Getting the Best Mortgage Rates in Rochester, NY (10-15-30-Year Fixed, 5/1, 7/1 ARM)

Although home prices in Rochester are on the rise, the median home in Rochester is still surprisingly affordable.

According to Zillow, the median price of homes listed in Rochester is $64,900, which is great news for potential home buyers.

By combining low home prices with competitive mortgage rates in Rochester, NY, home buyers can ensure that homeownership remains affordable and manageable for decades to come.

Today’s Grand Rapids Mortgage Rates | Best Mortgage Rates in Grand Rapids, MI

Good, Great, or Excellent Credit Score for Rochester Home Loans

Most lenders that provide competitive Rochester mortgages use a FICO score to determine if a borrower is creditworthy or not.

FICO scores range anywhere from 300 to 850, with higher numbers seen as the most creditworthy and lower numbers seen as the biggest financial risk.

FICO scores for Rochester, NY mortgage rates fall into the following categories:

- 300 – 629 is considered “Bad”

- 630 – 689 is considered “Fair”

- 690 – 719 is considered “Good”

- 720 – 850 is considered “Excellent”

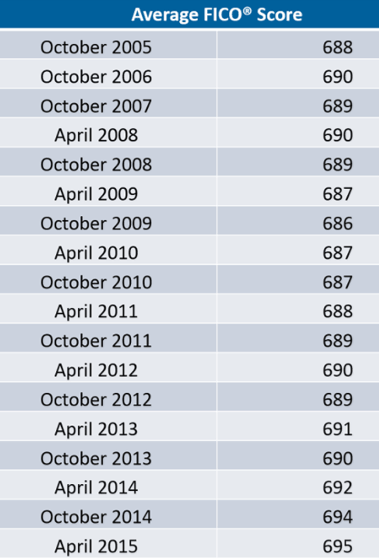

If you’re curious about the average credit score, see the table below for average FICO scores from 2005-2015. According to CNBC, as of this year, the average score is 700.

Today’s El Paso Mortgage Rates | Best El Paso Mortgages for Good-Excellent Credit Borrowers

Current Mortgage Rates in Fresno, CA | Home Loans in Fresno for Good-Excellent Credit Borrowers

Factors that Influence Mortgage Rates in Rochester, NY

While loan terms will play a role in determining monthly costs, the rate will be the biggest factor in whether monthly payments on Rochester mortgages are affordable.

See the sections below for common elements that can impact mortgage rates in Rochester, NY.

Credit Score

Just like any other loan, a borrower’s credit score is used as a benchmark for reliability. Most mortgage lenders in Rochester, NY see high credit scores as proof of reliability, offering more affordable Rochester mortgages as a result.

Lower credit scores are problematic for lenders, as it raises doubts on whether a borrower can financially manage the cost of Rochester mortgages.

While exploring mortgage rates in Rochester, NY, take the time to examine your credit score. Look for ways to boost your score through paying off any old debts or resolving errors before committing to Rochester home loans.

Location

For some mortgage lenders in Rochester, NY, the location of a home could make a significant difference in the affordability of Rochester mortgages.

Mortgage rates in Rochester, NY may differ when purchasing in an urban vs. a rural area, so make sure that you take note of the location while evaluating various rates and terms.

Down Payment

Putting aside more money for a down payment certainly isn’t fun, but it’s a great way to boost your chances of getting lower mortgage rates in Rochester, NY. According to Bankrate, most lenders require a payment of at least 3 percent.

Although some Rochester mortgages will still be affordable with a lower down payment, the best way to keep a home loan cost-effective over time is to put 20 percent down.

Key Requirements for Buying a House in Rochester

Before you apply for Rochester mortgages, you’ll want to complete the below list of requirements.

- Get your down payment ready (~20% of the loan amount)

- Maintain good to excellent credit

- Save some extra funds for your closing cost

- Maintain a low debt balance

- Demonstrate sufficient income

- Gather your financial documents

- Get a home appraisal on the home

You’ll also need to examine your options for conventional and adjustable loans before choosing the best mortgage rates in Rochester, NY for you.

Current Mortgage Rates in St. Louis | Best St. Louis Mortgages for Good-Excellent Credit

Today’s DC Mortgage Rates | Best Washington, DC Mortgage Rates & Offers

Conclusion – Current Mortgage Rates in Rochester, NY

Purchasing a home can be a confusing process, particularly when it comes to choosing from current mortgage rates in Rochester, NY.

With so many available offers and rates, how do you know which mortgage is the right one for you?

Affordable and manageable Rochester mortgages are determined not just by monthly payments, but also by interest rates and loan terms.

By looking closely at loan terms and mortgage rates in Rochester, NY, you will be well-equipped to find the best mortgage and refinance rates for your unique financial needs and goals.

Current Fort Worth Mortgage Rates | Best Fort Worth Mortgages for Good-Excellent Credit

Current Mortgage Rates in Tampa | Best Rates, Terms, & Offers from Mortgage Companies in Tampa

Mortgage Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the mortgage loan table(s) displayed on this page.

Image sources:

- http://www.fico.com/en/blogs/wp-content/uploads/2015/08/April-2015-Average-FICO-Score.png

- https://pixabay.com/en/house-snowfall-winter-front-door-54585/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.