Can I Retire Now? Find Out If You Can Afford to Retire Now

A few months shy of his 54th birthday, Jim D caught himself wondering, can I retire now? Have I saved enough to make it happen? He had read the 2014 Survey of Household Economics and Decisionmaking, conducted by the U.S. Federal Reserve System (the Fed), and was particularly struck by one stark finding:

“Thirty-nine percent of non-retirees have given little or no thought to financial planning for retirement and 31 percent have no retirement savings or pension.”

Jim has been a diligent saver throughout his working life and believed that he was not part of the “39 percenters” or the “31 percenters” referred to in the Fed survey. So, he asked himself, what if I want to retire now – can I do it?

If you are among the 39% of the population highlighted above, you, too, may soon find yourself asking the same question: Can I retire now? The answer you get back would probably depend on many retirement-related factors that are unique to you.

Let’s take a closer look at Jim’s situation to help you understand if you can retire now.

Image Source: Can I Afford Retirement?

Read More: Ways You Can Retire Early (Detailed Early Retirement Planning Guide)

Jim D’s Predicament: Can I Afford Retirement?

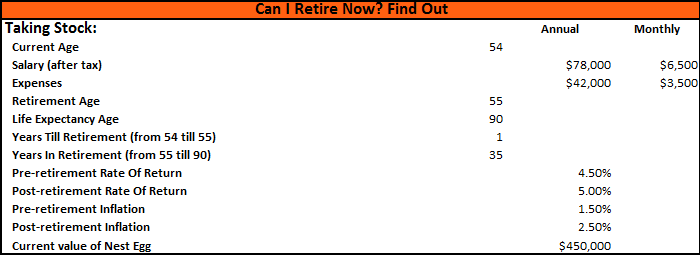

As Jim wrestled with his retirement predicament, he decided to do what any retirement planning expert would advise: take stock of your current situation, and that’s exactly what Jim did.

a. Jim will be 54 years old in 3 months and plans to retire next year – when he turns 55.

b. He earns $6,500 a month, spends $3,500 in monthly lifestyle expenses, and wants to maintain his existing lifestyle in retirement too.

c. His family has a history of longevity, and he, too, expects to live to a ripe old age of 90.

d. Jim has already managed to save a tidy sum of $450,000 over his working lifetime, which he has invested and expects will continue to grow at 4.5% annually, with interest/dividends received monthly until retirement and inflation eating up to 1.5% of his nest egg pre-retirement.

e. In retirement, Jim expects that his savings will grow at a healthier annual rate of 5%, with interest/dividends received monthly, but inflation will erode those savings by 2.5% each year.

Here’s a snapshot of Jim’s stock-taking exercise:

Image Source: AdvisoryHQ

Having taken inventory of where he currently stands financially and what his retirement goals are, Jim is now in a position to better answer the question, can I retire now? However, in order to find out whether he can afford to retire in a year’s time, he needs to do some math.

Related: Best States to Retire in the U.S. (Review of the Top Retirement States)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

A Calculated Decision

Determining whether Jim can retire now is a 3-step process that uses all of the information collected about his current situation above and then uses those bits of data to peer far into the future – right up to the end of Jim’s life expectancy.

Step 1: Future Expenditure

Jim currently spends $3,500 a month ($42,000 annually) in expenses to maintain his lifestyle and is determined to continue to live the same way in retirement. In answering Jim’s question – I want to retire now. Can I do it? – We first need to determine how much his retirement lifestyle will cost him.

Actuarial studies tell us that inflation causes the value of money to erode over time. We, therefore, need to predict what the future value (FV) of Jim’s $3,500 monthly expenditure will be by the time he retires.

Image Source: AdvisoryHQ

Using Excel’s FV function, we determine that it will cost Jim $3,552 a month ($42,630 annually) in retirement to maintain his current lifestyle.

