2017 Guide to Finding the Best Personal Loan Calculators

Whether you are preparing for a life-changing event, have an unexpected emergency, or simply want to splurge on something as a gift to yourself, you might consider applying for a personal loan.

But have you considered how much a personal loans calculator can help you decide how much you can afford to borrow?

Many borrowers enter blindly into loan terms that they do not fully understand, or they do not take the time to use a personal loan calculator USA banks usually provide online for free.

Using a personal loan calculator should be one of the first steps you take in searching for a personal loan.

From a personal loan repayment calculator to a personal loan interest calculator, the internet hosts various ways for you to calculate personal loan payments for free. Why not take advantage of these valuable resources before you step into a loan you cannot afford?

This article will take you through the process of using a personal loan payoff calculator and will focus on a few of the most popular online personal loan payment calculators, like the Wells Fargo personal loan calculator.

See Also: Finding the Best Home Loan Calculators | Top Home Mortgage & Home Equity Calculators

How to Calculate Personal Loan Payments

A personal loan is a general term that covers a variety of loans borrowers might request. Personal loans allow borrowers flexibility in how they use the funds.

This can range from funding a wedding to purchasing a new car to paying emergency medical bills.

No matter the need for the loan, it is wise practice for borrowers to take advantage of the free, online personal loan calculators USA banks often provide.

The Bankrate personal loan calculator, for example, helps a borrower understand the possible monthly payments he might have for his loan amount, and it is provided free of charge on the Bankrate website.

Image Source: Invest Korea

How does a personal loans calculator work? There is some variation in the free personal loan calculators you find online.

Where some focus more on your payoff amount, a personal loan interest calculator, instead, hones in on the amount of interest you will accrue during the life of your loan based on its interest rate.

Most borrowers should search for a reliable personal loan repayment calculator before they get ready to borrow. A repayment calculator will specifically help you determine how much your monthly payments can be based on your interest rate, length of the loan, and amount of the loan.

A well-rounded, reliable personal loan payment calculator should include the following information to accurately calculate personal loan payments:

- Amount you are considering borrowing.

If you have a specific amount you need to borrow, plug this into the personal loan calculator, or at least provide a good estimate. Try a few different amounts to see how they will affect your monthly payments.

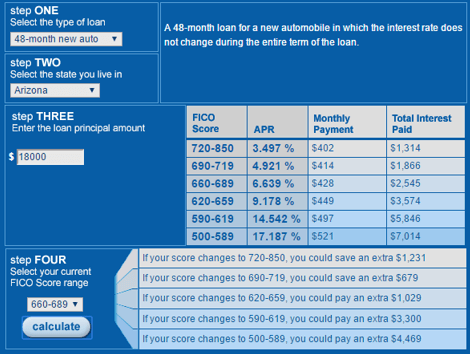

Image Source: MyFICO

- Interest rate of prospective loan (APR).

Before you add an interest rate into a personal loan interest calculator, consider researching some typical interest rates based on your credit score. MyFICO’s loan savings calculator helps you determine possible interest rates for your loan according to your current credit score.

- Length of the loan (term).

Personal loans can vary in length depending on the amount of the loan and how fast you can afford to pay it off. A personal loan repayment calculator should ask for the loan term to accurately predict your monthly payment.

The Chase personal loan calculator is a good example of a simple, yet reliable, calculator that includes this necessary information. A personal loan payment calculator does not have to be extravagant in information, but it does have to include the basics.

Don’t Miss: The Best Home Equity Calculators & Equity Line of Credit Calculator Websites

Why You Should Use a Personal Loan Payoff Calculator

Now you know the information that should be included in a reliable calculator. But why should you use the personal loan calculator USA banks provide? The simple answer is that these calculators are free for potential borrowers to ensure they enter into loans they can afford to pay back.

It is in the best interest of the borrower to take advantage of these helpful tools.

Additionally, there are other benefits to consider when using a personal loan payoff calculator:

- Determine the amount you can afford.

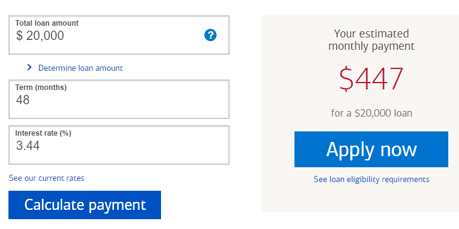

One of the most significant benefits of a personal loans calculator is that it helps you know exactly what you can afford. You may want to borrow $20,000, but after plugging in your information, you find that the monthly payment is higher than your budget currently allows.

