2017 RANKING & REVIEWS

TOP RANKING LOAN REPAYMENT CALCULATOR TOOLS

What Terms Should You Know to Use a Loan Payment Calculator?

A loan payment calculator is an excellent tool that can be used to look at assessing any type of loan, including mortgages, car loans, student loans, and personal loans. You can use a repayment calculator to determine how much your monthly payments will be based on factors such as APR and the term of the loan.

You can also use a repayment calculator to see how long it will take you to pay off a loan, how much you will pay in interest, and what a difference making additional payments could make.

Before looking at the specific features of a loan repayment calculator, however, it’s useful to consider the key terms associated with loans, because these are the input values you will need to know to calculate loan repayments accurately.

Award Emblem: Best Loan Consolidation Calculators

The following are some of the most important terms to know when you are calculating loan payments:

- APR: APR, also known as Annual Percentage Rate or interest rate, is one of the most important terms to know when you’re using a loan payment calculator. The APR is the amount of interest that’s charged on a loan. The APR, as compared to just looking at the interest rate, also includes any applicable fees, and it’s the most accurate way to see how much a loan will really cost you when using a loan repayment calculator.

- Amortization: Another term frequently used when calculating loan payments is amortization. This refers to loan payments that are made based on periodic payments of equal amounts. The debt is then paid off at the end of a fixed period of time.

- Balloon Payments: With some loans and loan payment calculator options, the term balloon payments may be relevant. This refers to a loan paid off in installments, with the final payment to pay off the loan completely being a larger amount than the other previous payments.

- Principal: The principal refers to the amount of debt owed on a loan, not including the interest.

The above is not an exhaustive list of all terminology related to loans and using a repayment calculator, but these are some of the primary terms used when calculating loan payments.

See Also: Best FD Interest Calculators | Guide | How to Find and Use the Top Fixed Deposit Calculators

What Is Loan Consolidation?

One topic covered on this list of the top loan repayment calculator options is loan consolidation calculators.

Loan consolidation calculators are frequently used by people who have student loans, but loan consolidation calculators can be used to look at any type of debt.

Image Source: Pixabay

A consolidation loan calculator shows the effect of combining debt and bringing it to one lender or combining it into one loan. When a borrower consolidates their loans, they also tend to have options for alternative repayment plans which are designed to make it easier to pay back the loans, and looking at repayment options are a big reason consumers use a consolidation loan calculator.

With loan consolidation calculators, you’ll see that the interest rate is the weighted average of all the loans that are being consolidated, rounded up to the nearest 1/8 of a percent.

The goal of consolidating loans and using a consolidation loan calculator isn’t to give you a lower interest rate, although the average interest rate may be lower than the rate of your highest loan. Instead, the goal is to make repayment more manageable and perhaps save you time, meaning you spend less time repaying your debt. These are things that can be worked out using a loan consolidation calculator.

What Are Repayment Options for Student Loans?

This ranking and review covers several different types of loan repayment calculator options, including loan consolidation calculators and student loan calculators. It also includes auto, mortgage, and personal loans, but student loans are unique from these loan products.

With student loans, there are a variety of repayment plans available, which is why borrowers often use a repayment loan calculator to determine which option is best for them.

Some of the repayment options available to student loan borrowers include:

- Standard Repayment Plan: With this option, you’ll see when you use a repayment loan calculator that you’ll pay lower total interest costs throughout the duration of the loan. Payments of the principal and interest are due monthly, and typically the repayment term is ten years.

- Income-Based Repayment Plan: With an income-based repayment plan, which is available for certain loans, you must show a partial financial hardship. You’ll then calculate loan repayments based on terms maxing out at 20 or 25 years. The total amount of interest paid will be greater than what would be paid with a standard plan, and eligibility is re-evaluated on an annual basis.

- Graduated Repayment Plan: Another potential option you might consider when you calculate a loan payment for student loans is a graduated repayment plan. To calculate loan repayments under this plan, you would look at a 10-year term and monthly payments that are reduced at the start of the plan. They then gradually increase over the ten years.

