2017 RANKING & REVIEWS

BEST MORTGAGE LENDERS FOR FIRST TIME BUYERS

Intro: 1st Time Home Buyer Loan Guide & Ranking of The Best Mortgage Lenders for First-Time Buyers

Regardless of where you might be in your life or your career, the decision to buy your first home is undoubtedly one of the most significant and exciting decisions you will make in your lifetime.

Before you can start shopping with your real estate agent and looking for that perfect property, whether it’s a starter house or your forever home, it’s essential that you research home loans for first-time buyers.

Not every bank or lender is going to offer ideal 1st-time home buyer loans or 1st-time home buyer programs.

This is why it’s important to do your research to find those mortgages for first-time buyers that offer advantages and favorable terms, specific to your situation.

Award Emblem: Top 6 Best First Time Home Buyer Mortgage Lenders

It’s also important to understand that when you’re searching for a first-time home buyer loan, it’s an intensive, in-depth process, and it can require that you gather a lot of paperwork and financial documentation.

Because of the lengthy and complicated nature of obtaining a first-time home buyers loan, not only do you need to shop for a lender that’s going to offer a strong product well-suited to your needs, but also a company with a reputation for excellent customer service, transparency, and ethical lending practices.

The following ranking and review of the best mortgage lenders for first-time buyers is designed to provide not just the names of the best mortgage lenders, but also to highlight what to look for in loans for first-time home buyers.

AdvisoryHQ’s List of the Top 6 Best Mortgage Lenders for First-Time Buyers

List is sorted alphabetically (click any of the lender names below to go directly to the detailed review section for that mortgage lender):

Top 6 Best Mortgage Lenders for First-Time Buyers | Brief Comparison & Ranking

Best Mortgage Lenders | Highlighted Features |

| AmeriSave | Consistently high customer satisfaction ratings |

| Bank of America | Affordable loan solutions for first-time house buyers |

| CitiGroup | Low down-payment options & affordable rates for low-income borrowers |

| loanDepot | “No Steering Policy” to alleviate pressure on borrowers |

| Sebonic Financial | Efficient & streamlined online mortgage resources |

| Wells Fargo Mortgage | Specific loans for home renovations & new construction |

Table: Top 6 Best Mortgage Lenders for First-Time Buyers | Above list is sorted alphabetically

What Are the Financial Benefits of Owning a Home?

If you’re considering looking for a first-time home buyer mortgage, but you’re nervous or cautious about taking on that level of responsibility, it is important to realize home ownership comes with many financial benefits.

While obtaining a first-time home buyer loan can be an intimidating process, purchasing a home is still an excellent investment in most instances.

Some of the financial benefits of homeownership include:

Home Equity

If you continue renting as opposed to exploring home loans for first-time buyers, you’re paying a significant amount of money each month with nothing to show for it.

On the other hand, if you do find a first-time buyer mortgage that works for your personal situation, the money you pay toward that loan becomes equity in your home.

This is one of the best long-term investments you can make in most cases.

Image Source: Best Mortgage Lenders for First-Time Buyers

Real Estate Value

Real estate value often goes up as well, which might not necessarily be the case with many other investments. This applies in particular if you buy in a high-value market.

While real estate may go through occasional declines, it almost always rebounds and ends up being worth more than what you paid for it.

1st-time home buyer programs can be great ways to add real estate value as an asset within your overall finances.

Tax Breaks

Taxes are an inevitable part of life, but there are tax breaks for homeowners.

For example, after you get that first-time home buyer mortgage, the interest you’re paying is deductible from your income tax.

Also, when you sell a home, if the value increases by less than a certain amount, you may not have to pay capital gains taxes when you sell it.

These are just a few of the financial reasons it can be smart to start exploring your options in terms of home loans for first-time buyers.

Tips for First-Time Home Buyers

When you start your search for the ideal loans for first-time home buyers, it’s important that you’re prepared and understand what you’re looking for, as well as know how to get the best terms.