Image Source: Bank of America

- Play with numbers.

Most calculators, like the Bank of America personal loan calculator, let borrowers play around with their numbers to immediately see how variations in loan terms can affect monthly payments. Change your interest rate, loan term, or loan amount and watch your estimated monthly payment change with the variables.

- See how your credit score and interest rate affect your loan.

Once you determine your possible interest rate based on your credit score, plug that into your personal loan calculator to see how it affects your monthly payment. Then, do the same with a better potential interest rate if you were to increase your credit score. You can quickly see the difference in monthly payments from both values.

- Consider refinancing your loan.

If you currently have a personal loan but are considering refinancing it, you can use a personal loan payment calculator to compare your current terms with other loans you might be considering. If the new loan’s terms do not significantly increase your savings, you might be better off staying with your current loan.

We know that a personal loan calculator is a useful financial tool readily available to borrowers. Now, we will discuss some of the most popular personal loan payment calculators and their unique features.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Best Personal Loan Payment Calculators

Searching for a personal loan calculator online can provide innumerable results. Most large banks have some form of a loan calculator on their websites, but not all calculators are the same. Here are a few things you should do before you decide on the calculator you want to use for your loan information:

- Check your bank or lender’s website first.

If you have a lender or bank you are considering using, check their website first to see if there is a personal loan payment calculator. Often, a bank or lender will have its own calculator specific to its loan options, making the results more tailored to you and the loan terms you are considering.

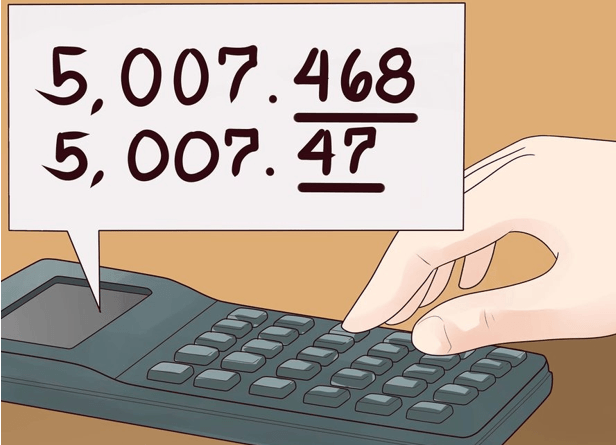

Image Source: WikiHow

- Double-check its calculations.

Make a simple calculation with the personal loan payment calculator to double-check its accuracy. WikiHow illustrates how to calculate a loan payment manually and provides some guidance to help you ensure that the loan calculator is accurate.

- Find one with simple results.

The best personal loans calculators display your results simply, either with numbers or graphs. This way, there is no guesswork involved with your results, just simple answers.

The following are some of the top personal loan repayment calculators you can find for free online based on the previously outlined criteria.

Related: Caliber Home Loans Reviews – What You Need to Know Before Using Caliber

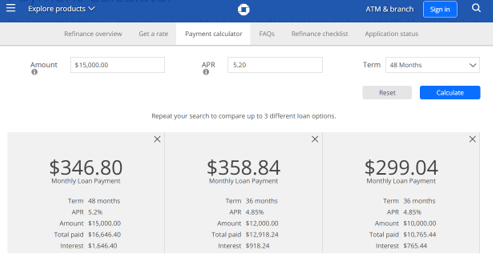

Chase Personal Loan Calculator

The Chase personal loan calculator is a great choice for borrowers who want a completely simplified calculator with an easy-to-use interface and simple results. This calculator lets you input your loan amount, interest rate, and the loan term. If you are unsure of the interest rate to use for the calculator, Chase has a “Get a Rate” page to give you a better idea.

Image Source: Chase

One of the best features of this personal loan calculator is the ability to compare three loan options side-by-side. Are you considering loans from different lenders or different loan terms from one lender? Plug your information for the first loan into the personal loan calculator and hit “calculate.” Then, do the same for your next two loans.