- Income-Contingent Repayment Plan: This is an option available to Federal Direct Loan Program borrowers, where the monthly payment is adjusted each year based on adjusted gross income, family size, and the total amount of Direct loans the borrower has.

These aren’t all of the student loan repayment plans that are available, but they are some of the most common used to calculate a loan payment for the cost of education.

Why Should You Use a Loan Repayment Calculator?

There are a couple of key reasons a repayment calculator is an excellent tool to use, whether you’re calculating loan repayments for a mortgage, an auto loan, student loan, or a personal loan.

The benefits of a repayment calculator include:

- A loan payment calculator can show you how different repayment options will change the amount of time it takes you to pay off a loan and how you can potentially shorten the time to repayment.

- A repayment calculator can show you the true monthly cost of your loan, including fees.

- When a consumer uses loan consolidation calculators, they can compare consolidation options and see whether or not it’s a viable, useful option for them. A consolidation loan calculator may show you that consolidation isn’t actually the least expensive repayment route in some cases.

- If you’re considering prepayment of a loan, a loan payment calculator can show you if that’s worthwhile financially.

- Most loan repayment calculator tools show how much you’re paying in interest versus what’s being paid on the principal each month.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s List of Top 6 Best Loan Payment Calculator Tools

List is sorted alphabetically (click any of the calculator names below to go directly to the detailed review section for that repayment calculator):

- Auto Loans Calculator and Comparison Tool From Allstate

- Bankrate Car Early Payoff Calculator

- Bankrate Personal Debt Consolidation Calculator

- Debt Snowball Calculator From Financial Mentor

- Mortgage Calculator from Dave Ramsey

- Student Loan Calculator from Smart Asset

Top 6 Loan Payment Calculator Tools | Brief Comparison & Ranking

Loan Payment Calculators | Used for | Inputs | Best for |

| Auto Loans Calculator and Comparison Tool from Allstate | Calculating auto loan payments and comparing offers | Purchase price Down payment Loan term Interest rate (Options for multiple loan entry) | Consumers in the process of shopping for auto loans |

| Bankrate Car Early Payoff Calculator | Comparing additional monthly payments versus current payments | Number of months remaining on auto loan Loan term Auto loan amount Additional monthly payment Annual interest rate | People who already have an auto loan and want to see the benefits of paying it off early |

| Bankrate Personal Debt Consolidation Calculator | Comparing current debt payments versus consolidation | Credit card debt Auto loan debt Real estate debt Other loans and installment debt | Anyone thinking about loan consolidation with multiple types and sources of debt |

| Debt Snowball Calculator from Financial Mentor | Calculating savings in time and money when using the debt snowball payment plan | Creditor Balance owed Interest rate Payment amount | Good for people who want a faster, less expensive way to pay off several types of debt |

| Mortgage Calculator from Dave Ramsey | Seeing mortgage payments over time and comparing accelerated payments | Original loan amount Month loan was issued Loan term Annual interest rate Potential extra payment amount | Excellent for consumers who want to take steps to pay their mortgage more quickly, or people considering a mortgage who want to plan payments |

| Student Loan Calculator From Smart Asset | Calculating student loan payments over time | Loan amount Interest rate Loan term Monthly prepayment | Useful for people to calculate total monthly and yearly student loan payments across multiple loans and see impact of prepayment |

Table: Top 6 Loan Repayment Calculator Tools | Above list is sorted alphabetically

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Loan Repayment Calculator Tools and Loan Consolidation Calculators

Below, please find the detailed review of each account on our list of the top tools to calculate loan repayments. We have highlighted some of the factors that allowed these loan payment calculator tools to score so well in our selection ranking.

Auto Loans Calculator and Comparison Tool from Allstate Review

Allstate is one of the leading insurance companies in the country, offering auto, home, life, motorcycle, renters, and condo insurance. They also provide valuable financial tools and calculators, including their Auto Loans Calculator and Comparison Tool.

