps people either increase their amount of take-home pay each week, or it can also help them avoid having to pay taxes in April if they didn’t withhold enough.

Other benefits of this tool to estimate income tax withholding include:

- This federal income tax withholding calculator walks users through one of the simplest processes with only three required input values.

- In addition to telling users how they could claim more or fewer allowances, the results of this calculator also give users a dollar amount showing how they could increase their monthly take-home pay by changing their allowances.

- This federal income tax withholding calculator doesn’t just provide calculations, but it’s also actionable, which is an important reason it’s included in this ranking of the leading federal income tax calculator tools.

Who It’s Good For

This is a basic, easy-to-understand income tax computation tool that’s good for anyone who works for someone else and fills out a W-2 or W-4.

It’s great if you just want to do a routine checkup to make sure your allowances are correct and don’t need to be tweaked. It can also be a useful income tax return calculator if you’ve recently had a change in your life or income that could require you to revisit your W-2 or W-4.

Popular Article: Best Credit Card Interest Calculators | Guide | How to Find and Use the Best Interest Calculators

Smart Asset Federal Income Tax Calculator Review

Smart Asset delivers consumers the answers they need to their financial questions. This website features very personalized and interactive tools and calculators designed not just to answer questions, but to guide consumers’ personal finance decisions. Some of the broad categories you can find covered on Smart Asset include home buying, refinancing, retirement, life insurance, and credit cards.

They also have calculators including great income tax return calculator tools and other options to estimate income tax. For this ranking, we’re including the Federal Income Tax Calculator, which is one of the most in-depth federal income tax calculator tools on this list of options for the calculation of income tax.

Image Source: Smart Asset

Key Factors That Led to Our Ranking of This as a Best Income Tax Calculator

Below are essential features and benefits of this federal income tax calculator used in the calculation of income tax.

Features and Use

The Federal Income Tax Calculator from Smart Asset is designed to provide in-depth information about how much you owe in federal taxes.

To begin, you enter the following information:

- Household income

- Location

- Filing status

You also have the option with this tool for the calculation of income tax to enter advanced information. The advanced input fields include:

- 401(k) contribution

- IRA contribution

- Itemized deductions

- Number of personal exemptions

You then receive a number which represents an estimated amount of tax you will owe.

Benefits

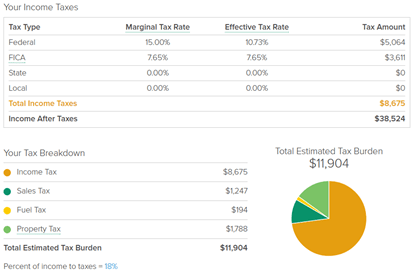

In general, the main benefit of this income tax return calculator used for the calculation of income tax is the detailed reporting.

Specifics of the benefits of this income tax rate calculator include:

- The reporting that comes with your income tax computation includes a breakdown of both your marginal and effective tax rate, as well as the tax amount you’re paying for Federal, FICA, state, and local taxes.

- You get numbers representing your total amount of income taxes, as well as your income after you pay the estimated income tax included in your results.

- There is a further detailed tax breakdown that includes not just estimated federal, state, and local taxes but also sales tax, fuel tax, and property tax.

Another advantage of this federal income tax calculator and income tax rate calculator is the fact that it goes on to provide comprehensive information about how your income tax rate is calculated, the current income tax brackets, and what to know about deductions and exemptions.

Who It’s Good For

With the most detailed reporting on this ranking of income tax rate calculator tools, the Smart Asset Federal Income Tax Calculator is great if you want to see what your take-home pay is after all of your taxes.

It’s also ideal if you want to see the percentage of your income that’s going to taxes, how much you pay in each individual area of your taxes, and also if you want to know what your tax bracket is.

This income tax rate calculator is also useful if you simply want to learn more about your taxes.

Read More: Best Car Interest Calculators | Guide | How to Find & Use the Best Car Loan Interest Calculators

TaxACT Tax Calculator Review

TaxACT is a web-based platform that lets users file and manage their taxes. TaxAct was founded in 1998 and since that time has remained a leading company for digital and download tax preparation options not only for individuals but also business owners and tax professionals.

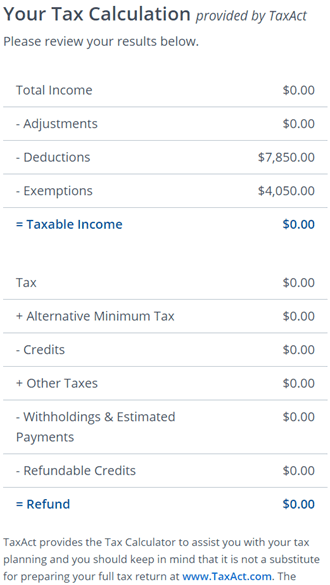

In addition to these tax preparation products, TaxAct also features an income tax refund calculator and income tax return calculator, available for free to site visitors. Called the TaxAct Tax Calculator, this income tax return calculator and income tax refund calculator asks for basic information and lets users see the impact certain things could have on their due amount or their refund amount.

Key Factors That Led to Our Ranking of This as a Top Income Tax Refund Calculator

Features and benefits of the TaxACT Tax Calculator that led to its ranking as a best income tax refund calculator and federal income tax calculator are listed below.

Image Source: TaxAct

Features and Uses

The specific focus of the TaxACT Tax Calculator is to be an income tax refund calculator and also an income tax deduction calculator. It includes input for the following:

- Income

- Deductions

- Credits

- Personal information

- Dependent information

The input of this income tax refund calculator and income tax return calculator is somewhat more in-depth than the input on many of the income tax calculator options on this ranking.

