How Much Should You Have Saved for Retirement by Age 30, 40, 50, and 60

“How much do I need to save to retire?” This question is often a challenging one to address. There are so many factors to deal with in the answer, including some that are beyond the average saver’s sphere of influence. However, even with so many moving parts, it is possible to provide a reasonable answer–with some caveats.

In a prior article, we helped our readers address the question: “How much should I have saved for retirement by age 50?” What about 60? 65? The focus of that article was to assess retirement needs and to figure out how much money was needed as a nest egg to meet those needs.

So, how much should you save for retirement? The focus of the discussion to follow will be how much of your income you need to save (i.e., what percentage) by a particular age—be that by 30, 40, 50, or 60—in order to reach your retirement goal.

THE BUILDING BLOCKS

When you ask yourself, “How much should I save for retirement?” It is assumed that you have some source(s) of income (or designated revenue streams), and you are interested in knowing how much of that should you save for retirement. A simple answer would be, “Save as much as you can,” but that would beg a follow-up question: “Save to do what?”

You’ll want a list of all the things you plan on doing during retirement and an estimate of how much you will need to spend annually to do what you plan on doing in retirement.

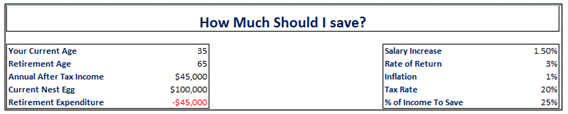

Image Source: How much should I save for retirement?

These will be the basic building blocks that ultimately lead you to how much to save for retirement. The 10 pillars that constitute these building blocks include:

- Your current age

- The age at which you plan on retiring

- How much after-tax income you earn each year

- How much that income will grow every year

- How much you have already saved (your nest egg)

- The rate of return you expect on your savings

- The rate of inflation you expect over your planning horizon

- The percentage at which you expect your returns to be taxed

- Your anticipated annual expenditure in retirement (in today’s dollars)

- And lastly, how much of your income you expect to save

For the purpose of this illustration, we’ll assume the following for our building blocks:

Image Source: AdvisoryHQ

The response you provide to all of these building block questions is important. However, of greatest significance is the answer to the last question: “% of income to save.” While your response will be based on what you plan on saving, by the end of this exercise, we’ll help you determine how much you should actually save for retirement by a specific age–whether that’s 35, 45, 50, or 65.

Read More: Best Retirement Communities in Florida

The Foundations

Wondering, “How much retirement should I have?” You now need to build the foundation for your savings plan, upon the building blocks you already have in place. The foundations for the calculations to follow are based on two Excel formulas:

Forecasting retirement expenditure

This calculation, of what your annual retirement expenditure (in today’s dollars) will be at the time of retirement, is worked out using the following approach:

- Expense amount in today’s dollars * (1+inflation%)^number of years from today

Using our building block data above, assuming you forecast incurring $45,000 in annual retirement expenditure in today’s dollars, one year from today, that amount won’t be $45,000 any longer. It will balloon by 1% (inflation rate) into $45,450.

Therefore, at age 35 today, when planning how much to save for retirement at age 65, you’ll need to factor on spending $60,653 in retirement expenditure (45000 * (1+1%)^30 = $60,653)–not the $45,000 you are planning on in today’s dollars.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

How long will your savings last?

The next foundational element is to determine how long a given nest egg will last you, assuming you spend the annual amount forecast for expenditure. The real test here is to determine how many years your savings will last, assuming you can save x% of your annual income.

To answer that question we once again turn to math. This time, we use Excel’s Number of Periods (NPER) function:

- NPER (Rate, Payment, PresentVal, FutureVal, Type): Where Rate is the annual Rate of Return, Payment is annual retirement expenditure, PresVal is the value of your nest egg at year-end of a period, FutureVal = 0, and Type (0 or 1) indicates whether withdrawal is at end or beginning of period–we’ll use 1 for our calculations.