Image Source: AllState

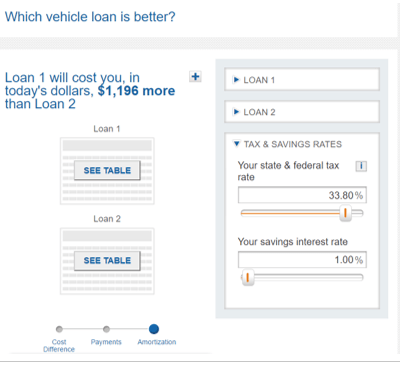

This loan repayment calculator is designed specifically for not only looking at how much your monthly payment will be, but it can also be used to compare different auto loan terms and offers to see which is best for your needs.

Key Factors That Led to Our Ranking of This as a Best Repayment Calculator

The following are specifics of why this is included on this list of the best tools to calculate a loan payment.

Features and Use

This loan payments calculator is used to compare car loans in order to find the best financing option. It highlights the importance of considering down payment, interest rate, and loan term, and it also emphasizes the fact that loans with the same interest rates may have different payment amounts, depending upon the length of the loan.

The calculator is designed to show the savings based on interest earned from investing the difference in monthly payments as well.

Inputs needed for this repayment calculator include purchase price, down payment, loan term in months, and interest rate. You also include your state and federal tax rate, as well as your savings interest rate.

Benefits

There are a few key advantages of this repayment calculator that led to its ranking on this list of the best tools to calculate a payment on a loan.

These benefits include:

- Graphs: Not only does this loan repayment calculator give you written results as to which auto loan will be best and save you money over time, but it also displays three different bar graphs for comparison purposes. These bar graphs include a cost difference graph, payments graph, and amortization/payment schedule graph.

- State customization: Also unique about this auto repayment calculator compared to many other available auto calculators is the fact that you can personalize your results to your state, including your state’s tax rate for the most accurate results.

- Comparison: Finally, this loan repayment calculator not only shows your auto loan repayments based on specialized criteria input; it’s also good if you want to compare different loan offers and see, including all factors, which one really works out to be the best value.

Who It’s Good for

This repayment calculator from Allstate is ideal for anyone who’s considering buying a new car and will be financing it. It’s great if you’re looking for different auto loan offers that may have the same interest rate but different terms, and you want to calculate loan repayments based on those conditions.

It’s also an excellent way to calculate loan repayments if you’re also interested in seeing how much you can save by investing the difference in monthly payments, so it offers a multi-faceted view of the value of one auto loan as compared to another.

Related: Best Car Interest Calculators | Guide | How to Find & Use the Best Car Loan Interest Calculators

Bankrate Car Early Pay Off Calculator Review

Bankrate is a top online resource for excellent financial information, including updated rates and original content. Bankrate is also known for their full selection of financial calculators, loan consolidation calculators, and loan payment calculator options. Some of the most popular tools for calculating loan payments available from Bankrate are aimed at mortgages, but they also feature tools to calculate a loan payment on an auto loan.

For this ranking, we’re including the Bankrate Car Early Pay Off Calculator, which shows users the value of paying off a car loan earlier than the terms call for.

Key Factors That Led to Our Ranking of This as a Best Loan Payment Calculator

Below are features and benefits of this calculator that resulted in its ranking as a best payment calculator for a loan.

Features and Use

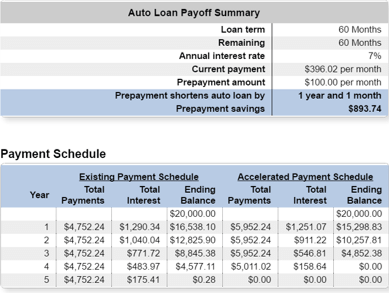

The goal of the Car Early Pay Off Calculator is to show users how much money they can save in interest and how they can shorten the term of their loan if they pay more.

