2017 RANKING & REVIEWS

BEST PENFED CREDIT CARDS

Introduction: Examining the Best PenFed Credit Cards

When it comes to finding the best credit cards, the possibilities are nearly limitless. Many of these possibilities come from big banks and often have complicated application processes.

If you prefer a more convenient, personalized experience when applying for a credit card, it may be worthwhile to consider opening a PenFed credit card through PenFed Federal Credit Union.

This article will offer a complete and thorough PenFed credit card review, including what to look for in a Pentagon Federal Credit Union credit card.

Finally, we will provide an in-depth look at the best Pentagon Federal Credit Union credit cards to consider applying for this year.

Award Emblem: Top 4 Best PenFed Credit Cards

What Is PenFed Credit Union?

Established in 1935, PenFed is among the strongest financial institutions across the nation. With 1.5 million members and $22 billion in assets, PenFed Credit Union is a diverse, stable option for those seeking a new credit card.

Many of these members are actively employed by the military, state and local governments, government contractors, and school systems across the nation.

Photo Courtesy of: Top PenFed Credit Cards

PenFed credit cards are available in all 50 states, including military bases in Guam, Puerto Rico, and Okinawa.

Their mission statement boils down to one simple principle: helping their members “Do Better.”

PenFed aims to do much more than provide loans, checking accounts, and savings accounts — instead, they aim to educate, encourage, and empower their members.

AdvisoryHQ’s List of the Top 4 Best PenFed Credit Cards

List is sorted alphabetically (click any of the credit card names below to go directly to the detailed review section for that credit card):

- PenFed Gold Visa® Card

- PenFed Platinum Rewards VISA Signature® Card

- PenFed Power Cash Rewards Visa® Card

- PenFed Promise® Visa Card

Top 4 Best PenFed Credit Cards | Brief Comparison & Ranking

Best PenFed Credit Cards | Annual Fee | APR (%) Rates | Promotional APR Offer(s) |

| PenFed Gold Visa® Card | None | 8.99-17.99 | 0% for 12 months on balance transfers |

| PenFed Platinum Rewards VISA Signature® Card | None | 9.24-17.99 | 0% for 12 months on balance transfers |

| PenFed Power Cash Rewards Visa® Card | None | 9.24-17.99 | 0% for 12 months on balance transfers |

| PenFed Promise® Visa Card | None | 8.99-17.99 | 4.99% for 12 months on balance transfers |

Table: Top 4 Best PenFed Credit Cards | Above list is sorted alphabetically

Eligibility Terms for PenFed Credit Cards

Before finding the best PenFed credit card for you, it is important to consider whether you are eligible for the best terms and conditions.

In comparison with larger financial institutions, where simply filling out an application is enough to grant membership, credit unions abide by specific sets of criteria for eligibility.

Oftentimes, these criteria revolve around location or employment. Applicants for a PenFed credit card should meet at least one of the following criteria:

- Active/retired member of the United States Military & Uniformed forces

- Employee of a qualifying organization

- Member of a qualifying organization or association

- Employee of the United States government

- Relative or housemate of someone who is eligible

- Residence or employment in a qualifying location

For those who are interested in Pentagon Federal Union credit cards, but do not meet any of the above requirements, PenFed provides a few additional options.

Members of Voices For America’s Troops or the National Military Family Association are granted eligibility for a PenFed card.

These memberships can be obtained through a one-time-only fee of $17, with 100% of the proceeds benefitting the charity of your choice.

See Also: Best Credit Cards for Rewards | Ranking & Reviews | Top Rewards Credit Cards

What to Look for in a PenFed Credit Card

As with any credit card, the best PenFed credit card for you will revolve around your specific financial situation, credit habits, and needs.

The top Pentagon Federal Credit Union credit cards highlighted by our review are split into two different options: a PenFed rewards card or a traditional PenFed card.

Benefits of a PenFed Rewards Card

While each PenFed rewards card will have varying PenFed credit card rewards, the underlying principle is the same.

The benefit to having a PenFed rewards card is that select purchases made on the card will collect either points or cash back.

Points are often redeemable for cash back or payment on the card, though it may be worthwhile to consider whether you prefer a card with points or direct cash back.

It may also be worthwhile to consider your spending habits and how PenFed credit card rewards can align with purchases you are already making.

For example, if you are planning on using a PenFed card for grocery or gas station purchases, the best value will come from getting a PenFed cash rewards card that offers incentives for those categories of spending.

Benefits of a Traditional PenFed Card

While a traditional PenFed card will not offer cash back benefits, they often come with other valuable credit characteristics.

Applying for a traditional PenFed credit card often means taking advantage of lower APR rates, and introductory rates on balance transfers or purchases.