While a detailed dissection of the NPER formula goes way beyond the scope of this article, at a very high level, here’s what it tells you:

- If I have a certain amount of money saved (PresentVal) in my nest egg, and

- If that nest egg earns me a certain annual rate of return (Rate), and

- If I wanted to withdraw a certain amount each year for my expenses (Payment), then

- How many years will that nest egg last me?

In a word, what this boils down to is asking, “How much money should I save for retirement each year, if I plan on spending a certain amount of those funds annually in retirement?”

Related: Find out If You Can Afford to Retire Now

Putting the Pieces Together

Now that we have our building blocks and a fair idea of what the foundations of our savings plan look like, it’s time to put the pieces together.

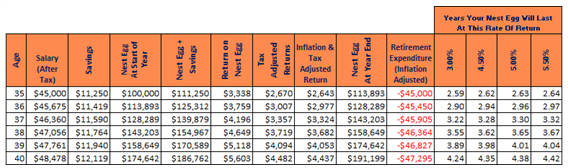

Image Source: AdvisoryHQ

To start off, let’s refer back to our building blocks and refresh our memories about the various assumptions we made. Based on those assumptions, we see that by the end of your first year (i.e., the year you are 35), your nest egg will have grown to $113,893. How did we arrive at that?

- You have $100,000 at the start of the year.

- You saved $11,250 from your first year’s annual income (i.e. 25%).

- Your total savings ($100,000 + $11,250) earn you $3,338 @ 3% return for the year.

- However, after factoring inflation (1%) and taxes (20%), you are left with only $2,643 of those returns.

- Therefore, your nest egg at the end of that first year now stands at $113,893.

Note to readers: It is assumed that you won’t be dipping into your nest egg to fund pre-retirement expenditure. That’s why the balance shown in the “Nest Egg at Start of Year” is the same as the balance shown in “Nest Egg at Year-End” for the prior year.

It is also important to note that NPER does not factor an inflation-adjusted expenditure amount, nor does it provide you a nest egg value adjusted for a particular rate of return. However, in our computational models, we mitigate those shortcomings, to a certain extent, up to the age that you plan to retire.

For instance, if you planned to retire by age 40, we’ve already factored in inflation and an assumed rate of return to forecast your nest egg will grow to $191,199 by the end of that year. We’ve also rightly forecast you’ll need $47,295 in retirement expenditure at that age, NOT $45,000 that you predicted at age 35. NEPR then uses those two variables to calculate how long your nest egg will last you.

So now if you needed to know, at this rate, how much of a retirement pot should I have at 40, the answer would be $191,199. But asking the next question is equally important: How long with that pot last you in retirement, given your plans to spend $47,295 in expenses? And the answer to that question is–it depends!

Using our NPER formula, and working it at 3%, 4.5%, 5%, and 5.5% rates of returns, we see that by the time you turn 40, you will have accumulated approximately four years of retirement expenditure in your nest egg.

Read More: Best States to Retire in the U.S. (Review of the Top Retirement States)

Tough Choices

Clearly, at your current rate of saving (25% each year), if you plan on retiring at age 40, and intend to enjoy your retirement beyond four years, you don’t have enough!