The input for this repayment calculator includes the number of months remaining on the loan, the loan term in months, the amount of the loan, the annual interest rate, current payment, and the additional monthly payment the user is willing to make.

A report is then created based on annual or monthly amortization. The report shows total savings based on various additional monthly payment amounts, and a line graph is also shown.

Users of this advanced loan payment calculator have the ability to create an advanced report that shows an auto loan payoff summary highlighting how the input prepayment shortens the auto loan and the amount of money saved on interest because of a prepayment.

The generated report also includes an existing payment schedule including total payments, total interest, and ending balance over the years of the loan term, as well as an accelerated payment schedule.

Image Source: Early Payoff Calculator

Benefits

First and foremost, this loan payment calculator is beneficial because it shows the financial value of paying off an auto loan early.

Many consumers don’t realize how significant the different in overall cost can be when they make additional payments on an auto loan, particularly since auto loans tend to have relatively high-interest rates.

Other benefits of this tool for calculating loan payments include:

- Simple Explanation: When you use this repayment loan calculator, you get a simple written report that shows how much you’ll shorten your loan repayment terms but also how much you’ll save in interest. This easy, straightforward breakdown is simple to understand.

- Advanced Reporting: If you want something beyond the basics, you can also choose advanced reporting with this loan payments calculator. You can get an auto loan payoff summary and a line graph that shows how much interest you pay with prepayments, the scheduled interest paid, your balance with prepayments each month, and the planned principal balance.

- Terminology Definitions: Since Bankrate is a leading financial education resource, this loan payment calculator also includes an in-depth glossary of terms related to auto loans and specifically to using this loan repayment calculator.

Who It’s Good for

This repayment calculator from Bankrate is versatile and well-suited to the needs of most consumers who want to see how making additional payments could save them money and shorten the time it will take them to pay off their loan.

It’s also great if you want a full amortization payment schedule, including a comparison of what your payment schedule will look like under your current payments, as well as how additional payments will change that schedule.

Bankrate Personal Debt Consolidation Calculator Review

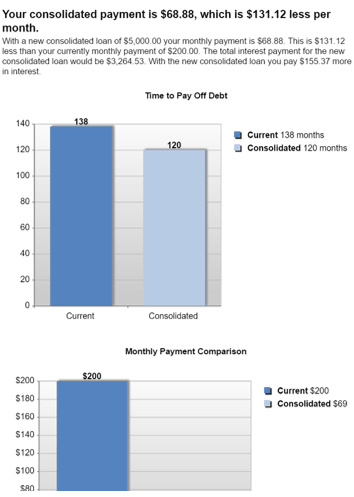

As mentioned in the introduction to this ranking of the best loan repayment calculator options, many consumers weigh whether or not it would be beneficial to them to consolidate their loans. The Personal Debt Consolidation Calculator from Bankrate helps users decide whether or not consolidating their personal debt would be financially worthwhile.

This loan consolidation calculator can be used to look at debt from installment loans like auto loans as well as credit card debt, and like the other repayment calculator tools from Bankrate, the reporting is highly detailed.

Key Factors That Led to Our Ranking of This as a Best Loan Repayment Calculator

The Bankrate Personal Debt Consolidation Calculator is included on this list of the best loan consolidation calculators for reasons listed below.

Features and Use

This loan consolidation calculator is designed to show users whether or not they should consolidate personal debt. It includes the ability to input the following:

- Credit card debt

- Auto loan debt

- Other loans and installment debt

You can add up to 10 credit card debt balances with information including not just the balance but also the interest rate and the payment you’re making. There are input options to add up to three different auto loans, and in the other loan category, users can add a personal loan, a real estate loan, and up to four loans of any other type.

Users of this loan consolidation calculator then receive information on what their consolidated loan would look like at a given interest rate and term. They can see how much their monthly payments are currently, and what they would be with consolidation.

Benefits

Loan consolidation isn’t for everyone; it’s not always going to be beneficial for all consumers, and that’s the primary reason this loan consolidation calculator is useful. This loan consolidation calculator lets you easily see the true impact consolidation would have on your monthly payments.