Depending upon your credit needs, it may be worthwhile to consider traditional PenFed credit cards, rather than Pentagon Federal Credit Union credit cards with rewards programs.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best PenFed Credit Cards

Below, please find a detailed review of each credit card on our list of Pentagon Federal Credit Union credit cards. We have highlighted some of the factors that allowed these PenFed credit cards to score so highly in our selection ranking.

Don’t Miss: Top Guaranteed Credit Cards with Approval for Bad & Fair Credit | Ranking & Reviews

PenFed Gold Visa® Card Review

As a traditional PenFed card, the PenFed Gold Visa® Card is a great choice for anyone looking for a line of credit that is simple, easy to manage, and affordable.

Key Factors That Led to Our Ranking of This as One of the Top PenFed Credit Cards

Below, please find a detailed list of the features that we took into consideration when ranking this as a top PenFed card.

Cardholder Benefits

This Pentagon Federal Credit Union credit card comes with a wide range of benefits, including a low APR range of 8.99%-17.99%. Other notable benefits include:

- No foreign transaction fees

- EMV chip enabled

- No annual fee

- No cash advance fee

Photo courtesy of: Pentagon Federal Credit Union

Promotional Offers

There are a few unique promotional offers associated with this PenFed card that led to its ranking among the best PenFed credit cards.

$100 Statement Credit

Accounts issued between January 1, 2017 – March 31, 2017 can receive a $100 statement credit upon spending $1,500 within the first three months.

Depending upon your credit limit, and how often you plan on using your PenFed card, this statement credit could be a valuable benefit.

Balance Transfers

Upon opening this Pentagon Federal Credit Union credit card, cardholders can enjoy a full 12 months of 0% interest on balance transfers made before March 31, 2017.

Afterward, the balance transfer APR will fall within the range of 8.99%-17.99%.

Related: Best U.S. Bank Credit Card Offers | Ranking | U.S. Bank Cash Back, Travel, Rewards Cards Reviews

PenFed Platinum Rewards VISA Signature® Card Review

For those who are looking for a PenFed federal credit card that offers PenFed credit card rewards, the Platinum Rewards VISA Signature® Card is a great option.

With a broad range of items to redeem rewards points for — and competitive rewards rates — this PenFed card stands out as one of the best Pentagon Federal Credit Union credit cards to consider.

Key Factors That Led to Our Ranking of This as One of the Top PenFed Credit Cards

Below, please find a detailed list of the features that we took into consideration when ranking this as a top PenFed card.

Cardholder Benefits

Our PenFed credit card review found that this PenFed card comes with a competitively low APR rate.

At 9.24%-17.99%, it stays very close to the national average of 15.07%, potentially offering a much lower rate for eligible applicants.

Additional benefits of this PenFed card include:

- No annual fee

- No foreign transaction fees

- EMV chip enabled

- Complimentary 24/7 concierge service

Photo courtesy of: Pentagon Federal Credit Union

Dynamic Rewards Program

The PenFed credit card rewards program offers cardholders a few dynamic ways to earn points and maximize savings.

The rewards program for this PenFed card allows cardholders to earn:

- 5x points on gas

- 3x points on groceries

- 1x points on all other purchases

For those who are primarily looking to use PenFed credit cards to pay for purchases within these categories, this is a great Pentagon federal credit card to consider.

Redeeming Rewards

Cardholders can trade their points in for anything from airline tickets to golf clubs, creating value across a wide range of personal tastes and preferences.

A few examples of ways to redeem points from the PenFed credit card rewards program include:

- Four-piece luggage set

- One-night stay in Las Vegas

- Designer handbags

- Children’s toys

- Gift cards

Promotional Offers

Most rewards cards do not provide promotional offers, though the PenFed Platinum Rewards VISA Signature® Card certainly does.

Our PenFed credit card review has highlighted a few unique promotional offers that led to its ranking among the best PenFed credit cards.

$100 Statement Credit

Accounts issued between January 1, 2017 – March 31, 2017 can receive a $100 statement credit upon spending $1,500 within the first three months.

Depending upon your credit limit and how often you plan on using your PenFed card, this statement credit could be a valuable benefit.

Balance Transfers

Upon opening this Pentagon Federal Credit Union credit card, cardholders can enjoy a full 12 months of 0% interest on balance transfers made before March 31, 2017.

Afterward, the balance transfer APR will fall within the range of 9.24%-17.99%.

