Guide: How Much Do I Need to Retire? | Average Retirement Savings by Age

When it comes to the average retirement savings required for Americans to live comfortably in their “golden years,” there is really no one-size-fits-all formula.

Plenty of people are asking, “How much do I need to retire?” though retirement planning experts are split on what that magic number should be.

Some experts believe your retirement savings should be sufficiently large enough to generate at least 80% of your pre-retirement income; others believe that percentage should be closer to 50%.

Saving for retirement is a crucial part of creating stability and security in our later years, though retirement readiness is on a steady decline.

In this article, we’ll take a closer look at what the levels of average retirement savings by a specific age should be. We’ll also provide you with some retirement planning guidelines to determine whether you are on track for a comfortable retirement.

Plans to Kick Back Your Heels

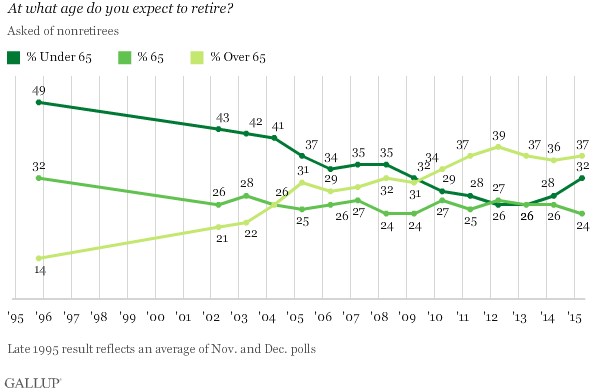

According to a Gallup poll conducted in 2015, 37% of working-age Americans don’t expect that they will be able to retire at least until age 65.

One year later, another Gallup poll found that 31% of American workers planned to continue working past age 67, delaying retirement plans even further.

Looking back at historical data, pollsters discovered that expectations for the average retirement age have been steadily climbing since 1995, when only 14% of Americans expected to retire by age 65. That percentage climbed to 31% in 2009.

Image Source: Gallup Poll

Whether people actually do retire as planned or retirement plans are deferred depends on many factors.

The most important factor is the level of average retirement savings by age 45, or 35, or whatever “magic number” one has in mind to cash in and kick back one’s heels.

See Also: Can I Retire Now? Find Out If You Can Afford to Retire Now

What’s Your Magic Number?

A March 2015 research report published by the National Institute on Retirement Security (NIRS) came to some pretty stark conclusions about America’s retirement readiness.

The report points out that the average retirement age household has just $14,500 to their name in retirement savings.

But the picture seems much bleaker when we dig deeper into the state of retirement savings as a whole: the average household holds a retirement savings balance of just $2,500.

Image Source: BigStock

So what does the report conclude about what your retirement preparedness “generally” looks like? Do the authors of the report say what the average retirement savings by age 50 should be?

Well, before we answer that question, we need to keep in mind that these are generalized conclusions based on a finite set of study participants. As all general observations go, your specific retirement readiness may differ from the report’s findings.

For instance, if you are looking to find out what the average retirement savings by age 60, or whatever your age is, should be…you may not find that answer specifically in the reports.

However, based on these generalizations and what we are about to discuss next, you’d do well to re-evaluate your “magic number” and where you stand with your retirement plans.

The Retirement Challenge by Age

Interesting paradigms of retirement and retirement readiness can be developed when looking at average retirement savings by age.

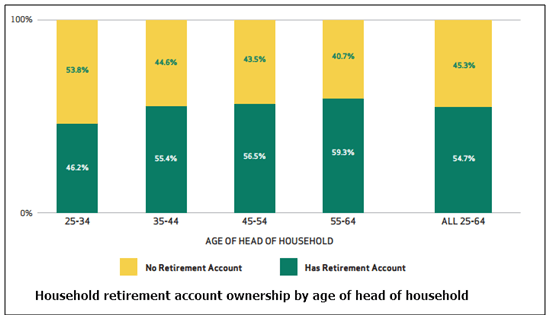

The NIRS study gives us a pretty good glimpse of this aspect of America’s working households. It does so by analyzing household retirement assets owned by age of the head of the family.

The figure below is a graphical representation of the report’s findings in this regard.

Image Source: NIRS

The average retirement savings of any given age group hinges on whether that particular demographic owns any assets in retirement accounts in the first place. Alarmingly, the report concludes that:

“Over 45 percent of all working-age households do not own assets in a retirement account!”

