Guide | Finding the Best Retirement Calculators (Savings, Income, Early Retirement Calculators)

Retirement saving can be a daunting task that few people feel prepared for when they reach their golden years.

Using a retirement calculator can assist you in determining what you need to store away each month to be adequately prepared. A quick search online will review dozens of these retirement income calculator options and simple retirement calculator programs.

Do you know how to find the best retirement savings calculator?

In an attempt to help consumers become more educated and financially responsible when it comes to their future, AdvisoryHQ wants to help you find the best retirement calculator for your needs.

Best Retirement Calculators

With so many options to choose from, finding the right retirement calculator can be tricky. We’re here to provide you with information to determine which of the retirement savings calculator choices will work best for your unique financial situation.

Let’s examine a few tips and tricks to know if the program you’re looking at is the right retirement calculator for you and your family.

Don’t Forget Your Family

One of the first tips for finding the best retirement savings calculator is to keep in mind the composition of your family as it stands today.

Your retirement savings affect not yourself but also your spouse if you happen to be married. Unfortunately, many of the retirement planning calculator programs will only allow you to plan for yourself.

By neglecting the fact that you have a significant other who is going to be actively involved in your golden years, a retirement income calculator may produce results that are off by substantial amounts.

It may calculate that you need to have a much larger nest egg than you really do, or it may encourage you to increase the percentage you contribute to your retirement savings each month.

Be sure to keep an eye out for a retirement calculator that can handle the addition of two salaries, two Social Securities, two savings accounts, and more.

Your spouse’s financial situation is equally important to your own, and you can only craft a realistic expectation for your financial planning when you include him or her with the retirement savings calculator.

See Also: Do I Have Enough to Retire? Find out If You Have Enough Money for Retirement

Account for Inflation When Deciding on a Top Retirement Savings Calculator

Don’t forget that the value of money as it stands today will not remain consistent over the years.

You should be accounting for the effect that inflation will have on your retirement savings and how far your money will actually go when it’s time for you to take a step back from your career. A simple retirement calculator may not include this calculation, which can leave your savings account smaller than you would want it to be.

For individuals who are well-versed in economics, they may prefer to enter their own projected inflation rate into a retirement planning calculator. The rest of us probably would not know what number to project for an inflation rate over the course of the next ten, twenty or thirty years.

The best retirement calculator gives you the option to fill in the number if you choose to do so or to make an assumption about the inflation rates moving forward.

While it isn’t necessarily a bad thing if a retirement age calculator does not give you the opportunity to adjust the rate of inflation, it is essential to know what assumptions the simple retirement calculator is making. You should be able to easily identify what numbers it placed into the blanks to generate what you need to save to live comfortably for retirement.

Retirement Savings Calulator

Keep the numbers that it displays in mind as you take a look at other retirement calculators. It may explain why one retirement age calculator says you should save 20 percent of your income and another recommends almost 50 percent.

If the information and assumptions that the retirement savings calculator uses are not readily available, it might not be the best retirement calculator for you.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Answering Questions

It might seem like a headache to sort through pages and pages worth of questions regarding your age, current income, expected Social Security benefits, estimated inflation rate, and more.

In the end, it really can take a great deal of time to answer all of the information required by an early retirement calculator or any other sort of retirement calculator.

If you value accuracy over efficiency, the best retirement calculator will ask more questions rather than fewer. This gives the program all of the necessary data to compute realistic numbers and expectations regarding your retirement savings plan.

The best thing to do is to find a retirement calculator with pension which asks you plenty of questions that you can reasonably answer. A retirement savings calculator that asks plenty of questions, none of which you have an answer to, will be no better than a simple retirement calculator that asks very few.

Before you begin entering information into a retirement calculator with the pension, it will help you to answer the questions more accurately if all the information is already assembled easily enough for you.