Popular Article: Best Instant Approval Credit Cards for Bad or Fair Credit | Ranking

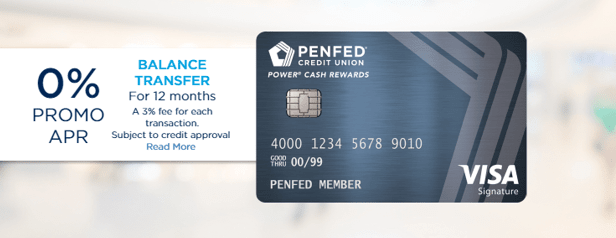

PenFed Power Cash Rewards Visa® Card Review

As the newest addition to the family of Pentagon Federal Credit Union credit cards, the PenFed Power Cash Rewards Visa® Card offers seamless cash back reward on each purchase.

With affordable APR rates and unlimited cash back rewards, this is a top PenFed cash rewards card to consider.

Key Factors That Led to Our Ranking of This as One of the Top PenFed Credit Cards

Below, please find a detailed list of the features that we took into consideration when ranking this as a top PenFed card.

Cardholder Benefits

With an APR as low as 9.24%, this is not only one of the best Pentagon Federal Credit Union credit cards but one of the best overall credit cards.

A lower APR makes managing a line of credit much easier and, over the long-term, much more affordable. Additional benefits to consider include:

- Unlimited rewards & flexible redemption options

- No annual fee

- EMV chip enabled

Photo courtesy of: Pentagon Federal Credit Union

Cash Back Rewards

For those who are looking for a PenFed cash rewards card, the PenFed Power Cash Rewards Visa® card is a perfect option.

Cardholders can earn an unlimited 1.5% cash back on all purchases, regardless of spending category.

Through the Honors Advantage program, cardholders can earn 2% with their PenFed cash rewards card. Eligibility for the Honors Advantage program applies to those who:

- Have an open PenFed Access America checking account

- Are current or retired military members

Promotional Offers

Another notable feature of this PenFed cash rewards card is that it comes with the same promotional offers that a traditional PenFed card does.

It is rare for a cash rewards card to come with a promotional offer, which certainly makes this line of credit stand out among Pentagon Federal Credit Union credit cards.

$100 Statement Credit

Accounts issued between January 1, 2017 – March 31, 2017 can receive a $100 statement credit upon spending $1,500 within the first three months.

Depending upon your credit limit and how often you plan on using your PenFed card, this statement credit could be a valuable benefit.

Balance Transfers

Upon opening this Pentagon Federal Credit Union credit card, cardholders can enjoy a full 12 months of 0% interest on balance transfers made before March 31, 2017.

PenFed Promise® Visa Card Review

With absolutely no fees whatsoever, the PenFed Promise® Visa Card is an ideal choice if you’re feeling fed up with unnecessary charges and annual fees simply for keeping a line of credit open.

Key Factors That Led to Our Ranking of This as One of the Top PenFed Credit Cards

Below, please find a detailed list of the features that we took into consideration when ranking this among the best Pentagon Federal Credit Union credit cards.

Cardholder Benefits

By and large, the most striking benefit about this PenFed card comes from zero fees. This means that cardholders can benefit from eliminating the following common credit card fees:

- Annual fees

- Foreign transaction fees

- Balance transfer fees

- Cash advance fees

- Late fees

- Over credit limit fees

For those who are looking for a PenFed card that will remain manageable and affordable over time, finding a card that eliminates fees — like the PenFed Promise® Visa Card — is a great place to start.

Photo courtesy of: Pentagon Federal Credit Union

Promotional Offers

Although this Pentagon Federal credit card does not offer cash back or points rewards, the combination of zero fees and valuable promotional offers make it a best PenFed credit card to consider.

Cardholders can benefit from the following promotional offers:

$100 Statement Credit

Accounts issued between January 1, 2017 – March 31, 2017 can receive a $100 statement credit upon spending $1,500 within the first three months.

Depending upon your credit limit and how often you plan on using your PenFed card, this statement credit could be a valuable benefit.

Balance Transfers

For balance transfers made before March 31, 2017, this Pentagon Federal credit card will apply a promotional 4.99% APR for 12 months.

Read More: Best Cash Back Credit Cards | Ranking | Best Credit Card Cash Back Offers & Reviews

Conclusion – Top 4 Best Pentagon Federal Credit Union Credit Cards

Now more than ever, choosing to use a credit union for a line of credit is becoming much more common.

With better APR rates, competitive promotional offers, and lower fees, these Pentagon Federal Credit Union credit cards are well-suited to fit a variety of financial needs.

Keep in mind that choosing the best PenFed credit card for you means taking an in-depth look at your spending habits and personal finances.

Thus, the PenFed card that you choose should align with these components and set you up for personal financial success.

Should you qualify for a PenFed card, there is no doubt that these Pentagon Federal Credit Union credit cards offer valuable ways to improve your money management.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.