2017 RANKING & REVIEWS

TOP RANKING BEST VA HOME LOAN LENDERS

Finding the Best VA Home Loan Lenders

Qualifying for a veteran home loan is one of the best loan options available for first-time home buyers or refinancers.

A veteran home loan offers a multitude of helpful benefits that can make the home buying process easier, such as no down payment.

When it comes down to choosing VA home loan lenders, it is important to always go with VA-approved lenders.

Award Emblem: Best VA Home Loan Lenders

The best VA home loan lenders are those that are VA-approved lenders, as they are better equipped with information on all of the benefits associated with a VA home loan.

Since there are an endless number of home loans for veterans available, it can become a difficult process figuring out which ones are VA-approved lenders.

The best VA home loan lenders will often mention their approval initially and present you with an outline of all of the ways they can help you better process your veteran home loan.

To help you better invest your time elsewhere, we’ve compiled this detailed review on the best VA home loan lenders that are VA-approved lenders.

See Also: Top Retail Credit Cards | Ranking | Best Retail Store Credit Cards for Bad Credit & Good Credit

The Importance of Choosing VA-Approved Lenders

There are many benefits with a veteran home loan.

Some of these veteran home loan benefits include:

- No down payment

- No monthly mortgage insurance premiums

- Lenient qualifications

- Lower interest rates

Deciding to go with VA home loan lenders that are approved will help you to better find out your veterans home loan eligibility along with better information on benefits.

The best VA home loan lenders can help you obtain a certificate of eligibility, calculate your entitlements, and decide on the right VA home loan option for your financial situation, along with applying for fee waivers.

No two VA home loan lenders are alike, so it is important to compare between the best VA mortgage lenders when getting a VA home loan.

AdvisoryHQ’s List of Top 6 Best VA Home Loan Lenders

List is sorted alphabetically (click any of the home loan lenders below to go directly to the detailed review section for that lender):

Top 6 Best VA Home Loan Lenders | Brief Comparison

VA Home Loan Lenders | Credit Score Requirement |

Citibank® | 620 or higher |

Direct VA Loans | 620 or higher |

NASB | 620 or higher |

Quicken Loans® | 620 or higher |

VA Loans | 620 or higher |

Veterans United® | 620 or higher |

Table: Top 6 Best VA Home Loan Lenders| Above list is sorted alphabetically

FAQ Section

- What are the VA home loan qualifications?

A veteran’s home loan eligibility depends on a few factors. VA home loan qualifications include your service time, income, credit score, previous bankruptcies, and any foreclosures.

- In terms of veterans home loan eligibility, what service time would not fit the VA home loan qualifications?

Generally speaking, getting a VA home loan will not be applicable to Active Duty Training in the Reserves or National Guard.

- How do I get a VA home loan if I am a veteran?

For those of you wondering how to get a VA home loan, the first step is to find out if you are eligible. Many of the best VA mortgage lenders offer a prequalification process where you can easily see if you will be qualified for any VA home loans.

- Why should I look into getting a VA home loan over other home loan options?

There are many undeniable benefits of taking advantage of VA home loans. Outside of the lenient requirements and no-down-payment offers, VA home loan lenders can also personally assist you with financial counseling.

- What is the maximum loan amount I can borrow on my veteran home loan?

With military home loans, there generally isn’t a cap on the amount of money that you can borrow. However, many VA-approved lenders tend to limit the amount to around $417,000.

Photo Courtesy of Loans By Lindy

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Don’t Miss: Best Jumbo Loans | Finding the Best Jumbo Mortgage Rates and Loans

Detailed Review – Top Ranking Best VA Home Loan Lenders

Below, please find the detailed review of each card on our list of the top ranking VA-approved lenders. We have highlighted some of the factors that allowed these home loans for veterans and VA home loan lenders to score so highly in our selection ranking.

Citibank® Review

As a well-known mainstream bank, Citibank® has a longstanding reputation for providing their customers with the best service and representatives.