Other benefits of this loan consolidation calculator include:

- This loan consolidation calculator is great since you can add so many different types of debt and receive results. Many loan consolidation calculators only offer options for one type of loan or debt, such as student loans only.

- As with other Bankrate financial calculators and tools, this consolidation loan calculator features excellent reporting. When you use this consolidation loan calculator, you receive not only written explanations of the impact consolidation would have for you, but also graphs. The first graph included with the reporting of this loan consolidation calculator includes the time difference to pay off debt currently and with consolidation. Then, with this loan consolidation calculator, you see a graph of your monthly payment comparison.

- Also excellent about this consolidation loan calculator that makes it one of the best available loan consolidation calculators is the table that’s created in the results report, showing how much you pay in interest and principal with each payment you make, as well as the difference in your balance with each payment.

Image Source: Bankrate

Who It’s Good for

First and foremost, this loan consolidation calculator is ideal for anyone with multiple sources of debt, as well as several different types of debt. It can be difficult to find loan consolidation calculators that let you account for as many types of debt as this option features.

This consolidation loan calculator is also useful if you’re weighing the pros and cons of consolidation and you want a detailed breakdown of why it may or may not be the right option for you.

Popular Article: Finding the Best Home Loan Calculators | Top Home Mortgage & Home Equity Calculators

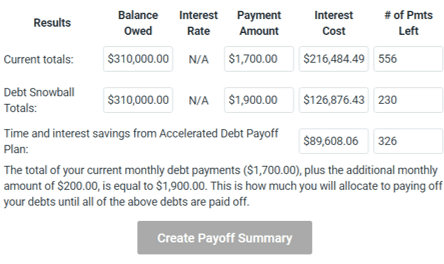

Debt Snowball Calculator from Financial Mentor Review

Financial Mentor is an online resource designed to help people find the tools and resources they need to invest and build wealth. Part of the tools offered on Financial Mentor are a range of financial calculators, including loan consolidation calculators and loan repayment calculator options. One of the best tools to calculate a payment on a loan is the Debt Snowball Calculator.

This loan payments calculator provides calculations based on a unique accelerated loan repayment structure. This tool not only makes it simple to calculate loan repayments; it also has other definitions and educational resources included with it, plus in-depth instructions.

Key Factors That Led to Our Ranking of This as a Best Loan Payment Calculator

The following details highlight why the Debt Snowball Calculator is ranked as a best repayment loan calculator.

Features and Use

This payment calculator for loan repayment focuses on the debt snowball repayment method. What this means is that you put any extra funds toward paying off your smallest debt first, making minimum payments on the rest; then, when that is paid off, you use the amount freed up from that payment to pay down your next debt. You continue the process until all the debts are paid off, which is like building a snowball. Many financial experts think this is the best and most cost-effective way to pay off debt.

With this loan payments calculator, users order their debts based on the ones with the highest interest rates, going down to the lowest interest rates.

Then, the calculator pays them off in the order they’re entered, and debts can also be ordered from smallest to highest balance.

Inputs needed with this payment calculator for loan repayment include the name of the debt, the current balance, and a monthly dollar amount that could be added to speed up payoff.

Benefits

The primary advantage of this payment calculator for loan repayment is the fact that it focuses not just on showing you payments or terms of a loan given specific inputs, but that it creates a particular plan for debt repayment.

It gives you an easy way to organize and visualize your debt and then start paying it off using the very popular snowball method.

This loan payments calculator shows you the total balance you owe on all of your debt, your total monthly payments, and the total interest you will pay over the lifespan of your debt under your current payment plan.

You can then compare that to what you would pay following the debt snowball plan, and it shows the reduction in total interest you will pay and the reduced number of payments you will be responsible for. It’s an excellent tool for highlighting the impact of taking the snowball repayment route.