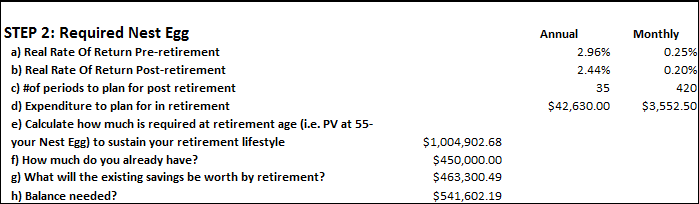

Step 2: Required Nest Egg

Next, in seeking an answer to Jim’s can I retire now question, we need to determine how large of an accumulated nest egg he needs in retirement to produce that $3,552 monthly expenditure.

A snapshot of what’s involved here is provided in the table below.

Image Source: AdvisoryHQ

This multi-staged calculation step, to determine whether Jim can retire now, significantly involves the following:

- Steps 2a and 2b: First, calculating the pre and post-retirement real rates of return (RRR) that Jim can realistically hope for. The RRR is nothing but an inflation-adjusted rate which says if I expect to earn X% in interest/dividends on my savings, and if inflation runs at Y%, how much are my savings really growing by?

- Step 2c: Establishing how many periods (i.e., 35 years or 35 x 12 = 420 months) his retirement nest egg should last.

- Step 2e: Using the present value calculations to establish what Jim’s retirement nest egg should be at retirement (in today’s dollars) to sustain his future monthly expenditure (as noted in Step 2d) for the rest of his retirement years – i.e., what amount of savings will generate the required monthly expenditure required in retirement, assuming inflation and rates of return as disclosed in taking stock.

- Step 2g: Addressing Jim’s question: Can I retire now? We, then, need to estimate what the value of Jim’s existing nest egg (as noted in Step 2f) will be by the time he retires.

- Step 2h: Finally, after taking the result from Step 2g above, we need to determine the additional balance needed (shortfall) for Jim to save, prior to retirement, so that he can maintain his desired lifestyle in terms of monthly retirement expenses.

A special note for Step 2e is that, if I want to retire now and my nest egg is invested in vehicles that provide me monthly returns – as is the case with Jim – then the real return rates used must be the monthly values since my returns will compound (i.e., grow bigger) each month by the said rate.

Popular Article: Retirement Calculator Tool

Step 3: Monthly Savings Target

Jim is now at a stage where he can look at the calculations thus far and ask himself, how can I retire now if I the balance needed to fund my retirement lifestyle is $541,602? Clearly, Jim needs a reality check at this point. He has determined that he is short by $541,602 in order to retire in 1 year and fund a retirement lifestyle requiring $3,500 a month (in today’s dollars).

So, to help Jim understand how to retire now and still enjoy his “dream retirement,” we need to indulge in one last bit of math – to find out what it would take for Jim to meet the shortfall in the time he has left prior to retirement. That’s where Excel’s PMT function comes in!

PMT will help us calculate the monthly payment (saving) required – based on constant payments (savings) and a constant interest rate – in order for Jim to reach his nest egg shortfall by the time he retires, which is in 12 months.

A snapshot of what the figures look like is provided in the table below.

Image Source: AdvisoryHQ

Using the pre-retirement real rates of return calculated in Step 2a and the retirement shortfall from Step 2h, we are able to determine that if Jim wants to retire now, he needs to save $44,415 monthly (or $526,053 annually) from now till his retirement (1 year from now).

A special note, about the table above, for anyone asking: If Step 3c says Jim needs to save $541,606 by retirement for his nest egg, then how come Step 3d says he needs to save $526,053? The answer is simple: Step 3d tells us the amount Jim needs to pile up in today’s dollars. By way of validation, if we use Excel’s FV function to compute what that amount ($526,053) will be in 1 year, the answer is $541,602!

The bottom line: In regard to Jim’s question of can I retire now? The answer is a categorical no, you can’t!

Hang in There!