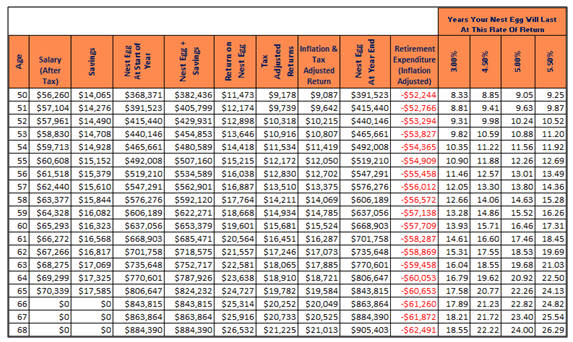

Image Source: AdvisoryHQ

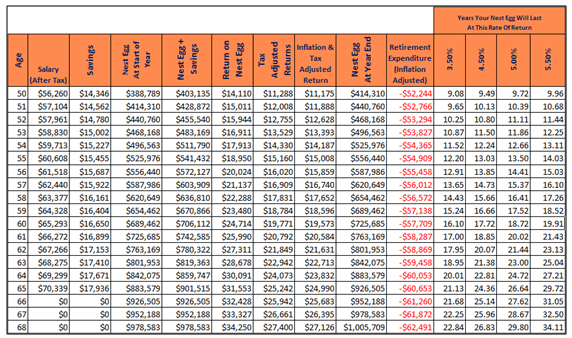

Based on the building blocks for this particular scenario, the answer to how much to save for your retirement is predicated on when you plan on retiring, and for how long. Retirement at age 50 will give you approximately 8.33 to 9.25 years of retirement expenditure (subject to the rate of return used). So, your choices are:

- Delay retirement by a few additional years, allowing you to accumulate a larger nest egg.

- Save more than the planned 25% of your annual income, which could allow you to retire earlier.

- Hope that your retirement savings grow faster than the forecast 3%, 4.5%, 5%, or 5.5%, once again increasing your nest egg enough to make earlier retirement possible.

Given the current building block assumptions, however, by age 65–your planned retirement age and your last year earning a salary–you will have a nest egg of around $843,000. Based on our NPER workings, and assuming a 5.5% rate of return, that should serve you for a comfortable retirement for nearly 25 years.

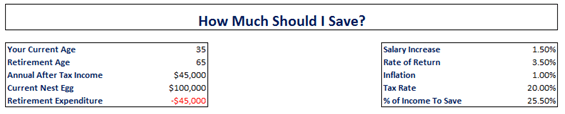

However, to see how much you’d have to save for retirement under a slightly accelerated saving plan, let’s run the numbers once again. Let’s assume the building blocks change as follows:

Image Source: AdvisoryHQ

Notice that we’ve just assumed a slightly higher rate of return (by half a basis point) and a similar increase in the amount of your salary that you save annually. Given these slight revisions, here’s what your retirement plan looks like:

Image Source: AdvisoryHQ

Given this accelerated saving plan, at 65 years of age, your number of years in retirement increases four or five years, depending on how well the savings in your nest egg performs (i.e. 3.5%, 4.5%, 5%, or 5.5% rates of returns).

Popular Article: How Soon Can You Retire?

Other Variables

In determining how much to save for your retirement, we have tried to keep the assumptions simple so as not to overwhelm or confuse our readers. In reality, however, there may be many other factors to consider before you get a definitive answer to how much should you have saved for retirement by, say, age 40, 50, 60 or 65. Some of these factors include:

- How much do you expect to receive from government pension sources?

- When is the right age for you to start drawing on those sources?

- What tax bracket do you fall into during retirement?

- What types of assets do you have in your retirement portfolio–Tax-Sheltered, Taxable, Tax-Free?

- How well, or poorly, are each of those retirement portfolios performing?

- When do you start drawing down from your sheltered assets–IRA/401(k)?

The NPER calculations are also based on a constant payment, and a constant rate of return, and do not factor in the future rate of inflation. A change in these variables could change our computations significantly.

Having said that, the answers to some of these questions will definitely help you address the broader question, “How much should I be saving for my retirement?” However, there’s no denying that, even when you put all of these new variables into the mix, the basic process to determine how much to save for retirement remains largely as highlighted in the discussions above.

Free Wealth & Finance Software - Get Yours Now ►

Disclaimer

There are many ways to skin a cat, and the method discussed here is just one such approach. This is NOT an actuarial approach and, for the sake of simplicity, there are many variables missing from the underlying computations. However, the approach followed should give you a fairly accurate picture of how much you should have saved for retirement by a certain age.

Before you use any of this information for your own retirement planning, you should consult a qualified retirement planning expert.

Don’t Miss: Ways You Can Retire Early (Detailed Early Retirement Planning Guide)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.