The results also include an accelerated debt payoff plan payment schedule

Image Source: Financial Mentor

Who It’s Good for

This tool to calculate a loan payment plan is good for someone with multiple sources of debt who wants to find a more manageable, streamlined way to pay them off.

Since this loan repayment calculator isn’t focused on a particular type of debt, and you can include multiple sources of debt, it’s highly flexible and versatile.

Read More: Top Credit Unions Credit Cards | Ranking | Best CU Secured & Unsecured Credit Card Offers

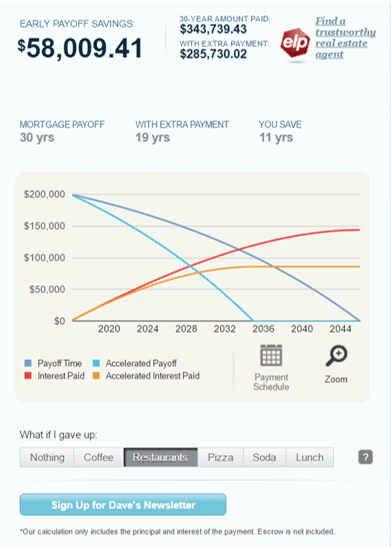

Mortgage Calculator from Dave Ramsey Review

Dave Ramsey is one of the most well-known financial advisors, having gained worldwide notoriety for providing education and resources for people to get out of debt and experience more financial freedom. All of the tools offered by Dave Ramsey are designed based on common-sense and empowerment, and the Mortgage Calculator is one of many excellent loan payment calculator tools available on Dave Ramsey’s website.

The Mortgage Calculator is a loan payment calculator focused on helping users understand multiple aspects of their mortgage as well as what can happen with the introduction of accelerated payments.

Key Factors That Led to Our Ranking of This as a Top Loan Repayment Calculator

Listed below are features and benefits of the Dave Ramsey Mortgage Calculator that led to its inclusion on this list of the best repayment loan calculator options.

Features and Uses

With this handy repayment calculator, users enter some basic information to calculate loan repayments.

To begin, the input includes the original amount of your home loan, the number of years of the loan term, and the annual interest rate; then, there’s an option to include the amount of extra money you want to put toward the loan each month.

The results include a total amount of the extra money you would save by paying the loan off early, as well as a comparison of what you would pay if you made regular payments on the 30-year loan, versus what you would pay following an early payoff plan.

The results of this repayment calculator are shown in written form, and there is also a line graph that shows payoff time, interested paid, accelerated payoff, and accelerated interest paid.

Image Source: Dave Ramsey

Benefits

Many consumers don’t realize just how much money they can save over the life of a mortgage loan simply by accelerating their monthly payments even a small amount. That’s the big benefit of this repayment calculator.

Other benefits of this payment calculator for loan repayment include:

- The line graph portion of the results reports gives users a visual representation of their results so they can see the effects of payment acceleration.

- This unique tool for calculating loan payments also features the option to see how much more you could save on your mortgage payments by giving up certain things. Categories include coffee, restaurants, pizza, soda, and takeout lunch. The results totals will show users just how much those small, incremental changes can speed-up their mortgage payoff.

- This loan repayment calculator also includes a repayment schedule outlined for the entirety of your mortgage. This repayment plan shows your monthly payment for every month until your mortgage is paid off, your interest, your principal, and your balance.

Who It’s Good for

There are a few different consumer groups this repayment loan calculator might be most useful for. The first group is people who have an existing mortgage. This is an illustrative tool to calculate a payment on a loan, but also to see how adding a little more to your payment each month can change your financial situation.

The other group of consumers who might benefit from this loan payments calculator are those people who are contemplating a mortgage and want to experiment with different figures to see what their payments could look like.

It’s a great planning tool that lets users look well into the future before they take out a mortgage loan. It leaves no questions regarding what you will pay each month on your mortgage, which can give potential borrowers peace of mind.