The first thing you can do before starting to identify the best mortgage lenders for first-time buyers is to clean up your credit.

Before you ever step into a lender’s office or apply online for pre-qualification, pull your own credit report. Look for any possible errors, and then try to correct anything that could be a red flag to a lender.

This is the best way to get the best possible deal on home loans for first-time buyers.

Along with looking at your credit report, take an objective look at your assets versus your liabilities.

This ratio is what lenders use to determine whether or not you’re creditworthy, so it’s best to go into your search for a first-time home buyers loan without any surprises.

Make sure all of your payments are up-to-date, and that you’re in a strong position to buy a home.

If you have high-interest debts, consider consolidating them before you start looking for 1st-time home buyer loans.

The next thing to understand is what type of loan will be best for you. If you’re planning to use your first-time home buyer loan to purchase a starter home where you’ll only live for a few years, a fixed-rate, 30-year mortgage doesn’t make much sense.

On the other hand, you may potentially qualify for some government-sponsored home loan programs, so check on these as well.

Government-backed mortgages for first-time buyers tend to have more flexible lending requirements, and may allow you to pay a significantly lower down payment than you would with a conventional option.

Big Mistakes First-Time Home Buyers Make

Now can be a very good time to obtain loans for first-time buyers because of the low interest rates and lending requirements that are loosening slightly.

Still, it’s important that new buyers are aware of potential pitfalls that could create a negative buying experience for them.

The first mistake is opting to buy when you’re not ready, or when you’re planning on moving within a few years.

If you even think that moving could be a possibility in the next two to four years, it might be best to wait on buying a home. Homeownership is a good long-term investment, but depending on your situation, may not be ideal in the short-term.

The next issue is that first-time buyers may not realize that the market is competitive, and that can be especially true for lower-priced homes. It’s important for first-time buyers to save as much as they reasonably can for a down payment and have a pre-approval letter before they start shopping for homes.

Finally, if you’re planning on obtaining a first-time home buyer loan in the immediate future, you should probably put off the other large purchases, including a new car.

Your asset-to-debt ratio is one of the primary determining factors in whether or not you’ll get that first-time home buyer mortgage, so if you make a big purchase before trying to buy a home, it can derail your plans.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best Mortgage Lenders for First-Time Buyers

Below, please find a detailed review of each lender on our list of best mortgage lenders for first-time buyers. We have highlighted some of the factors that allowed these best mortgage lenders to score so high in our selection ranking.

See Also: Best VA Loan Lenders | Ranking | Best VA-Approved Mortgage Lenders for VA Loans

AmeriSave Review

A retail mortgage lender working with consumers in 49 states as well as Washington D.C., AmeriSave offers a range of mortgage products, many of which are excellent options for first-time house buyers.

Some of the products available to borrowers include VA loans, fixed and ARM mortgages, non-conforming loans, and FHA loans.

AmeriSave is an excellent resource for obtaining a first-time home buyer mortgage because they do each step of the lending process in-house, including processing, underwriting, closing, and funding.

Key Factors That Enabled This to Rank as One of 2017’s Best Mortgage Lenders for First-Time Buyers

Factors leading to the inclusion of AmeriSave on this list of the best lenders for first-time buyer mortgage products are detailed below.

Convenient Process

For many first-time house buyers, one of the most important considerations when working to obtain a first-time home buyer loan is how streamlined and efficient the lending process is.

AmeriSave excels at not just offering excellent options for 1st-time home buyer loans, but also for having a very fast, easy process.

Buyers can use the AmeriSave website to search the rates and products and determine what’s best for them. They can then submit an online application.

At that point, they can download their loan documents, sign them, and mail them to AmeriSave Mortgage Corporation, who then processes and underwrites the loan. The loan is reviewed and subject to a sales contract, appraisal, and title review.

If all initial criteria are met, then the borrower receives a Pre-Approval Certificate so they can begin shopping for a home.

AmeriSave Advantage

One of the exclusive offerings available from this provider of loans for first-time home buyers is called AmeriSave Advantage. This free program is available to both buyers and sellers.