Citibank® offers current or former members of the U.S. Armed Forces access to military home loans that can help veterans take advantage of the many benefits with a veteran home loan.

A Brief Overview of the Citibank® Home Loans for Veterans

Access to Representatives

Citibank® makes getting in touch with one of their veteran home loan representatives incredibly simple.

On their website, Citibank® clearly states a phone number that you can call in order to get all of your questions answered regarding getting a VA home loan.

You can quickly find out the amount you are eligible for on the veteran home loan you receive from Citibank®.

VA Home Refinance Options

Along with their VA home loans, Citibank® also offers veterans refinancing options.

This is a fantastic option for veteran homeowners who have already taken out a veteran home loan from other VA-approved lenders.

Citibank’s VA home loans representative will work with you to get you the best interest rates and closing costs on your refinance VA home loan.

Direct VA Loans Review

Direct VA Loans is one of the best VA home loan lenders, as they work hard to get you some of the best rates and deals on your veteran home loan.

Putting you in contact with some of their veteran home loan specialists, Direct VA Loans has plenty of experience working on veterans’ home loan eligibility and eventual approval.

Direct VA Loans Offers:

- Competitive VA home loan rates

- Veteran home loan specialists

- VA purchase loans

- VA refinance loan

Detailed Review of Direct VA Loans

iFreedom Direct®

When it comes to finding the best military home loans, the iFreedom Direct® Veterans Services Department was established with veterans in mind.

The department is filled with experienced veteran home loan specialists and in-house loan officers who have years of experience working on getting a VA home loan for approved veterans in any financial situation.

The iFreedom Direct® is a direct VA home loan lender, helping veterans to cut out the middle man.

Loan Information Packet

Direct VA Loans is also a great resource for veterans looking to find out more about VA home loans based on their loan type.

Direct VA Loans works as one of the best VA home loan lenders to help you better understand the process, along with the most common interest rates, recommended credit score, and other valuable information.

To receive their veteran home loan information packet, simply fill out the contact form, and you’ll be emailed all of the information.

Related: The Mortgage Brokers | Guide | How to Find Top Mortgage Brokers

NASB Review

As a VA-approved lender with thousands of satisfied customer reviews, the North American Savings Bank is one of the best VA mortgage lenders.

As one of the top VA home loan lenders, NASB finds it a privilege to supply veterans with the best offers on VA home loans.

Benefits Offered by NASB VA Home Loan Lenders:

- Quick prequalification process

- No lenders’ fees or points

- VA Streamline Refinance

- VA-approved

Key Factors of NASB VA Home Loan Lenders

No Lender Fees or Points

Ranking as one of the best VA home loan lenders, NASB offers current active duty military personnel, reservists, and veterans no lender fees on their VA home loans.

Unlike many other VA-approved lenders, NASB doesn’t charge a 1% origination fee, loan processing fee, or other unknown costs on their veteran home loans.

Getting a VA home loan from NASB will ultimately save you tons of cash as you avoid a multitude of hidden costs and fees.

Streamlined Refinance Program

If you happen to choose NASB as your original veteran home loan lender, then you’ll also be qualified for their reduced interest rate refinancing terms.

On their streamlined program, any refinancing on your VA home loan will be given extra consideration in terms of interest rates.

Your interest will be substantially lower than if you went with other VA home loan lenders.

Quicken Loans® Review

Quicken Loans® is a well-known name in the financial world for providing loans instantly online.

As the biggest online mortgage lender, Quicken Loans® is a great option for those looking for an easy and simple way of getting approved for a VA home loan.

Highlights of Quicken Loans® VA Home Loan Lenders

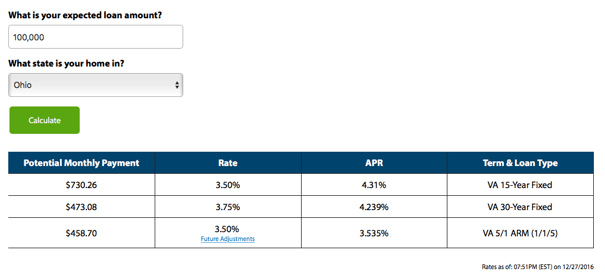

Rate Calculator

As part of their lending process, Quicken Loans® gives you free access to their simple-to-use VA home loan rate calculator.