It’s hard to give an average retirement saving by age 30 when over half of that demographic doesn’t have retirement savings of any kind.

Just getting an account—no matter your age—will put you ahead of a large swath of the population.

We can, therefore, generalize our magic number discussion by stating definitively that your average retirement savings by age 30 could be higher, if you start early with a retirement account, than your average retirement savings by age 35 – if you delayed putting aside retirement savings that long.

Don’t Miss: How Much Should You Have Saved for Retirement by 30, 40, 50, or 60

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Getting Specific

Clearly, based on findings of both the Gallup and NIRS studies, we may generalize that average retirement savings by age depends on how early in your working life you start accumulating retirement assets.

However, there are a number of other more specific factors which impact how much retirement savings you accumulate by a specific age, including:

- The level of your pre-tax income, and how much that income grows annually, between now and the time you decide to retire

- The impact that taxes have on your income

- How much you have already accumulated in your nest egg

- The rates of return you receive on your various retirement assets

- How much of a drag inflation is on your investments

- …and much more

So, depending on how well your own retirement nest egg has grown, the constraints for the average retirement age may or may not be applicable to you.

Statistics provided in the reports, however, are indicative of “most likely” trends for Americans as far as their retirement plans go, and how much they actually accumulate in terms of average savings at retirement.

Consequently, the report’s findings could also be used to deduce that, the greater your average retirement savings by age 35 or 50 or 65 are, the more likely it is that you can retire by any specific age.

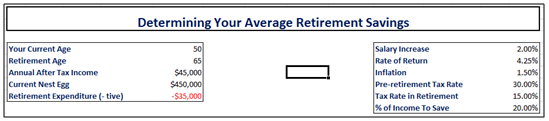

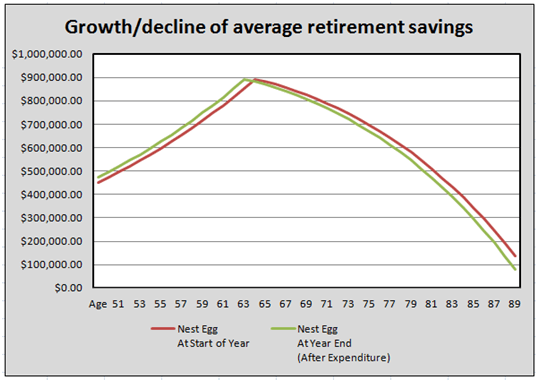

In the table below, we’re going to explore what some of the impact variables can do to the value of your average retirement nest egg over time.

Image Source: AdvisoryHQ

In this specific instance, we are assuming the following scenario:

- You are currently 50 and plan on retiring at age 65.

- You earn an after-tax salary of $45,000 and are able to live comfortably off the annual 2.0% salary increases your employer offers.

- While you are currently in a 30% tax bracket, you expect your tax rate to be half that—15%—by the time you retire.

- You currently earn a generous 4.5% return on the $450,000 you have saved so far for your retirement.

- We are also assuming that you save approximately 20% of your annual salary.

- Inflation runs at 1.5%, decreasing your average retirement savings by that much each year.

We have built a financial model to see what these variables do, at a very high-level, to your retirement savings plan and to assess what effect that will have on your decision on when to retire.