With AmeriSave Advantage, borrowers have access to a network of highly experienced real estate agents.

They also work with a trusted adviser for guidance throughout the process, which can be particularly helpful for first-time house buyers.

Finally, AmeriSave offers a rewards program, which provides anywhere from $250 to $4,500, given to the borrower at the end of a transaction.

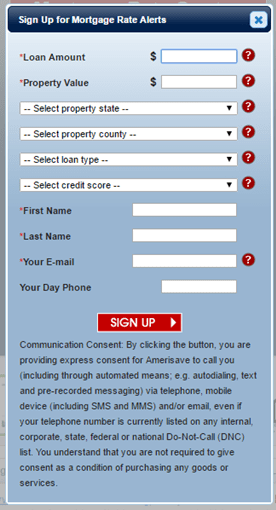

Mortgage Rate Alerts

If you’re in the process of searching for a first-time home buyer loan with the most favorable terms, AmeriSave offers a unique tool.

This rate alert tool is available on the AmeriSave website, and users can enter the loan amount they hope to obtain, the property value of what they want to buy and the property location, type of loan, and their credit score.

Borrowers then enter their contact information, and AmeriSave will monitor interest rates on applicable first-time home buyer mortgage products for that individual.

The borrower will receive customized alerts if the mortgage they’re considering goes down in price because of lower interest rates.

Photo courtesy of: AmeriSave

Customer Satisfaction

Many first-time house buyers may not realize how essential excellent customer service is when searching for mortgages for first-time buyers.

Customer service should actually be a high consideration because when you’re working to secure a first-time home buyer mortgage, it’s important that you’re working with people who are accessible, readily available to answer questions, and who can provide the necessary guidance you might require.

According to reviews on LendingTree, 98% of customers would recommend AmeriSave as a lender. They also ranked on the highest 10 list for customer satisfaction for Q1, Q2, and Q4 of 2016.

On Zillow, AmeriSave also has a nearly perfect customer rating.

Don’t Miss: Top Mortgage Lenders and Companies | Ranking Comparison | Best Mortgage Companies

Bank of America Review

Based in Charlotte, NC, Bank of America has a long history serving the needs of consumers in the United States.

This full-service financial institution is not just an excellent option to obtain a first-time buyer mortgage, but they also provide a range of other products and services for individuals and businesses.

Bank of America offers government-backed loans, as well as specific products for first time home buyers. This also includes buyers who may be low- to moderate-income, or want to pay a lower down payment than the standard 20%.

Key Factors That Led Us to Rank This as One of 2017’s Best Mortgage Lenders for First-Time Buyers

When ranking home loans for first-time buyers and the best mortgage lenders for first-time buyers, below are some reasons Bank of America is a leader.

Preferred Rewards

If you’re already a Bank of America customer and searching for the best first-time home buyers loan products, you may be eligible for the Preferred Rewards program. This program is designed to offer loyalty rewards for customers because of their Bank of America and Merrill Lynch investment accounts.

The Preferred Rewards program includes three tiers. The tier you qualify for is based on 3-month average combined balances in your banking and/or Merrill Lynch investment accounts.

If you are eligible and enroll in the program, you may get not only benefits like credit card bonuses and no-fee banking, but you can also save on your mortgage origination fee with a Bank of America loan.

Adjustable-Rate Mortgages

Often what’s ideal in terms of a first-time home buyer loan is an adjustable-rate option.

This is because many first-time house buyers are only planning on staying in their starter home for a few years, and an adjustable-rate mortgage typically offers fixed interest rates for a period of a few years.

This means during the introductory interest rate period the interest rate is typically lower, so during this time, the borrower’s monthly payments will be lower.

Bank of America offers competitive adjustable-rate first-time home buyer mortgage options.

Home Loan Navigator

One of the best aspects of working with Bank of America to find home loans for first-time buyers is their Home Loan Navigator.

This advanced online platform is perfect for first-time house buyers because it’s a convenient way to always know what’s going on with the application and lending process.