The best retirement calculator will ask questions regarding your current income, any potential raises or salary increases in the future, information regarding your pension and the rate of returns on current investments, and social security benefits. This will save you a significant amount of time and make it easier for the next tip

Don’t Miss: Review of The Retirement Planning Group | Everything You Need to Know About TRPG

Compare Retirement Calculators

Because there can be so much variation in the numbers generated by a retirement calculator with a pension, an early retirement calculator or any other source, you should always compare the answers from a number of the best retirement calculator options.

In this way, you can expect to receive a range of answers regarding what you will need and what you can expect to have saved by the time you enter into your retirement years.

Keep detailed notes with the estimated necessary savings and nest egg that a retirement calculator estimates that you will need. If you check with three separate retirement planning calculator programs, you will likely receive three different answers regarding your needs.

Take a look at whether or not they are similar to one another.

If two of them seem reasonable but the third retirement calculator seems way out in the left field, there is a good chance that it is not accurately assessing your needs. Go back and review the assumptions and the data you entered into this retirement calculator to determine which of the three seems most accurate.

This establishes an excellent system of checks and balances to ensure that you are saving an adequate amount of your income each month for retirement and tells you whether you can expect to be able to live off of your retirement nest egg for the rest of your life.

Check with Social Security

Many of the best retirement calculator programs will ask you to enter in information regarding any expected Social Security benefits that you will receive when you reach retirement age. Unfortunately, you may not find a retirement savings calculator that also includes a Social Security retirement calculator.

Understanding what to expect from Social Security benefits can have huge implications for the amount of money that you will need to save. Not sure what sort of monthly income you can expect from Social Security when you reach retirement age? You can find out quickly with the social Security retirement calculator directly from the Social Security Administration.

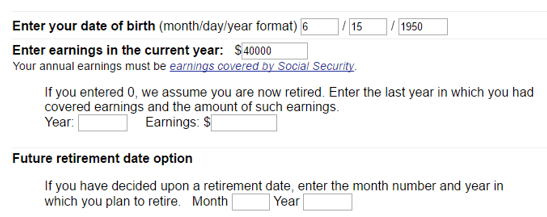

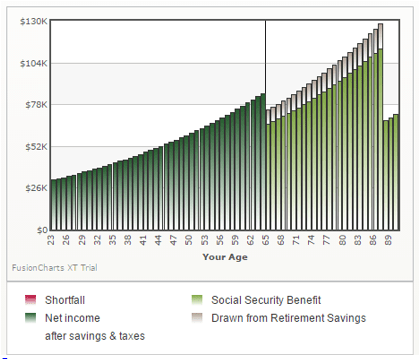

Social Security Retirement Calculator

Its Social Security retirement calculator asks for your birthdate, your annual earnings in the current year, and your anticipated retirement date. In just a few seconds, it provides you with estimated monthly earnings through the Social Security retirement calculator. You can then take this estimate and provide it to any of the retirement savings calculator choices that you are using to plan ahead.

Related: Average Retirement Savings by Age 30, 35, 40, 45, 50, 60, 65

Recheck your Figures

Just because you estimate what you will need with a retirement calculator once doesn’t mean that you should never do it again. Consider rechecking your figures every few years to make sure that you are still on track for your retirement.

You can use a retirement withdrawal calculator at this time to estimate whether it is worth it to withdraw funds earlier or later, a retirement age calculator to decide if you should retire earlier or wait a few more years or an early retirement calculator to see if you could be ready sooner than you anticipated. The options for retirement calculators are endless, but it’s important to check back in with them every few years.

This simple action can provide you with a clearer picture of your current financial situation. You have a good idea of how your investments are doing as well as the added benefit of being a few years closer to your projected retirement date. All of these factors can lead you to a slightly more accurate projection of what you need through the retirement savings calculator.

Consider Investing with a Retirement Calculator

Many of the new robo advising platforms that are growing in popularity also provide robust retirement calculators to help you determine specific next steps for your savings. Many of these platforms provide a retirement planning calculator through subscription on their webpages (rates will vary but are often determined by a percentage of your investment amount).