After you input the necessary information, you receive a tax calculation that includes a figure of total taxable income. You can also if applicable, receive a total of your anticipated refund.

Benefits

First and foremost, the advantage of this income tax refund calculator is, of course, to see how much money you’re anticipated to get back as a tax return.

Other benefits of this income tax return calculator and income tax refund calculator include:

- This income tax return calculator can help users accurately plan their deductions and exemptions, and they can also play around with different options to see how they can maximize their tax refund.

- In addition to seeing an estimated refund, with this income tax refund calculator and income tax return calculator you can also get a precise number that lets you know your taxable income. That number can then be used to determine your tax bracket accurately.

- Another benefit of this income tax refund calculator and income tax return calculator is the fact that TaxAct recommends which of their services would be most advantageous for you to then use to file your taxes.

This tools is perfect for calculation of income tax brackets and refunds and is also good if you’re looking for a streamlined, one-stop way to then move on to filing your taxes.

Who It’s Good For

This income tax calculator is highly flexible and is useful for anyone with an income who pays income taxes and someone who is searching for an income tax deduction calculator.

There should be a few things noted, however.

While this income tax refund calculator and income tax return calculator is valuable because it’s simple, if you also need to calculate state taxes or you have a more complicated income tax situation, this might not be the best income tax computation tool for you.

It’s better for giving you a general overview of the refund that’s due to you, as opposed to determining something such as how much you owe for self-employment taxes.

Related: Top Credit Card Balance Transfer Offers & Deals | Ranking | Interest-Free Credit Card Transfers

TaxCaster from TurboTax Review

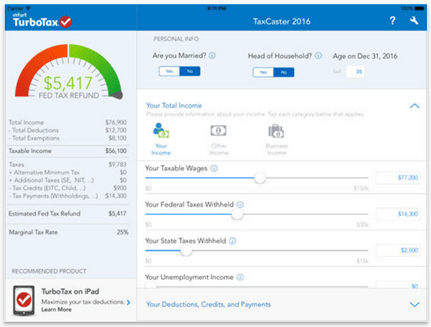

TurboTax is an Intuit company that is well known for making it easy for people to do their own taxes and maximize their refund, if applicable through offerings like income tax deduction calculator tools. TurboTax offers benefits to their customers such as a guarantee on 100% accurate calculations and audit protection options. They have also been continuously ranked as America’s top tax software.

Their software is regularly updated to reflect the latest laws and the most advanced technology. Their TaxCaster calculator is a mobile app, making it different from the other names on this ranking of the best income tax refund calculator tools and income tax return calculator options.

Key Factors That Led to Our Ranking of This as a Best Federal Income Tax Calculator

When comparing tools used as an income tax calculator, the following are specifics highlighting why TaxCaster is one of the leading ways to estimate income tax and why it’s a top income tax deduction calculator.

Features and Uses

The TaxCaster mobile app is primarily designed as an income tax refund calculator, but it has other features and uses as well, for example being a good income tax deduction calculator. This free income tax return calculator is downloaded like any other app and then provides a quick estimate of your possible tax return.

To use this mobile app that is a tool for the calculation of income tax refunds, you first enter personal information about yourself. You then enter your income, your tax breaks and you receive a final result.

In addition to a mobile smartphone version of this income tax refund calculator, users can also download an iPad version.

Once you see your potential refund, the TaxCaster app also recommends the best TurboTax products for you to file your returns.

Image Source: TaxCaster

The results of this income tax calculator are broken down to show not just your estimated federal tax refund, but also your taxable income and your marginal tax rate.

Benefits

Among income tax calculators and income tax refund calculator tools, the TaxCaster from TurboTax ranked well for several reasons, including the fact that it’s a mobile device. You don’t have to use your browser to take advantage of this federal income tax calculator since everything you need is right at your fingertips.

It’s also flexible because you can choose to use it on your smartphone or your iPad, and a version of the calculator is also available in a browser-based version if that’s what you prefer.

Other advantages of this income tax rate calculator and income tax refund calculator include:

- This is a good income tax computation tool so that you can make any necessary adjustments to your paycheck and take-home pay to plan ahead or pay less in taxes

- The sliding scale for adding things like your taxable wages is easy to adjust, and it also gives you the opportunity to experiment with different tax scenarios and see which is most advantageous before filing.

- This income tax refund calculator and income tax rate calculator walks you through everything that’s needed and provides details and explanations of thing such as credits or possible deductions if they’re needed.

Who It’s Good For

If you enjoy convenience, advanced technology paired with a user-friendly interface, and the ability to manage your finances and your taxes right at your fingertips, the TaxCaster is an excellent way to estimate income tax or your refund.

This is useful for anyone who is going to be filing their income taxes, not just people expecting a refund.

While it’s characterized as an income tax refund calculator, by entering the relevant information it will also show you if you owe money on your taxes, and break down those details as well.

Conclusion—Top 6 Federal Income Tax Calculator Tools

The primary objective of this ranking of the leading options for income tax calculator, income tax refund calculator, and income tax rate calculator tools was first and foremost to help people recognize the key concepts of income taxes.

Then, the goal was to provide a broad overview of some of the best available income tax calculator solutions, regardless of your individual situation.

This ranking of income tax calculator tools includes a salary income tax calculator, income tax rate calculator options, self-employed income tax calculator platforms, and a federal income tax withholding calculator.

Each of the income tax calculators on this ranking has great features and remains user-friendly and convenient.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.