Overview: Understanding and Calculating the Debt-to-Equity Ratio

“Debt-to-equity ratio” may sound like a scary term if you’re not familiar with financial lingo, but learning to calculate debt-to-equity ratio is actually really simple. In plain terms, a debt-to-equity ratio calculator is a tool to help you understand the relationship between equity and liability that a company has, according to Investopedia.

Whether you’re running a business or just trying to better understand your own personal finances, knowing how to calculate the debt-to-equity ratio is crucial. Without a debt-to-equity ratio calculator, it’s hard to obtain a full understanding of a company’s financial picture.

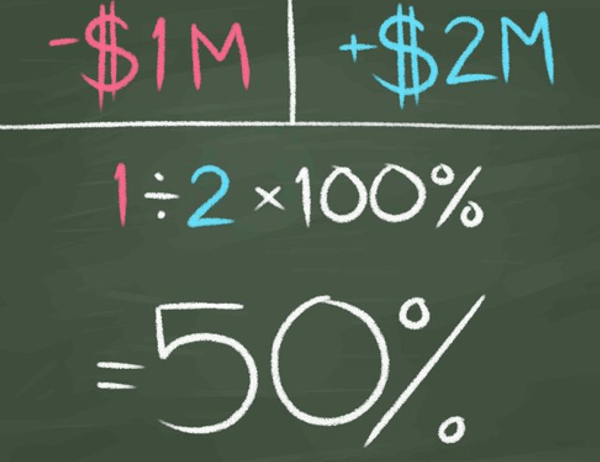

Image Source: Calculating Debt-to-Equity Ratio

This review will explain the debt-to-equity ratio and why using a debt-to-equity ratio calculator matters for both your business and personal finances.

You’ll learn how to calculate the debt-to-equity ratio and you’ll find out what number you should strive for, whether you’re calculating the debt-to-equity ratio for your company or for your personal finances. Finally, we will list the top debt-to-equity ratio calculators.

See Also: The Best Retirement Calculators | Guide | Top Retirement Savings & Income Calculator

What Is a Debt-to-Equity Ratio?

According to the Harvard Business Review, a debt-to-equity ratio calculator provides “a simple measure of how much debt you use to run your business.” In other words, your debt-equity ratio calculator gives you a ratio that represents your financial leverage.

It is important to know this number to understand how a company or individual uses different types of funding to pay for its various operations.

A debt-to-equity ratio calculator shows the amount of debt you have compared to your assets. When you calculate the debt-to-equity ratio, you can see how much of a business is funded by equity versus how much is funded by debt.

Why is it important to understand how much of a business is funded by equity as opposed to debt? Calculating the debt-to-equity ratio reveals how much a company relies on debt to fund its operations, which is something potential investors want to know.

When you calculate the debt ratio, you get a better idea of how vulnerable a company is to events like insolvency or interest rate hikes.

Knowing how to calculate the debt-to-equity ratio is vital if you want to have a thorough grasp of a company’s business operations. Calculating the debt-to-equity ratio sheds insight on the following aspects of a company:

- How much debt is used to fund operations: When you calculate the debt ratio, you can understand the extent to which a company is taking on debt (borrowed money) to fund its operations.

- Amount of debt compared to amount of assets: A debt-to-equity ratio calculator shows the amount of debt a company has compared to its assets.

- How much is funded by equity and how much by borrowed money: How much of a business is funded by equity as opposed to how much is funded by borrowed money can be revealed through a debt-equity ratio calculator.

- Contributions from creditors vs. contributions from shareholders: You need to calculate the debt-to-equity ratio to see the amount of capital contributed by creditors versus the amount of capital coming from shareholders.

- Financial stability: The financial stability of a company or individual is hard to fully understand if you don’t know how to calculate the debt-equity ratio.

Now that you understand more clearly what debt-to-equity ratio means, let’s take a closer look at why calculating this matters and how using a debt-to-equity ratio calculation can shed light on your business or personal finances.

Don’t Miss: How to Find the Best Personal Loan Calculator to Calculate Payments & Interest (USA)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Why Does Your Debt-to-Equity Ratio Matter?

Knowing how to calculate the debt-equity ratio is important for both businesses and individuals. Whether your calculation is high or low can reveal important things about the health of your business or personal finances.

If a business has a low debt-to-equity ratio calculation, it means its equity holders have put more money into the company than its creditors have. On the flip side, if your debt-to-equity ratio calculator yields a high ratio, it indicates that the company’s debts are greater than its assets.

Let’s review the differences between a high debt-to-equity ratio calculation versus a low one:

- High ratio: more debt and fewer assets

- Low ratio: less debt and more assets

Ok, so there are high ratios and low ratios, but what does it all really mean? If a debt-to-equity ratio calculator yields a high ratio for a company, does that mean the business doomed? The short answer is: not necessarily. Let’s examine this question further in the next section.

Is a Low Debt-to-Equity Ratio Better Than a High One?

Generally, a high debt-to-equity ratio suggests that a business may not be pulling in enough revenue to cover its debts, reports Investing Answers. On the flip side, when you calculate the debt-to-equity ratio and get a low ratio, that can mean a company is not taking advantage of the potential increased profits that can result from assuming more debt.