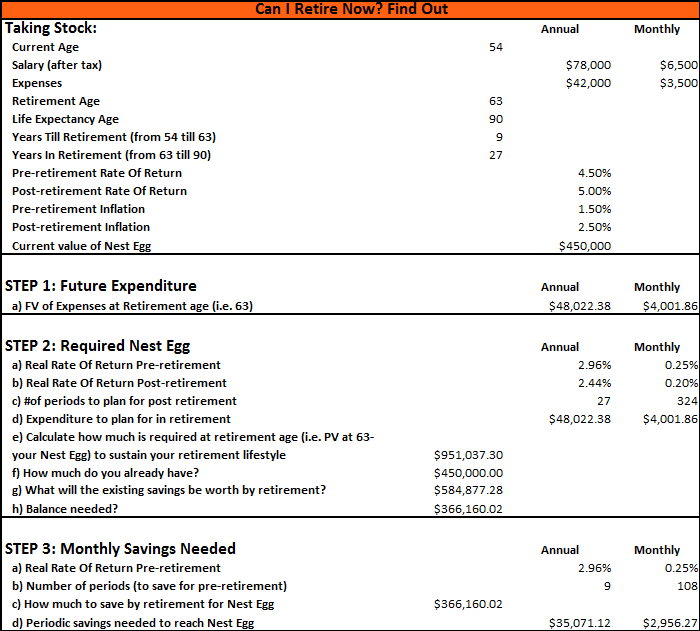

Jim needs to be prepared to hang on to his job for another 9 years – with all other assumptions remaining the same – and then he could comfortably retire at age 63 if he started putting away $2,956 (or about $3,000) a month towards his savings goal.

A snapshot of what the figures look like is provided in the table below.

Image Source: AdvisoryHQ

Don’t Miss: Average Retirement Savings by Age 30, 35, 40, 45, 50, 60, 65

So, why is it that Jim will receive a response of “yes,” at age 63, to his question, can I retire now? The answer is simple:

a. He currently has exactly $3,000 of additional saving capacity available ($6,500 monthly salary minus $3,500 monthly expenses).

b. For him to retire any earlier than age 63, while sustaining a retirement lifestyle of $3,500 in monthly expenses (in today’s dollars), would require saving more than $3,000 a month. For instance, at a retirement age of 62, his required monthly savings work out to be $3,626, which exceeds his current available saving capacity.

At age 54, then, if Jim asks his financial planner, “I want to retire now – can that happen?” The answer will likely be: No, you can’t. Not before you turn 63!

Summing It All up

Anyone wondering how to retire now needs to follow a logical path to determining whether that’s possible. In summary, here’s how to go about confirming your retirement readiness at any given age:

- Find out what your current monthly expenditures are, in today’s dollars, and then work out what they will be in future retirement dollars (hint: use Excel’s FV function).

- Once you know how much you’ll need for your monthly retirement lifestyle, find out how large a nest egg you need to generate that amount each month in retirement – through interest, dividends or other investment returns (hint: use Excel’s PV function).

- Now that you know how much you’ll need to retire, subtract what you’ve already saved (hint: adjust it for retirement dollars using Excel’s FV function) in order to determine the net shortfall you need to come up with in order to retire.

- The final step in answering the question, can I retire now? Is to find out how much you need to save monthly in order to bridge the shortfall by your retirement date (hint: use Excel’s PMT function).

By the time you have finished this exercise, you’ll be in a better position to determine whether you can retire now or whether you need to postpone your retirement date, accelerate your savings or even revisit your lifestyle spending expectations for retirement.

Read More: Best Places to Live in Ireland When You Retire (Retirement in Ireland)

Free Wealth & Finance Software - Get Yours Now ►

Caveats and Disclaimers

The process discussed above will give you a broad answer to the question; I want to retire now – am I ready? However, before you act on any of the recommendations offered, you need to consult with a qualified financial planner. Why? Because:

- These concepts are generic in nature and may not necessarily be applicable to your specific circumstances.

- The approach discussed is a high-level look at retirement planning and does not go into many of the nuances associated with the planning process. For instance, we don’t consider the impact of taxes or Social Security payments you may be entitled to in retirement.

- We also don’t factor a year-by-year impact that returns and inflation will have on your savings and expenses. For simplicity, we assume inflation and returns will be a fixed value throughout the planning horizon.

Therefore, for all of these reasons, while the above exercise is a great start to answering your question, can I retire now? You would do well to have your calculations and assumptions validated by an expert.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.