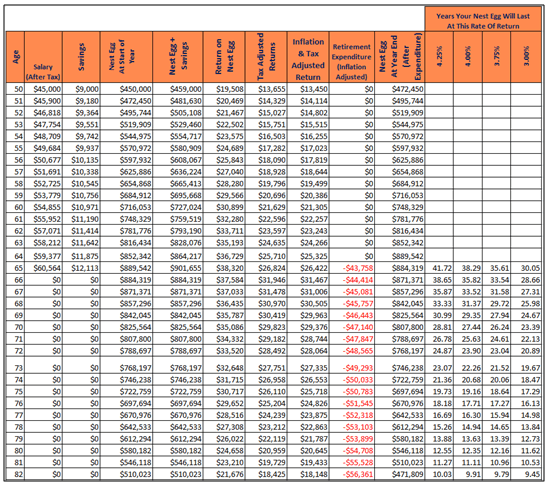

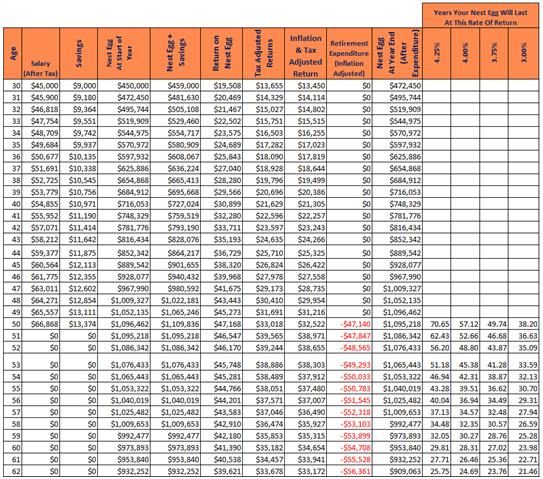

Image Source: AdvisoryHQ

Based on the specific details of your current financial situation (assumed in the input variables used for the scenario here), the model tells us that your average retirement savings by age 60 will have grown to around $748,000–just five years from retirement.

Remember, at this point, we are assuming all of your pre-retirement expenditure takes place using your employment income, and that you are not dipping into your retirement nest egg for day-to-day living.

Related: How Much Money Do You Need to Retire By Age 40, 50, 60, 65…

What Your Magic Numbers Say

As your income grows by 2% each year, your average pre-retirement savings grow too, starting at $9,000 annually at the beginning of our model’s planning horizon and ending at $12,113 by the time you retire.

From this point on, your lifestyle expenditures will be funded entirely through retirement savings.

Based on the model above, your average retirement savings by age 60 will have reached approximately $889,000. From here on, because you are withdrawing more from it than you are growing it, your retirement nest egg will see a steady decline each year.

Image Source: AdvisoryHQ

Based on your average retirement age of 65, the model is able to forecast that, assuming all things remain equal (which, given how Murphy’s Law works, they won’t!), your savings should last you anywhere between 30 and 42 years, depending on varying rates of return.

Specifically speaking, there is a gradual decline in your retirement nest egg, primarily because of two reasons:

- You are no longer working, so there is no regular income or savings flowing into your retirement nest egg.

- Simultaneously, your retirement expenditures are eroding your retirement savings.

As a result of these negative factors, your average retirement savings balance will continue to decline each year during your retirement.

Popular Article: Do I Have Enough to Retire? Find out If You Have Enough Money for Retirement

Conclusion: Successful Retirement Planning & Saving for Retirement

As both the Gallup and NIRS research indicated, the earlier one starts saving for retirement, the larger the average savings accumulated at retirement will be.

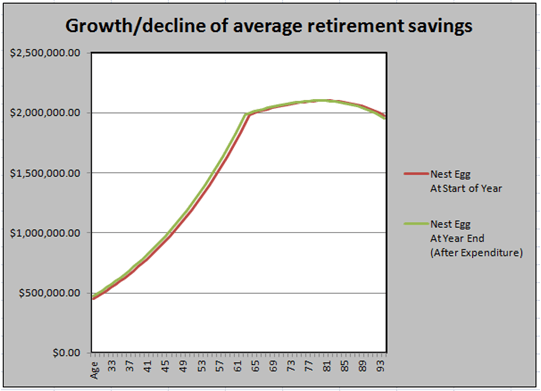

To put that thought into numbers, let’s see what your specific situation would look like if, all other things being equal, we started crunching your average retirement savings by age 30 (instead of age 50 as was the case earlier).

Image Source: AdvisoryHQ

Free Wealth & Finance Software - Get Yours Now ►

Under such circumstances, your average retirement age could well be 50, since by then your retirement nest egg will have ballooned to over a million dollars. Granted, you will be saving for longer in this scenario–but that’s exactly the point.

Image Source: AdvisoryHQ

As the graph indicates, your savings, both at the start of each year and at the end, grow steadily (for longer) right up to retirement.

And because you had accumulated a sizable balance of average retirement savings by age 50, your withdrawals will have a more gradual declining impact on retirement savings balance (as indicated by the comparatively gentler decline curve in the chart above).

There is no one-size-fits-all answer to the question, “How much do I need to retire?”

The best way to approach retirement savings is to begin saving early and regularly to ensure your average retirement age decreases over time, while your retirement nest egg sees a healthy increase.

Read More: Ways You Can Retire Early (Detailed Early Retirement Planning Guide)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.