Free Wealth & Finance Software - Get Yours Now ►

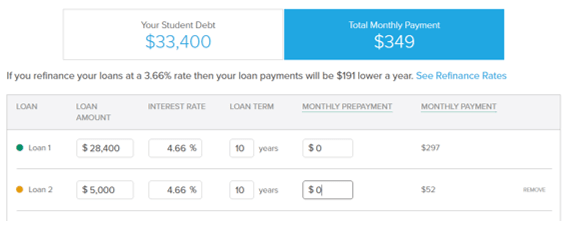

Student Loan Calculator from Smart Asset Review

Student loans are one of the most common and largest sources of debt for many people today, so it was important to include a loan repayment calculator on this ranking of the best tools for calculating loan payments that addressed this particular area of debt. Smart Asset features an excellent option, simply called the Student Loan Calculator.

In general, Smart Asset is an online resource featuring fast answers to any and all financial questions, and personal, interactive tools and many calculators there are designed to help users make the best possible money decisions.

Key Factors That Led to Our Ranking of This as a Best Loan Payment Calculator

When comparing tools used to calculate a loan payment, this loan payments calculator excelled for the reasons listed below.

Features and Uses

This repayment loan calculator is designed to help users understand how much they will be paying each month toward their student loans and understand the amortization schedule of their student loans.

This payment calculator for loans first considers the monthly payment for each individual student loan. Each individual loan includes input fields for the loan amount, interest rate, loan term, and prepayment.

Then, this repayment calculator adds the monthly payment for each of the loans to provide a total payment each month.

The amortization is calculated by taking away the amount being paid toward the principal each month from the loan balances.

Benefits

Student loans can be complicated to understand, and many students graduate without a clear idea of what they owe, how long it will take for them to pay it off, or even where to begin with a repayment schedule.

This repayment calculator helps them quickly and easily tackle all of these issues and have a centralized way to see what they owe, and how much they will pay monthly and over time.

Other benefits of this payment calculator for loan repayments include:

- The calculator shows total monthly payments as well as the total lifetime costs of your student loans

- It features a graph showing loan balance over time and how it goes down through the term of the loan

- You can add multiple student loans in varying totals, and the results charts and number totals will reflect all of the loans together, as well as a comparative breakdown of each loan

- There are options to incorporate potential prepayments into the calculations

Another benefit of this repayment calculator is the ability to see the potential for refinancing your loans and how that would impact loan payments.

Image Source: Smart Asset

Who It’s Good for

This repayment loan calculator is useful for anyone with student loans, whether they’re new loans and they’ve recently graduated, or they’re loans they’ve held for many years.

It’s an excellent loan repayment calculator for people who want to see how accelerating their payments could impact the rate at which they repay student loans, and for consumers interested in exploring refinancing options for their student loans.

Conclusion—Top 6 Best Loan Repayment Calculator Tools

The goal of the above ranking of the best loan payment calculator tools was to show consumers a wide variety of equally valuable repayment calculator options that can help them achieve different financial objectives.

To sum up, here is a cheat sheet on the tools to calculate a payment on a loan featured in this ranking:

- The Auto Loans Calculator and Comparison Tool is a way to calculate loan repayments on auto loans and to compare different loan offers.

- With the Bankrate Car Early Payoff Calculator, users can input information into this repayment loan calculator that will let them see how paying off their car loan early could cut the total amount they pay on the loan.

- The Bankrate Personal Debt Consolidation Calculator is one of the best loan consolidation calculators available. This consolidation loan calculator lets users combine multiple sources of debt in one calculator and see the effects of consolidation.

- The Debt Snowball Calculator is a tool for calculating loan payments based on the popular and efficient snowball repayment method.

- Mortgage Calculator from Dave Ramsey provides a way to calculate a loan payment on a mortgage and see how many budgetary changes and accelerating payments can affect the total cost of a home loan.

- The Student Loan Calculator from Smart Asset is a tool for calculating loan payments across several student loans.

Each of the above loan payments calculator options has a specific personal finance objective, and each is also valuable and useful in its own right to consumers.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.