Many times, first-time buyers can feel like they’re in the dark when it comes to their loan’s progress and what’s expected of them.

This is completely eliminated with the Home Loan Navigator. This first time home buyer loan tool is something borrowers use along with the guidance of their loan specialist throughout the process for obtaining a first-time buyer mortgage.

Users can log on to not just see the status of their application, but there’s also a to-do list feature. The to-do list lets borrowers see what they need to do to keep their loan application moving along quickly.

The Navigator can also be used to sign and manage documents securely and quickly.

Affordable Loan Solution

Many of the names on this list of the best mortgage lenders for first-time buyers will offer signature loan products that are aimed at the needs of first-time buyers.

At Bank of America, an excellent first-time home buyer mortgage product is the Affordable Loan Solution Mortgage.

This is designed to help buyers who want to make a purchase, but also need a lower down payment. The down payment with this loan may be as little as 3%, making buying a home more affordable for many.

The Affordable Loan Solution Mortgage also features competitive interest rates, no mortgage insurance requirement, and it can be ideal for qualified borrowers seeking 1st-time home buyer loans.

Related: Best VA Home Loan Lenders | Ranking | Best VA-Approved Lenders (Reviews)

CitiGroup Review

CitiGroup leads the way in the financial industry as one of the most recognizable banks in the world.

As a whole, Citi serves more than 200 million customers in 160 countries, through their extensive range of consumer, business and institutional products and services. Citi bases its services on the idea of progress and innovation, strong leadership and responsible finance.

In terms of being one of the best mortgage lenders for first-time buyers, Citi offers an extensive portfolio of loan products.

It also provides excellent homeowner support, all important reasons it’s included on this list of the best sources for mortgages for first-time buyers.

Key Factors That Enabled This to Rank as One of the Best Mortgage Lenders for First-Time Buyers

Based on considerations important to consumers when searching for mortgages for first-time buyers, the below list represents some key reasons Citi was included in this ranking.

Government Loan Options

When searching for the best first-time home buyers loan products, many consumers will opt for a government-backed loan, perhaps because they meet certain qualifications or are looking for something for low- to moderate-income buyers.

Citi offers two of the most common government-sponsored loan products, which are the FHA Loan and the VA Loan.

With the FHA Loan, the Federal Housing Administration backs the loan, and there are fewer restrictions in terms of down payments and qualifying credit scores, as compared to traditional loans.

VA Loans are designed for veterans of the U.S. Armed Forces, or surviving spouses of servicemembers.

They are guaranteed by the Department of Veterans Affairs, and benefits include lower down payment requirements and lower interest rates. VA loans also feature lower closing costs and fees, in contrast to conventional loans.

Free Evaluations

Citi is unique from many of the other names on this list of the best places to obtain home loans for first-time buyers because they have thousands of branch locations throughout the country, which makes them ideal for buyers who want face-to-face interactions with a loan officer.

At the same time, they offer convenient online tools, one of which is a free mortgage evaluation.

Consumers can complete a brief form online, and it includes information about their home buying goals. After that, they’ll receive a free mortgage evaluation from a Citi representative.

This is an excellent tool during the search for home loans for first-time buyers because there is no obligation, and it can give you a good idea of what you can afford and what you should be looking for.

OWN

Opportunities Within Neighborhoods (OWN) is a signature program offered by CitiMortgage that may be appealing if you’re looking for 1st-time home buyer loans.

This program was designed to offer not only low down payment options for borrowers but also flexible credit requirements for low- and moderate-income borrowers, who are buying a home in low- and moderate-income areas.

This mortgage program is geared toward borrowers who earn 80% or less than the Area Median Income and are planning to buy in a particular area.

The interest rates are comparable to conventional loans, down payments are as low as 3%, and the credit guidelines are flexible. It also features the stability of a fixed-rate loan, making it a great lending option for a first-time home buyer.

Citigold

Citigold is a preferred customer program that rewards loyalty. As customers grow their accounts and deposits with Citi, they gain special benefits through this program.