However, it’s not that simple, and knowing how to calculate the debt-to-equity ratio is crucial in being able to effectively answer this question. First of all, let’s take a look at what is considered a “high” debt-to-equity ratio calculation.

According to Investopedia, what is considered a high debt-to-equity ratio varies across different industries. In other words, if you calculate the debt-to-equity ratio for a financial institution, you’re going to have a different standard for what “high” means than if you were calculate for a company in the service industry.

Related: The Best Military Retirement Calculators for Active & Reserve Military Personnel

Why Can Some Industries Tolerate Higher Debt-to-Equity Ratio Calculations Than Others?

Learning how to calculate the debt-to-equity ratio is vital here. Basically, some industries can afford to take on more debt than others for a variety of reasons, including:

- Higher overhead costs: These companies need to purchase more equipment to operate the business, meaning they can handle a debt-to-equity ratio calculator that yields a high ratio.

- More stable revenue stream: Their revenue line is more predictable and stable, so a higher debt-to-equity ratio calculation is not as risky.

For example, a debt-to-equity ratio calculator for a telecommunications company yields, on average, a much higher ratio than for company in the service industry.

Investopedia explains that when you calculate the debt ratio for a telecommunications company, you get a high ratio because these companies have to take on significant debt early on in order to build phone lines and other infrastructure that is crucial for their business operations. Only after the infrastructure is set up can these companies begin earning revenue, thereby lowering their debt-to-equity ratio calculation.

Image Source: Debt-to-Equity Ratio Calculators

Telecommunications companies also have a higher tolerance for high debt-to-equity ratios because they often have a monopoly in their region. This makes them more stable and thus not as vulnerable to the risks that come with having a high debt-to-equity ratio.

Knowing how to calculate the debt equity ratio for companies in the service industry, which tend to have a lower threshold for a debt-to-equity ratio than capital-intensive companies, is also important. These types of companies are more vulnerable to risk, so they typically can’t take on as much debt which results in lower debt-to-equity ratio calculations.

How Do You Calculate the Debt-to-Equity Ratio?

The principle of the debt-to-equity ratio is simple, and there is an easy formula you can use to calculate it. In this section, let’s walk through the process of calculating the debt-to-equity ratio so you’re clear on how it works.

A debt-to-equity ratio calculator uses a simple formula: debt-to-equity ratio = total liabilities / total shareholders’ equity.

Let’s look at a very simple example of how to calculate the debt-equity ratio. Company X has $10,000 in debt and $5,000 in equity. Plugging these numbers into our debt-to-equity ratio calculator formula yields the following result:

$10,000 debt / $5,000 equity = 2.0 (or 200%) debt-to-equity ratio

This means that Company X has $2 of debt for every $1 of equity. Looked at another way, this debt-to-equity ratio calculation shows that Company X gets 2/3 of its capital from debt and 1/3 from shareholder equity, meaning that it borrows double the amount of funding that it owns. As you can see, a debt-equity ratio calculator is a very simple tool that can quickly give you important insights into the financial health of a company.

Top Debt-to-Equity Ratio Calculators

While the formula for calculating debt-to-equity ratio is simple and straightforward, figuring out exactly how much debt and equity you have can be more complicated. Luckily, there are a number of debt-to-equity ratio calculators you can access online that will help you through this process:

- Bankrate: This debt-to-equity ratio calculator helps individuals looking to buy a home determine what kind of mortgage they should obtain.

- AccountingTools: This site offers a step-by-step guide on how to calculate the debt-equity ratio for companies.

- CSG Network: This program uses JavaScript to help you calculate the debt ratio.

- The Bank of Texas: The Bank of Texas offers a free online debt-equity ratio calculator to help you understand your finances.

Using these free online debt-to-equity ratio calculators will help you calculate the debt-to-equity ratio for your company or personal finances.

Popular Article: Tips for Finding the Top Amortization Calculators & Schedules | Guide to Loan Amortization

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: What You Should Know About Debt-to-Equity Ratio Calculators

This review explained what a debt-to-equity ratio calculation is, why calculating the debt-to-equity ratio matters for your business, what a high versus low debt-to-equity ratio is, and how you can calculate a debt-to-equity ratio on your own.

Calculating the debt-to-equity ratio reveals a company’s total amount of debt compared to its total amount of equity. This ratio is useful to businesses and stakeholders because it shows whether a company relies more on creditors or its own equity to fund its operations.

While it may seem like having a high debt-to-equity ratio calculation is a bad thing for a business, that’s not always the case. Some industries are better equipped than others to handle the risks that come with having a high debt-to-equity ratio, as discussed above.

Knowing how to calculate a debt-to-equity ratio is important. Luckily it’s also easy. All you have to do is plug your company’s total debt and total equity into a simple formula to calculate the debt-to-equity ratio. There are a number of free online calculators that can help you.

Now that you know how to calculate the debt-to-equity ratio, you’ll have a more thorough and nuanced understanding of your company’s (or your personal) finances.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.