With this calculator, you can quickly estimate your potential monthly payments based on your term and loan type.

You’ll also be able to estimate your rate percentages and APR.

Photo Courtesy of Quicken Loans®

Jumbo VA Home Loans

If you’re a veteran who is in need of a larger loan than is usually permitted with typical military home loans, then the jumbo VA home loans from Quicken Loans® are a fantastic option.

Their jumbo VA home loans are available up to $1,500,000 in 30-, 20-, and 15-year fixed rates.

You can even refinance up to 120% of your primary home’s worth.

Popular Article: Home Loan Interest Rates Today | Tips for Finding Today’s Best Home Loan Rates

VA Loans Review

VA Loans is one of the top VA-approved lenders that works to educate veterans on the process of taking out and getting approved for a veteran home loan.

VA loans offers veterans and spouses an enormous amount of information with their VA home loan articles and provides veterans with documents such as proof of service and certificate of eligibility.

Overview of VA Loans, a VA-Approved Lender

VA Loans Articles

Veterans who are looking to better understand the veteran home loan process will find that VA Loans is stockpiled with information.

Their website was built around the premise of educating veterans on VA home loan lenders and the process of getting VA home loans.

VA Loans is one of the best VA home loan lenders for veterans hoping to better understand the terms associated with their veteran home loan.

Veteran Documents

For those who need access to the proper documentation for VA home loan qualifications, VA Loans has all of the documents readily available.

You can access and print DD214: Proof of Military Services forms as well as your Certificate of Eligibility.

Both of these forms are crucial to a veteran’s home loan eligibility.

Veterans United® Review

Veterans who are in search of a dedicated team of VA home loan lenders that actively hire retired military personnel will find that Veterans United® is one of the best VA home loan lenders.

Benefits of Getting a VA Home Loan from Veterans United®:

- No hidden costs

- No locking fees

- Military advisors

- Featured in top publications

Key Factors of Veterans United® VA-Approved Lenders

Expert Loan Lenders

Unlike many other VA home loan lenders, Veterans United® is one of the best VA home loan lenders due to their industry-leading experts.

Photo Courtesy of Veterans United Home Loans

Veterans United® lenders are extensively trained in the process of VA home loans and are aware of all of the intricacies associated with the loan process.

Along with their lenders, Veterans United® enlists military personnel to advise veterans on their military home loans.

Credit Building Tips

Since a decent credit score is a significant requirement when it comes to VA home loan qualifications, Veterans United® seeks to help veterans improve theirs.

Veterans United® offers a free credit-building program that seeks to help you build up your credit by picking up financially sound spending habits.

Their credit counseling will help put you on the best track toward getting approved for a veteran home loan.

Read More: Buy a Tiny House | Guide | How, Where, When to Buy a Tiny House

Conclusion—Top 6 Best VA Home Loan Lenders

As you can see, there are a variety of VA home loan lenders that one can choose to borrow a veteran home loan from.

Choosing to go with one of the best VA home loan lenders requires you to go with VA-approved lenders.

VA-approved lenders offer veterans knowledgeable loan officers and personnel that can better assist them in receiving the best rates on your VA home loan offers.

The best VA mortgage lenders are also completely transparent with all of their possible fees and rates.

Finally, the question comes down to which VA-approved lenders should you go with?

Depending on how much information you already have on the VA home loan process, you may want to choose to go with a website like Veterans United®, which hires retired military personnel and that can better assist you.

However, if you’re looking for a quick loan approval, then the Quicken Loans® VA home loan lenders is a perfect choice.

Quicken Loans® VA home loan lenders can quickly approve you and are also in supply of jumbo loans for veterans in need of a larger veteran home loan sum.

Now, with all of the detailed information available on VA home loans, you can safely decide on the best VA home loan lenders for your specific situation.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.