Some of these advantages include bonus reward offers on credit cards, ThankYou points on checking accounts, and waived monthly service fees.

Also if you’re looking for a better deal on loans for first-time home buyers, and you’re a Citigold member, you can receive benefits on your mortgage.

The main advantage is a tiered interest rate on a mortgage, and you get benefits applied toward your closing costs.

Popular Article: Best Mortgage Loan Originators | Ranking | Top Loan Origination Companies

loanDepot Review

Many consumers searching for the ideal first-time home buyer loan are millennials, and loanDepot tends to offer a non-bank lending model they appreciate.

Founded in 2010, this e-commerce style lender features a unique marketplace approach to 1st-time home buyer loans.

loanDepot was built on the concept of fair and ethical lending practices, which is something else that’s widely appealing, including to younger home buyers and those consumers looking for the best first-time buyer mortgage options.

In addition to their online marketplace, they also feature over 180 loan stores and employ more than 1,700 licensed loan officers.

Key Factors That Allowed This to Rank as One of 2017’s Best Mortgage Lenders for First-Time Buyers

Key reasons loanDepot is included in this ranking of the best mortgage lenders for first-time buyers and one of the best places for a first-time home buyer loan are detailed below.

Loan Options

When you initially begin your search for the best loans for first-time home buyers, you will quickly realize that not all loans are created equally, and what might be good for one consumer isn’t necessarily going to be ideal for another.

That fact underscores the importance of choosing a lender with a variety of loan products.

While loanDepot represents a unique model regarding obtaining loans for first-time home buyers, primarily because technology drives it, they still offer an extensive portfolio of products borrowers can choose from.

loanDepot features options for the traditional fixed-rate mortgage, which they say is their most popular option for refinancing or buying a home. Also popular are ARM Loans, designed to reduce the cost of a mortgage.

Other options from loanDepot include the government-backed VA and FHA loans, as well as Jumbo mortgage programs, which provide the opportunity to borrow a larger amount and buy a higher-priced property.

Instant Rates

If you’re a buyer primarily interested in convenience and an easy experience when you’re searching for a first-time home buyers’ loan, loanDepot is a great option. This online marketplace lets you shop for and customize your loan online.

Additionally, you can get on the loanDepot website and not only browse available mortgages, interest rates, and options, but you can also apply to receive an instant rate quote.

The instant rate quote tool requires only that you enter the type of home loan you want, the price range of homes you’ll be shopping for, and your credit score, and then within just a couple of minutes you’ll have a quote.

This can help in the process of getting a first-time buyer mortgage and figuring out where to start your search for the perfect home.

No Steering Policy

loanDepot is the only name on this ranking of the best mortgage lenders for first-time home buyers that has a unique policy they call the “No Steering Policy.”

This is a safeguard and a business practice that was put in place by loanDepot to ensure customers and people searching for first-time home buyer loans aren’t pressured into taking on a mortgage they can’t afford.

This No Steering Policy provides a concrete protection for loanDepot customers against unethical or predatory lending, as well as against trying to push a customer toward a loan for the lender’s own gain.

It’s a safeguard that many people searching for loans for first-time home buyers will find comforting.

Homeowner Support

Unfortunately, there are some occasions when consumers take out loans for first-time home buyers, and they find themselves facing a difficulty or hardship that makes it challenging to make their payments on time.

loanDepot is one of the best mortgage lenders for first-time buyers because they do outline ways this can be handled.

Some of their options they may offer borrowers include:

Repayment Plan

If a borrower is facing a temporary situation that’s led to past-due payments, they may be able to pay them back over an extended time period, while still making their regular payments as well.

Forbearance

Temporary but long-term situations may require forbearance, which includes the ability to make either reduced or no mortgage payments for a specific time period while your situation improves.

Loan Modification

Some loanDepot borrowers may be able to permanently modify their mortgage, creating a schedule and payment amount that is more manageable for them.

Other options may include a partial claim, short sale or a deed in lieu of foreclosure or mortgage release.