If you prefer to be relatively hands-off when it comes to planning for your retirement but still want to get it done, investigate a few robo advisors who can help you along. In this way, they provide you with regular updates regarding how close you are to your savings goal as well as giving you the opportunity to tweak your information regarding how and when you would like to retire.

Since they are also monitoring your investments, they have a greater awareness of what the return on your investments is so you don’t have to track down your investment information. This can make reevaluating with a retirement calculator in years to come even easier.

Many robo advisor platforms allow you to create an account for free, giving you access to the various tools and retirement calculators that you would want to investigate before making a commitment to a specific company. It is a risk-free way to evaluate whether a particular service will work for you before making a large commitment.

Popular Article: At What Age Can You Retire? Here Is an Overview of How Soon You Can Retire

Investigate Free Options

There’s no need for you to pay for a retirement calculator unless you choose to. On the Internet, you can find any number of retirement calculators that won’t cost you a dime. Consider some of these options from personal finance websites or robo advisors that are designed to help you maximize your savings for retirement:

- Betterment – With Betterment’s retirement calculator, RetireGuide, you can input basic information regarding your current income, age, contributions, and expected retirement age. In just a handful of simple steps, its retirement savings calculator can walk you through what you need to be saving to reach your goals, absolutely free. Of course, if you decide to take Betterment’s advice, you can always invest directly through its robo advisor.

- Personal Capital – After creating a free account with Personal Capital, you can use its retirement savings calculator in order to determine if you’re on the right track with your current investment strategy. Similar to Betterment, it requires only a handful of steps, and it also provides you with an option to invest with it at its completion.

- AARP – AARP also provides one of the best retirement calculator choices for free. It requests simple information with explanations for each question and a brief summary of your responses. One thing to pay attention to on the AARP retirement calculator is the spending scale. You can adjust the sliding scale of what percentage of your income you will spend to see how it affects your need to save through the retirement calculator.

Retirement Age Calculator

These three options for some of the best retirement savings calculator programs on the Internet give you a free glimpse into what it will require for you to retire comfortably. You can select what age you would like to retire, even using the programs as an early retirement calculator. With the sliding scales and easy adjustments that can be made on each one, it will give you flexibility in planning well ahead of your golden years.

Of course, there are many other choices for retirement calculators available, including those that feature a retirement calculator with pension planning or a retirement withdrawal calculator if that is where your need is greatest.

This list serves as a jumping-off point for you to begin to investigate and compare the results of several different choices for a retirement savings calculator. Is one easier for you to use or seem more accurate? That’s okay – use whichever retirement calculator works best for you.

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: Finding the Best Retirement Calculators (Savings, Income & Early Retirement Calculators)

If you’re trying to see exactly what you need to do to prepare for retirement, using a retirement calculator is an excellent and simple first step toward being prepared.

The loss of a steady full-time income can be intimidating, but a retirement savings calculator can help you feel more at ease by providing answers regarding what you should expect to have saved by your predicted retirement age.

Of course, each situation is unique. Where one person may need a simple retirement calculator, another may need a retirement withdrawal calculator or retirement calculator with a pension.

Whatever your financial situation entails, there are plenty of choices for a robust retirement savings calculator (many of which don’t cost you a thing).

Keep close tabs on how each of the retirement calculators works and what assumptions it makes about you. Compare the responses with those from other calculators and then determine what you should do with your savings plan.

Even the best retirement calculator can’t make that decision for you. However, your retirement income calculator can begin to point you in the right direction.

Read More: 7 Ways to Conduct Financial Planning for Retirement

Image Sources:

- https://pixabay.com/photos/calculator-figures-accounting-dial-1180740/

- https://www.ssa.gov/OACT/quickcalc/index.html

- https://www.aarp.org/work/retirement-planning/retirement_calculator.html#/your-retirement-income

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.