The Chase personal loan calculator will give you the information for all options for quick and easy comparisons.

Bank of America Personal Loan Calculator

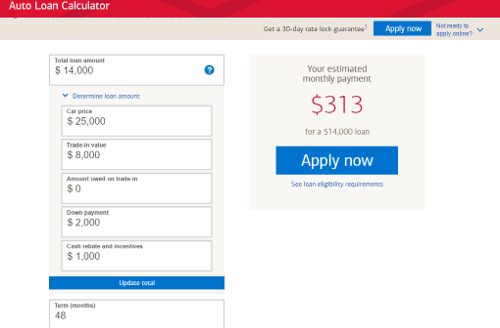

The Bank of America personal loan calculator is an excellent option for those wishing to use their personal loan funds for a vehicle, either to purchase a new vehicle or refinance a current loan.

Image Source: Bank of America

Popular Article: Capital One Mortgage Reviews – Get What You Need to Know! (Home Loans, Complaints & Review)

The Bank of America personal loan calculator has an excellent feature to help you determine the actual loan amount you need. This figure can sometimes be tricky, and borrowers could end up requesting a loan for more or less than they need.

To use this feature, click on “Determine loan amount.” Here, you will see fields for Car Price, Trade-in Value, Amount Owed on Trade-In, Down Payment, and Cash Rebate and Incentives. Once you plug in your values, the personal loan payment calculator will update the loan amount with the amount you should request.

After updating your loan term and interest rate, look to the right of the payment loan calculator to find your estimated monthly payment.

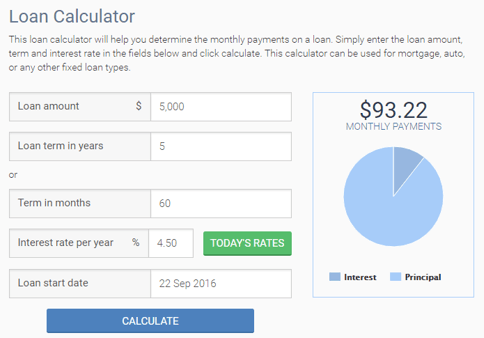

Bankrate Personal Loan Calculator

Another go-to personal loan payment calculator is the Bankrate personal loan calculator. This calculator is one of the more detailed options that also features a pie graph to help visual borrowers understand how much each monthly payment will go toward principal and interest.

Image Source: Bankrate

Bankrate’s calculator also serves as an excellent personal loan interest calculator. If you are unsure of the interest rate to enter into the calculator, click on “Today’s Rates” and Bankrate will provide you with a possible interest rate based on some personal information you provide.

Bankrate personal loan calculator will also show you your amortization schedule based on the information you provide the calculator. This is a helpful feature most personal loan calculators do not have.

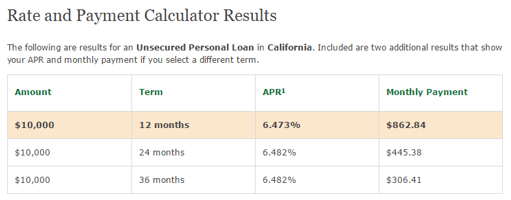

Wells Fargo Personal Loan Calculator

Finally, the Wells Fargo personal loan calculator is another great option for those looking for a simple calculator that lets you easily compare your loan options. This personal loan calculator has the basic information necessary for an accurate loan payment estimate: loan amount, loan type, and loan term.

Image Source: Wells Fargo

Rather than ask you for an interest rate, the results display three possible loan terms for the amount of the loan. The personal loan repayment calculator calculates your estimated monthly payment based on different loan terms and interest rates. This provides an easy comparison for possible loans using the amount you would like to borrow.

Read More: Chase Mortgage Reviews – Complete Report (Jumbo Rates, Complaints, & Home Loan Reviews)

Conclusion

There are plenty of loan payment calculators on the internet. However, you should only use calculators that ask the necessary information to determine an accurate monthly payment. Find a personal loan payment calculator that lets you input a loan amount, loan terms, and interest rate, or at least helps you find this information more easily.

Wells Fargo, Bankrate, Chase, and Bank of America provide payment loans calculators for free on their websites. Based on their specific features and benefits, consider using one of these trustworthy calculators to calculate personal loan payments before settling on a loan.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.