Read More: Best Refinance Companies to Refinance with | Ranking | Top Mortgage Refinance Lenders

Sebonic Financial Review

Sebonic Financial is part of Cardinal Financial Company, which is a mortgage bank with a history dating back to 1987. Sebonic strives to take a different and innovative approach to home loans and the lending process, based on innovation, rapid execution, and technology.

The core concepts that define the Sebonic Financial business are “reliable,” “real-time,” and “reinvented.”

This modernized concept of lending can be advantageous for those consumers that want a lender offering excellent home loans for first-time buyers, paired with convenience and a technologically driven platform.

Key Factors That Enabled Us to Rank This as One of 2017’s Best Mortgage Lenders for First-Time Buyers

Some of the factors that make Sebonic one of the best mortgage lenders for first-time buyers and a great option for first-time buyer mortgage products are listed below.

In-Depth Explanations

Regardless of whether you’re an experienced home buyer who’s ready to move on to something larger, or you’re just starting out and looking for the best loans for first-time home buyers, it can be incredibly important to feel like you really understand what your options are, what the terms and conditions are, and what the best loan is for you.

This is an area Sebonic excels in. A big part of their signature lending process is having loan consultants who take the time to help borrowers make the right decision when it comes to their loan.

When a Sebonic consultant is talking to a borrower about 1st-time home buyer loans, they won’t try to confuse them with jargon or technical language.

Instead, these best mortgage lenders will speak in a way that’s straightforward and will really provide borrowers with everything they need to know.

Customized Requirement List

There are so many ways Sebonic is unique and is ranked as one of the best mortgage lenders for first-time buyers, and a lot of their differences are based on technology and a seamless, automated, and fast process.

Typically, when you’re shopping for home loans for first-time buyers, and you start the application process, you’ll be asked to submit documents based on a standardized list given to every borrower.

At Sebonic, instead of having a vague list with documents that might not even be required for your unique situation, you receive a custom-tailored document list that explains what you, specifically, need.

Their first-time buyer program will help you make sure you everything is in line, which will in turn speed up the entire process.

Core Principles

Along with having a distinctive, largely automated application process, another way Sebonic differs from other providers of loans for first-time home buyers is their general approach to lending.

The core principles that set Sebonic apart in terms of providing not just the best first-time home buyers loan options, but also excellent service include:

Quality

The loan experience is the product at Sebonic, so to make this smooth, there’s a focus on accuracy.

Respect

Sebonic strives to treat the customer with the utmost respect in all areas, from respecting their time to their privacy. Technology, processes, and people at Sebonic all come together to ensure this happens.

Efficiency

Sebonic includes collaboration with the borrower on their loan and automated processing also helps move the loan process along much more quickly as compared with other providers of mortgages for first-time buyers.

Low Cost

The unique Sebonic approach lets the provider lower closing costs, payments, and overall costs for the entirety of the life of a loan.

Simplicity

Rather than sticking with the concept that getting a home loan is complicated, Sebonic strives to make it simple by keeping borrowers up-to-date with what’s happening and explaining each step.

Flexibility

When you’re searching for the best lender to obtain a first-time home buyer loan, flexibility can be critical. You may change your mind after applying, or realize you could have done things differently, and at Sebonic, that isn’t a problem.

In fact, this is one of the biggest points of praise consumers have for the company on review sites like LendingTree.com, where Sebonic has a 4.7 out of 5 rating.

Borrowers can work on different loan terms or options even after they’ve applied, and if the applicant does decide they’d like something else, it won’t derail their entire loan process, since flexibility is welcomed at this pick for one of the best mortgage lenders for first-time buyers.

Related: Best Subprime Mortgage Lenders | Review | Finding the Best Bad Credit Mortgage Lenders

Free Wealth & Finance Software - Get Yours Now ►

Wells Fargo Review

With a long history in the United States spanning back to the mid-1800s, Wells Fargo is one of the oldest names on this ranking of the best mortgage lenders for first-time buyers and the best places to go for a first-time home buyer mortgage.

Wells Fargo is not just a lender providing loans for first-time home buyers, but they are also a stable full-service financial provider, offering banking and deposit accounts, investments, and business banking.

Some of the Wells Fargo mortgage products include government-backed loans, as well as options for small down payments, and even loans designed specifically for buying fixer-upper properties.

Key Factors That Enabled Us to Rank This as One of 2017’s Best Mortgage Lenders for First-Time Buyers

When reviewing the best options for borrowers looking for a first-time home buyers’ loan, below are some reasons Wells Fargo was included in this ranking.

yourFirst Mortgage℠

Wells Fargo is a unique name on this list of the best mortgage lenders for first-time buyers because they have a specifically designated first-time buyer mortgage called yourFirst Mortgage℠.

yourFirst Mortgage℠ is a home loan that requires as little as a 3% down payment. It features a low down payment and low out-of-pocket costs, making it a great option for a first-time home buyer mortgage—and the down payment can also come from gift funds.

Other reasons the yourFirst Mortgage℠ can be ideal as a first-time buyer mortgage is because qualification can come from rental income or from having someone who lives with you but isn’t a borrower.

Credit history can also come from sources including rent, tuition, and utility payments, and there are no area median income requirements.

Renovation Loans

If you’re like many first-time house buyers, you may want to explore mortgages for first-time buyers that offer the opportunity to purchase a property that needs work or improvements.

This can often be difficult, but Wells Fargo offers a mortgage specifically for those fixer-upper properties. This loan is called the Purchase & Renovate℠ loan.

The program lets the borrower finance the cost of renovations and improvements, so the amount of the loan is based on the home value post-improvements.

Since the cost is spread throughout the entire loan term, the monthly payment is likely going to be lower than it would be using other methods of financing renovations, and this opens up the field of homes a borrower can look at.

This is also an excellent first-time buyer mortgage because it speeds up the time it takes to get improvements done since work can start immediately after closing.

New Construction Loans

Another option available to borrowers at Wells Fargo seeking mortgages for first-time buyers is a new construction loan. Not every lender is going to offer this loan option, and it can be valuable for borrowers that want to have this available to them.

Wells Fargo offers the Builder Best® Extended Rate Lock program that protects borrowers with new construction loans from changes in interest rates. It locks interest rates and safeguards borrowers while their home is being built.

The advantages of choosing this option as a first-time home buyer loan are that the borrower can fully customize their home, and there could be incentives offered from the builder, such as paying the closing costs.

Online Loan Tracker

When you’re in the process of obtaining a first-time home buyer loan, one of the most important things is feeling like you’re kept in the loop and that you’re ahead of what’s happening in the process, as well as what’s needed and expected from you.

Wells Fargo is one of the best mortgage lenders for first-time buyers because they offer an online platform to help applicants manage their loan throughout the process.

Called yourLoanTracker℠, this tool is accessible from a computer or mobile device, and it delivers progress reports on your loan as they happen, and you’ll also receive alerts when a milestone is achieved.

YourLoanTracker includes a to-do list that clearly outlines everyone’s next steps, and documents and disclosures can be uploaded, reviewed, and signed online.

Conclusion— The Best Mortgage Lenders for First-Time Home Buyers

Unfortunately, there are many situations where first-time house buyers discover the experience isn’t what they expected or what they wanted it to be.

This is often because they chose the wrong loan, felt blindsided by unclear terms or conditions, or they didn’t feel like they had guidance during the process of obtaining a first-time buyer mortgage.

It’s for those reasons that it’s so essential to choose only the best mortgage lenders for first-time buyers.

A good lender who has experience with 1st-time home buyer loans and 1st-time home buyer programs is going to understand how important it is to match the borrower with the right product and make sure they’re clear on even the smallest details from the start.

Each of the names on this list of the best mortgage lenders for first-time buyers and the best places to obtain a first-time home buyers loan excels in these areas, combining expertise with high levels of customer satisfaction and ethical lending practices.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.